Letztes Update: 28. September 2023

Especially for beginners, everyday stocks are often advertised on various channels. It sounds like this or something similar: Just look around in your everyday life and buy shares in the companies that you encounter every day and to which you have a connection – investing is child’s play. Especially on Instagram, such investment ideas are popular:

My alarm goes off (iPhone from Apple), I make myself a coffee (Nespresso from Nestlé, oat milk from Oatly), brush my teeth (Elmex from Colgate-Palmolive), tie my shoes (performance shoe from On), etc.

In this article, we take a look at whether everyday shares are really such a good idea, with a few examples.

In selecting the “everyday stocks”, I deliberately paid attention to a broad spectrum. So stocks from the technology sector, food, consumer goods and two hyped fashion stocks. Some actually existing portfolios are likely to have greater cluster risks. As always, these are not buy or sell recommendations, but only examples.

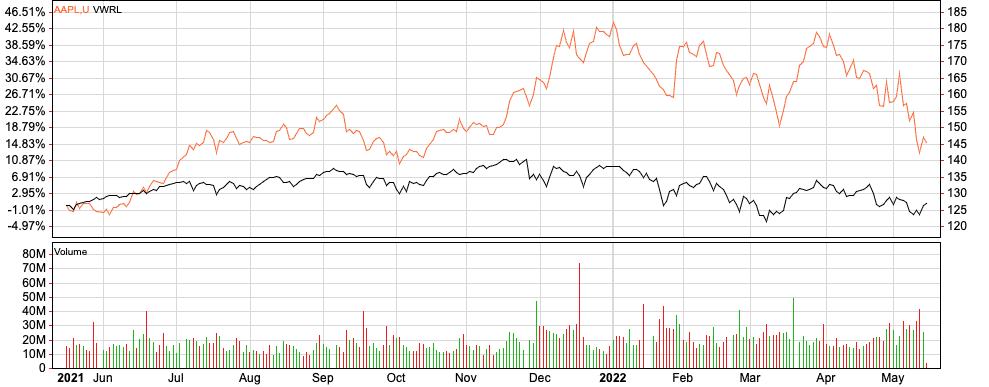

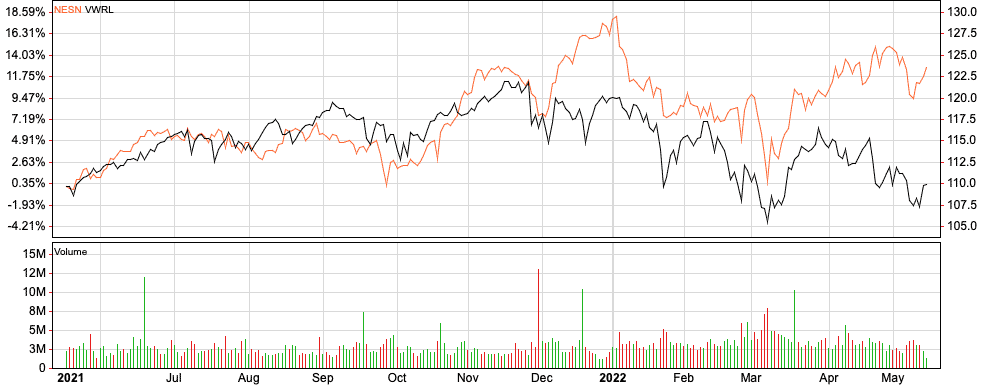

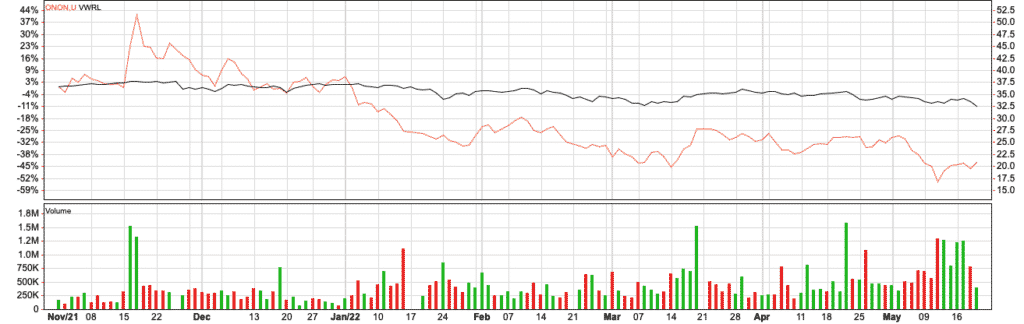

The following charts show the price trends of the last 365 days. As a comparison, I have chosen the Vanguard FTSE All-World UCITS Distributing ETF (VWRL) in CHF. For an exact comparison, one would still have to take into account the respective currencies and possibly distributed dividends, but we generously ignore that in this article.

And of course, charts of just one year are not really meaningful. However, since many ventured into the stock market for the first time last year, we will just look at this one year. Admittedly, this is somewhat arbitrary, but the red in many depots is real.

Apple

In retrospect, anyone who had held Apple stock in their portfolio instead of the ETF would have fared better. The global ETF has made about 0% in a year, while Apple stock has soared nearly 15%.

But what immediately catches the eye when looking at the chart is the much higher volatility of Apple stock. It fluctuates much more, or in other words, the valleys are lower and the mountains higher.

Nestlé

With Nestlé, you’d be looking at a gain of around 13%, while the ETF of course – it’s the same period of time – barely got off the ground.

What is striking here is that the valleys of the two courses are similarly deep and the mountains similarly high. But why are the swings in the ETF much larger this time than in the chart with the Apple share? This is due to the scale on the left. In the chart with Apple this went from -4.97 to +46.51 and here only from -4.21 to +18.59. What we learn from this: Always look at price trends in detail.

Both stocks beat the ETF, so immediately into everyday stocks? At least wait for the next example.

Oatly

At this scale, the ETF becomes almost a horizontal line. And the Oatly share, listed on the stock exchange at all since May 2021, really only knows one direction: from top left to bottom right. The share has fallen by 80% in a year. Oatly can save as much CO2 as cow’s milk, but the loss in the depot hurts. We see: Being overdrawn by a company and holding its stock are two different things.

Colgate-Palmolive

You could argue that Oatly is simply a hyped fashion stock. Well, as the chart of Colgate-Palmolive shows, even boring consumer staples stocks can underperform a broad ETF. Over the past year, Colgate-Palmolive stock has fallen about 6%.

On

The On share chart shows only 200 days instead of 365 days as in the other charts, because the On share did not have its IPO until mid-September 2021. As is so often the case with stocks that have only recently gone public, the price rises in the first few days and then falls quite sharply. With the On share, you would have made a book loss of about 45%. You can still think the company and its products are great, but who doesn’t think about selling at a 45% loss?

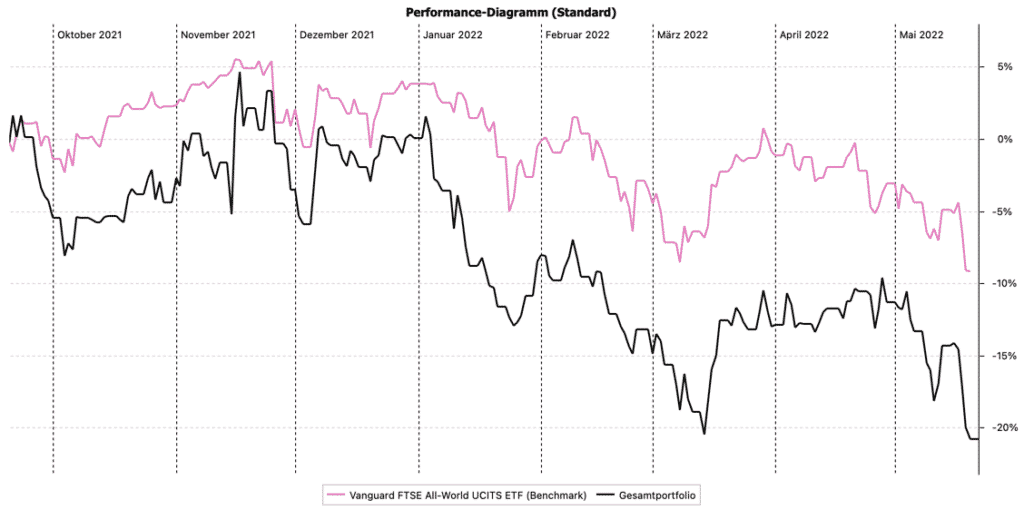

Portfolio with everyday shares

If you had bought all five shares in equal proportions (equally weighted) on September 20, the chart would look like this:

Our benchmark is also down, but only half as much as the portfolio of everyday stocks.

If we also compare the volatility of the everyday stock portfolio with the volatility of the benchmark, we can quickly see that the latter was higher and the return just lower.

Security-specific risk

Individual stocks have what is known as security-specific or unsystematic risk. For Oatly, for example, one title-specific risk is the strengthening competition for plant-based dairy products. Or Oatly’s warning in November 2021 of a surprisingly large loss, which sent the stock plummeting by a fifth.

The stock-specific risk can be “differentiated away” by mixing stocks from different sectors and countries in your portfolio. This requires around 20 shares. What then remains issystematic risk, also called market risk. This refers to fluctuations in the overall market, influenced, for example, by changes in the inflation rate, the economy or the political environment. And you always have to learn to deal with this market risk when you invest in shares.

Costs

In addition to the time involved in setting up and monitoring a portfolio of more than 20 stocks, you should also keep an eye on the purchase and rebalancing costs. And you will also buy stocks in foreign currencies for a broadly diversified portfolio; there are additional currency exchange fees when you trade.

An ETF, index fund or mutual fund does it all for you. You buy several hundred shares in a basket at once and if you buy the fund in CHF, it even does the currency exchange.

Conclusion Everyday Shares

In my opinion, everyday stocks are not at all suitable for beginners. The danger of building up a one-sided portfolio is very great, especially for laymen, and if things don’t go so well on the stock market, such portfolios are subject to above-average fluctuations. It then takes a lot of staying power not to drop out and demonize stocks as gambler’s papers and the stock market as a casino in the future.

Broadly diversified ETFs, funds or even robo-advisors are much more suitable for beginners. Admittedly, this is a lot more boring and I have no emotional attachment at all to the companies in my ETFs. But what is the point of owning shares in a company that I believe in wholeheartedly, that I am convinced of the products, that I understand the business model (another 0815 saying that I can’t relate to, but that would fill an entire post), but that the market disagrees with? Then I’m sitting on an 80% book loss and don’t know what to do. Sell? Buy more? Wait until the stock goes back to 0 and then sell? By the way, to make up for a book loss of 80%, you need a price gain of 400%. I can only wish you a lot of patience.

And if individual stocks are absolutely necessary, then it is better to use them as part of a core-satellite strategy.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.