Letztes Update: 11. July 2024

What has been on the horizon for some time is slowly becoming reality: Swissquote Banking. In addition to its existing trading and investment offering, Swissquote’s new banking offering now makes it a fully-fledged Swiss bank. And not to “a bank”, but to “the bank”. In this post, we’ll take a closer look at the two banking packages with a debit card from Swissquote. Cash deposits of up to CHF 500,000 currently earn interest at Swissquote at 0.00%. Interest rates increase for higher amounts.

Swissquote Banking Packages

Swissquote offers a total of two banking packages. The prerequisite is a general Swissquote account; a Forex and CFD account or a pure robo-advisor account is therefore not sufficient.

Applying for the banking package in the Swissquote app is very easy and took me just under two minutes. Depositing the virtual Swissquote debit card with Apple Pay also worked without any problems directly from the app.

Mobile payments are possible in both packages with Apple Pay, Google Pay and Samsung Pay, and eBill is also available. The Swissquote TWINT App has been around for a while.

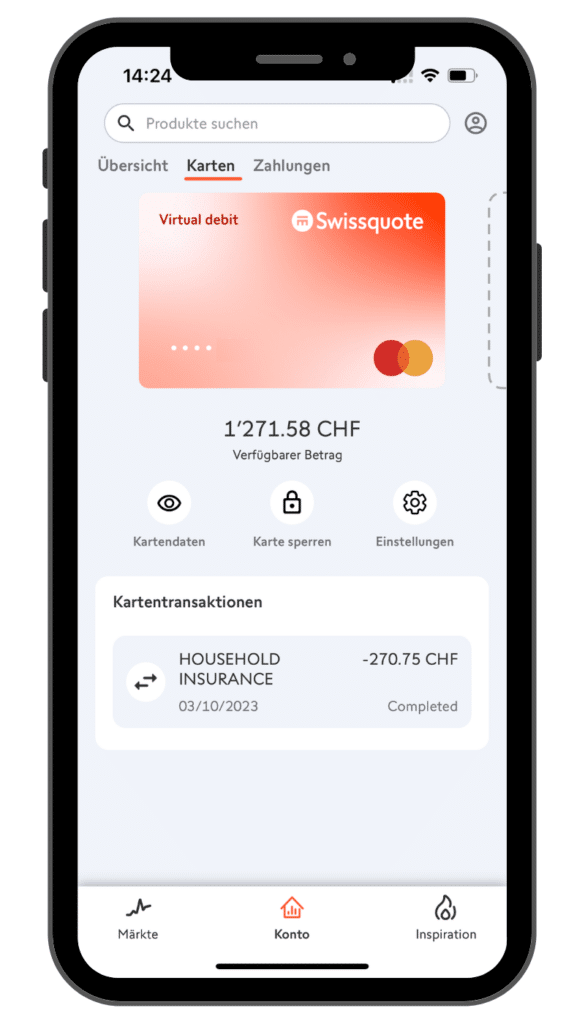

The card settings in the Swissquote app are still a bit sparse. Right now, you can only block the card, set a monthly limit, or enable crypto payment. If you wish, you can also use the Swissquote debit card to pay for your daily purchases with crypto. Currently, Bitcoin, Ethereum and XRP are available for this purpose. However, when exchanging cryptos, a 1% fee is charged. When making payments with cryptos in currencies that are not set up on the account, an additional currency exchange fee of 0.95% will be charged.

Unfortunately, if you want to view your card data, it’s a bit of a hassle. You will receive a text message with a unique identification number that you need to type into the app.

No transaction fees are charged for the 13 currencies in the multi-currency account. For all other currencies, Swissquote charges debit card transaction fees of 1.5%. The relatively high currency exchange fee of 0.95% applies to both packages. The great thing about the Swissquote multi-currency account is that you only get one IBAN. Cash receipts are automatically assigned to the appropriate currency.

After the similarities, we now come to the differences between the two banking packages:

Swissquote Bright

The banking package includes a physical and a digital Debit Mastercard and costs CHF 6.90 per month, with the first six months free. For normal card payments you will receive 0.5% cashback in the form of trading credit. If you pay with cryptocurrencies, it’s even 1%. SEPA payments in EUR are free of charge, as are five cash withdrawals per month at ATMs in Switzerland. Abroad, each purchase costs CHF 4.90.

Swissquote Light

The simpler banking package is free of charge and only comes with a purely virtual Debit Mastercard. With this card you get 0.25% cashback and if you pay with cryptocurrencies, it’s 0.5% cashback. Domestic payments are free and a SEPA transfer costs EUR 2. An ATM withdrawal costs CHF 1.90 in Switzerland and CHF 4.90 abroad. It should be noted, however, that very few ATMs in Switzerland are equipped for withdrawal with a virtual debit card.

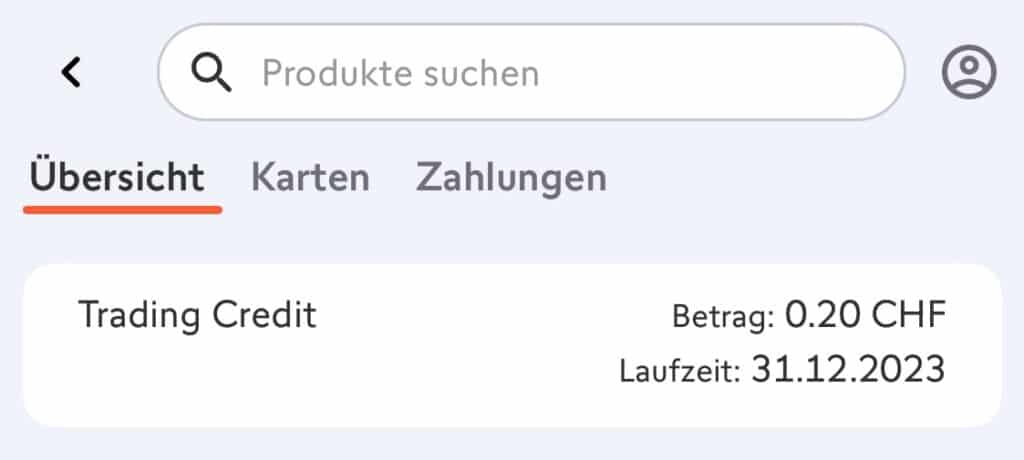

Swissquote Trading Credit Cashback

Depending on the banking package, you will receive either 0.5% or 0.25% cashback, as mentioned above. For crypto payments, it is even 1%, or 0.5% cashback. You can view the trading credits you have collected in the Swissquote app and they are automatically redeemed with every trading transaction. This way you can save on fees when placing orders online.

Swissquote Credit Cards

The Gold, Silver and Digital credit cards previously offered will be discontinued as of November 30, 2023. The conditions of these cards were not really advantageous and the agreed spending limit was always blocked as “margin” on the Swissquote account. So to speak of a credit card was a bit of an exaggeration. The only thing that remains is the prepaid card. However, with a top-up fee of 1% or at least CHF 5, this is also not very attractive.

Swissquote Banking Services

Swissquote has been offering online mortgages for some time, in cooperation with Luzerner Kantonalbank. In addition, Swissquote offers a car leasing service together with Tesla. The application process is 100% online and there’s even a special Swissquote app for the Tesla that lets you check stock prices on the go.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.