Letztes Update: 29. September 2024

It’s almost vacation time again and you’re probably wondering which card you should take with you on vacation so that you get as much as possible for yourself and as little as possible for the bank. Find out how you can minimize fees and find the best rate for your currency transactions. Find out which bank is ahead in the Swiss exchange rate comparison!

Inhaltsverzeichnis

- Paying abroad without fees

- Banks in exchange rate comparison Switzerland

- Best bank for the euro exchange rate

- Exchange rate fees and hidden costs

- Online banking vs. traditional banks: where are the better rates?

- Frequently asked questions about the exchange rate comparison Switzerland

- Conclusion: The bank with the best exchange rate in Switzerland

Paying abroad without fees

It is often cheaper if you do not withdraw cash with your credit or debit card, but pay directly with the card if possible. Most banks charge additional fees when you withdraw cash from an ATM. This can be a fixed fee such as CHF 5 or a percentage fee such as 1.5%. In addition to this fee, the bank usually applies its own exchange rate, which in most cases is less favorable for you.

If you withdraw smaller amounts, the percentage fee is more favorable. The fixed fee is more attractive for larger amounts. If you compare neon (1.5%) with radicant (CHF 5), for example, you are better off with radicant from an amount of CHF 334. The different exchange rates have not yet been taken into account in this calculation.

If you exchange Swiss francs for foreign currency at the counter, the exchange rate of the banks is usually even less favorable, as the banknote rate is applied. This is higher because the foreign currency must be available in the branch in note form, a person must hand over the notes to you, a security infrastructure must be in place, etc.

When paying at a payment terminal abroad, you will often be asked whether you want to pay in the local currency or in your home currency, i.e. in Swiss francs. The payment providers earn a fortune because they charge a very unfavorable exchange rate for the conversion. Always choose the local currency and leave the conversion to your bank.

Banks in exchange rate comparison Switzerland

As I have done a few times before, I carried out another exchange rate test this summer and used seven different debit and credit cards to make purchases for exactly the same amount in the same online store. The test took place on Thursday morning, June 6, 2024, between 10:26 and 10:31 a.m. I have taken into account the amount definitely booked. Some banks use the current exchange rate at the time of payment, others use the current exchange rate at the time of booking. In addition, not only the exchange rate was included in the comparison, but also any conversion fees, such as those charged by Wise.

When comparing exchange rates, it should be noted that the Cumulus credit card is a real credit card with (modest) insurance benefits, while the others are only debit cards. And if you exchange more than EUR 1,000 per month with Revolut, Revolut charges an additional fee. There is also a weekend surcharge at Revolut.

neon, Alpian and Wise all took second place. I have therefore not only compared the final amount invoiced, which is the same for all three providers due to rounding, but also the effective exchange rate. The new order of places two to four is therefore as follows:

2. wise (0.21%)

3. alpian (0.25%)

4. neon (0.32%)

Best bank for the euro exchange rate

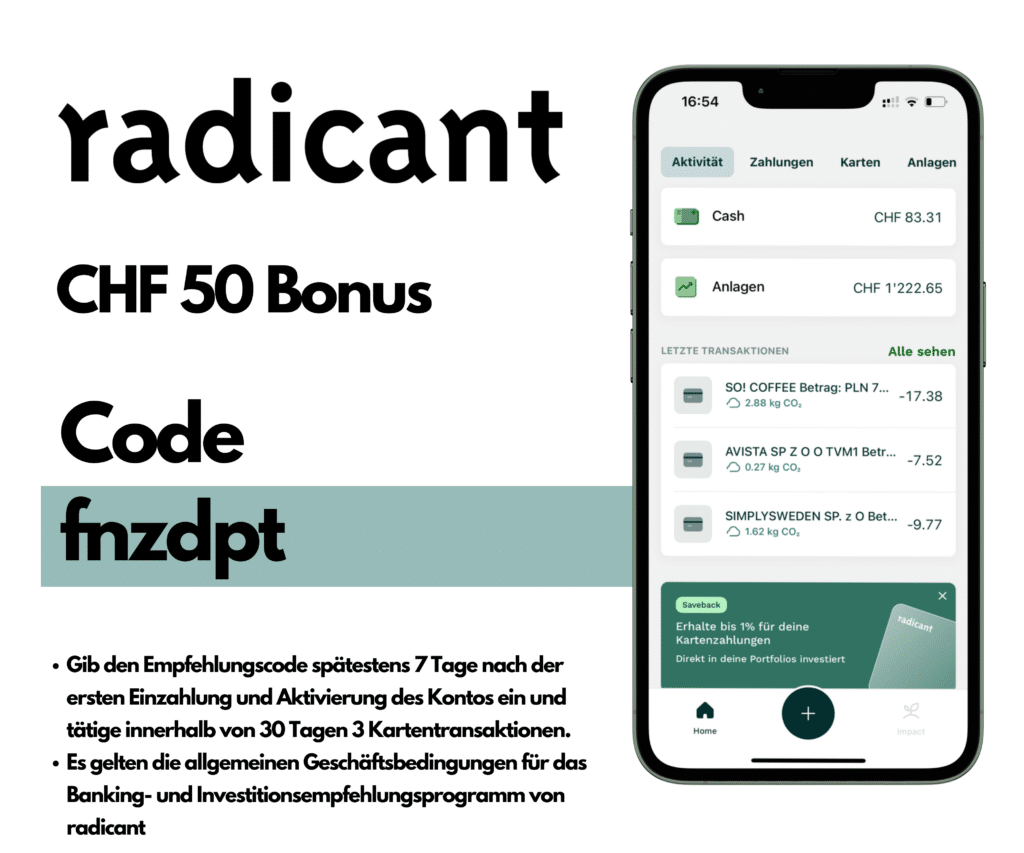

radicant, the independent subsidiary of Basellandschaftliche Kantonalbank BLKB, has the best euro exchange rate. Interestingly, the price calculated by radicant was even 0.23% lower than the reference price on Google.

Regardless of the exchange rate, radicant’s banking offer is interesting: you get an account with a virtual Visa debit card for free. The interest on the money held at radicant is higher than at other banks and radicant supports sustainable projects worldwide with a portion of its customers’ money. radicant has its own banking license and therefore your deposits up to CHF 100,000 are covered by deposit protection. If you are interested in SDG investing, you will find what you are looking for in the blog post radicant SDG Investing: What the new bank does differently.

Exchange rate fees and hidden costs

Let’s take a concrete example of the savings you can make thanks to a favorable exchange rate. According to the summer vacation barometer conducted by the Ipsos Institute on behalf of Europ Assistance, the average budget of Swiss households for 2.3 weeks of summer vacation is CHF 4,041.

Assuming you enjoy your vacation abroad and pay the entire amount with the Cumulus credit card, this will cost you 3.09% more, i.e. a whole CHF 125. You can use it to treat yourself to a nice meal in a restaurant during your vacation.

It is advisable to take a real credit card – not a debit card – with you on vacation. Car rental companies (for example in Italy) often insist on a credit card in their own name.

Online banking vs. traditional banks: where are the better rates?

Online banks usually have better exchange rates than traditional banks. Billing is also often more transparent. For example, Wise shows the exchange rate and the conversion fee separately. This is not the case with the Cumulus credit card, where the conversion rate and the total amount are simply displayed in the One app. It is not at all obvious that the exchange rate is so bad. Funnily enough, Migros Bank recently sent out a newsletter entitled “Clever payment abroad”. The really clever thing to do is not to use your Cumulus credit card abroad.

Frequently asked questions about the exchange rate comparison Switzerland

radicant had the best exchange rate in the exchange rate comparison – radicant does not charge any surcharges.

In the vast majority of cases, it is cheaper if you pay abroad in the local currency and have the exchange into your home currency carried out by your bank. Look for a bank like radicant that offers favorable exchange rates.

Look for a bank that charges no or only a small surcharge on the exchange rate and no fixed fees for the exchange. This means you can pay abroad without fees or at least with much lower fees than with conventional banks.

Conclusion: The bank with the best exchange rate in Switzerland

In our exchange rate comparison, radicant is the clear winner. With the best euro exchange rate and zero surcharges, it offers the most favorable conditions on the Swiss market. For travelers in particular, choosing the right card is crucial to avoid unnecessary fees and benefit from the best exchange rate. So if you want to save on fees when paying abroad, you should consider radicant.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.