Letztes Update: 28. September 2023

Even though I now pay for almost everything by card, I can’t get around cash now and then. If there is no ATM nearby or it costs to withdraw from an ATM, I have been using the “ATM on your phone” since January 2019 -. Sonect . This allows you to withdraw cash at over 2,300 partner stores. Read about my experience with Sonect here.

Sonect

After a year of product development, Sonect launched a pilot project in Switzerland at the end of 2017. In 2018, the first customers were able to use the platform for cash transactions, and new partners were integrated on an ongoing basis. In 2019, Sonect already had the largest cash withdrawal network in Switzerland. In the meantime, Sonect has also expanded into other European countries such as France and the UK. The fintech startup is headquartered in Zurich and employs around 30 people.

Withdraw money

And it’s as simple as this: Download the app from the Apple or Google Play Store. Register with your first and last name, cell phone number, email address and IBAN number. The IBAN is necessary so that Sonect can transfer unused credits to your account.

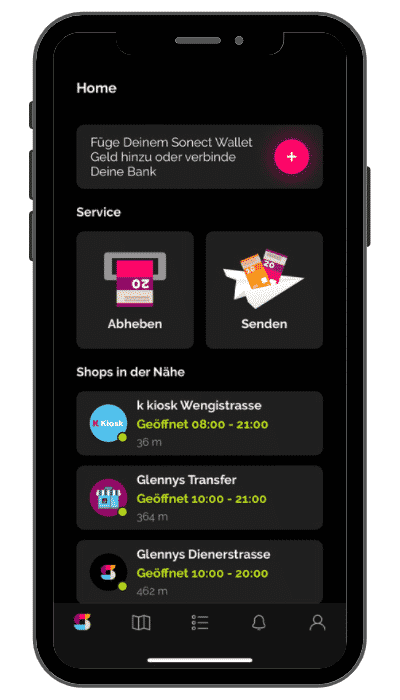

When you open the Sonect app, the stores in the immediate vicinity are displayed and you can also see immediately whether they are open.

For a map view, select the corresponding store or tap on the map below.

Now you choose “Withdraw” and the amount. The choices are: CHF 20, 50, 100, 150 and 200.

Wallet recharge

If you don’t have enough money in your Sonect wallet, you can either top it up by linking your bank account or paying by debit or credit card.

It is also possible to top up by bank transfer. You can find the necessary IBAN and reference in the Sonect app. The money must come from your IBAN provided during registration. The transfer takes two to five business days. All rather cumbersome: So I would rather not choose the recharge via bank transfer.

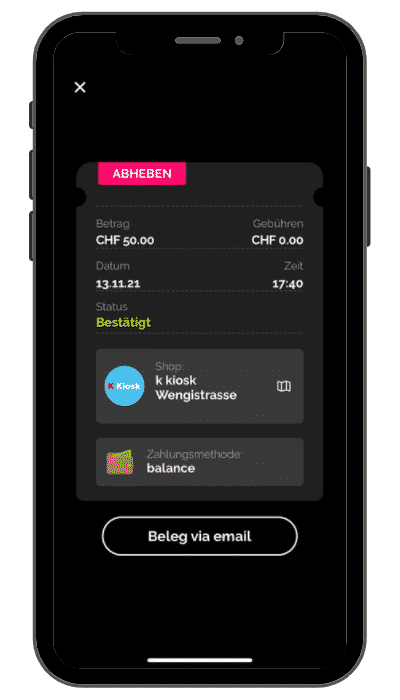

Once you have topped up your account, you will be shown a barcode which you can present at a Sonect partner store. And you will receive your cash.

You can connect your account directly to Sonect with the following banks:

- PostFinance

- Migros Bank

- Mortgage Bank Lenzburg

By the way, an Internet connection is always required to withdraw money.

If you make a request in the Sonect app and don’t pick up your money within 15 minutes, the barcode will expire. Your money will then remain in the wallet. If you do not withdraw it within 60 days, it will be transferred to the IBAN you provided during registration.

Track

Under “Track” you can see at any time when and where you last drew cash. You can also track every transaction in your Sonect wallet, such as top-ups or shipments to friends, there.

Send money

Even if the recipient does not have a Sonect account, you can still send them money with Sonect. The person simply receives an SMS with a code that he or she can present at a partner store, and the cash is handed to him or her. Below you can see what limits apply.

Sonect costs

The costs differ depending on the type of purchase:

| free | neon, Mortgage Bank Lenzburg |

| CHF 0.99 per cash withdrawal | Migros Bank, PostFinance |

| CHF 1.00 per cash withdrawal | TWINT (for withdrawals between CHF 20 and CHF 100) |

| CHF 1.50 per cash withdrawal | VISA, Mastercard, TWINT (for withdrawals over CHF 100) |

Paid cash withdrawals at an ATM usually cost around CHF 2.00. Sonect therefore offers a cost-effective alternative.

Transfers from one Sonect account to another Sonect account are free of charge.

Sonect Limit

Take off and send

- per day CHF 200

- per month CHF 200

- per year CHF 2’400

Receive

- per month CHF 500

- per year CHF 3’000

If you have your identity verified, you can withdraw up to CHF 4,000 per month and send up to CHF 1,000 per month. To do this, go to “Track”, “Increase Limits” and answer a few legal questions. Finally, you scan an identification document. The verification process can take up to 48 hours.

Sonect neon

Until recently, you could connect your neon account directly to Sonect. This is now no longer possible. However, you can still withdraw cash with neon via Sonect. When registering, enter your neon IBAN and select “neon” as your bank. This way, Sonect recognizes you as a neon customer and you benefit from free cash withdrawals.

To withdraw, add money to your Sonect wallet using your neon Mastercard. This is particularly easy if you have deposited your neon Mastercard in Apple Pay.

Sonect TWINT

In the TWINT app, tap “TWINT+” and then “Cash withdrawal”. A new window will now open in your cell phone’s browser. You can enter the amount to be withdrawn as described above and see transparently how high the fees are.

Again, a barcode is generated that you can show at the partner stores and receive your cash in return. The installation of the Sonect app and a registration are not necessary for this. The debit will then of course be made via TWINT.

Sonect stores

In addition to all k kiosk and Volg stores, you can also withdraw cash from participating bakeries, pharmacies, gas stations or restaurants. A total of over 2,300 partner stores are available in Switzerland. In the Sonect app, you can see all the stores on the map view and whether they are currently open.

Sonect experience

At launch in 2019, many store employees were overwhelmed and didn’t know what to do with the code. Several times, I was even denied cash withdrawals because the employees didn’t know Sonect, even though there were stickers all over the store.

Previously, you had to select which specific store you wanted to withdraw money from and only in this store you got the money. In Zurich’s main station, it wasn’t easy to find the right store. Fortunately, this is no longer the case today – you can show the Sonect barcode in any store.

In general, the teething troubles have been eradicated. The app and the withdrawal process usually work flawlessly and the stores have trained their employees.

If you have any questions, the helpful Sonect team responds very quickly via email. By the way, you can also reach them by phone.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.