Letztes Update: 31. July 2024

In this article, we take a closer look at radicant’s SDG investing. Sustainable investing is one of those things, because there are no uniform standards or definitions for it, or they are only just emerging. The term “greenwashing” crops up time and again. Last year, for example, the US Securities and Exchange Commission (SEC) fined the fund subsidiary of a major German bank millions for “materially misleading statements”.

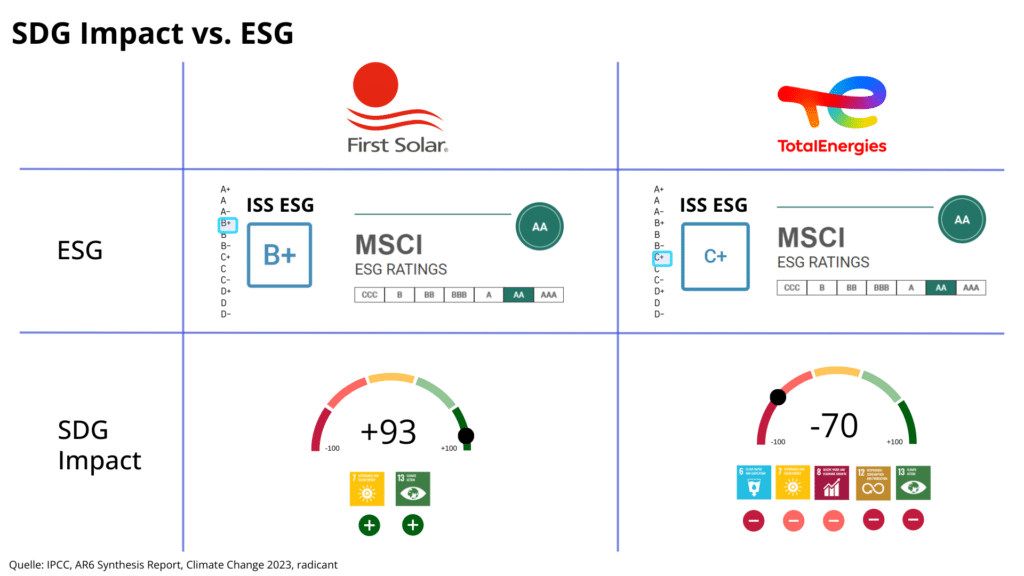

What doesn’t make things any more transparent is that ESG ratings vary from agency to agency. The same company receives a very good ESG rating from one agency, while other agencies rate the same company much lower.

The range of “sustainable” investment opportunities is growing rapidly. Whereas ETFs used to be something simple, today they are available in countless variations. And “sustainable” ETFs in particular have been launched en masse in recent years, making it difficult for non-experts to keep track. There are names like:

- ESG

- ESG Broad CTB Select

- ESG Climate Net Zero Ambition

- ESG Elite

- ESG Enhanced

- ESG Leaders

- ESG Leaders Extra

- ESG Screened

- ESG Universal Low Carbon Select

- ESG Universal Screened

- Net Zero Pathway Paris Aligned

- Paris Aligned Climate

- Socially Responsible

It is therefore time to make sustainable investing more understandable and transparent for investors. And this is where radicant comes into play. In the blog post “Sustainable banking & investing with radicant“, I already introduced the digital bank, which had its market launch in August 2023. This article is about what makes radicant different and, in my opinion, better than other providers.

History of sustainable investing

But first a brief look at the history of sustainable investment. The origins of ethical investing lie in the Anglo-Saxon free churches. The exclusion of companies whose business model is based on alcohol, tobacco, weapons or gambling (sin shares) reflects Christian values. Later, especially in Germany, the exclusion of nuclear power was added, and even later climate change became an important issue.

The abbreviation ESG (Environmental, Social, Governance) stands for environmental, social and corporate governance, whereby the 2004 study “Who Cares Wins” for the United Nations is considered the birth of ESG. The Swiss-funded study sought to identify the financial risks that arise when companies do not pursue sustainable strategies. An attempt was made to minimize the risks of “dirty” business through the lens of economics.

Nowadays, the question arises as to what actual effects investment instruments have and this is where the term impact investing comes into play. The International Finance Corporation (IFC) and the Global Impact Investing Network (GIIN) define impact investing as “investments that are designed to achieve a measurable positive social and environmental impact in addition to a financial return”. Impact investing therefore stands between purely return-oriented investing and philanthropic donations.

The 17 UN Sustainable Development Goals (SDGs)

But if it is not just about minimizing risk, as is the case with ESG, what positive objectives should be used to measure the impact? One of the frameworks that are recognized by investors and regulators alike are the SDGs, the 17 UN Sustainable Development Goals.

Let’s take a look back: The “Agenda 2030”, which was adopted by all member states of the United Nations in 2015, focuses on socially, economically and ecologically sustainable development. At its core are the 17 Sustainable Development Goals (SDGs) with their 169 sub-goals. They call on all countries to work together to solve the world’s pressing challenges.

radicant – like other providers of financial products – believes that SDGs offer significant investment opportunities. This is because the SDGs identify global problems to which the international community wants to respond together. This creates pressure on politics and business to offer solutions, which in turn leads to innovations and adjustments in companies. This competition creates an advantage for companies that contribute to solving global problems and makes them attractive investment opportunities.

SDG Impact Rating from radicant

Companies interact with nature, society and the economy and therefore always have an impact. radicant attempts to measure this impact as comprehensively as possible – in contrast to ESG, which primarily measures sustainability risks for companies – and has developed its own methodology for this purpose. radicant uses the United Nations’ 17 Sustainable Development Goals as a framework for measuring impact.

What a company produces has the greatest impact. At radicant, the focus is therefore on products and services. On the other hand, radicant pays attention to the operational processes, i.e. how something is produced. And last but not least, negative news (controversies) are taken into account.

On this basis, radicant calculates a score for each of the 17 SDGs, with the extreme values (positive and negative) being overweighted. In doing so, radicant initially draws on the extensive data sets of ISS ESG, a leading global agency for ESG research with a total of around 5 million data points. For example, a company that produces wind energy receives a positive score for SDG 13 “Climate action” and SDG 7 “Affordable and clean energy”, while a company that produces oil receives a negative score.

The individual scores are then used to calculate an overall score, which ranges from -100 (high negative impact) to +100 (high positive impact), whereby radicant only invests in companies with a positive impact and therefore a score of over +20.

Of the approximately 12,000 companies for which radicant has data, around 2,200 issuers remain at the end of the selection process and are available for the compilation of the radicant portfolios. From these remaining issuers, radicant’s portfolio management team is now putting together portfolios that are actively managed.

radicant transparency

All well and good, but how does radicant manage to avoid creating anonymous funds like the ones you can buy in heaps? You can also buy radicant funds through a broker of your choice, i.e. without being a radicant customer, but the radicant app has several advantages: Firstly, the TER is significantly lower – so you can access the funds more cheaply via the radicant app. You also have access to comprehensive reporting via the app. In the radicant app you can get an exact picture of each individual company in the fund. In addition to the overall SDG impact score and the SDGs on which the company has a particularly high impact, you will find a short text about the company so that you know what it actually offers or manufactures. The company’s positive contributions to the SDGs are listed, as well as the potential for improvement.

In addition, each company receives a so-called radiTag. This makes it clear at a glance which solutions a company offers with its products or services. The Swiss healthcare and logistics group Galenica, for example, receives the radiTag #healthprevention. At the bottom you will also find a chart showing the performance of this company’s share.

radicant investment products

Global equities

The core of radicant’s investment mandate is a globally diversified portfolio and is implemented with the radicant “Global Sustainable Equities” fund. In line with the methodology described above, investments are made in global companies that offer products and services that make a positive contribution to the SDGs. The radicant SDG score of the fund is +43. The largest position is currently Microsoft with 4.5%, followed by Puma with 4.3%. The largest country is the USA with 44%, Switzerland is represented with 5%. Compared to the MSCI World, the weightings are therefore very different, which is due to the fact that this is an actively managed fund.

Global bonds

Depending on the risk profile, the radicant bond fund “Global Sustainable Bonds” is also added to the equity fund, which invests in a global, broadly diversified portfolio of bond issuers and in sustainably certified green bonds. The largest issuer is the International Bank for Reconstruction and Development with a share of 8.9%.

Swiss shares

Anyone wishing to increase the Swiss share can add the “Swiss Sustainable Equities” equity fund from radicant, which uses the same methodology as the “Global Sustainable Equities” fund, but only invests in Swiss companies. The largest position is Roche (9.7%), followed by Novartis (9.7%) and Swiss Re (8.9%). Nestlé and Holcim are not included in the “Swiss Sustainable Equities” fund, as their SDG impact rating is too low.

Investment themes – radiThemes

You can choose two of a total of eight radiThemes as an additional admixture. In other words, topics that are particularly important to you. These investment themes are implemented via tracker certificates. The issuer of the radicant certificates is Zürcher Kantonalbank ZKB. The following radiThemes are available for selection:

- Climate stability

- Basic needs

- Healthy ecosystems

- Clean water & sanitation

- Health & Wellbeing

- Gender equality

- High quality education

- Social progress

The monthly “Investment Update” presents a company and its products or services. This allows you to get to know the companies in the fund even better and find out what services or products they offer and why they are in the fund.

radicant SDG Investing fees

You can invest as little as CHF 1,000 with radicant. The annual investment fee varies depending on the investment amount:

| Investment amount | until January 1, 2025 | as of January 1, 2025 |

|---|---|---|

| CHF 1’000 – 24’999 | 0.45% | 0.90% |

| CHF 25’000 – 99’999 | 0.40% | 0.80% |

| CHF 100’000 – 249’999 | 0.325% | 0.65% |

| from CHF 250,000 | 0.24% | 0.50% |

In addition, annual product costs of 0.4 to 0.47% are incurred. For an invested volume of CHF 50,000, for example, Radicant currently costs between 0.8 and 0.87% per year. Compared to an asset management mandate with a traditional bank, radicant’s digital asset management mandate is around half the price.

Incidentally, you can open up to five investment portfolios in the radicant app. For example, you can invest for your godchild, implement various strategies or invest money that you will need again in a few years’ time with a lower equity allocation.

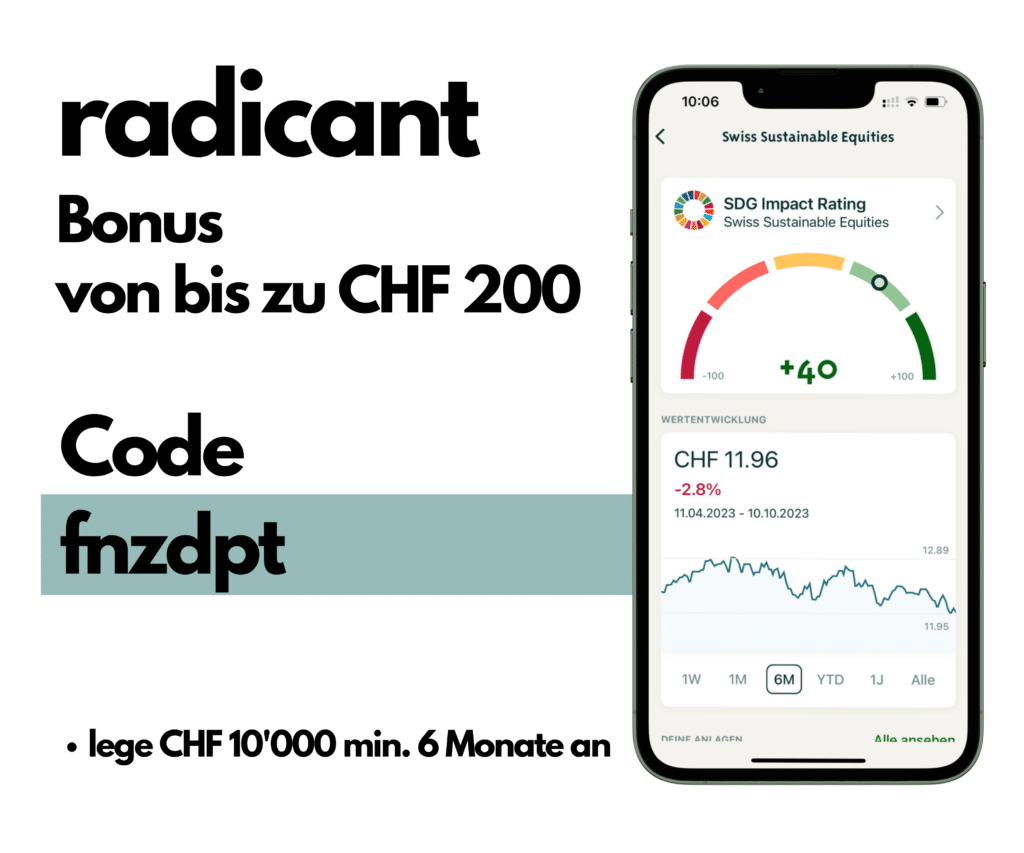

radicant code – receive CHF 200

Invest CHF 10,000 with radicant for at least six months and receive up to CHF 200. Simply enter the radicant code fnzdpt when opening the account. The following conditions apply:

- A net inflow of funds of at least CHF 10,000 is required within 30 days of the first portfolio creation. You will receive CHF 50.

- In order to receive the additional CHF 150, you must keep the CHF 10,000 invested with radicant for at least 6 months.

- You must enter the radicant code fnzdpt manually when you open your account or in the radicant app no later than 30 days later.

Conclusion radicant SDG Investing

Thanks to its clear alignment with the 17 Sustainable Development Goals (SDGs) of the United Nations and the innovative SDG Impact Rating, radicant creates transparency and traceability. The focus is on the impact of companies on society and nature, whereby radicant thus chooses a clearly different focus than the usual ESG risk approach. In addition to the broadly diversified global fund, it is possible to individualize the portfolio with investment themes according to your own impact themes. radicant is therefore suitable for investors who value high transparency, a comprehensible sustainability concept and competitive fees.

Transparency and disclaimer

This post was made in collaboration with radicant, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.