Letztes Update: 28. January 2025

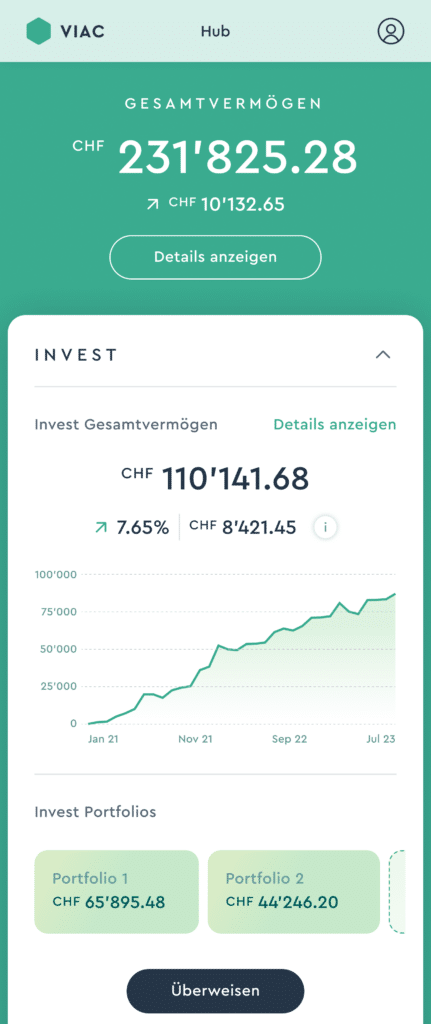

The digital Pillar 3a pioneer VIAC has finally launched its long-awaited feature. Now you can invest your funds with VIAC not only in Pillar 3a and vested benefits, but also in VIAC Invest for free assets. VIAC has played with the fee structure and now offers simple and cost-effective savings and withdrawal plans. In my VIAC Invest experiences, you’ll learn all about the advantages, costs, and strategies.

Inhaltsverzeichnis

- What is VIAC Invest and who is it suitable for?

- Costs and fees of VIAC Invest – Is it worth it?

- Investment options at VIAC Invest: How it works

- Swiss stock market in focus: How VIAC Invest uses it

- How safe is VIAC Invest?

- VIAC Invest in test: Experiences and opinions 2025

- Alternatives to VIAC Invest: A comparison of the best offers

- VIAC Invest Code

- Conclusion VIAC Invest Experiences

What is VIAC Invest and who is it suitable for?

With VIAC Invest, you can create savings and withdrawal plans easily and cost-effectively. On VIAC’s website, a calculator is available for you to simulate the performance of savings and withdrawal plans.

You can start investing from CHF 1. You can access VIAC Invest via both the app and the website. To open an account with VIAC Invest, you must be at least 18 years old, live in Switzerland, and be taxable only in Switzerland. Additionally, the deposit must be made from a Swiss bank account.

Of course, you are not obligated to deposit regularly (although a monthly savings plan is often recommended). You can decide for yourself when and how much you want to deposit. The easiest way to do this is with a standing order that you can set up in your main bank’s e-banking. It’s important that you enter the provided reference number for each transfer.

You can open up to ten VIAC Invest portfolios and set a separate strategy for each. You can customize the names of the portfolios in the app.

During the first trade of the month, it’s checked whether the current weighting of the investment funds deviates by at least 2% from the target weighting. If this is the case, rebalancing occurs automatically.

There is no notice period, so you can withdraw as much money as you want at any time. VIAC doesn’t trade daily, but every Tuesday. So it may take a few days for the money to reach your private account, as the funds need to be sold first.

VIAC Invest Funds

VIAC doesn’t use ETFs like most other providers, but rather their own launched funds. The VIAC funds usually contain UBS index funds. For example, the “VIAC Equity North America” fund consists of the index funds “UBS Equity US” (CH1390275233) and “UBS Equity Canada” (CH1390275118). VIAC uses its own funds because this allows them to act as fund management and manage customer accounts independently. This means they are not dependent on a custodian bank, which keeps costs low.

VIAC Invest: Investing for children

Since multiple accounts can be opened within a customer relationship, it is of course also possible to open a portfolio for your own children or godchildren. Legally, the portfolio always belongs to you. If you wish, you can transfer the portfolio to the child when they come of age. The portfolio does not automatically transfer to the child. You decide if and when this happens.

Costs and fees of VIAC Invest – Is it worth it?

The total costs amount to (from 2026; with bonds) 0.45% to 0.52%, depending on the chosen strategy and equity share. In 2025, VIAC completely waives the asset management fee of 0.25%, so that only the fund costs are incurred during this period. The funds in the interest-bearing account at VIAC are not subject to the asset management fee.

Since VIAC funds are traded in CHF, there are no foreign currency costs when buying or selling VIAC funds. Unlike ETFs, VIAC funds are not subject to stamp duty. Thus, neither stamp duties nor stock exchange fees are incurred when buying and selling.

The tax statement from VIAC is free. With it, you can fill out your tax return in no time.

Investment options at VIAC Invest: How it works

There are five global, five sustainable, and five Swiss investment strategies to choose from.

The “Global Sustainable” investment focus avoids investments in gold and companies significantly involved in controversial activities.

For each investment focus, the following equity ratios are available:

- Invest Account

- 20%

- 40%

- 60%

- 80%

- 100%

Strategies can be changed free of charge. The adjustment takes place on the next trading day. You can also create your own strategies. However, only the 15 VIAC funds are available for selection. Most people should be satisfied with the standard strategies.

As with VIAC’s Pillar 3a, you can decide whether to use bonds for the lower-risk portion or leave the money in an interest-bearing account.

Transferring a portfolio from another bank to VIAC is possible. However, VIAC does not allow the deposit of securities, meaning the securities are always sold first, then the money is transferred and reinvested at VIAC. You can easily create a transfer order in the VIAC app or web app. You must fill out this order, sign it, and send it to your current bank or asset manager.

Swiss stock market in focus: How VIAC Invest uses it

Even in the “Global 100” strategy, the Swiss share is around 40%, which corresponds to a relatively high home bias. The largest stock position in this strategy is currently Nestlé with a weighting of 5.6%. In the “Switzerland 100” strategy, the Swiss share is even around 75%. If you want to counteract this, you can simply create your own strategy. However, a certain Swiss home bias can make sense due to the strong currency and the rather defensive Swiss stock market.

How safe is VIAC Invest?

The VIAC fund shares are held by VIAC Invest AG and constitute special assets. This means they are protected in case of bankruptcy. Money not invested in securities is managed by VIAC Invest AG. A default guarantee from WIR Bank fully secures the balance including interest in the event of VIAC Invest AG’s bankruptcy.

VIAC Invest AG as the fund management company works with Regiobank Solothurn as the custodian bank for the securities shares of the VIAC funds. The fund shares form special assets and are also protected in case of insolvency of the custodian bank.

Payouts are only possible to a verified connection account, ensuring that the money always ends up in your own account.

VIAC Invest in test: Experiences and opinions 2025

The VIAC app receives predominantly positive reviews in the app stores. For example, it is rated an average of 4.7 out of 5 stars in the Apple App Store.

Users praise the intuitive operation and the ability to create individual investment strategies. Some highlight the cost-effective structure and competent support. Overall, the app is appreciated for its user-friendliness and flexibility.

Alternatives to VIAC Invest: A comparison of the best offers

Descartes and finpension also offer similar savings plans alongside VIAC. With these providers, you can also invest in both Pillar 3a (tied pension) and Pillar 3b (free pension).

You can also open ETF savings plans with Swiss brokers Swissquote or Saxo. Neo-banks neon or Yuh are also suitable for younger people.

VIAC Invest Code

As a new customer, receive CHF 2,000 fee-free amount with the VIAC Invest Code finanzd. If you enter the code when signing up, you won’t pay any management fees on the first CHF 2,000 for life.

Conclusion VIAC Invest Experiences

VIAC Invest offers a modern and simple way to invest money cost-effectively and flexibly. Thanks to the user-friendly app and web interface, you can start with as little as one franc and benefit from low fees without foreign currency fees or stamp duty. Many users praise the intuitive operation, easy strategy change, and helpful support. Compared to other providers, VIAC Invest scores with transparency, fair costs, and a wide selection of investment strategies that can be individually adjusted if desired.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.

1 comment

I would also like to leave a reference code: ZQKxt2C