Letztes Update: 19. April 2025

Two established financial service providers are venturing into the young, digital financial world – and with success! The Yuh banking app has managed to turn a profit in less than four years and establish itself as a significant player in the Swiss financial market. Currently, around 300,000 customers trust Yuh, and the assets under management amount to an impressive 3 billion Swiss francs. But what’s behind Yuh’s success, and how do the experiences of users measure up? In this article, we take a close look at the strengths and weaknesses of the app and show whether switching to Yuh is worthwhile.

Start with Yuh

Because I already have a Swissquote account, the registration process was extremely fast for me. Download the app, install it and simply log in with your Swissquote username and password. After that, I had to register the cell phone via SMS, and that was it. All data such as address and telephone number were transferred automatically.

If you already have an account with PostFinance, it should be just as easy.

Once you have gone through the entire registration process, you can share your experiences in the comments below.

Yuh promises “no hidden costs” and “crystal clear prices.” I will go into more detail about the costs in the respective section. You can find all other prices here.

Numbers with Yuh

With Yuh, you get a free debit Mastercard, a multi-currency account, and see all account activity in real time.

The Mastercard, designed in plain black can be deposited with Google Pay, Apple Pay and Samsung Pay. And as the first Swiss neo-bank, Yuh has its own TWINT app.

Under“Map settings” you can:

- Lock card

- Change PIN code

- Change card limit

- Block and replace card

A virtual card is now available to you directly when you open a Yuh account. You just have to activate it under “Numbers” and “Card”. You can also add this virtual card to your Apple Wallet, for example.

Of course, transfers – Yuh calls these payments – are also possible. Either realtime to friends who also have a yuh account, or classic as bank transfers within Switzerland or worldwide. At the moment 13 currencies can be transferred. Bank transfers within Switzerland and SEPA transfers are free of charge. Other transfers cost CHF 4. You can either scan QR invoices with your camera or, conveniently, simply upload the QR code as a photo or document. Standing orders are now also possible.

To activate eBill, tap “Payment” under “Payments” and tap “eBill” under “New Payment”. After accepting the terms and conditions, you can use eBill within Yuh. eBill is not directly integrated with the Yuh app, so a browser window opens.

One cash withdrawal per week is free of charge, after that a withdrawal costs CHF 1.90. Abroad, a cash withdrawal costs CHF 4.90.

Push notifications can be set up for incoming payments, payments with your card and for executed trade orders.

LSV+ is currently not yet possible.

Save with Yuh

Savings projects can be created in the app – other providers call this feature Pots or Spaces. For example, taxes, car or travel are available as predefined projects. But also own projects can be created. You can activate automatic saving within the project and enter the frequency and amount.

Transfers within the pots are of course possible and free of charge.

Your money is deposited with Swissquote Bank AG and enjoys the Swiss deposit guarantee of CHF 100,000. PostFinance acts more in the background in this joint venture and operates the call center, for example.

Yuh interest

Cash balances are subject to an interest rate of 0.10%. There is no upper limit. For the currencies EUR and USD, there is also a 0.10% interest rate.

And the best thing about it: your money is not blocked like in some savings accounts. You can spend or invest it as you wish. However, you must keep your money in a project under “Savings” in order to earn interest. You do not earn interest on cash under “Pay”. However, you can move money back and forth between “Pay” and “Save” indefinitely.

Yuh 3a

Tap “Save” and you’ll find “Yuh 3a” in the upper left corner. The following investment strategies are available

- Mild: 20% shares

- Hearty: 40% shares

- Spicy: 60% shares

- Sharp: 80% shares

- Fiery: 98% shares

The strategies are implemented using Swisscanto index funds, with investment strategies ranging from Mild to Sharp including bonds, real estate and gold in addition to equities. Descartes provides the technological platform together with Lienhardt & Partner Privatbank Zürich.

You can set a goal that will be converted into an automatic transfer. This way you can easily set up a monthly transfer to your Pillar 3a. At the moment you can open only one Pillar 3a account, in the future there will be more. If you already have a pillar 3a account with another provider, you can transfer it to Yuh using the transfer form.

Investing with Yuh

And definitely here is where it gets exciting and really unique: When buying and selling a product, a transaction fee of 0.5% is charged, with a minimum fee of CHF 1. For example: You buy ETF shares worth CHF 1,000 and pay CHF 5 in fees. There are no custody account fees. Especially for smaller amounts, this is unrivaled in Switzerland for real shares. However, if you want to invest larger amounts at once, you will be better off with the Swissquote broker. For an ETF on SIX, the broker Swissquote is cheaper from just over CHF 2,000. Depending on the trading currency, even for smaller amounts.

Cryptocurrencies incur a slightly higher transaction fee of 1%. This is the same as with the broker Swissquote. Another commonality: apart from Swissqoin, cryptocurrencies can only be bought using EUR or USD.

At Yuh, investment orders are executed in real time at the market price, provided the relevant exchange is open.

Orders for cryptocurrencies are executed immediately (24/7). Depending on the cryptocurrency, the minimum investment amount varies. For Bitcoin, for example, it is USD 25.

Transfers to another provider are not possible, and registration in the share register is also not available. This also means that it is not possible to attend general meetings.

Dividends will be prorated and credited to your account. When it comes to other corporate actions, such as a capital increase or spin off, Yuh decides how to handle it. So you don’t have the choice you would have with a traditional broker.

In total are currently:

- 327 Stocks

- 47 ETFs

- 50 Cryptocurrencies

- 27 Trend themes (Tracker certificates from Swissquote)

- 10 Bonds ETF

- 2 Investment themes (actively managed tracker certificates of LUKB)

available.

The complete Yuh ETF and Stock List.

Fractional Trading

In November 2021, Yuh introduced fractional trading. From CHF 10, you can invest in fractional shares. Instead of buying a whole Amazon share (value on September 17 of USD 3,480.46), you can now buy a fraction of it. Swissquote holds the financial instruments in trust for you. Legally speaking, you no longer hold the financial instruments yourself. This has also been the case for whole shares since November 2021.

Savings plans

Since February 2022, automatic investing is possible at Yuh – so savings plans are finally available in Switzerland! Here you can find out everything about the savings plan at Yuh.

ETFs

Let’s take a closer look at ETFs. Meanwhile, the popular VWRL, which is traded on the Swiss stock exchange in CHF, is also available. It covers the global equity market and contains over 3,700 companies.

If an ETF is not traded in CHF, fees are incurred for currency exchange: The markup to the interbank rate is 0.95%, which is in the upper range. The fee is already included in the exchange rate and is not specifically shown, which is a bit of a shame.

The term sheets of the ETFs can conveniently be accessed directly in the app.

Yuh ETF savings plan without trading fees

The following 13 ETFs can be purchased at Yuh as part of a savings plan without trading fees:

| ETF | Symbol | ISIN | TER |

|---|---|---|---|

| Vanguard FTSE All-World UCITS ETF Distributing | VWRL | IE00B3RBWM25 | 0.22% |

| Vanguard FTSE All-World High Dividend Yield UCITS ETF Distributing | VHYL | IE00B8GKDB10 | 0.29% |

| iShares MSCI World CHF Hedged UCITS ETF (Acc) | IWDC | IE00B8BVCK12 | 0.55% |

| iShares SMI (CH) | CSSMI | CH0008899764 | 0.35% |

| Invesco Nasdaq-100 UCITS ETF CHF Hedged | EQCH | IE00BYVTMT69 | 0.35% |

| Invesco CoinShares Global Blockchain UCITS ETF Acc | BCHE | IE00BGBN6P67 | 0.65% |

| WisdomTree Physical Bitcoin | BTCW | GB00BJYDH287 | 0.25% |

| Vanguard ESG Global All Cap UCITS ETF (USD) Accumulating | V3AA | IE00BNG8L278 | 0.24% |

| Invesco FTSE All-World UCITS ETF CHF PfHdg Acc | FWCA | IE000SHR0UX9 | 0.20% |

| Vanguard Global Aggregate Bond UCITS ETF CHF Hedged Accumulating | VAGX | IE00BG47KF31 | 0.10% |

| Swisscanto (CH) Gold ETF EA CHF | ZGLD | CH0139101593 | 0.40% |

| Swisscanto (IE) ESGen SDG Index Equity World UCITS ETF ET CHF | SWCSW | IE000ZI3FFP9 | 0.35% |

| Swisscanto (CH) ESGen SDG Index Equity Switzerland ETF EA CHF | SWCSS | CH1408319130 | 0.35% |

Only the stamp duty, the ongoing TER of the ETFs and the trading fees on sale are payable. As all ETFs are traded in Swiss francs, there are no currency exchange fees and no custody account fees. For the purchase to count as a savings plan, at least two executions must be made in succession.

In the Yuh app, you can find these ETFs under “Invest”, “Search”. Then set the filter “Special Savings (ETF)” under “Investment Types”. You can recognize ETFs without trading fees by the symbol with the two circular arrows.

Yuh Swissqoin

As befits today’s hip fintechs, Yuh also has its own cryptocurrency: Swissqoin (SWQ) is based on the Ethereum blockchain and forms the center of the Yuh rewards program.

If certain actions are taken in the app, such as the first transfer of CHF 500 or a transaction with the Yuh card, you will be rewarded with Swissqoin.

You can exchange the collected Swissqoin for cash, give it to friends or simply keep it and hope that the value increases.

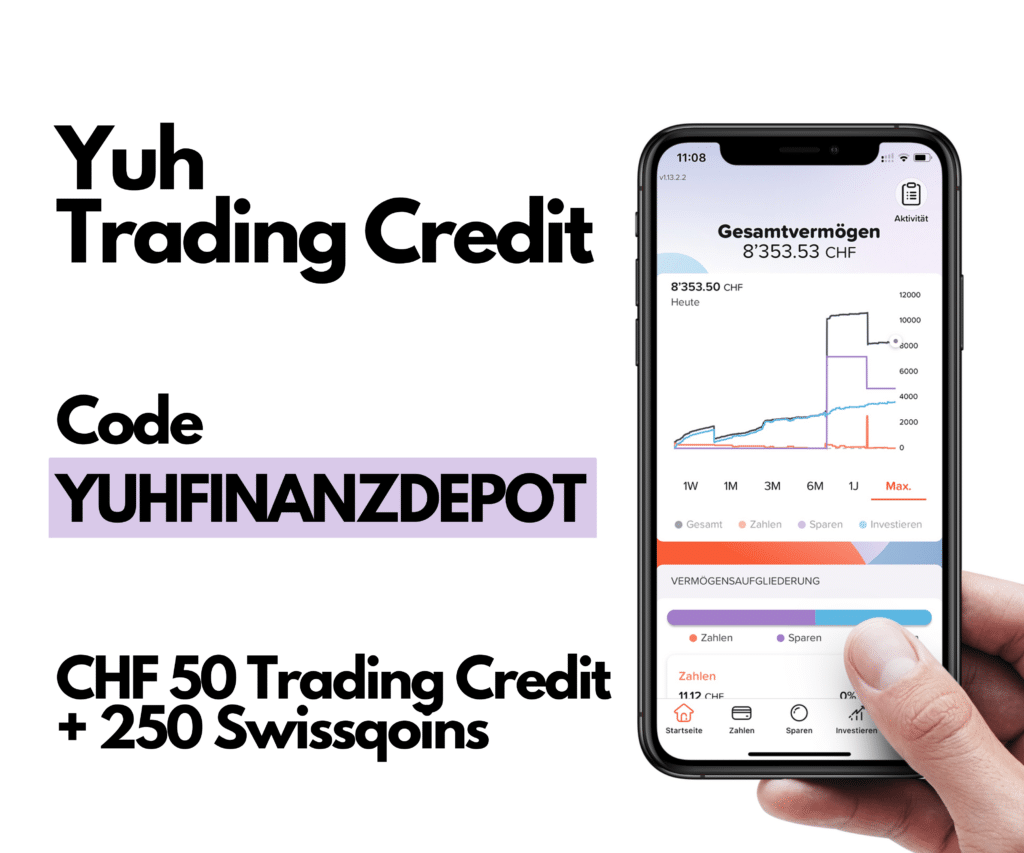

Yuh Code – CHF 50 Trading Credit

With the promotional code YUHFINANZDEPOT you will receive CHF 50 Trading Credit and 250 Swissqoins when you open your account.

Only valid for persons living in Switzerland; minimum deposit CHF 500.

Yuh App for:

iPhone

Android

HUAWEI

Conclusion Yuh experience

The design is reminiscent of a faded Joseph-and-the-Amazing-Technicolor-Dreamcoat musical performance and takes some getting used to.

However, younger customers in particular are very well served by Yuh. You get a cost-effective (almost) all-in-one solution with the security of a Swiss bank.

With YuhLearn, an educational offer with easy-to-understand blog articles is also available. In general, the texts in the Yuhniverse are very direct and loosely formulated.

FAQ Yuh

Yes, you can now request a tax statement in the app at the introductory price of CHF 25. A withholding tax statement, a custody account statement and an interest statement are free of charge. These documents will be available in the app from mid-January.

The transaction fee is 0.5%. The minimum fee is CHF 1.

The transaction fee for cryptocurrencies is 1%.

There is no custody fee.

There is a fee of 0.95%.

Currently, you receive 0.10% interest per year on funds in CHF that you hold in the “Savings” area at Yuh.

Yuh is a joint venture between Swissquote and PostFinance. Financial services are provided by Swissquote, which is regulated by FINMA, the Swiss Financial Market Supervisory Authority. Deposits with Yuh are subject to Swiss deposit protection up to CHF 100,000.

No, the Yuh Mastercard is a debit card.

Yes, you will receive your own Swiss IBAN and your money will be held at Swissquote Bank AG in Switzerland.

Yes, Yuh is the first Swiss neo-bank to have its own TWINT app.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.