Letztes Update: 28. September 2023

If you scroll through the new ETF listings on the SIX Swiss Exchange, quite a few themed ETFs pop up. Here is a brief overview:

- GLOBAL X FINTECH UCITS ETF – USD Acc (0.60%)

- GLOBAL X CLOUD COMPUTING UCITS ETF – USD Acc (0.55%)

- L&G Digital Payments UCITS ETF – USD Accumulating ETF (0.49%)

- VanEck Vectors New China ESG UCITS ETF (0.60%)

- iShares MSCI Global Semiconductors UCITS ETF USD (Acc) (0.35%)

- Invesco Solar Energy UCITS ETF Acc (0.69%)

- GLOBAL X TELEMEDICINE & DIGITAL HEALTH UCITS ETF – USD ACC (0.68%)

- GLOBAL X VIDEO GAMES & ESPORTS UCITS ETF – USD Acc (0.50%)

- Invesco MSCI China Technology All Shares Stock Connect UCITS (0.49%)

- VanEck Vectors Digital Assets Equity UCITS ETF (0.65%)

The same picture emerges for the most actively traded ETFs, with the iShares Global Clean Energy UCITS ETF (0.65%), for example, coming out on top.

ETFs have had an incredible growth story in recent years and have become the absolute darlings of self-investors. And I’m also admittedly a fan of ETFs, so that shouldn’t have escaped your attention. But not all ETFs are created equal, and that’s what this post is about.

ETFs on broad market standard indices

Competition among ETF providers for market-wide standard indices has led to ever lower fees. By market-wide standard indices, I mean indices that track entire countries, regions or the world and include all sectors. For example, the MSCI World or the FTSE All-World. The advantage of such standard indices is that mostly different providers launch ETFs on these indices. You can then easily compare the ETFs with each other. Suppliers are in direct competition with each other, which leads to falling prices.

To compensate for dwindling margins, ETF providers have released products that track more specialized indexes – fashion themes, future themes or investment trends.

Theme ETFs

The research paper “Competition for Attention in the ETF Space” by Itzhak Ben-David, Francesco A. Franzoni, Byungwook Kim and Rabih Moussawi of the Swiss Finance Institute (Research Paper Series N°21-03) examined the performance of thematic ETFs. The complete paper can be found here.

For the research paper, only equity ETFs launched in America and related to the U.S. equity market were considered. The remaining 1,080 ETFs were divided into the two categories “broad” and “specific”. ETFs that track a sector or theme were assigned to the “specific” category.

By the way, sustainable ETFs can be both “broad” and “specific” ETFs. For example, if only the topic of water is covered, it is of course a “specific”. However, I would assign an MSCI World ESG, for example, to the “broad” ones. But let’s see what the paper concluded.

1) The theme is already out

“Specific” ETFs are often launched on themes that are in at the moment. These issues are currently getting a lot of attention in the press. For example, telemedicine or digital payments. If a thematic ETF is launched, an index must first be constructed, the legal documents must be drawn up, etc. It takes between six and twelve months until the first trading day.

The research paper has now found that the stocks included in themed ETFs are already overvalued at launch due to high public interest, so the ETF is very likely to deliver negative risk-adjusted performance after launch. The ETFs studied in the paper had a negative alpha of about -3% per year. The underperformance was mainly evident in the first five years after launch.

Risk-adjusted performance

Most of the time, we only look at returns, that is, what percentage an ETF has made in a certain period of time. If you also consider the risk you have taken, you talk about risk-adjusted performance or risk-adjusted return. In addition to the return, this measures how volatile an ETF was, i.e. how much an ETF fluctuated. One key figure for this is the Sharpe ratio, for example. Put simply, the higher the value of the Sharpe Ratio, the better the performance of the ETF in relation to the risk taken. Here are some examples of ETFs:

| ETF | Return/risk 1 year |

|---|---|

| Vanguard FTSE All-World UCITS ETF (USD) Distributing (VWRL) | 1.68 |

| WisdomTree Cloud Computing UCITS ETF USD Acc (WCLD) | -0.08 |

| HANetf EMQQ Emerging Markets Internet & Ecommerce UCITS ETF (EMQQ) | -0.96 |

Alpha

This measures how a fund performs against a benchmark – a reference index. One can use it to find out if the investment performance was above or below average.

2) The risk is higher

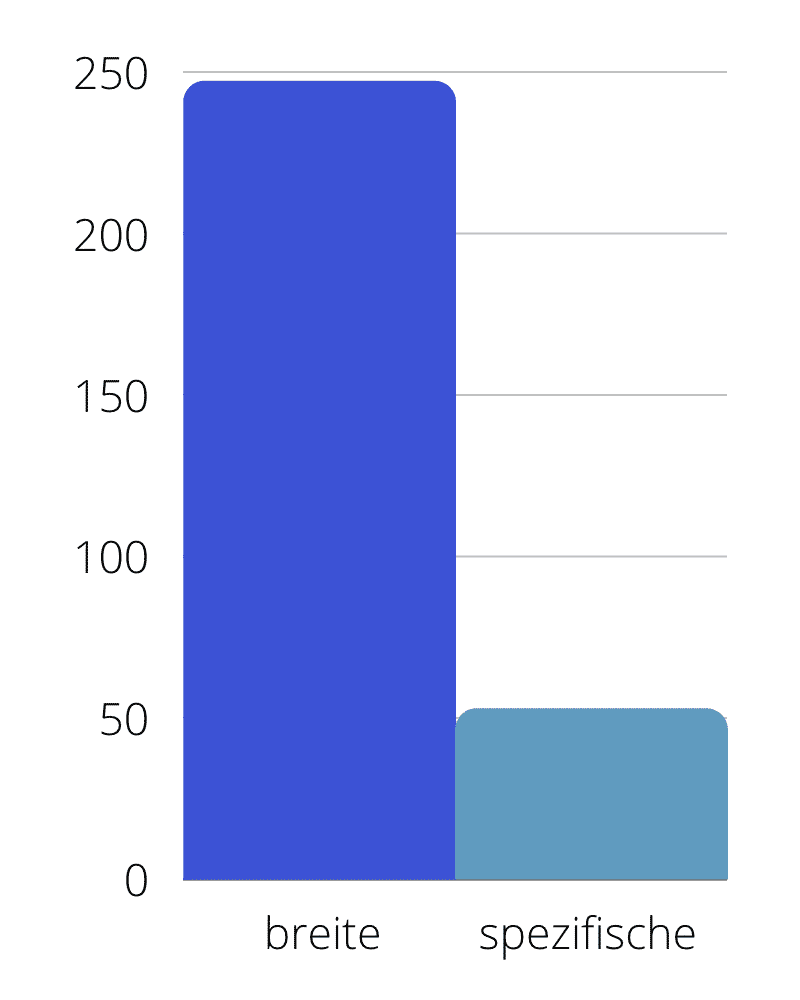

The research paper goes on to show that “specific” ETFs contain far fewer stocks and are therefore riskier. The median “broad” ETF holds 247 shares, while the median “specific” ETF holds only 53 shares. Theme ETFs are therefore less diversified, focus only on a small part of the market and are therefore more risky.

You should always look at the composition of an ETF before adding it to your portfolio anyway, but this is especially important for thematic ETFs. This is because there are often not that many companies whose shares are traded on the stock exchange for a particular topic. The companies included are therefore fairly speculative second-line stocks that are hardly traded, and thus illiquid. And if the mood on the stock markets is less rosy, such second-line stocks fall particularly sharply.

Or the ETF contains large companies that make only a fraction of their sales with the respective theme. For example, Daimler is the seventh largest position in the L&G Battery Value-Chain UCITS ETF. Or the Global Online Retail UCITS ETF contains Alibaba, Amazon and Netflix. If you have a broadly diversified world portfolio on the side, you are most likely already invested in these companies and simply weight them higher with a thematic ETF. In any case, this does not lead to higher diversification.

3) The cost is higher

The costs of the ETFs considered in the paper also differed markedly. Thus, the median for “broad” ETFs is 0.35% and for “specific” ETFs 0.58%.

This may not seem like much at first glance, but with initial assets of CHF 100,000, a term of ten years and a return of 6% per year, it still makes a difference of CHF 3,735.

The research paper also showed that theme ETF investors lose their interest after a few months and sell the ETFs again. They additionally worsen their performance with higher trading costs. Not to forget the spread, which is much higher for many niche ETFs and becomes all the more important when trading constantly, but is usually ignored.

| ETF | Spread |

|---|---|

| wide | |

| iShares Core S&P 500 UCITS ETF USD Acc (CSSPX) | 0.0459% |

| UBS ETF (CH) – SMI (CHF) A-dis (SMICHA) | 0.0800% |

| Vanguard FTSE All-World UCITS ETF (USD) Distributing (VWRL) | 0.1013% |

| specific | |

| GLOBAL X FINTECH UCITS ETF – USD Acc (FINX) | 0.4527% |

| L&G Digital Payments UCITS ETF – USD Accumulating ETF (DPAY) | 0.5456% |

| Invesco MSCI China Technology All Shares Stock Connect UCITS (MCHT) | 0.6672% |

| VanEck Vectors Digital Assets Equity UCITS ETF (DAPP) | 0.8838% |

4) Mainly for inexperienced private investors

Last, we examined which investors are more likely to trade thematic ETFs. The percentage of retail investors was significantly higher than institutional investors at the launch of the “specific” ETFs. The paper concluded that the clientele of thematic ETFs tends to be unsophisticated investors.

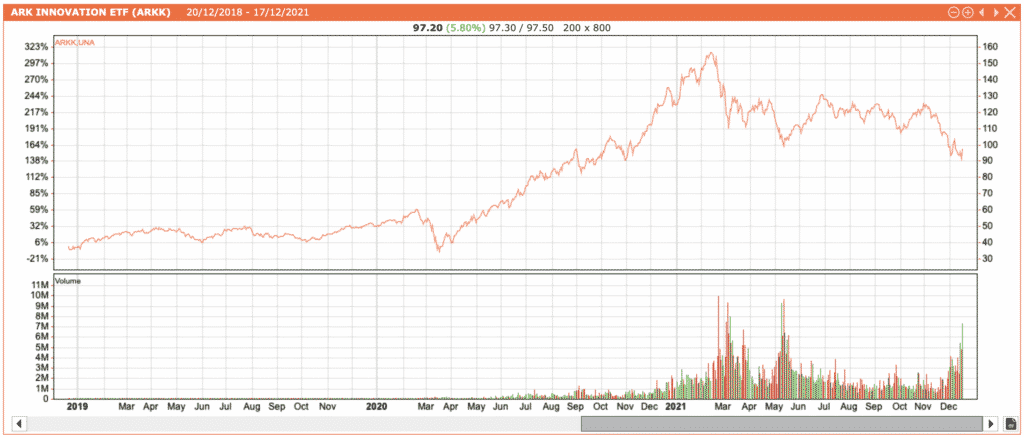

Often, private investors would project the performance of trendy investment themes into the future and thus chase performance. This was evident in the hyped (active) ARK ETFs from Cathy Wood. The great performance from March 2020 to February 2021 of over 300% was shared by very few investors.

The chart clearly shows that the trading volume did not increase significantly until March 2021 and that many only entered with larger stakes then – since then, the performance has been anything but exhilarating with a minus of around 40%.

In addition, shares included in thematic ETFs are lent much more frequently.

| ETF | Dur. Awarded (% of AUM) June 20 – June 21 | Dur. Awarded (% of AUM) June 19 – June 20 |

|---|---|---|

| iShares Core S&P 500 UCITS ETF USD Acc (CSSPX) | 2.56 | 3.55 |

| iShares Global Clean Energy UCITS ETF (INRG) | 17.46 | 28.45 |

Financial professionals borrow stocks to short them. And a high short interest means that some traders expect prices to fall soon.

Conclusion Theme ETFs

As you’ve probably noticed by now, I don’t believe in themed ETFs. So I don’t hold a single one in my portfolio either.

If you don’t want to give up thematic ETFs despite the numerous disadvantages, you should familiarize yourself with the Core Satellite strategy. The largest part of your assets – usually about 80% – is invested in a solid core of basic investments, a world portfolio. And if you have to, you can hold some smaller ETF or individual stock positions around it.

However, chances are very high that the Core will make you a lot less work, let you sleep a lot better, and cost you a lot less.

Why not write in the comments which themed ETFs you have in your portfolio and why?

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.