Letztes Update: 28. September 2023

At Swissquote you can not only buy and sell ETFs on the exchange, which is called secondary market. No, you can also buy index funds directly from the fund provider at Swissquote. This is then called the primary market. Here you will learn step by step how to buy an index fund at Swissquote – at foreign brokers this is usually not possible. But first, let’s take a closer look at what small caps actually are, because that’s what we’re buying an index fund on in the example.

What are small caps?

Each index provider defines small caps a little differently. We focus on the definition of the index provider MSCI in this article.

MSCI divides public companies into the following categories based on market capitalization:

- 70% Large Caps

- 15% Mid Caps

- 14% Small Caps

- 1% Micro Caps

Accordingly, they are relatively small stock corporations. But not to be confused with SMEs, like the baker or painter around the corner. In order for companies to be included in the index by MSCI, they must already be listed on a stock exchange. For example, the currently largest Swiss public company in the MSCI Small Cap Index is PSP Swiss Property Ltd with a share of 0.07%, followed by BELIMO Holding Ltd and Georg Fischer Ltd. The latter is an industrial company with around 15,000 employees. So small is relative.

If you buy an ETF on the well-known MSCI World, only large and mid caps are included. Only the MSCI World IMI index – where IMI stands for Investable Market Index – includes small caps. However, ETFs on this index do not exist in Switzerland. If you want to invest in small caps within the MSCI family, you have to add an additional ETF or index fund to your portfolio. This article explains the differences between ETFs and index funds.

Swisscanto Index Funds

Two ETFs on global small caps indices are listed on the SIX Swiss Exchange:

- You can trade the “SPDR MSCI World Small Cap UCITS ETF” in CHF and it has a TER of 0.45%.

- The still very young “UBS ETF (IE) MSCI World Small Cap Socially Responsible UCITS ETF (USD) A-acc” focuses on companies that have a lower carbon footprint than the broad market and have a high ESG rating. The TER on this ETF is 0.23% and unfortunately it is traded in USD.

Both ETFs could not really convince me (SPDR: no ETF leader at Swissquote; UBS: spread of over 1% very high), which is why I looked around for alternatives and found what I was looking for in Swisscanto’s index funds.

The index funds available from Swisscanto, which invest globally, mostly exclude Swiss equities. This can be recognized by the addition of “ex CH” in the title. Switzerland accounts for about 1.8% in the MSCI World Small Cap Index.

| Index funds | Swisscanto (CH) Index Equity Fund Small Cap World ex CH FA CHF | Swisscanto (CH) Index Equity Fund World ex CH FA CHF |

| Index | MSCI® World ex Switzerland Small Cap Index TR Net | MSCI® World ex Switzerland Index TR Net |

| Number of positions in the index fund | 4’126 | 1’523 |

| Largest position in the index fund | Marathon Oil Corp (0.22%) | Apple Inc. (4.87%) |

| Share of the largest 10 positions | 1.8% | 19.21% |

| TER | 0.30% | 0.25% |

| Volatility 1Y | 9.59% | 9.82% |

| Volatility 3Y | 21.69% | 17.04% |

| Volatility 5J | 18.94% | 15.05% |

At first glance, you can see that the small cap index fund contains many more companies and the individual stocks have much less weight. It is more broadly diversified.

An example: If the highest weighted stock increases by 5% (which is admittedly rather unusual on one day) and all others remain unchanged (which is also unusual), the small cap index fund with Marathon Oil Corp. increases by only 0.01% and the “normal” world index fund with Apple increases by 0.24%. Apple moves the index fund much more.

Buy index funds at Swissquote

And now we come to the practical part, buying an index fund at Swissquote, and there you will also see that it is a bit different from buying an ETF.

The prerequisite for the purchase is, of course, a custody account with Swissquote and a sufficiently high cash balance. So you open an account with Swissquote and get a credit worth CHF 100 with the Swissquote promotion code 2023 Trading.

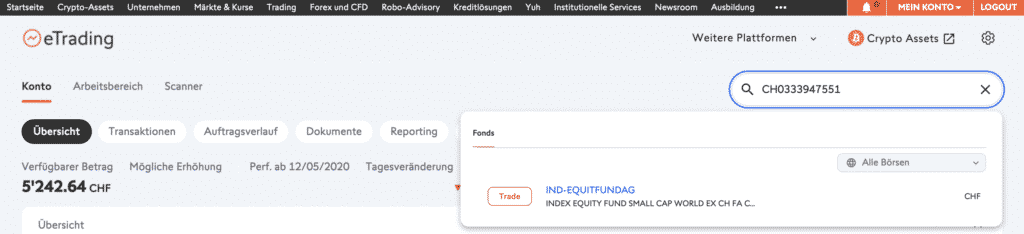

Log in to your Swissquote account (“Login Bank”), select the button “Access to Trading Platform” and search for the desired security in the upper right corner. In our example with ISIN CH0333947551.

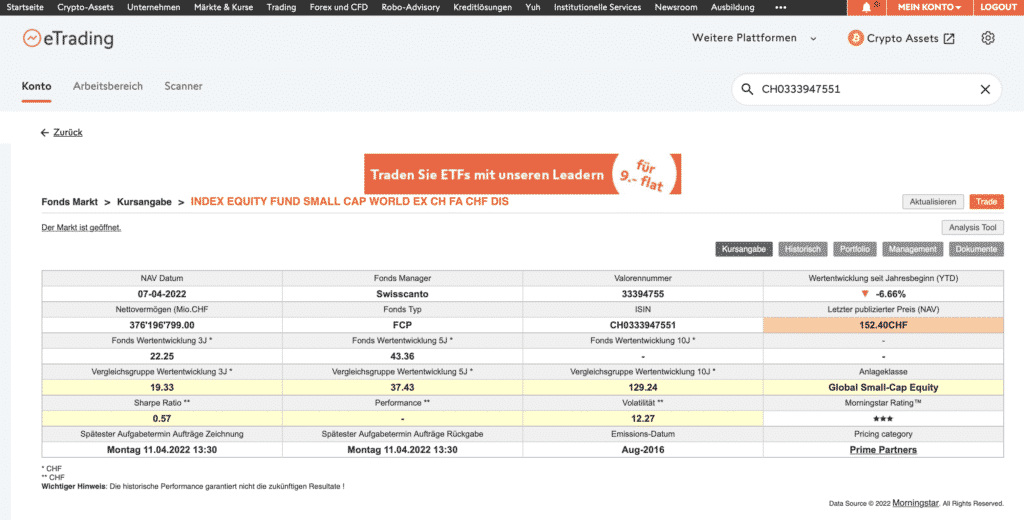

Either click directly on “Trade” or on the blue text, then you will get to the following overview:

Here you can find various details about the index fund. An index fund is not constantly traded on the stock exchange like an ETF, but is only issued once a day by the fund company. That’s why it says “Latest date of submission of orders drawing”. By that time, your order must be received to be purchased at the net asset value (NAV) of that day. But don’t worry, if you enter your order after that, it will simply be bought at the (NAV) of the following day.

Also you can see under “Pricing category” that the fund is listed as “Prime Partners”, so you only pay CHF 9.00 flat per trade.

Via “Analysis Tool” you can call up a chart and compare the index fund with other securities, for example.

Trade index funds at Swissquote

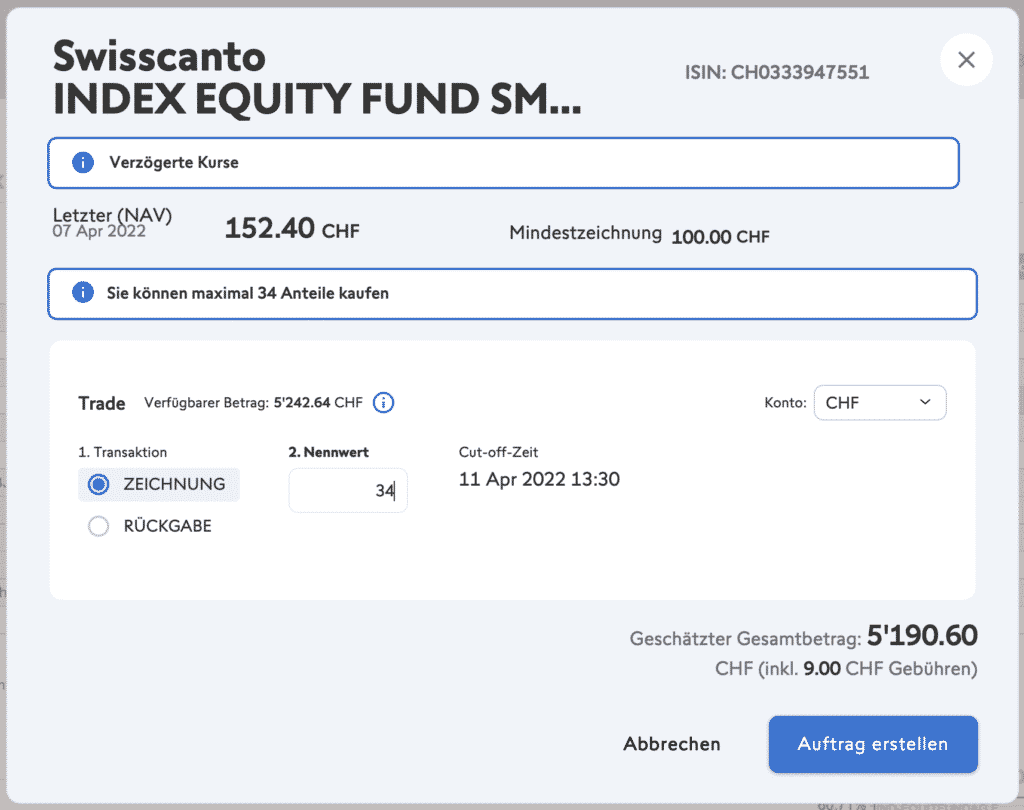

Now click on “Trade” in the upper right corner.

Conveniently, Swissquote shows you the maximum number of shares you can buy with your currently available cash balance.

At “Nominal value” you enter the desired number of shares. In our example, this is 34 shares. You do not have to enter a limit as with an ETF or a share, because the index fund is not traded on the stock exchange and therefore there is no ask and bid price, but only one price, the NAV at the end of the day.

You will also see transparently how much this trade will cost you.

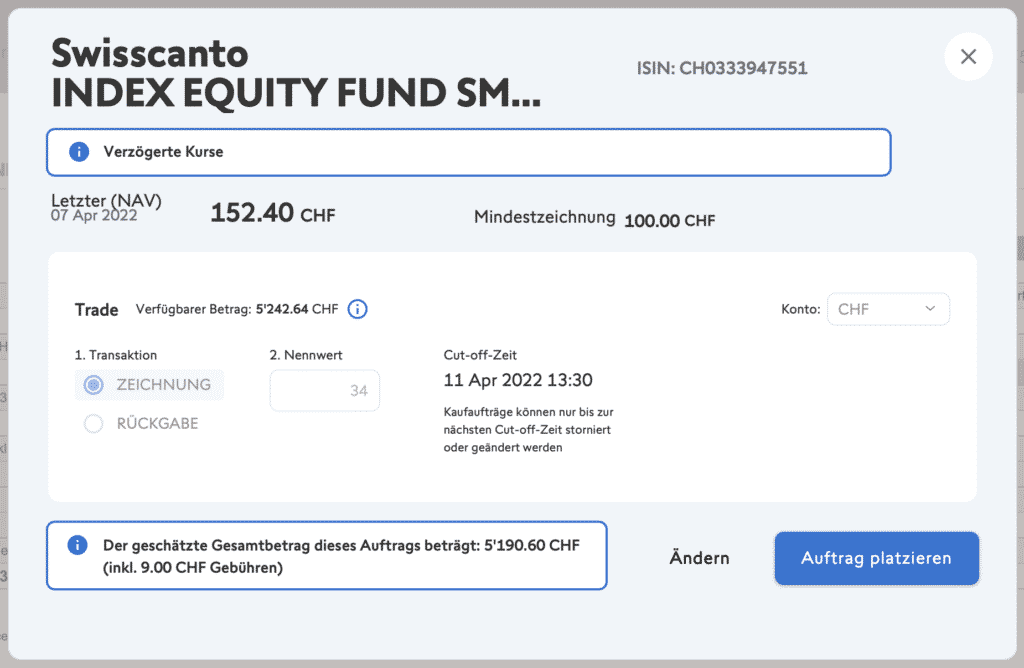

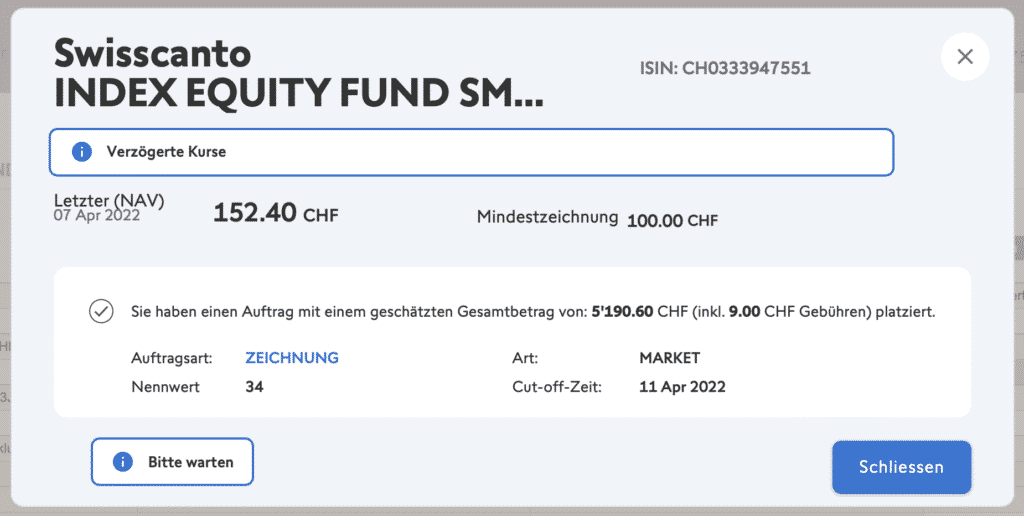

Next you will see a summary where the cut-off time is displayed once again. Once you have checked all the information again, you can select “Place order”. Now follows the confirmation of the order.

If you click on “Workspace”, you will find the order you just placed under “Orders”. Here you could delete the order if necessary.

Swissquote stock market settlement purchase index funds

As you know by now, an index fund is not traded on the stock market. And that is why there is neither an exchange fee nor a real-time fee. Swiss stamp duty is also not levied, as the fund is a Swiss index fund (recognizable by the CH in the ISIN). So buying an index fund at Swissquote is cheaper than buying an ETF.

You can read what all has been charged in the stock exchange statement (which is a somewhat misleading name for an index fund) from Swissquote.

I entered the order on Monday at Swissquote, on Wednesday I received the exchange settlement and the value date was then on Thursday. So don’t be alarmed if the index fund doesn’t immediately appear in your securities account. This is normal for funds that are not traded on the stock exchange.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.