Letztes Update: 11. July 2024

Glücks-Paket (Happiness package): What sounds like a voucher for a wellness weekend in a country inn in the Emmental is actually a savings plan from Swiss Life Select. In the promotional images, pale rays of sunlight fall on a couple dressed in earth tones and smiling blissfully. We’ll take a look at who the happiness package actually makes happy in this post.

Bloggers usually present products of which they are more or less convinced. This often has monetary reasons: After all, who writes a critical review and then puts an affiliate link under it? You can do that, but probably no one will complete the product through the link and thus you have earned nothing. As a financial advisor, I’ve come across the happiness package a few times now and think it’s important that you get a second opinion on it before closing.

Swiss Life Select

Swiss Life Select Switzerland Ltd. is a company specializing in financial planning for private households and the brokerage of financial products. A total of around 700 financial advisors work for Swiss Life Select. Before Swiss Life Select became a wholly owned subsidiary of the listed Swiss financial advisory and insurance group Swiss Life, Swiss Life Select operated under the name AWD. The website repeatedly refers to the cooperation with over 60 product partners and also to the fact that the customer is at the center.

According to job advertisements, Swiss Life Select offers a “transparent and performance-oriented career and compensation model regardless of gender, age or origin” and seeks applicants with “strong sales and interpersonal skills.” Applications should be sent to the Sales Development Department.

Glücks-Paket from Swiss Life Select

Let’s let Swiss Life Select have its say:

“Glück to go” and the “Glücks-Paket” are about laying the foundation for a self-determined future and fulfilling your personal wishes with targeted wealth accumulation.”

Swiss Life Select’s Glücks-Paket is touted as a “profitable investment” with an “optimal fund preselection.” So let’s take a closer look at the terms and conditions and the fine print.

What’s in it?

Let’s start with the simple. A total of three investment profiles are available for selection:

- safety-oriented

- balanced

- dynamic

Now it gets more complicated on the website, because all further information is well to very well hidden or not available at all.

It is not easy to determine how high the share proportion of the individual strategies is. Not to mention the weighting of countries or individual stocks.

A crumb of information can then be found in the performance comparisons of the individual Glücks-Paket. Let’s look at the Dynamic investment profile, which consists of an equally weighted basket of the following funds:

- Flossbach von Storch Multiple Opportunities II

- Swisscanto (CH) Portfolio Fund Resp. Valca

- UBS Suisse 65

These are not bad funds, but they have one thing in common: they are expensive. We will go into more detail on the TER of the individual funds later.

First, however, we will look at the costs incurred directly by Swiss Life Select.

Swiss Life Select Commissions

Commission on purchase is 2%, no commission on sale. The commission on the purchase is also called the issue surcharge.

The front-end load is not an annual fee, as is the case with most other fees, but a one-time fee that is charged when a new fund share is purchased. So, with a monthly savings plan, this fee is incurred each month when new shares are purchased. An example: With a monthly savings plan of CHF 200, CHF 4 per month is incurred for the issue surcharge. Calculated over the year, this amounts to CHF 48.

The longer a fund share is held, the less the impact of the front-end load. However, the compound interest effect is naturally slowed down.

Note that the front-end load is not taken into account in performance comparisons and in charts.

Swiss Life Select fee for currency exchange

The currency exchange fee, i.e. the difference from the bid or ask rate, is a maximum of 1% per transaction. This is not unusual, but tends to be in the upper range. However, it is not apparent in which currency the funds are traded.

Swiss Life Select All Inclusive Fee

The All Inclusive Fee at Swiss Life Select is 0.3% per quarter. If you want to make them appear smaller, you specify them quarterly. It amounts to 1.2% per year, which is quite steep.

The federal sales tax is incurred in addition. However, since this is also an additional cost for most other providers, I will not go into it further here. Just so: All Inclusive Fee does not always mean All Inclusive, which brings us to the next question that should keep me busy longer than I thought.

TER of the funds used

What is not apparent on the website: Are the TERs of the funds used already included in this all-inclusive fee or are they still to be added? And if so, how high are they? So, as a curious private customer, I ask Swiss Life Select. First answer: All information can be found on the website. But since I can’t find the information, I’m replying to the mail and asking for a specific answer. A mail comes back that this question will be forwarded to the specialist department. Almost two weeks later, I receive the reply that, as a matter of principle, no information will be provided without a signed consulting order. However, an agent could contact me as soon as possible to schedule a consultation.

The answer is still unsatisfactory for me, so I officially turn to the press office as a financial blog and give it a week for a response. The week passes without result. My query also remained unanswered.

So I tried to gather the information from the Internet.

| Fund | TER | Through. monthly Value dev. 3 years p.a. (Source: Morningstar) |

|---|---|---|

| Flossbach von Storch Multiple Opportunities II* | 1.53% | 2.81% |

| Swisscanto (CH) Portfolio Fund Resp. Valca | 1.53% | 5.12% |

| UBS Suisse 65 | 1.05% | 3.40% |

Swiss Life Select Criticism – Refunds

A portion of the management fee charged by the funds flows back to Swiss Life Select in the background, according to the document “Basis of Cooperation”:

“Calculated on the basis of the amount invested in the relevant product, the reimbursement of this share to Swiss Life Select is 0.1% to 1.5% p.a.”.

According to the Federal Supreme Court, retrocessions, as refunds are also called, belong to the customers. But now comes the crucial point: They only belong to them if they have not expressly and legally waived them. At Swiss Life Select, for example, a so-called advance waiver is then also found in the document “Basis of Cooperation”:

“You hereby expressly waive in favor of Swiss Life Select the issuance of this rebate.”.

This can lead to conflicts of interest. For Swiss Life Select, it is naturally most lucrative to pack those funds into their investment solutions that pay them the highest possible rebates. It goes on to say:

“You acknowledge that such compensation may lead to conflicts of interest and, in particular, may create an incentive to favor those products that are remunerated at a higher rate. Swiss Life Select takes account of these conflicts of interest by having taken appropriate organizational measures aimed at safeguarding the client’s interests at all times.”.

It is not possible to find out what these organizational measures look like from Swiss Life Select – e-mails are not answered.

Reimbursements are not uncommon in the financial industry, but they are no longer appropriate. In recent years, other providers have moved to using only reimbursement-free funds. From my point of view, the most customer-friendly “organizational measure”.

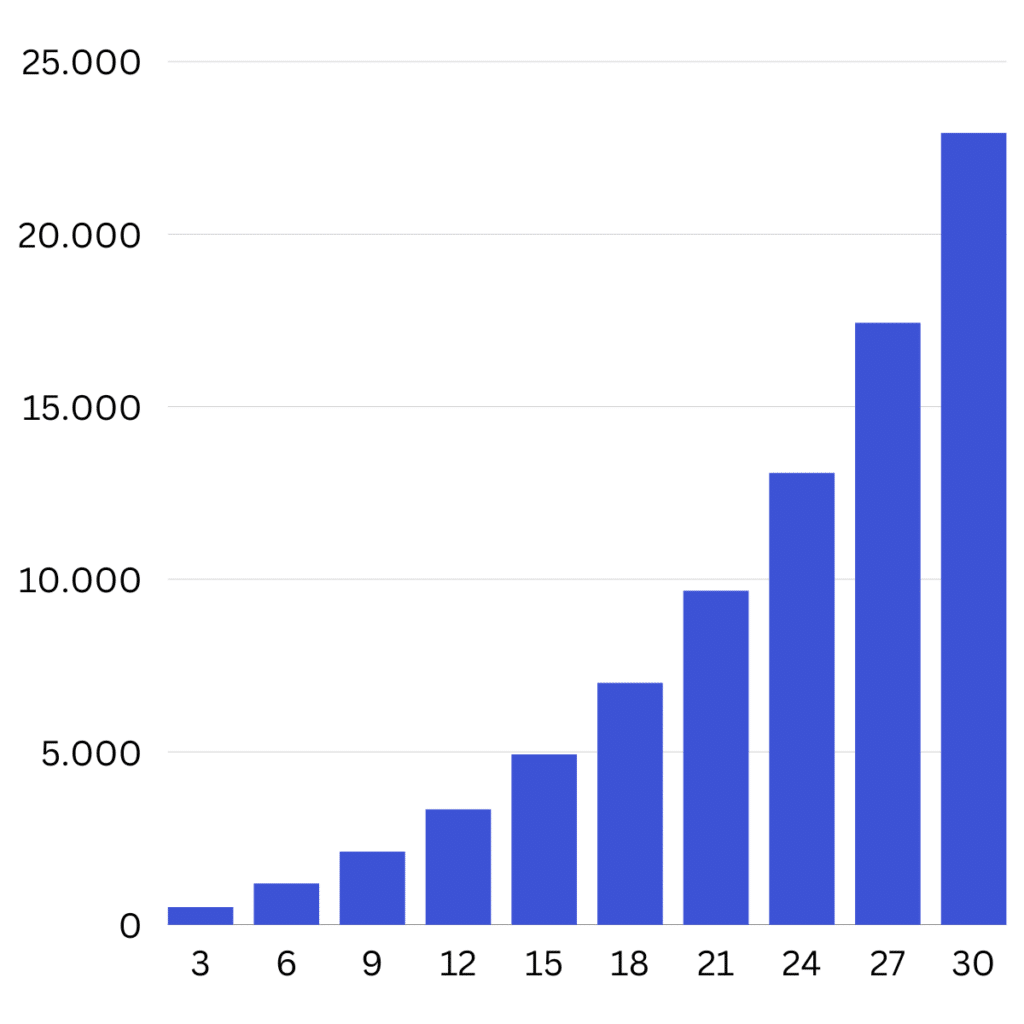

Let’s calculate this once with the following parameters:

- Starting amount: CHF 10’000

- Gross yield: 6.5%,

- Amount of the rebate: 1.5%

- Yield after reimbursement: 5%

- Investment term: 30 years

- Balance with reimbursement: CHF 43,219

- Balance without reimbursement: CHF 66,144

- Difference: CHF 22,925

And here still graphically the difference of the asset development due to the refunds of 1.5%:

“Difference in asset performance” sounds so nice. In other words, it is the amount that moves from your pocket to someone else’s pocket.

Swiss Life Select Total of costs

After so many costs, your head is spinning. Therefore, a brief summary. And an example with a deposit of CHF 10’000.

| Issue surcharge | 2.00% | CHF 200 |

| All Inclusive Fee | 1.20% | CHF 120 |

| TER of the funds | 1.37% | CHF 137 |

| TOTAL | 4.57% | CHF 457 |

In the first year, 4.57% of the CHF 10,000 is lost, i.e. CHF 457. In the second year, it is “only” 2.57%.

This does not even include the federal sales tax and the costs for any currency exchange.

If we look at the performance of the funds over the last three years, which was around 3.7%, then you can work out for yourself how much is still in it for you. To be fair, the performance already takes into account the TER of the funds used. But not the all-inclusive fee and the issue surcharge.

And that’s still the “dynamic” investment profile, with a relatively high share of equities and thus potentially the highest return. The “safety-oriented” investment profile will have a lower annual return. Since it can be said with certainty that all except the customers earn well.

The Swiss Life Select Spirit

Incentive trips are donated to particularly successful consultants. In 2022, for example, top advisors flew to Singapore and Andalusia at Swiss Life Select’s expense. After all, “personality development is a high priority at Swiss Life Select”. A company must first be able to finance such goodies. Three guesses who is doing this: if you look at Swiss Life Select’s compensation methods and approach, it’s the clients who are being pitched the expensive products.

Annual kick-off meetings, where the “glamour factor” is not to be missed, are also popular, as are Power Days and Careerdays. At these events in (not entirely cheap) top locations, top consultants are honored as “Diamond Performers”. Of course, awards are given to those who have made the most deals and not to those who have gone over the fine print in the “Fundamentals of Cooperation” with customers and made sure it was understood.

Swiss Life Select advisors like to show themselves on social media lifting weights at the gym. After all, “you’re supposed to be successful with the mindset of an athlete.” Or they pose at a hip travel destination, with the poetry album catchphrase not missing in the caption: #donotgiveup #doitorleaveit

To round things off, here are a few reviews from the employer rating portal kununu

You have to be a very unscrupulous person to sell expensive products to your friends and relatives.

Customers are being ripped off in the worst possible way. Consultants tell something and at the end it is completely different.

You decide how much you want to earn and there are no upper limits.

If you can sell brainlessly, you'll make good money. But your superiors and the company even more so.

Like a kind of s e c t e . You stick together because everyone wants to get to the top.

Swiss Life Select Alternatives

If you are looking for a more transparent and cheaper savings plan alternative after reading this article, I look forward to hearing from you at onlinefinanzberater.ch – Finanzen auf Augenhöhe.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.