Letztes Update: 14. January 2025

I am asked again and again whether I can recommend a Swiss broker. Especially in terms of security, many seem to feel more comfortable if their money and shares are located in Switzerland or at least processed through a Swiss provider. That’s why this post is about opening a Swissquote account and my experience with the Swiss online broker. There is a Swissquote coupon code for CHF 100 Trading Credit for you in this post.

The simplest solution, where you only need to open an account and then make regular deposits, I have already shown with the provider Avadis. However, if you want to buy one or the other individual share or compile your ETF portfolio yourself, you need a broker.

Broker search

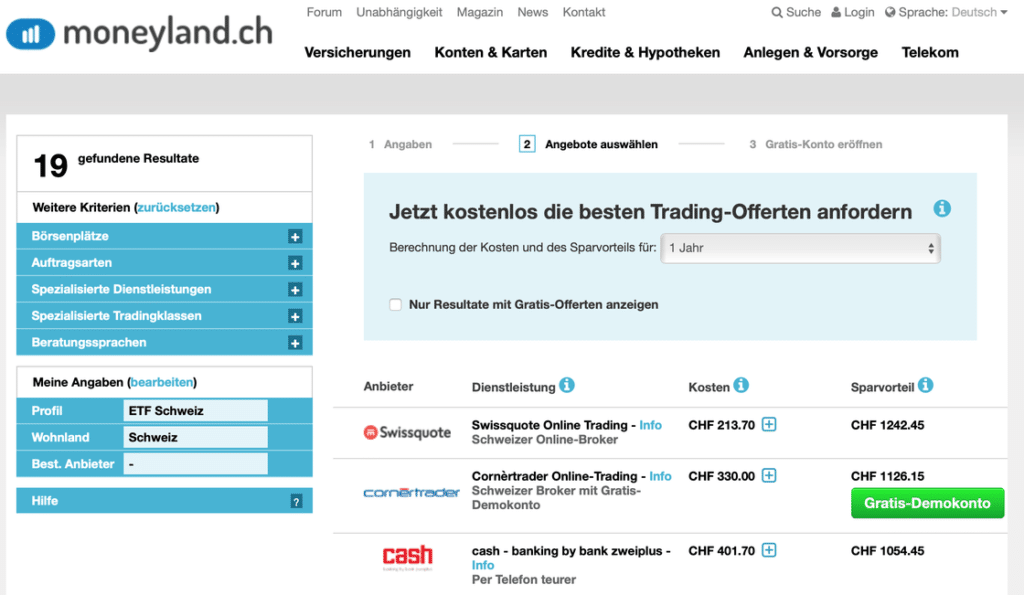

After looking closely at all the Swiss brokers, I chose Swissquote because of its attractive fees. Moneyland offers a great tool that lets you play through different scenarios. Especially for ETFs, the fee structure at Swissquote is very attractive. You can find more details below. Even if you don’t trade anything, the custody fees at this Swiss broker are attractive.

And this is how Moneyland’s comparison looks for the profile “ETF Switzerland”:

You can find a comparison of Swissquote with Saxo in the blog post Swissquote vs Saxo: Find the best Swiss online broker.

The Swiss online broker Swissquote

Swissquote Bank is a recognized Swiss bank and is subject to the Swiss Financial Market Supervisory Authority (FINMA). Swissquote Group shares have been listed on the Swiss stock exchange since May 29, 2000 and have performed well in recent years. Assets under custody amount to CHF 52.2 billion.

The low-cost broker offers over 3 million products in the areas of shares, ETFs, funds, cryptos, CFDs and forex. Since 2023, Swissquote has also been offering a regular bank account for everyday banking transactions with Swissquote Banking and the Swissquote Debit Mastercard.

Swissquote has so-called lounges in Gland and Zurich, which you can visit and get advice over a cup of coffee. So if you value personal proximity and don’t want to communicate with an employee over the phone from another country, you’ll be in good hands.

Incidentally, Swissquote has provided the trading platform for PostFinance since fall 2015. In this function, it also processes stock exchange orders for PostFinance customers.

And by the way, I think the commercial is brilliant, but see for yourself:

Swissquote advantages and special features

Portfolio performance as a graph

You can now track the performance of your portfolio in a chart and even compare it with benchmarks such as indices or gold.

Recurring orders

You can easily create a savings plan with recurring orders.

Securities lending

If you wish, you can instruct Swissquote to lend your portfolio to financial institutions. They deposit a security and pay a rental fee. The gross return on securities lending is between 0.5% and 4%, although a borrower is by no means found for all securities. During the loan period you will receive dividends as normal and of course you can sell your positions at any time. You can activate your account in eTrading. You must then send the contract generated there to Swissquote by post. Find out about the risks of securities lending before activating it.

Swissquote fees

In 2023, Swissquote replaced the percentage-based custody fee with a fixed one. The custody fee is due even if you do not trade at all.

| Asset value in CHF | Custody fee per quarter (excl. VAT) |

|---|---|

| 0 – 50’000 | 20 |

| 50’000.01 – 100’000 | 25 |

| 100’000.01 – 150’000 | 37.5 |

| > 150’000 | 50 |

Assets include securities and cryptocurrencies. This does not include cash. For assets above CHF 1 million, an additional quarterly fee of 0.0075% is due. You can find the update on Swissquote rates on the blog.

What’s great is that you can enter your Swiss shares in the share register free of charge. This is usually not possible with foreign brokers such as DEGIRO. If you are registered in the share register, you can be informed directly by the stock corporation about general meetings, for example, or you receive dividends in kind.

This is how the purchase of a share and the registration in the share register at Swissquote works.

Attractive for a Swiss broker is the or fee for ETFs that fall under the category “ETF Leader“, for this you pay only CHF 9.00 flat per online trade on the SIX Swiss Exchange. If you trade ETF Leaders below CHF 500, the flat fee is CHF 5. Foreign fees, any stamp taxes and real-time fees are charged in addition.

Incoming securities can be deposited free of charge. If securities are transferred to another broker, CHF 50.00 per position will be charged. This is also still very favorable for a Swiss broker.

You can find the other rates directly on the website.

And one more difference to foreign brokers: If you buy securities through a Swiss broker, the following stamp tax (Swiss federal turnover tax, transaction tax) is due:

- Stamp duty for domestic securities (domestic ISIN) for investors: 0.075%.

- Stamp duty for foreign securities (foreign ISIN) for investors: 0.15%.

Swissquote account opening + CHF 100 voucher code 2025

The opening process is simple and straightforward. You can start opening your trading account immediately via this link*. The promotional code “MKT_FINANZDEPOT” is already stored. If you are a Swiss citizen and have min. CHF 1’000 to Swissquote, you will receive CHF 100 Trading Credit for free.

On the registration form you enter your personal data and continue with information about your employment status, tax residence and financial information, i.e. how much you want to invest approximately and where the money comes from.

Finally, the online identification follows. Optionally, the identification can be done by video or by mail. Online identification is of course faster and is also possible at the weekend. To complete the identification and after photographing the passport or ID, as well as taking a selfie, it is necessary to transfer any amount from an existing bank account of a Swiss bank. An account can now also be opened directly via the Swissquote app.

Everything is done within fifteen minutes. And two days later I have already received the following e-mail:

Interview with Jan De Schepper, Chief Sales and Marketing Officer at Swissquote

According to your homepage, the corona-related price drop in March led to a high demand for account openings. How long does it currently take to open an account?

We still have more than twice as many account opening requests than normal. However, thanks to settings we managed to reduce the processing time to 2 – 3 days at the moment.

Which financial products do new customers mainly invest in? Are these stocks, ETFs or classic funds?

Long-term oriented new customers are mainly invested in shares, ETFs and funds. We are also seeing a lot of interest in cryptocurrencies and themed trading certificates. Short-term oriented traders appreciate our wide range of Swiss DOTS and Forex leverage products.

What are the most common questions you receive from new customers?

We generally have rather few questions that we communicate our offer very transparently on the website.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.