Letztes Update: 16. July 2024

For a long time, people in Switzerland had to go to Germany or to robo-advisors for savings plans. The former was quite cumbersome and the latter was not very satisfactory for self-deciders and investors who wanted to invest in individual stocks. The free financial app Yuh from Swissquote and PostFinance now jumps into this gap and offers savings plans starting at CHF 25. For some ETFs there are even no purchase fees. In this post, we’ll take a closer look at the Yuh Savings Plan, also called the Recurring Investing or Recurring Investments Feature at Yuh, and the costs.

Yuh

Yuh is a finance app that lets you pay, save and invest. It was launched in May 2021 and has already attracted 50,000 customers after nine months. You can read all the details in the article Yuh experiences and review (2024). You can find the ETFs and stocks tradable at Yuh in this list.

Recurring investing – this is how it works with Yuh

Regular investing is available for stocks, trending topics, ETFs and investment themes. Savings plans for cryptocurrencies are currently not yet possible.

And here’s how you set up a savings plan:

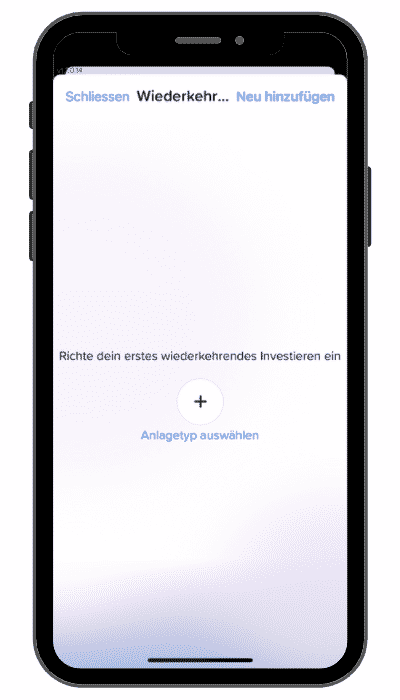

Select “Recurring investment” under “Invest” and use the + to select the investment type. The easiest way to do this is if you already know the exact name or symbol of the security.

If you don’t know the name or the icon, you can also select “Find attachments” first. Here you have more detailed filter options at your disposal. In my example, I filtered by “ETF” and “World”.

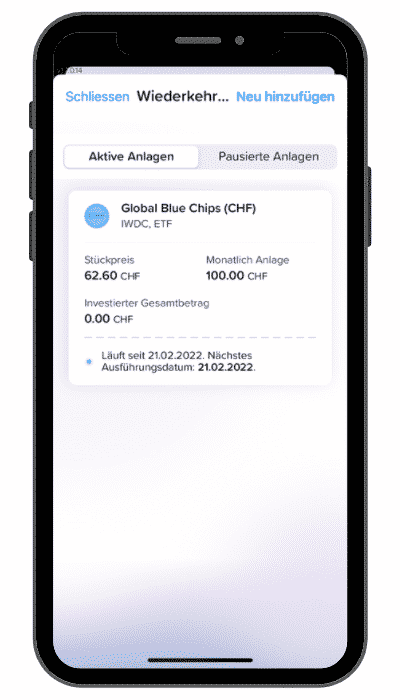

Among the 14 results, I selected the ETF with the symbol IWDC. The “iShares MSCI World CHF Hedged UCITS ETF (Acc)” includes nearly 1,600 companies from developed countries, is hedged on a monthly basis in CHF and automatically reinvests the dividends. Since it is traded on the Swiss stock exchange in Swiss francs, there are no currency exchange fees. As always, this is not an investment recommendation.

The first thing you do is choose the amount of your savings plan. On it, the estimated fees are displayed directly to you. If you select “Next”, you can specify the start date and frequency. The choices are:

- weekly

- monthly

As a last step, you will see a summary that you need to confirm.

Your recurring investing is thus set up.

If you ever run out of money in a yuh account, the savings plan is simply suspended and will not be executed again until the next run.

You can recognize securities that you have bought in the savings plan under “Invest” by the blue dot and the text “Automatic investment”.

Yuh pause or delete savings plan

Under “Investing” and “Recurring Investing” you will find all your active savings plans listed. Here you can edit, delete or pause them. If you pause a savings plan, it will appear under “paused investments”.

Yuh Savings Plan Costs

Whether you invest manually or via a savings plan, the costs remain the same. Trading stocks, ETFs and themes costs 0.5% at Yuh, with a minimum fee of CHF 1. When I purchased my ETF, an additional stamp duty of CHF 0.15 was due. You can find a PDF with detailed information for each transaction on your Yuh home page.

If you do not have the currency of the security you want to buy in stock at Yuh, the currency exchange will be done automatically. Yuh charges 0.95% for the currency exchange.

And of course, as with manual investing, you will receive an investment bonus of 10 Swissqoins (SWQ) per savings plan execution.

You can set up savings plans from as little as CHF 25. However, the minimum fee of CHF 1 then comes into effect, which then corresponds to a fee of 4%. Generally, it is advised that purchase fees should not exceed 1%. Setting up a savings plan below CHF 100 is therefore hardly worthwhile.

By the way, Yuh does not charge any custody fees.

Yuh free ETF savings plan

From summer 2024, six ETFs can be purchased without purchase fees as part of a savings plan. Stamp duty and ongoing charges (TER) continue to apply. However, as in the entire Yuh universe, there are no custody fees.

With these ETFs you can set up a savings plan without trading fees:

- Vanguard FTSE All-World UCITS ETF Distributing (VWRL)

- Vanguard FTSE All-World High Dividend Yield UCITS ETF Distributing (VHYL)

- iShares MSCI World CHF Hedged UCITS ETF (Acc) (IWDC)

- iShares SMI (CH) (CSSMI)

- Invesco Nasdaq-100 UCITS ETF CHF Hedged (EQCH)

- Invesco CoinShares Global Blockchain UCITS ETF Acc (BCHE)

Yuh may receive retrocessions from ETF providers for the distribution of its ETFs.

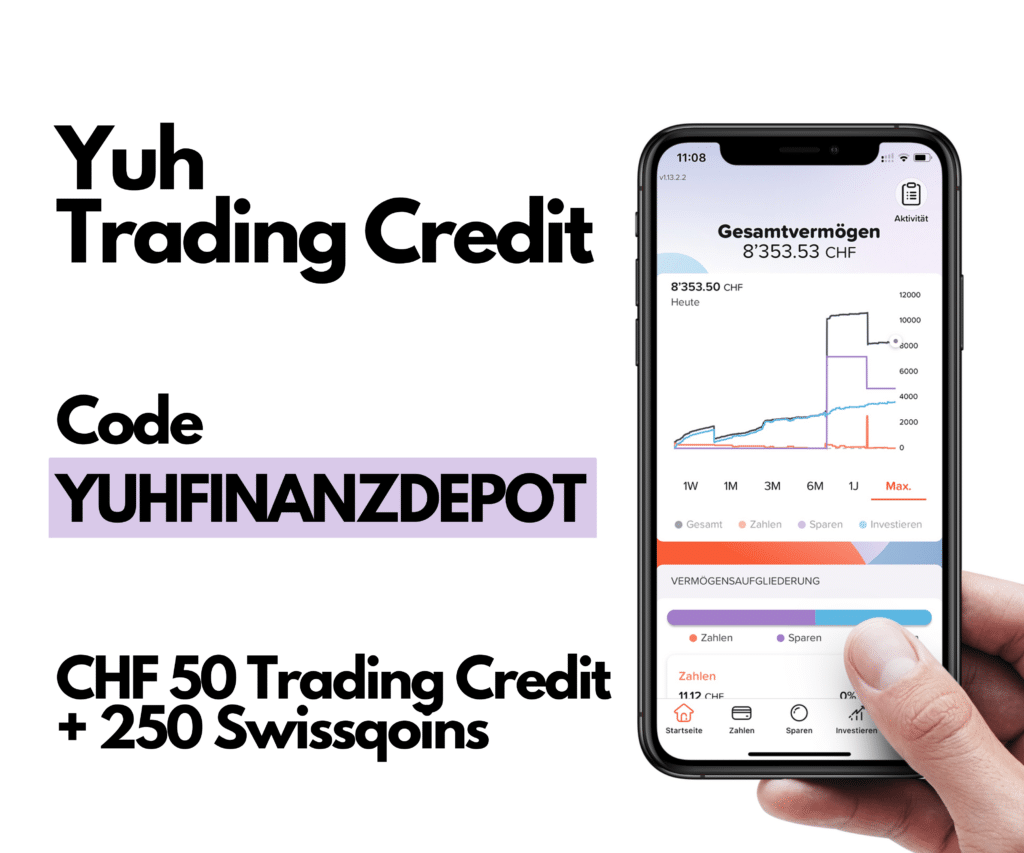

Yuh promotion code

With the promotional code YUHFINANZDEPOT you will receive CHF 50 Trading Credit and 250 Swissqoins when you open your account.

Only valid for persons living in Switzerland; minimum deposit CHF 500.

Yuh Savings Plan Conclusion

Yuh has been synonymous with simplicity since the beginning, and setting up savings plans is truly foolproof with Yuh. Yuh’s Recurring Investments feature allows you to make automated investments even with relatively small amounts – and sometimes even free of charge. That way, you won’t be tempted to try to time the market, and once your Yuh Savings Plan is in place, you’ll have more time for the really important things in life.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.