Letztes Update: 28. September 2023

The Cumulus credit card still has the same name, but since the summer of 2022 it has looked quite different. Cembra Money Bank’s Cumulus Mastercard became the Cumulus Visa credit card, which is now issued by Migros Bank. Because readers asked me about my experience with the Cumulus credit card, I quickly applied for the new credit card. So here you can read my review and at the end you will find a comparison with the cashback cards.

Cumulus Credit Card Fees

The Cumulus credit card is a free credit card. An annual fee is therefore not due, neither in the first nor in the following years. Any additional cards are also free of charge.

Cash withdrawals at Migros are free of charge up to CHF 1,000 per day. This way, you can conveniently withdraw cash at the same time as you shop. Abroad, you can withdraw CHF 500 free of charge twice a year. Thereafter, 2.5% or at least CHF 10 per cash withdrawal will be charged. There are cheaper alternatives at Neobanken.

While we’re on the subject of foreign countries: There was one innovation in transactions in foreign currencies. There used to be a 1.5% fee per transaction. This is now omitted.

The APR on installments, like most credit cards, really pours it on. At 9.4%, the Cumulus credit card is even one of the cheaper ones. It’s best to always keep track of your expenses so you’re never charged interest on late payments.

Cumulus Credit Card Exchange Rate

On a Monday morning, I bought the same product online three times for EUR 4.50. I was very disappointed. With neon, the exchange rate was the most advantageous, closely followed by Revolut, and bringing up the rear was the Cumulus credit card. Even though the fee for transactions in foreign currency has been abolished, there are providers that offer more attractive exchange rates.

Premium to the average exchange rate in percent:

Apply for a Cumulus credit card

The application is made completely digitally in the Viseca One app. You can also fill out the application in the traditional way on the computer, then the application will be sent to you by mail, you sign it and send it back.

To identify yourself via the app, you need your ID, passport or alien registration card. After scanning one of these documents, create a short video selfie.

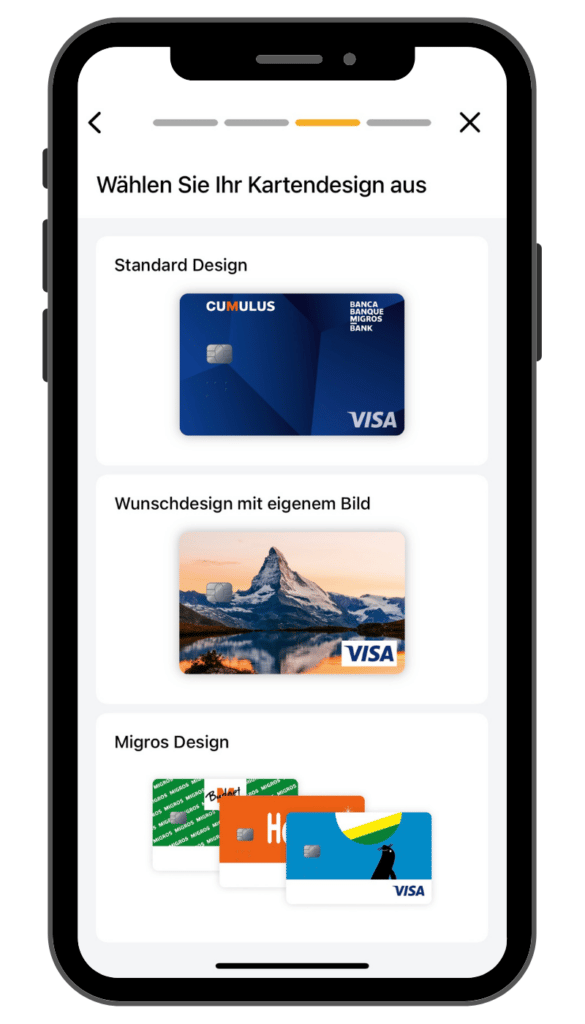

You now add your address to your data. Unfortunately, after filling in the zip code, the locality is not automatically added. Next, you need to provide information about your financial situation. You can also choose whether or not you want to collect Cumulus points when you pay. If you have decided to collect, enter your Cumulus number in the next step. Finally, you can choose the design of your Cumulus credit card. The following options are available for selection:

Your own picture is free with your first ticket order. However, costs CHF 30. for a change or reorder.

The very last step is the automatic check. This one took me less than two minutes.

The advantage of applying via One App is that you can deposit the digital credit card in an e-wallet immediately after verification. Currently, the Cumulus credit card supports the following mobile payment providers: Apple Pay, Samsung Pay, Google PayTM, Garmin PayTM, Fitbit Pay and SwatchPAY! Apple Pay unfortunately displays the default design of the card.

The PIN code came a week after the application. The physical Visa card a day later.

Collect Cumulus points

With the normal Cumulus barcode, you collect 1 Cumulus point per CHF 1 of sales at Migros. This corresponds to a cashback of 1%. Conveniently, the Cumulus barcode is printed on the back of your Cumulus credit card.

If you pay with the Cumulus credit card in the first year, you will receive an additional 1 Cumulus point for every CHF 1 you spend at Migros. So that’s 2 Cumulus points per CHF 1 of sales. In the second year, you will receive only 1 Cumulus point at Migros, the one for scanning the Cumulus barcode. You will no longer receive the additional point for paying with the Cumulus credit card.

If you shop outside Migros, it’s a little easier because then you automatically score points and receive one Cumulus point for every CHF 3 you spend. This corresponds to a cashback of 0.33%.

The points you earn will appear on your Cumulus statement every two months.

The Cumulus credit card offers various insurance benefits. I will not go into this any further. However, they are listed in the comparison below.

Cumulus Credit Card Login

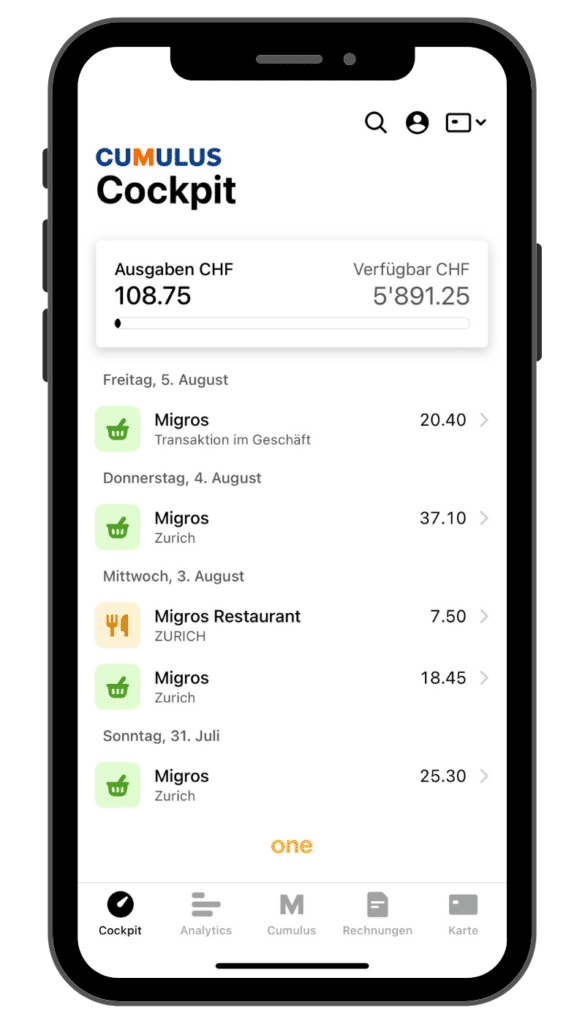

The easiest way to manage your Cumulus credit card is in the One app. As a new customer you will receive the registration code automatically. In the One app you always have an overview of your expenses and the amount still available.

If you already have other maps from other providers stored in the One app, this is no problem at all. You can still apply for the Cumulus credit card directly in the app, and later you can easily switch back and forth between the different cards.

Under “Analytics” you can see your expenses sorted by different categories. You can set personal spending goals there, giving you a better overview of your spending.

Under “Invoices” you can change the invoice type. I immediately changed the default invoice type in the One app to electronic invoice. A paper bill costs CHF 2 per month. The most convenient way to pay is via eBill. To do this, you activate the biller “Viseca Payment Services SA” at your house bank and enter your date of birth and your card account number when registering.

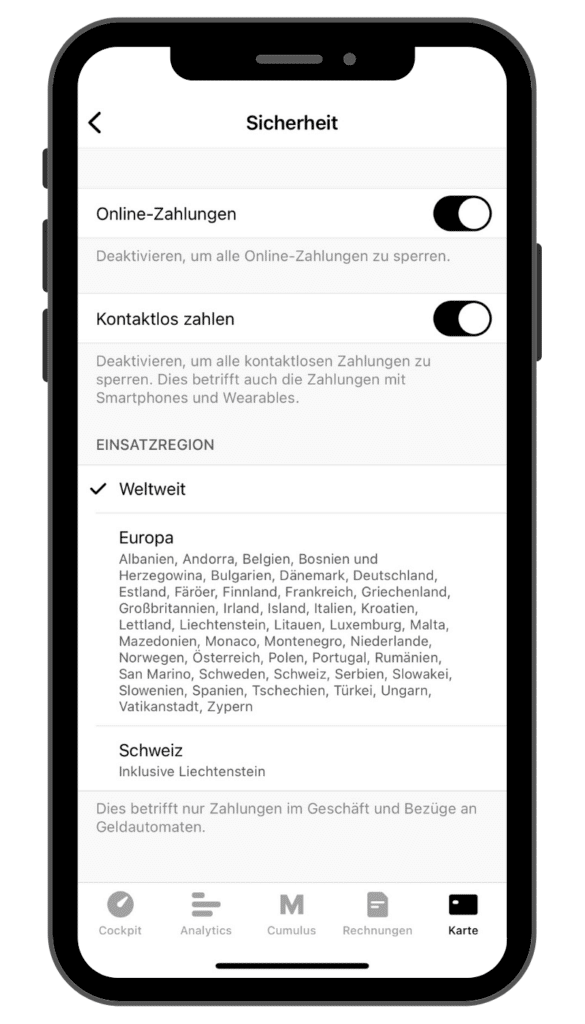

Under “Card” you can block the credit card, display the PIN and replace the card. Unfortunately, you cannot change the PIN in the app. If you select “Card details”, you will be able to view the card number, expiration date and security code(CVV). You will also see the Cumulus credit card limits and the card account number. Under “Security” you can block the card for online payments and contactless payments. You can also select the region of operation.

Comparison Cumulus Credit Card vs. Cashback Cards

| Cumulus credit card | Cashback Cards | |

|---|---|---|

| Editor | Migros Bank | Swisscard AECS Ltd. |

| Annual fee | none | none |

| App | Viseca One | Swisscard |

| Digital onboarding | yes | no |

| Own map image | yes | no |

| Card replacement | CHF 20 | CHF 25 |

| Fee for transactions in foreign currency | none | 2.5% |

| Cash withdrawal in CHF/EUR in Switzerland | 2.5% (min. CHF 5) free of charge at Migros (max. CHF 1’000 per day) | 3.75% (min. CHF 5) |

| Default interest | 9.4% | 11.95% |

| Paper invoice | CHF 2 | CHF 1.95 |

| Mobile Payment | Apple Pay, Google Pay, Samsung Pay, Garmin Pay, SwatchPAY!, Fitbit Pay | Apple Pay, Google Pay, Samsung Pay, Garmin Pay, SwatchPAY! |

| Cashback | 1 Cumulus point per CHF 1 turnover in Migros (1%) 1 Cumulus point per CHF 3 of sales outside Migros (0.33%) Every two months on Cumulus statement | American Express: 1% Visa/Mastercard: 0.25% credited to the card account once a year |

| Payment methods | Invoice, eBill, LSV | Invoice, eBill, LSV |

| Insurance benefits | Travel interruption insurance up to CHF 4,000 Search and rescue costs up to CHF 60,000 24h assistance Purchase and transport insurance up to CHF 2,000 Best price guarantee up to CHF 2’000 Online account protection up to CHF 10,000 Online legal protection up to CHF 10,000″. | Return of goods insurance CHF 1’000 |

| Customer service | Contact form, telephone (free of charge) | Telephone (CHF 1.90/call except in the case of card blocking and complaints about the monthly statement) |

Conclusion Cumulus Credit Card Experience

For users who use the credit card mainly in Switzerland and are “Migros kids”, the Cumulus credit card is an interesting option.

However, you tie yourself strongly to the Cumulus system and Migros. In fact, by default, Migros Bank can transmit transaction data to the Federation of Migros Cooperatives (MGB). You can find more information in the document “ Privacy Information“. You can object to the transmission of transaction data to the MGB using the “Form Objection to the Transmission of Transaction Data to the MGB”.

I prefer collecting cashback with the Cashback Cards. If the Cashback Card American Express is accepted, you will collect 1% cashback everywhere. This is credited to your card account once a year, so I am not tied to any points system.

The digital application worked flawlessly for me, and other credit card providers are welcome to use the process as a model.

For payments abroad in foreign currencies, there are cheaper alternatives at Neobanken. You can find a comparison in the article about paying abroad.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.