Letztes Update: 23. March 2025

You’re probably familiar with this: In keeping with the spirit of the times, every bank has to be a bit sustainable and quickly comes up with a cool digital by-product. Unfortunately, this is then often just as cumbersome as the parent company, but comes with a new coat of paint. Not so with radicant – Switzerland’s first digital sustainability bank. Behind it is the Basellandschaftliche Kantonalbank BLKB, but radicant has its own banking license and was developed from scratch – and you can tell! Find out what you can expect from radicant banking and investing in my radicant experience.

radicant

radicant Bank AG is an independent subsidiary of Basellandschaftliche Kantonalbank BLKB with its own banking license from the Swiss Financial Market Supervisory Authority (Finma). This means that the Swiss deposit guarantee of up to CHF 100,000 applies to funds held at radicant. radicant was founded in 2021 and is based in Zurich. Starting in March 2023, a test phase ran, in which I also participated, and since August 2023, the radicant app has been available to everyone.

Radicant and their Client Service Officers can be reached via chat, email or phone. The call costs CHF 0.08 per minute.

radicant experience Open account

You can open your radicant account within five minutes, without any paperwork and 100% digitally. To do this, download the radicant app to your smartphone – a desktop version is not available – create a login and enter your personal data. To open an account, you must be at least 18 years old and reside in Switzerland. After that you can sign the contracts and to verify your identity you need a valid Swiss or EU/EEA identity card or passport. With your digital signature via SMS code and the transfer from another account, which must be in your name, you activate your radicant account.

radicant experience banking

radicant App

You can use radicant banking without any monthly fee. The virtual debit card, with which you can make purely digital payments, is free of charge. You can deposit the radicant Visa debit card with Apple Pay and Google Pay. And a dedicated radicant TWINT app has already been available since the beginning. With eBill, you receive your invoices in a digital and environmentally friendly way. If you opt for the physical card, it is made of recycled plastic and costs a one-time fee of CHF 15.

In the app, you can view your card details, change your limits and PIN, block the card, or customize the security features. When you pay with your card, the transaction is displayed in the app with the merchant’s logo. What I still miss are push notifications that inform about card transactions or money receipts. However, these are to be introduced soon.

Speaking of the future, radicant is currently working on it:

- Add card directly from the radicant app to Apple Pay/Google Pay

And are in the planning phase:

- Completely new and improved app design

- Introduction of climate and biodiversity targets for radicant and their investment portfolios.

For every CHF 100 you spend with your radicant card, you support the restoration of a mangrove ecosystem in Kenya. You can easily track your impact in the radicant app.

No Visa surcharge or transaction fees are charged when paying with the card in foreign currencies. radicant uses the mean rate of exchange instead and is therefore one of the most favorable providers. Even Revolut or Wise can’t keep up with that.

Twelve cash withdrawals in Switzerland are included per year, after which each additional withdrawal costs CHF 2. Euro withdrawals and withdrawals abroad also cost CHF 2. Here too, radicant does not charge any foreign currency fees!

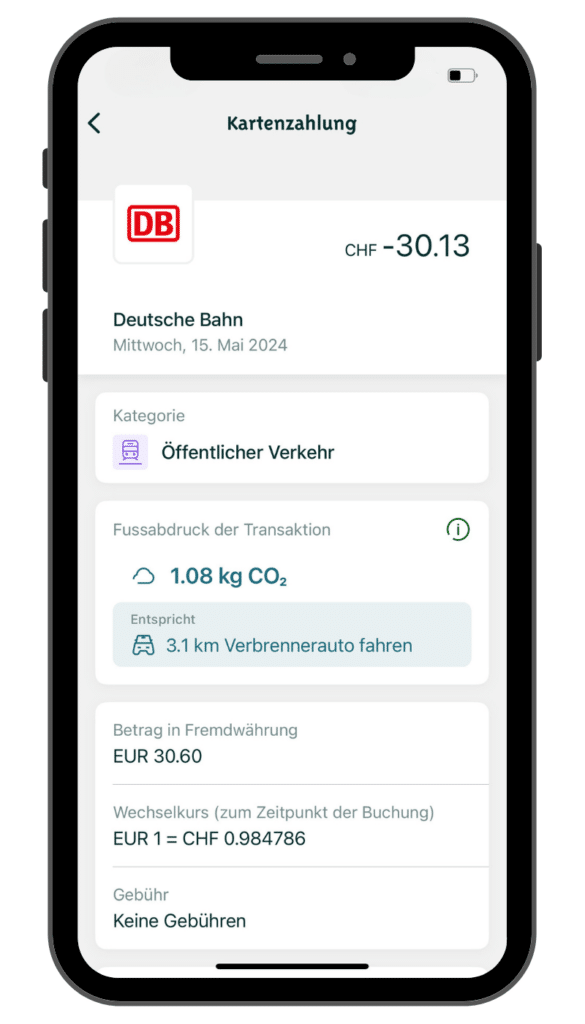

CO2 footprint tracker

The CO₂ footprint tracker is based on a module of the “Personal Finance Manager,” a digital financial assistant developed by Swiss fintech Contovista. The basis for the CO₂ calculations is Swiss climate data provided by Contovista’s partner Deedster, a leading Swedish specialist in sustainability data. More than 90 data sources and methods are used for the individual calculations.

In the radicant app, you can view the CO₂ footprint of your debit card payments either for each individual transaction or track it over the course of the year. The figures are rough estimates and are based on the amount and category of the transaction. For example, a purchase from a retailer of CHF 17.15 is shown as having 13 kg of CO₂, which corresponds to a trip of 36 km in a combustion car. You can find more information about the calculation method directly in radicant’s FAQs about theCO2 footprint tracker.

radicant interest and radicant withdrawal limit

On your account with radicant, you receive 0.1% interest. Conveniently, you can just leave your money in the radicant everyday account and don’t have to move it to a special sub-account. However, this also means that there are no sub-accounts (yet). There are no conditions for withdrawal. You can dispose of the entire amount at any time.

Incidentally, a portion of the cash deposits is invested in green bonds to support sustainability projects. Here I would like to see more details, i.e. the info where exactly the money goes.

radicant pillar 3a

On the radicant Pillar 3a Cash account, you currently receive 0.75% interest, with no ongoing costs. radicant invests part of your investment in the financing of impactful projects through labeled bonds. Open your fully digital 3a account in less than a minute directly in the radicant app.

Now you also have the option to invest in radicant’s investment products within the framework of Pillar 3a, thus participating in the global financial markets with actively managed, impactful investment funds and certificates.

radicant free travel insurance

When you pay for your travel expenses with your radicant debit card, you now receive free travel protection. The travel insurance is automatically active, there’s only one condition: You must pay at least 50% of your travel costs with your radicant debit card. The following services are included

- Trip cancellation

- Travel interruption

- Help (return transportation)

- Medical expenses abroad

- Search and rescue costs

- Luggage

- Car rental excess (CDW)

The insurance partner is Europ Assistance.

radicant EUR account

Opening, maintaining, and closing a EUR account with its own IBAN is free. The interest rate for balances on the EUR account is 1.25% for up to EUR 250,000. Transfers in EUR to SEPA banks are free. The conversion fee from CHF to EUR for payments is 0.9%. Somewhat unfortunate: The radicant debit card is only linked to your CHF account.

radicant experience Investing

If you’ve ever looked into sustainable investing, you’ve probably noticed that it’s not that simple and not everyone understands the same thing by “sustainable.” A large proportion of the financial products offered exclude “dirty” companies with a filter or select and weight the companies in the funds according to a so-called ESG rating (Environmental, Social, and Governance). Many are then bothered by the fact that, for example, the food company Nestlé is included in sustainable funds.

The EU regulation on sustainability-related disclosure requirements in the financial services sector (SFDR) attempts to make the term “sustainable” more transparent, in other words, in simple terms, to classify funds into different shades of green. The funds are classified under Articles 6, 8 and 9 of the SFDR, with Article 6 considering only limited ESG risks in the investment process and Article 9, the “greenest” tier, focusing on achieving a predefined sustainability target. According to Morningstar, Article 9 funds account for only around 2.8% of the total EU fund universe.

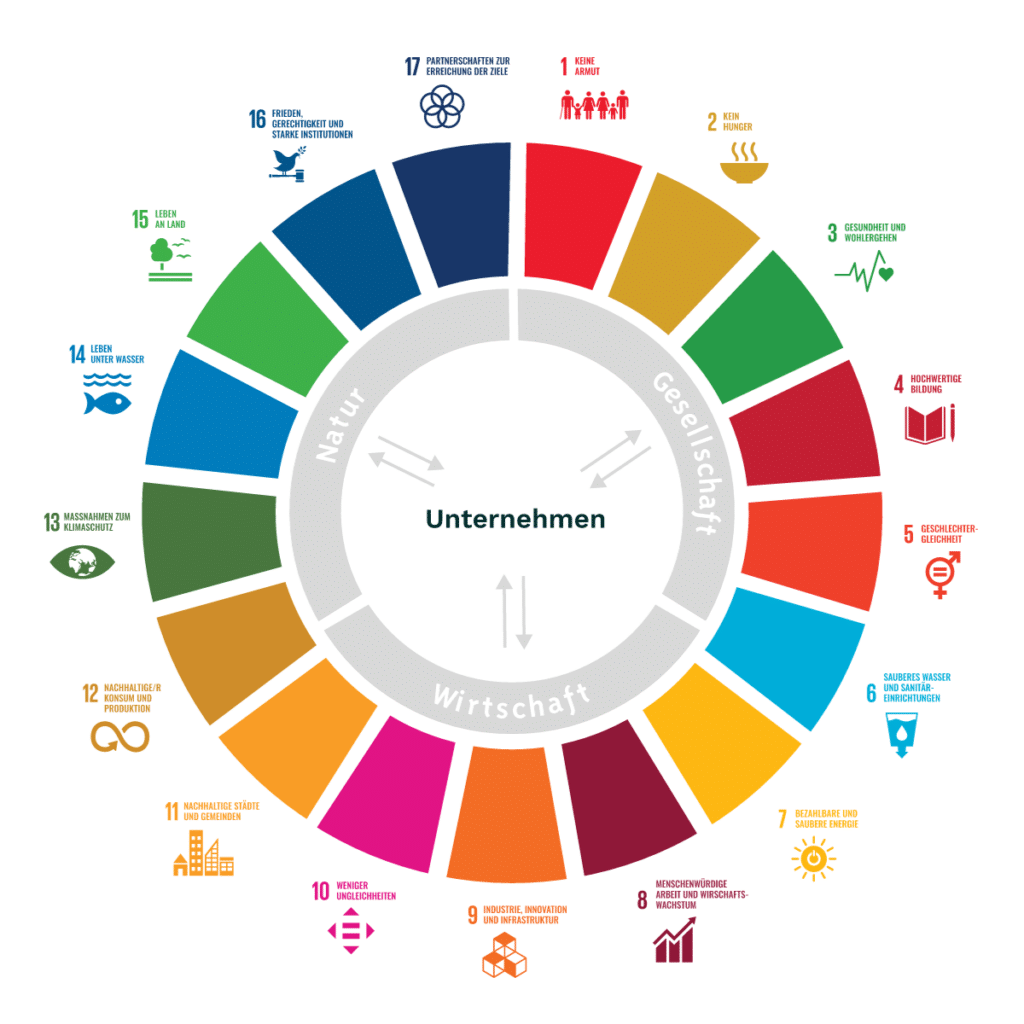

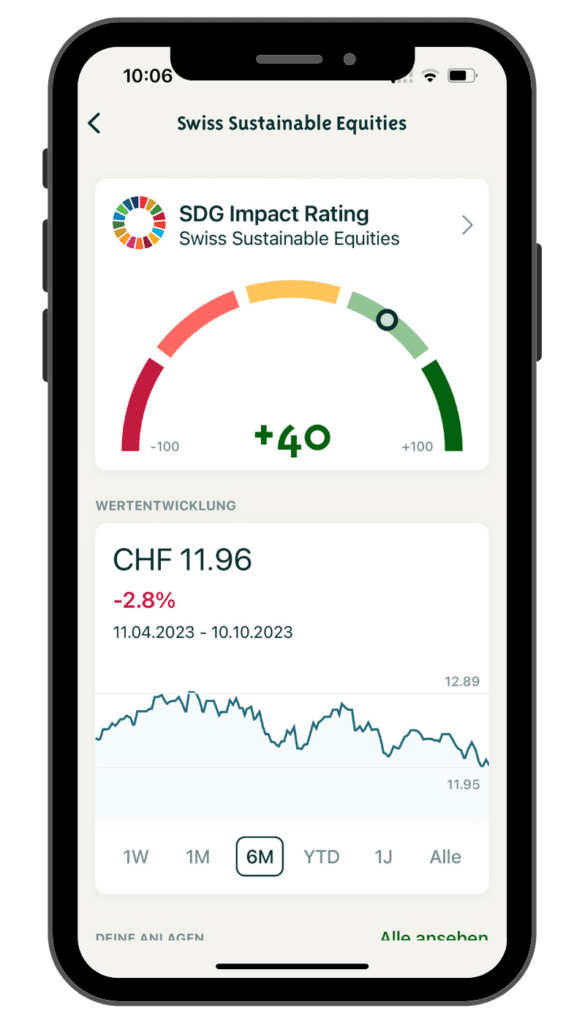

radicant SDG impact rating

radicant bases the stock selection of its funds on the 17 United Nations Sustainable Development Goals (SDGs). These include, for example, the fight against poverty or gender equality. Incidentally, radicant’s three funds are classified under Article 9 of the SFDR and Nestlé is not included.

radicant’s SDG Impact Rating calculates a score for each company and each of the 17 SDGs, ranging from +100 to -100. The focus is on the company’s products and services. Finally, the overall SDG score is calculated from the 17 individual scores. Companies with a score of 20 or higher are classified by radicant as having a positive net impact. Let’s come back to Nestlé for a concrete example: According to radicant’s SDG Impact Rating, the large corporation has a negative net impact on society and nature and thus does not meet the investment criteria.

In addition, strict exclusion criteria are applied. The list of exclusion criteria and the exact methodology can also be found on the radicant website.

This sounds a bit dry now, but don’t worry, in the radicant app it’s all presented very clearly and you can dive deeper and deeper into the companies and scores depending on your information needs. Because each company is listed with its weighting in your portfolio and if you tap on it, you can view details about the company. There you will find a brief description of the company, the positive contributions of the company to the SDGs, but also potential for improvement. Below you will find the performance and market statistics. For the entire fund, you will also find a report on the main negative impacts on sustainability.

Details on radicant’s methodology and the differences to ESG investing can be found in the article radicant SDG Investing.

Core Satellite

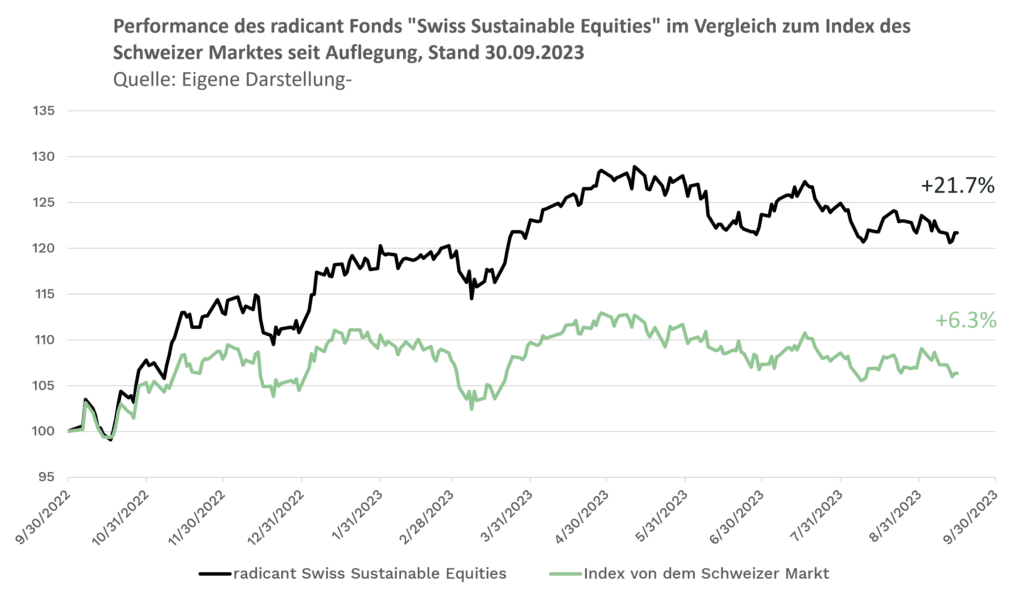

In the core, a specially established fund with sustainable global equities and – depending on the risk profile – an additional fund with sustainable global bonds is used. Optionally, a fund with sustainable Swiss equities can be added to the Core.

As a satellite, you can select two of a total of eight so-called radiThemes. These are implemented with the help of tracker certificates. In the case of structured products, the issuer risk must always be taken into account, since in the event of the issuer’s insolvency – in contrast to funds – they fall into the bankruptcy estate. The issuer of the certificates of radicant is the Zürcher Kantonalbank ZKB. The following radiThemes are available for selection:

- Climate stability

- Basic needs

- Healthy ecosystems

- Clean water & sanitation

- Health & Wellbeing

- Gender equality

- High quality education

- Social progress

Costs radicant asset management

Let’s move on to the conditions: The minimum investment is CHF 1,000, which is pleasingly low. The annual fee starts at 0.9%. From an invested asset of CHF 25’000 the fee decreases to 0.8%, from CHF 100’000 to 0.65% and the last reduction is from CHF 250’000 to 0.5%. In addition, annual product fees of 0.4 to 0.47% apply.

You can now open up to five investment portfolios, i.e. invest in different strategies at the same time. For example, you can create a portfolio with a long investment horizon and a portfolio with a shorter investment horizon or invest for your godchild.

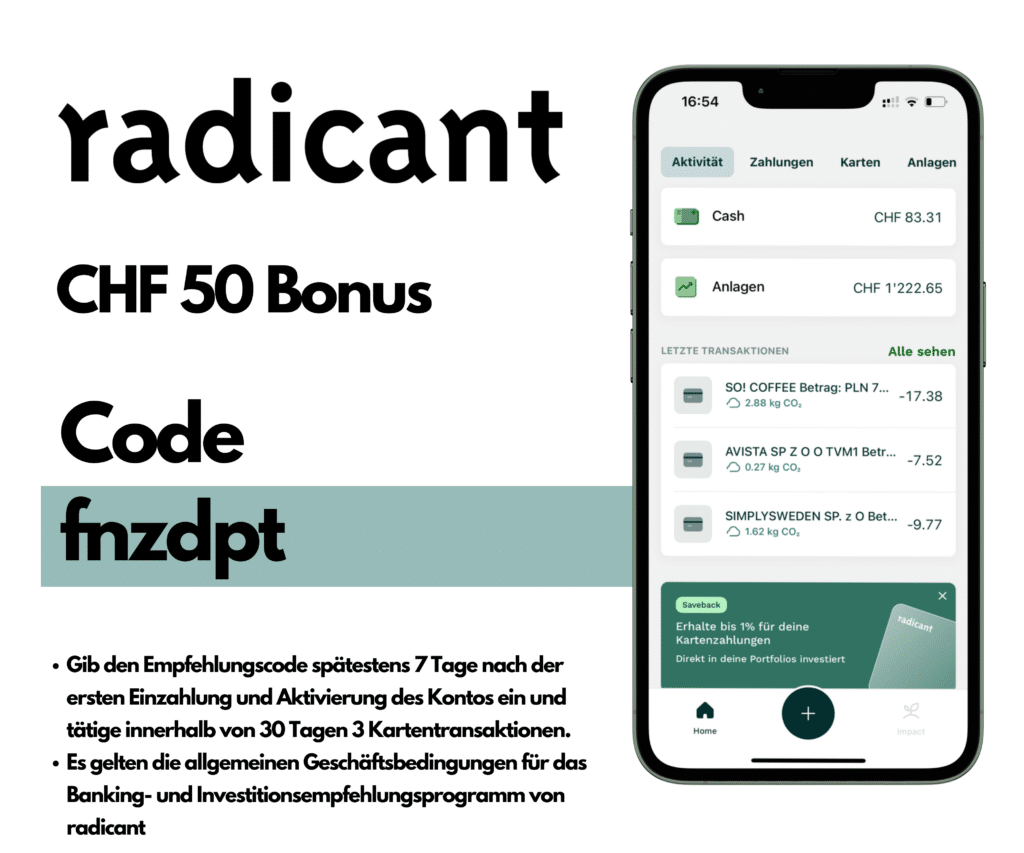

radicant recommendation code

Banking premium

You receive CHF 50 after you’ve opened your account and made 3 transactions with the radicant debit card within 30 days. Simply enter the radicant code fnzdpt when opening the account.

Investing premium

Depending on the investment amount, you can receive bonuses between CHF 5 and CHF 200. Simply enter the radicant code fnzdpt when opening the account. There are three tiers:

- Level 1: CHF 1,000 – CHF 4,999

- First bonus: CHF 5 after you have paid CHF 1,000 into your portfolio.

- Holding premium: CHF 20 if at least CHF 1,000 is held for a period of 6 months.

- Level 2: CHF 5,000 – CHF 9,999

- First bonus: CHF 20 after you have paid CHF 5,000 into your portfolio.

- Holding premium: CHF 80 if at least CHF 5,000 is held for a period of 6 months.

- Level 3: CHF 10,000 +

- First bonus: CHF 50 after you have paid CHF 10,000 into your portfolio.

- Holding premium: CHF 150 if at least CHF 10,000 is held for a period of 6 months.

The general terms and conditions for radicant’s banking and investment recommendation program apply.

Conclusion radicant experience

The free banking offer from radicant is attractive, particularly the comparatively high interest rates, paying abroad without foreign currency fees, and the free travel insurance. The CO2 footprint tracker integrated into the radicant app raises climate awareness. The Investing offer is suitable for investors who want more than an anonymous ETF whose methodology has to be painstakingly compiled from fund and index prospectuses.

radicant’s monthly “Investment Update” provides interesting background information on market developments as well as a performance and portfolio overview. In addition, an investment case is presented every month so that you can get to know the companies you invest in better.

Transparency and disclaimer

This post was made in collaboration with radicant, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.