Letztes Update: 3. May 2024

With the pillar 3a provider finpension, you can now choose between two fund houses. In addition to Credit Suisse funds, Swisscanto funds are now also available. This strengthens finpension’s independence. Incidentally, the two fund houses together manage over 100 billion Swiss francs. In this article, you will learn how to choose between the two fund houses and how to switch an existing finpension Pillar 3a portfolio to another fund house.

In the case of the finpension vested benefits solution, Swisscanto’s funds have been available for a little longer. There is even a third fund house to choose from, UBS.

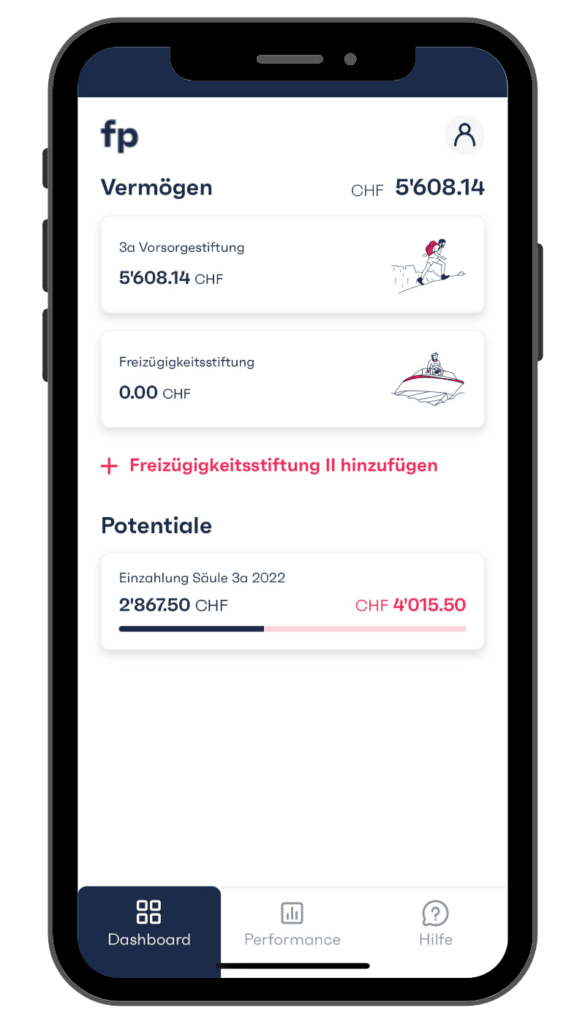

In addition, finpension comes up with some innovations: The finpension app now comes with a clearer dashboard. There you can see how much you can still pay into your pillar 3a at finpension this year. Any vested benefits will also be listed in the new dashboard.

finpension has also established a second vested benefits foundation. This means that you can have your pension fund assets paid out to two different vested benefits foundations, whereby the administration of both foundations is carried out by finpension AG. This is also called pension fund splitting.

Credit Suisse

I probably don’t need to introduce you to the major Swiss bank Credit Suisse. Finally, in recent years, it has repeatedly drawn attention to itself with various headlines. Here are just a few key figures: The bank was founded in 1856, employs more than 50,000 people and manages assets of CHF 1,614 billion.

Are you interested in the history of Swiss companies? Then I can recommend you the book “Wirtschaftswunder Schweiz: Ursprung und Zukunft eines Erfolgsmodells” by R. James Breiding and Gerhard Schwarz.

Credit Suisse index funds are used, for example, by digital 3a pioneer VIAC and pension funds.

Swisscanto

In 1959, Swisscanto was founded as a manager of real estate funds for the Swiss cantonal banks. In 2015, Zürcher Kantonalbank acquired Swisscanto Group. Swisscanto develops and manages funds for private and institutional clients.

Some of the pension funds offered by finpension and managed on an indexed basis are also used within the frankly funds. Swisscanto index funds, which are not subject to investor group control, can be purchased from a broker such as Swissquote for your private custody account. I have described how to do this here.

Choice of the fund house

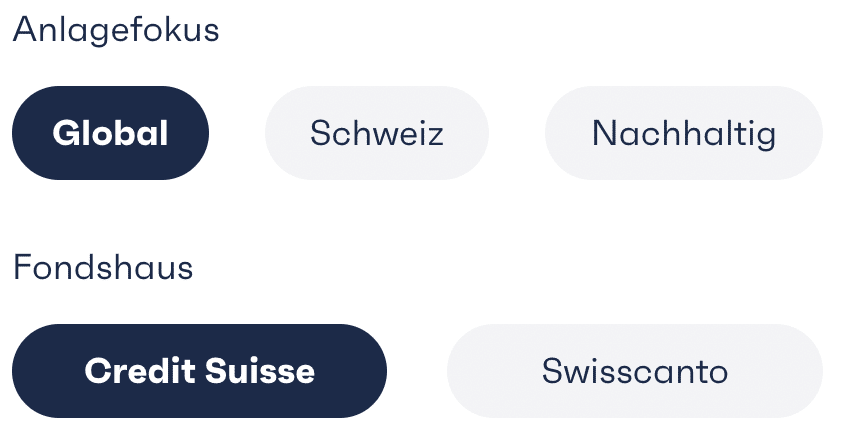

Under “Strategies” you can choose the investment focus as well as the fund house.

You cannot directly compare the funds of the two fund houses, as they hardly differ from each other.

If you scroll down a bit further, the products used are listed and you can directly access the fact sheets of the funds.

You can customize the strategy even further below and view all index investments available at finpension.

Change of fund house

If you already have a portfolio with finpension and would like to change the fund house, this is also possible. Log in to your mobile or web app, select the three dots at the top right of your portfolio and tap “Strategy”. At the very bottom now appears “Change strategy”. If you want to keep the investment focus, confirm this in the next step with “Keep focus”. And now you can change the fond house.

finpension does not charge any fees for switching fund houses. Regardless of whether you have Credit Suisse or Swisscanto funds in your custody account, you pay the flat fee of 0.39%. This already includes the fees of the investment funds used.

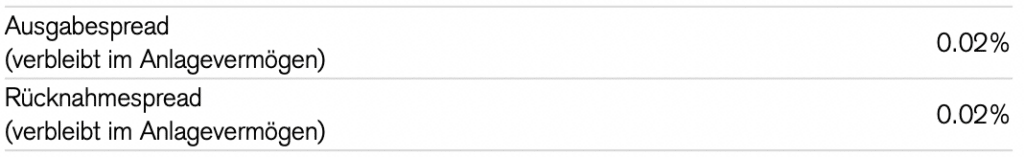

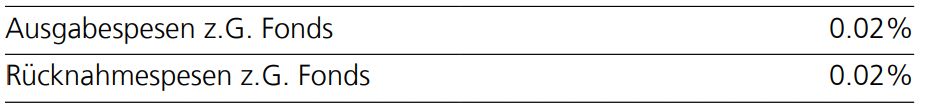

However, issuance fees are incurred when fund units are issued, and redemption fees are incurred when units are redeemed. In the factsheets it looks like this:

Credits Suisse:

Swisscanto:

Spreads can be significantly higher for more “exotic” funds such as emerging market funds. The spreads are not earth-shatteringly high, but you should think twice about switching funds.

If you want to know more about the issue and redemption spreads of fund shares, I can recommend the FAQ article by finpension .

Conclusion

With the two selectable fund houses, finpension strengthens its independence. The 3a securities app finpension thus becomes even more attractive for self-deciders.

In the end, the funds of the two fund houses are almost equal and you can make your decision based on whether you like Credit Suisse or Swisscanto more.

Advertising

Enter the code FIDE83 directly in your profile during registration or 24 hours later at the latest and you will receive a fee credit of CHF 25.

Condition: You transfer or deposit at least CHF 1’000 within the first 12 months

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.