Letztes Update: 10. September 2024

Descartes has been offering pension savings with pillar 3a and the vested benefits solution in a joint web app since 2016. Descartes has now also integrated digital share saving in free assets (3b) into the same web app, which provides a comprehensive overview of your assets. In addition to the newly introduced investment models, Descartes has also reduced the minimum deposit from CHF 25,000 to CHF 10. In this article, I share my Descartes Invest experience with you and we take a closer look at the two investment models, the fees and the benefits of the savings plan.

About Descartes

Descartes was founded in 2015 and is one of the pioneers of digital wealth management in Switzerland. The co-founder and managing director of Descartes, Adriano Lucatelli, held management positions at major Swiss banks and taught at the University of Zurich.

Descartes has been offering ESG investments exclusively since 2016 and has been fully owner-managed and not dependent on any bank from the outset. Descartes has been licensed as an asset manager by the Swiss Financial Market Supervisory Authority FINMA since 2023.

The account and custody account manager for Descartes Invest is now Lienhardt & Partner Privatbank Zürich AG, a Swiss universal bank based in Zurich with a history dating back to 1868.

Descartes Invest

Even before the introduction of Descartes Invest, it was possible to have your money managed by Descartes in the free pension plan, although the entry threshold was relatively high at CHF 25,000. This has changed fundamentally with Descartes Invest, because you can participate with a minimum deposit of just CHF 10 ! Descartes Invest has also been integrated into the same web app as pension savings, which is characterized by a lean and clear structure.

Within the Descartes web app, you receive a consolidated overview of your invested assets, see the performance and the pillar 3a payments made in the current year.

If you would like to open an additional portfolio, you can do this yourself in the web app by clicking on “Additional portfolio”. You will then be asked whether you would like to open a pillar 3a account or an investment account. With an additional pillar 3a account, you can optimize your later withdrawal for tax purposes or maintain different accounts with different equity ratios and investment horizons in your unrestricted pension provision.

Opening an account Descartes Invest

To open an account online with Descartes Invest, you must live in Switzerland, invest your own money, be at least 18 years old and not be a politically exposed person or a US person.

First, your profile is created and a progress bar shows where you are at the opening. In addition to your investment horizon, you will be asked about your annual income, your monthly savings contribution and the maximum temporary loss you can cope with.

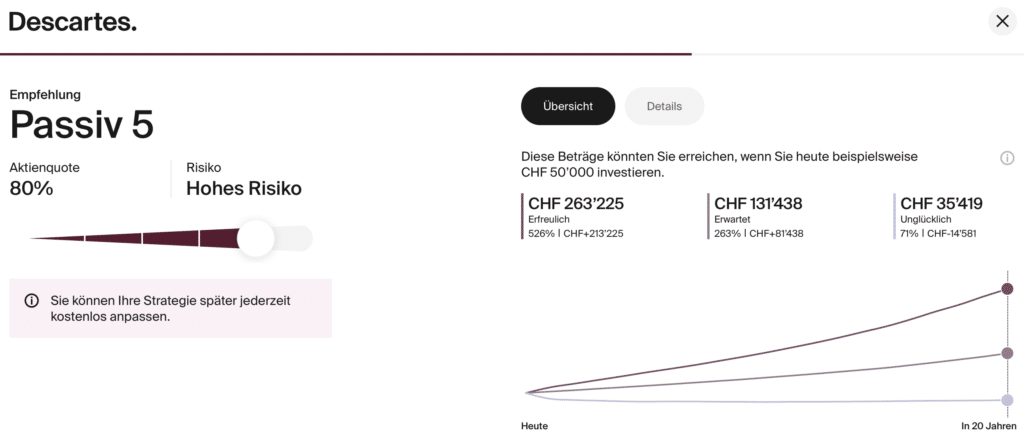

Now you can choose whether you want to invest in sustainable index funds or in risk-minimized investments. Details on the investment models can be found below. Descartes then suggests an equity quota, which you can of course override. Even if you have already invested, you can adjust the share quota at any time free of charge. A chart shows you three different scenarios for the performance of an initial amount of CHF 50,000 over a period of 20 years.

If you click on “Details” above the chart, you will find further information on your future portfolio, such as the weighting of the index funds used, the country distribution or the ten largest shares.

Finally, you enter your personal details and a digital ID check is carried out, which you can do both on your desktop with a webcam and on your smartphone. To do this, scan the front and back of your ID and take a video selfie. Verification usually only takes a few minutes and is possible from Monday to Saturday from 7 am to 10 pm.

Once you have checked the documents, you can sign them digitally. You will receive a unique code by SMS. When you click on Deposit, you will be shown the QR code directly, which you can scan with your banking app.

Investment models Descartes Invest

Providers often offer various investment models from which customers can choose. However, during the consultation I found that this leads to confusion rather than added value, as the differences cannot be explained clearly by the providers. Not so with Descartes Invest, where the two investment models differ quite clearly.

The following equity ratios can be selected for both investment models:

- 20% – low

- 40% – moderate

- 60% – medium

- 80% – high

- 100% – very high

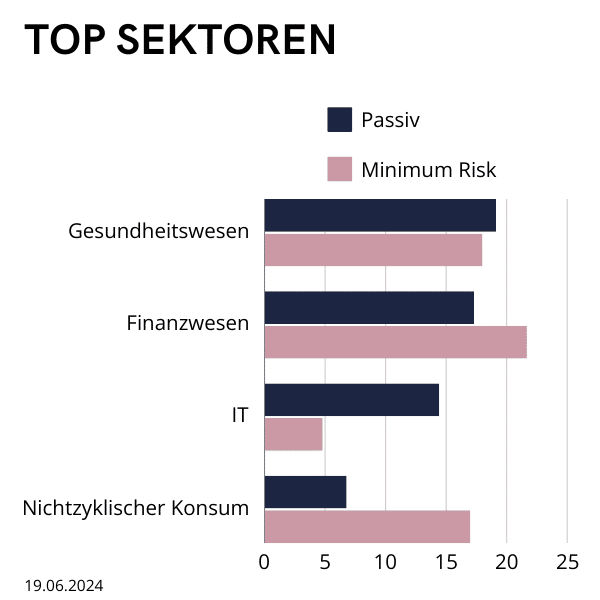

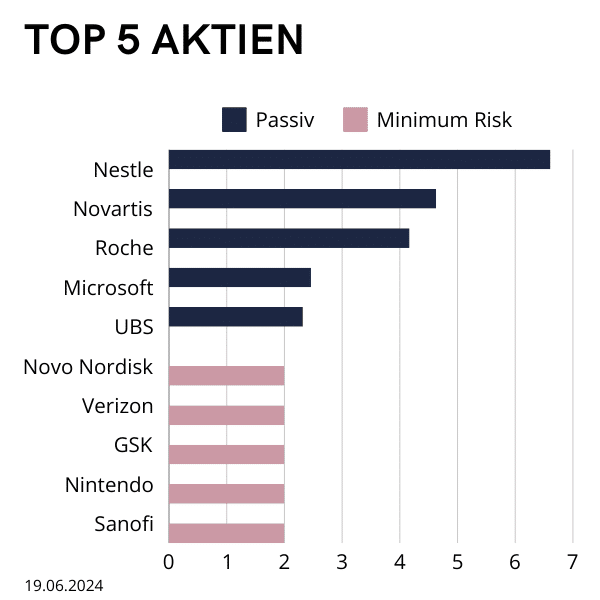

Passive – Sustainable index funds

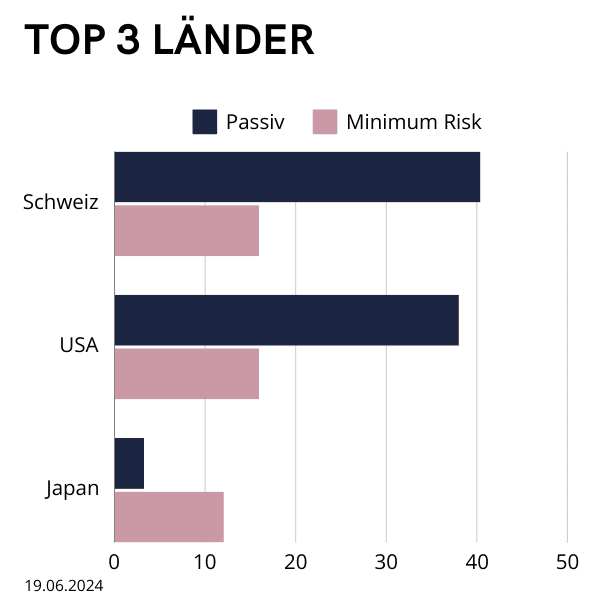

This investment model is implemented with sustainable index funds from Swisscanto. Although index funds passively follow an index, the weighting of the individual funds still reflects Descartes’ opinion. Switzerland, for example, accounts for 40% of the equity component and both a currency-hedged and a non-currency-hedged index fund are used for the developed countries. The currency-hedged fund applies less stringent sustainability criteria. Presumably Swisscanto does not (yet) offer the corresponding fund.

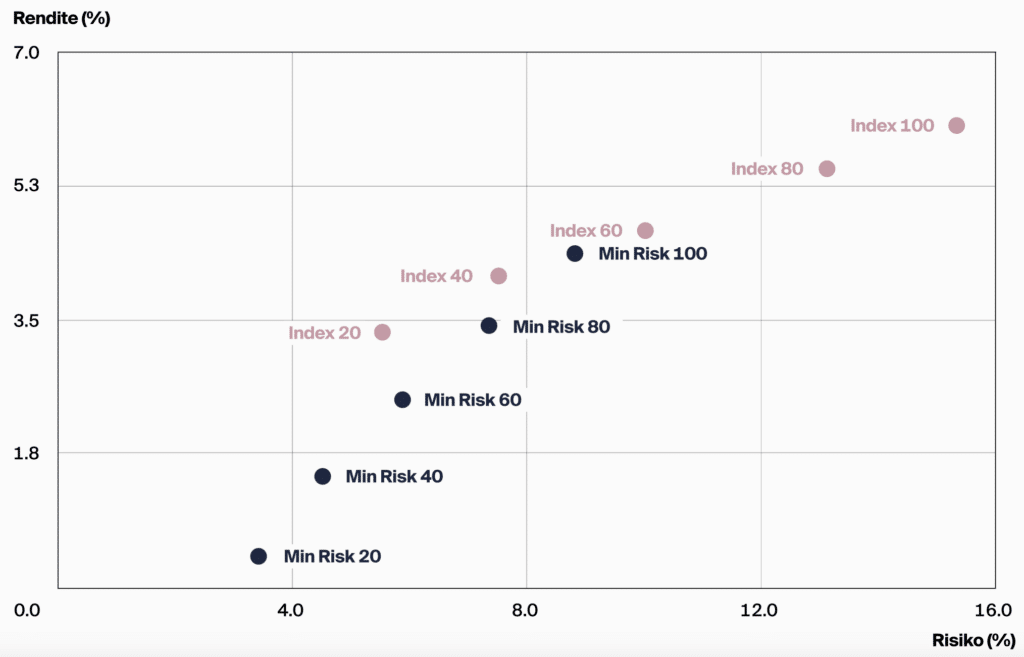

The passive investment model shows greater fluctuations and is more volatile. In times of rising stock markets, this leads to higher profits, but also entails the risk of higher losses in falling markets.

The equity ratios up to and including 80% also include alternative investments. These are implemented with index funds on Swiss real estate and gold.

Minimum risk – risk minimization and CO2 reduction

The active minimum risk investment model is somewhat less common than implementation with index funds and therefore requires a brief explanation. Minimum risk reduces the risks in the portfolio, which has a particularly positive effect in falling markets. In rising markets, however, the profits are not as high as with an index-based strategy. Descartes uses funds from OLZ, an independent Swiss asset manager specializing in risk-based investment strategies.

The scientifically based investment concept gives a higher weighting to shares with lower price fluctuations. In addition, cluster risks are actively avoided, for example by weighting the USA significantly lower than in a world index. This means that around 25% more shares can be held for the same risk.

In addition, companies with lower CO2 emissions are weighted more heavily. As a result, the ecological footprint with the Minimum Risk investment model is at least 30% and up to 50% smaller than with passive investments. Currency risks are largely hedged and China is not included in the funds at all.

Passive vs. minimum risk

The differences are best illustrated using a few specific examples. In the following charts, we always assume the highest equity allocation, i.e. 100%. The values are given as a percentage.

And if you still don’t know which investment model to choose, here’s a very brief summary:

Passive: For investors who value simplicity and cost-effective implementation.

Minimum Risk: For risk-averse investors who prefer stable returns to large profits and for whom sustainability is important.

You can find more details about the investment strategies on Descartes’ blog. The two investment models also differ in terms of fees, which brings us to the next chapter.

Descartes Invest fees

The following annual fees are calculated on the average invested assets and vary depending on the equity component and investment model:

| 20% | 40% | 60% | 80% | 100% | |

|---|---|---|---|---|---|

| Passive | 0.87% | 0.86% | 0.85% | 0.87% | 0.84% |

| Minimum risk | 0.91% | 0.94% | 0.98% | 1.02% | 1.05% |

You can see how the fees are made up in detail on the Descartes website.

When comparing fees with other providers, it should be noted that Descartes Invest actually charges all-in fees. These include the fees for Descartes, for the custodian bank and for the product costs of the funds. Descartes Invest does not charge the following fees:

- Administrative costs: No fees for opening, managing and closing accounts.

- Foreign currency fees: Funds are purchased in Swiss francs.

- Spreads: Funds are not purchased on the stock exchange, but at net asset value.

- Issue and redemption commissions: Funds are purchased at net asset value.

- Transaction costs: There are no stock exchange fees or brokerage fees.

- Federal stamp duty: Stamp duty is not payable on the vast majority of funds.

With other providers, the costs for the funds used, the stock exchange fees, the fee for currency exchange and the federal stamp duty are often not shown separately or are well hidden.

Advantages of Descartes Invest

- There are two very different investment models to choose from.

- Low minimum deposit of CHF 10.

- Pension assets can be transferred to free assets upon retirement free of charge and can continue to be invested in the same fund.

- Overview and management of pension assets (3a and vested benefits) and free assets in a single web app.

- Transparent cost structure without surprises.

- Data is stored exclusively in Switzerland, access to the account only with two-factor authentication.

- Two trading days per week (Tuesday and Thursday): Your money never sits idle in the clearing account for long.

- E-tax card included in the all-in fees.

Experience Descartes Invest

The opening of my Descartes Invest real money account was completed without any problems within about ten minutes. The process is easy to understand and the questions on the risk profile should not overwhelm even beginners.

The web app looks modern and very tidy. Sometimes it’s too tidy, for example under “Transactions” you can only see that something has been purchased, the amount and the date. You can find out exactly what was purchased at what price under “Documents” and then in the respective daily statement.

Descartes has consistently ranked among the best asset managers in the Swiss business magazine BILANZ for several years. Descartes took second place in the overall “Asset Manager of the Year 2024” ranking over 24 months.

FAQ Descartes Invest

You can join in with as little as CHF 10. Whether you make a one-off deposit or pay in regularly (savings plan) is entirely up to you.

Descartes Invest may be a digital product, but there are still people behind it who you can reach by phone, email, message function in the web app, video consultation or, by appointment, on site in Zurich.

Opening an account is very simple and can be done from home without any paperwork.

The data is securely stored and managed by Descartes in Switzerland. Access to your account is only possible via two-factor authentication.

Payments can only be made to an account in the name of the beneficiary/beneficiaries at a Swiss bank. In addition, you will receive a code by SMS when you make a withdrawal, which you must enter to confirm the payment. This further increases safety.

Conclusion Descartes Invest experience

Descartes Invest offers a user-friendly and comprehensive solution for digital share saving that is accessible to many thanks to the low minimum deposit of CHF 10.

Descartes relies on a transparent cost structure and offers two clearly differentiated investment models. The clearly structured website, which is completely free of empty phrases, reflects the modern and accessible approach of the owner-managed company. The website also features a blog that is well worth reading and a very comprehensive glossary.

With its many years of experience and innovative approach, digital asset manager Descartes is one of the leading providers in Switzerland. If you are looking for a transparent and sustainable investment opportunity, Descartes Invest is an interesting option.

Incidentally, there will also be a savings plan in the future. And the opportunity to invest part of your assets in Bitcoin. Despite the addition of Bitcoin, the footprint of the investment solution is expected to be below the market average, while the risk remains largely unchanged thanks to Descartes’ risk-mitigating strategies.

Transparency and disclaimer

This article was written in collaboration with Descartes and reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.