Letztes Update: 28. September 2023

For a long time, I only used the Swissquote app and the “Buy” button in it. That’s all I needed from the extensive range. Over time, however, I’ve discovered a few handy features that you should know about, too. In this Swissquote tutorial, I’ll introduce you to seven Swissquote hacks that will help you get even more out of Swissquote, the Swiss broker.

1. world heatmap

In the Swissquote app, go to “Dashboard” and select “World” at the top instead of “Switzerland”. If you scroll down a bit, you will see a heatmap with indices from all over the world. This way you always have an overview of the moods on the global, at least the western stock markets.

The abbreviations of the indices are not really understandable at first sight. That’s why here is the written out variant:

- OMXC20: The 20 largest companies on the Copenhagen Stock Exchange.

- PX1: Also called CAC 40. The top 40 French public companies.

- SX5E: The 50 large listed companies in the euro area.

- FTSEMIB: The 40 leading Italian public companies.

- NDX: Also called NASDAQ-100. The 100 shares of NASDAQ-listed non-financial companies with the highest market capitalization.

- OMXS30: The 30 most traded stocks on the Stockholm Stock Exchange.

- SPX: Also called S&P 500. The 500 stocks of the largest publicly traded U.S. companies.

- COMP: Also called Nasdaq Composite. Over 3,000 companies mainly from the technology sector.

- DAX: The 40 largest and most liquid companies on the German stock market.

- OMXH25: The 25 largest companies on the Helsinki Stock Exchange.

- DJIA: The Dow Jones Industrial Average or Dow Jones Index for short. Includes 30 U.S. companies listed on the New York Stock Exchange (NYSE).

2. registration Swiss share register

I have shown you here how you can enter your shares in the Swiss share register at Swissquote for free.

3. yields

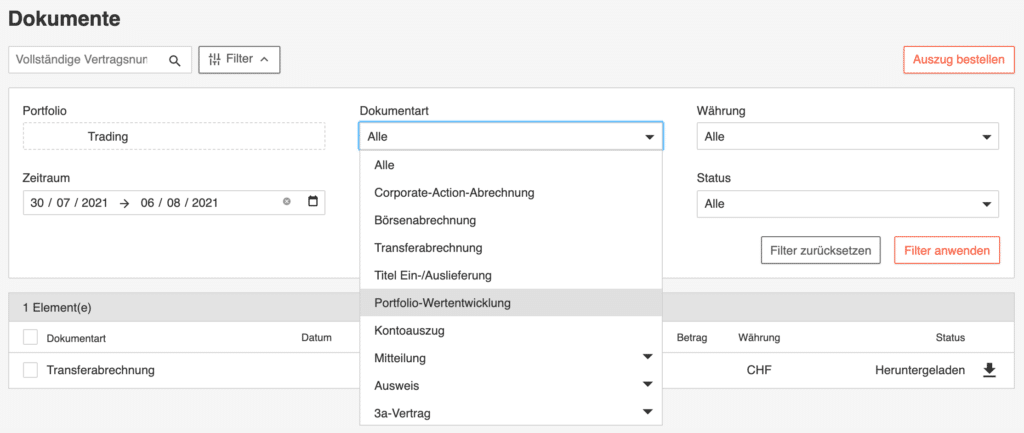

You go to “Documents” in eTrading and select “Portfolio Performance” under “Document Type”.

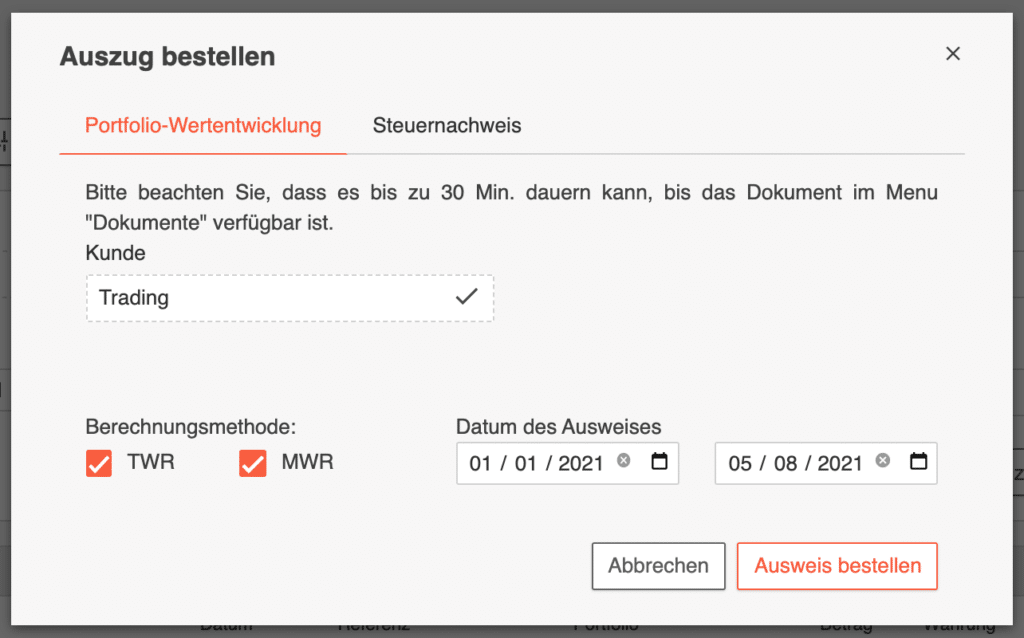

Now click on “Order statement” and in the window that opens you can select whether the statement should be created using the “TWR” or “MRW” calculation method. You can also select both at the same time. Finally, you select the period and complete the request with “Order badge”.

The generated PDF can be found under “Documents” in eTrading and contains a chart for each return type, the absolute and the percentage performance of the two return types.

For me, the money-weighted return (MWR) is lower than the time-weighted return (TWR) in the displayed period. So my “market timing” was not optimal. I would have done better if I had invested everything at the beginning of the year. But first, you don’t know that in advance. Secondly, I didn’t have the money at that time, that comes in with the monthly salary. And third, this was not active timing. I just stubbornly and boringly buy ETFs every month.

You want to know more about the different yields? Then you can find a post about it here.

Also, a pie chart that breaks down the asset categories is displayed. For me it looks like this:

4. swissquote Magazine

Swissquote no longer automatically sends the Swissquote Magazine to all clients. You can either buy it at the newsstand, where one issue costs CHF 9, or you can order an annual subscription directly in your account for CHF 40, so you get the six issues delivered to your home. Under “MY ACCOUNT” go to “Services” and then on to “Subscriptions”. At the bottom you will find the option to subscribe to Swissquote Magazine.

By the way, in the Swissquote lounges you get the magazine for free. And on the website of Swissquote you can find the magazine as well. There you can download the entire magazine for free as a PDF and read it on screen. This link will take you directly to Swissquote Magazine.

5. investment inspiration widget

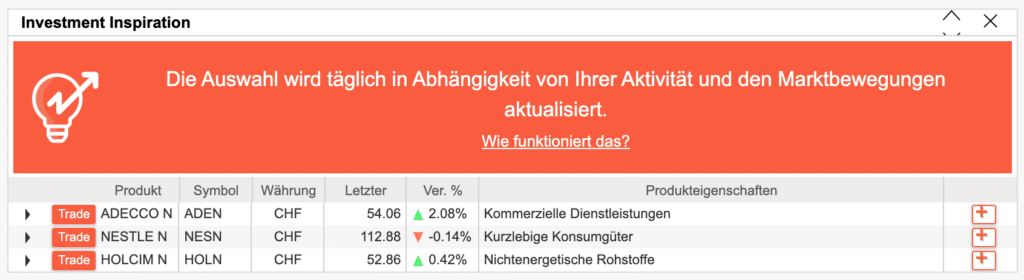

The new widget suggests you daily stock recommendations based on your trading activities. In my case, for example, these are Adecco, Nestlé and Holcim right now.

That’s not a bad fit for my boring ETF buy and hold. As you can see on the pie chart above, in addition to the broadly diversified ETF portfolio that makes up most of it, I also hold some individual stocks. This is also known as the core-satellite strategy.

But back to the Investment Inspiration Widget: Swissquote analyzes your investment behavior and shows you stocks that clients with similar investment behavior hold in their portfolios as well as stocks that most closely match your trading pattern.

6. charts

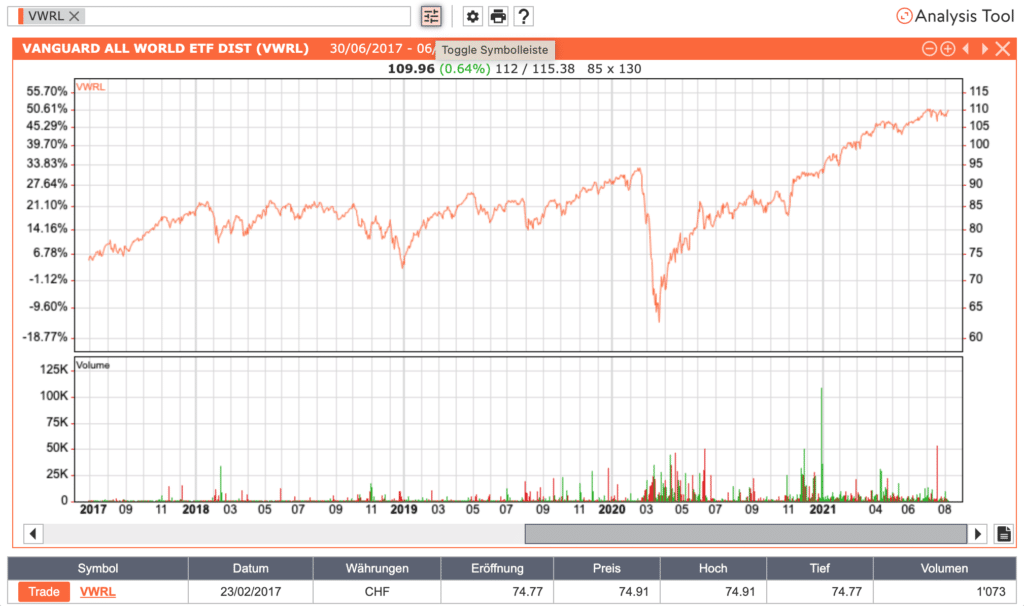

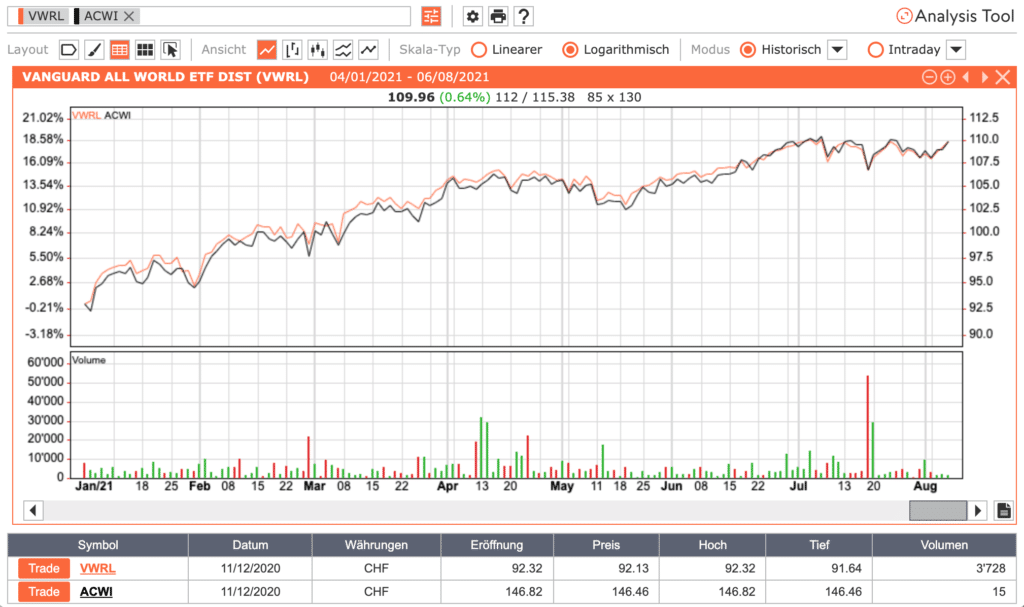

Under “Financial Tools” and “Charts” you can access the “Analysis Tool”. As an example, I have added the Vanguard FTSE All-World UCITS ETF (VWRL).

If you now click on “Toggle toolbar”, additional options will appear. For example, you can change the scale to logarithmic or adjust the time span. You can also create comparisons with other securities and even indices. Below the chart you can always see the traded volume of the respective trading day.

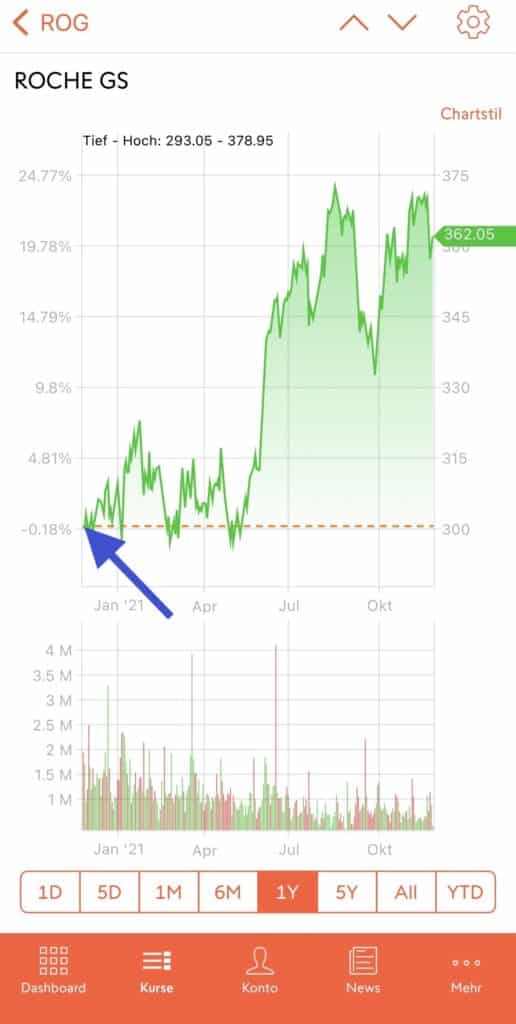

What does the orange line on the chart in the Swissquote app mean?

This marks a closing price. However, depending on the selected time interval, a different one. The following are displayed on the iPhone:

- five days (5D): closing price of the last day.

- all others (1M to YTD): closing price of the previous period.

Admittedly, this still sounds a bit confusing. Let’s make an example:

Roche had on November 25, 2021 a closing price of CHF 362.05. The orange line will show you the November 26, 2021 in the time interval of five days, i.e. at 362.05.

For example, if you switch to the time interval of one year, the orange line will be displayed at the closing price of November 25, 2020. The closing price a year ago was 300.15.

In the Android app, the orange line is only displayed for the “Intraday” and “1 week” time intervals.

7. Swissquote ETF Leaders

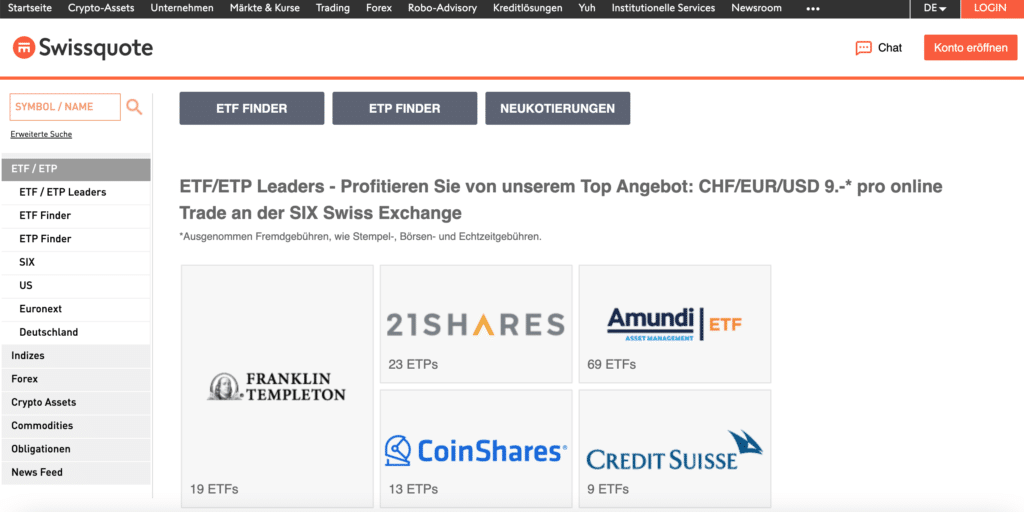

At Swissquote you can trade ETF Leaders at competitive prices of CHF/EUR/USD 9 per online trade on the SIX Swiss Exchange. Third-party fees such as stamp duties, stock exchange fees and real-time fees are then charged in addition. I am asked again and again which ETFs belong to the ETF Leaders. You can find this info under “ETF / ETP” and then under “ETF / ETP Leaders”. All associated providers are listed there. If you click on the logo of a provider, all offered ETFs will be listed.

If you scroll down a bit further, you will see an overview of all new listings. Sometimes that can also be quite exciting.

More Swissquote Tutorials

Wondering what the different order types mean at Swissquote? Then this post is for you. Or if you want to know how to buy a stock at Swissquote, read on here.

Now it’s your turn: Which hidden functions and features do you use at Swissquote? Share your Swissquote hacks with the financial deposit community in the comments.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.