Letztes Update: 29. April 2024

I have already presented the online wealth platform True Wealth to you in detail here. Since the beginning of November 2022, True Wealth has finally made it possible for you to invest your assets within the framework of pillar 3a at very favorable conditions. Of course, I put True Wealth’s Pillar 3a to the test. In this review you will also read about my experience with True Wealth’s unbeatable Pillar 3a.

By the way, True Wealth now has 12,500 clients and manages more than CHF 800 million in assets. True Wealth is a member of the Swiss Association of Asset Managers and holds a FINMA license as an asset manager for pension assets. Access your True Wealth portfolio through both the web and smartphone apps.

True Wealth Pillar 3a

If you already have an account with True Wealth for the free assets, opening the pillar 3a account is very easy. Clicking on “Activate Pillar 3a” in the dashboard already does it. This is because True Wealth applies the same risk profile and investment strategy to Pillar 3a as it does to discretionary assets. So you have a strategy for both depots.

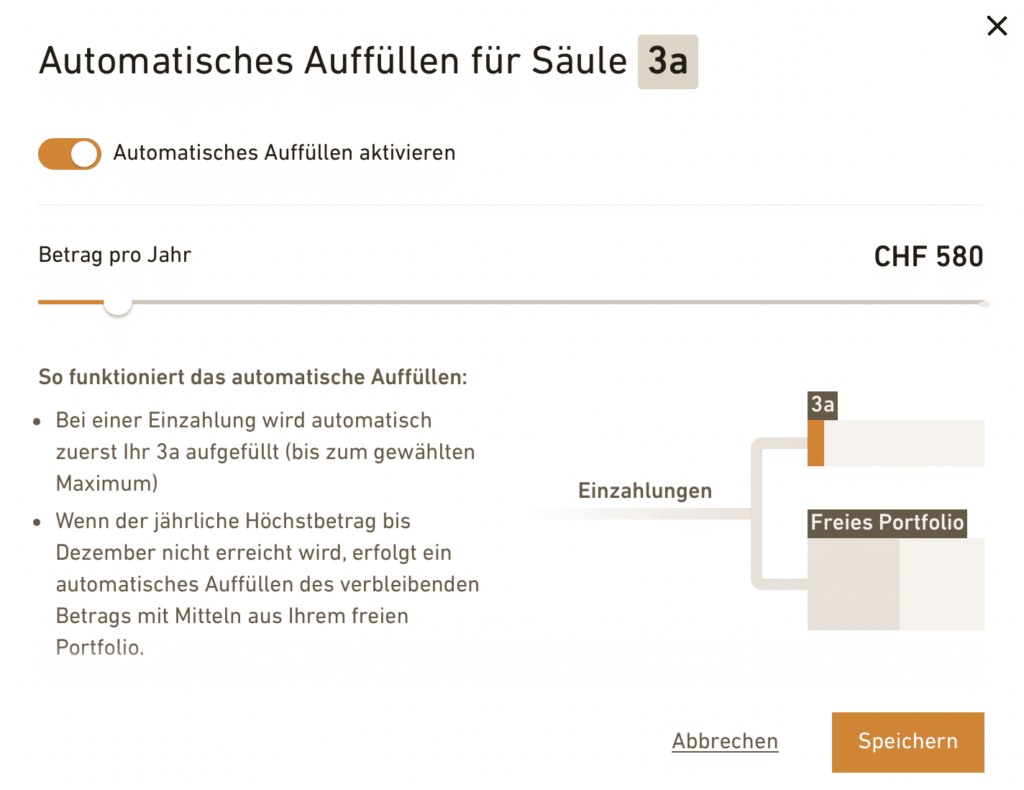

Thus, there is only one IBAN to which you can transfer funds from an account that is in your name. Automatic replenishment of your Pillar 3a is also possible. To do this, you specify an amount up to which Pillar 3a payments are credited. If you have paid in less in a year, funds from the free assets will be used to top up at the end of the year.

Of course, you can also “manually” transfer funds from the free portfolio or from an external pillar 3a to True Wealth’s pillar 3a. For the latter, you create a form in the dashboard that you can send to your previous 3a foundation. Optionally, True Wealth will send you the form to sign.

A sustainable strategy is also available. In the dashboard you can easily change the investment universe from “global” to “sustainable”. The product fees increase slightly as a result, but the administration fee remains the same.

If you don’t already have an account with True Wealth, opening an account in the app takes just a few minutes. You will need a valid identification document and a Swiss mobile phone number to digitally sign the documents.

Accounts

A special feature of True Wealth’s third pillar is that several pension accounts are automatically opened over the years. An algorithm ensures that your pension assets are distributed evenly among the various accounts. With the staggered payment of the accounts, the progression of the capital payment tax can be broken. In other words, depending on the canton and the asset situation, you can save taxes with it. As a reminder: 3a accounts cannot be split, but they can be merged without any problems.

There is no minimum investment amount of CHF 8,500 for pillar 3a as there is for free assets. You can also test True Wealth’s Pillar 3a with small amounts without obligation. Because True Wealth uses fractional shares in its Pillar 3a plan, small portfolios are also optimally diversified.

Costs

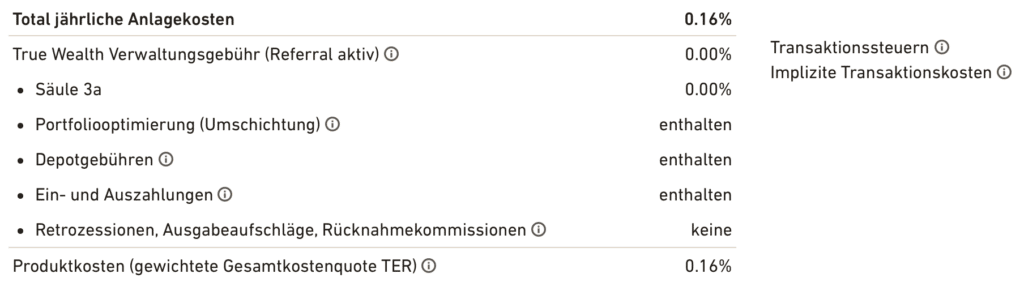

True Wealth says it can eliminate all administrative costs thanks to largely automated investment processes. Thus, with True Wealth’s Pillar 3a, only the product costs are incurred. These amount to approx. 0.15% for the global and approx. 0.25% for the sustainable investment universe and are of course dependent on the index funds and ETFs used. With my strategy, the product cost is 0.16%. The dashboard shows the annual investment costs very transparently.

The Board of Trustees of the Pension Foundation could introduce a management fee of a maximum of 0.225% per annum on the securities portion. However, the introduction of the administrative fee is not planned for the next few years. Even if it were to be introduced, True Wealth would still be among the cheapest 3a providers.

Processing fees are charged for certain special cases, as is the case with other pension foundations. For example, if the Foundation is left within one year of joining, a fee of CHF 100 will be charged. And the homeownership advance withdrawal costs CHF 250. Further fees can be found in the cost regulations.

True Wealth pays 1.25% interest on the cash. That is also very attractive compared to the competition.

Instruments

The custodian bank is Basellandschaftliche Kantonalbank (BLKB). The cash is also held by BLKB, which has a state guarantee.

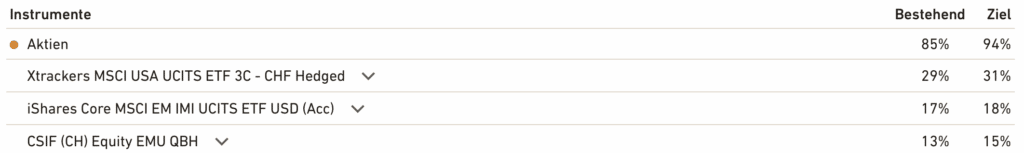

As with the free portfolio, True Wealth also uses ETFs for the most part in the third pillar. In addition to ETFs, my 3a portfolio assembled by True Wealth also includes index funds. For regulatory reasons, True Wealth relies in part on products that are currency hedged in the third pillar.

Other providers consistently rely on index funds within the framework of the third pillar, which are subject to investor group control and can thus reclaim the withholding tax. True Wealth also intends to use withholding tax exempt index funds in the future, particularly for U.S. equities.

Reporting

True Wealth’s reporting function is one of the most sophisticated in the Swiss robo-advisor market. So you can compare True Wealth’s return over time using various benchmarks. For example, the MSCI ACWI, the SMI or the MSCI World can be selected – this is how transparency works. You can also easily select the period to be viewed via dropdown.

Since the introduction of True Wealth Pillar 3a, you can now select whether the total portfolio (“Holistic”) or only the free or only the 3a assets should be displayed.

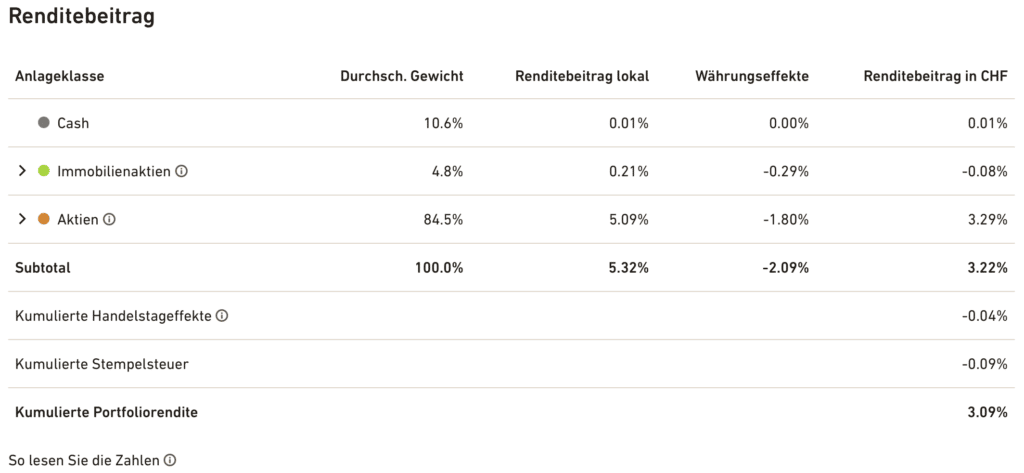

As addressed above, the total costs can be listed in more detail. The instruments used, currency risk, product costs, time-weighted and money-weighted returns, return contribution, etc. can also be shown in detail.

If a term seems strange to you here, you can call up easy-to-understand info boxes.

True Wealth Pillar 3a Conclusion

True Wealth manages to holistically integrate its Pillar 3a into the existing online wealth platform and stays true to itself with transparent, simple and cost-effective offerings. Speaking of simplicity: The risk profiling once determined applies to both the free assets and the tied assets in pillar 3a. Thus, True Wealth allows only one investment strategy per client. True Wealth also automatically staggers the accounts.

With 1.25% interest on the cash and no management fee, True Wealth currently offers the most attractively priced pillar 3a in Switzerland. It would be disappointing if this was a loss leader offer and the management fee of 0.225% was actually introduced in a few years.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.