Letztes Update: 23. October 2024

I stumbled across findependent by chance in the fall of 2020. At that time, you still had to go in person to findependent in Aarau to open the account. In the meantime, opening an account is also possible completely digitally and without paperwork. So it’s time to take a closer look at findependent’s investment solutions, ask the founder a few questions and report on my findependent experience.

Who is behind findependent?

The founder of findependent Matthias Bryner studied at the University of Zurich in the Bachelor and at the University of St. Gallen (HSG) in the Master Banking & Finance. He gained experience with fintech startups at the online bank neon.

In conversation, he explains that he lacked a simple and easy-to-understand app for investing his free assets in Switzerland. That’s why he founded findependent in 2019.

Findependent, by the way, is regulated in Switzerland and is a member of the Association for Quality in Financial Services (VQF) and the Industry Association for Independent Asset Managers (BOVV). In winter 2023, findependent received its license as an asset manager from the Swiss Financial Market Supervisory Authority FINMA.

What is findependent?

Findependent is an investment app that lets you invest in ETFs in a simple, understandable, fair and digital way, according to Matthias Bryner. Hypothekarbank Lenzburg acts as the banking partner. If you have an account with neon, Hypothekarbank Lenzburg should look familiar to you, because the banking app neon also works together with Hypothekarbank Lenzburg.

Depending on the investment character and risk appetite, there are a total of five investment solutions to choose from, which differ mainly in the weighting of the equity component. The “Cautious” and “Prudent” investment solutions include gold as well as equities, bonds and real estate. The “Risk-taking” solution, on the other hand, contains only equities and some liquidity. At your disposal:

- Cautious – 20% shares

- Considered – 40% shares

- Balanced – 60% shares

- Courageous – 80% shares

- Risk-averse – 98% equities

The five investment solutions are available in two levels, which differ according to the investment amount.

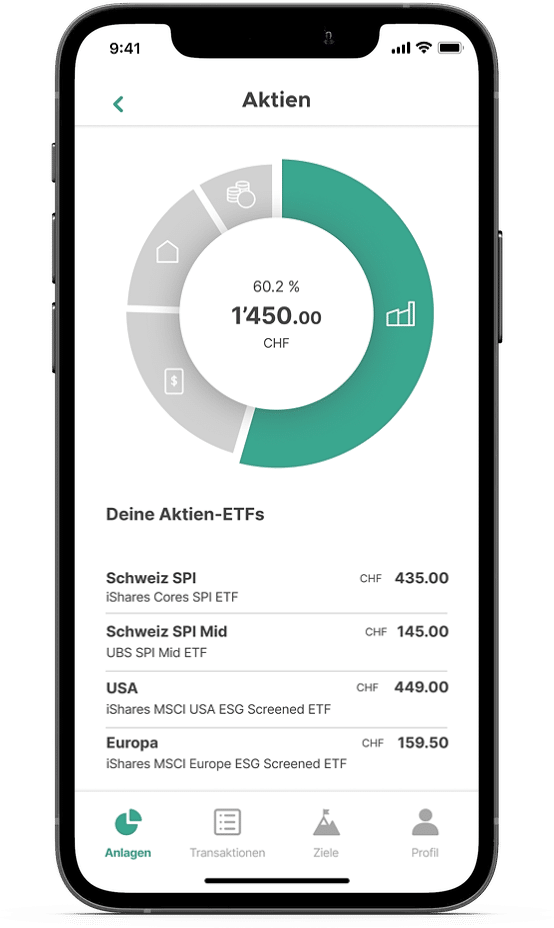

The first level from CHF 500 to CHF 2,000 is called “findependent Start“. A total of five ETFs are used here, covering the broad Swiss equity market (SPI) as well as the US and European equity markets (MSCI USA and MSCI Europe). We also invest in corporate bonds denominated in Swiss francs and in Swiss real estate funds.

If your investment amount exceeds CHF 2,000, you automatically switch to the “findependent Grow” investment solution. Further ETFs are now being added to the existing five. So you are additionally invested in emerging markets (MSCI Emerging Markets), Japan (MSCI Japan) and bonds from emerging markets. In addition, Swiss mid-cap shares (SPI Mid) are weighted higher. Government bonds and emerging market bonds in USD are added to the investment solutions with a high bond component.

With the exception of the Swiss ETFs, findependent uses so-called ESG Screened ETFs for its equity ETFs. These exclude companies that operate in the following areas:

- Controversial weapons

- Nuclear Weapons

- Thermal carbon

- Civilian firearms

- Tobacco

- Oil sand

In addition, companies that violate the United Nations Global Compact are excluded.

The exclusions reduce the CO2 intensity of the portfolio.

If an asset class deviates more than 5% from the target weighting, rebalancing is performed to restore the original allocation. Traded daily.

The Investment Committee, consisting of Matthias Bryner, Tobias Hochstrasser and Prof. Dr. Thorsten Hens, meets semi-annually to monitor the investment universe and determine the investment solutions by selecting and combining the right ETFs.

If you have any questions, you can reach the findependent team by mail, chat or phone. You can now also start a chat directly in the app.

You now have the option of setting up two-factor authentication with all common authenticator apps.

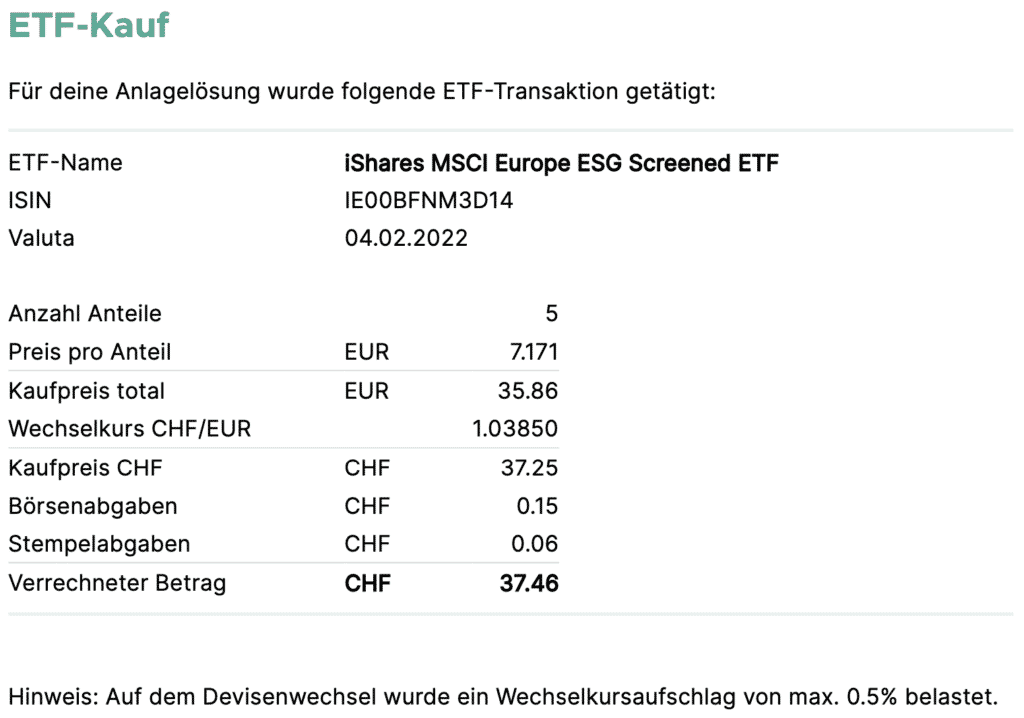

findependent fees

So that you can get off to an uncomplicated start and convince yourself of findependent, the “findependent Start” level (up to CHF 2,000) does not incur any administration or custody fees for the rest of your life. From CHF 2,000, management and custody fees of 0.40% per year are added. For both levels, ETF costs (0.12-0.23% per year), exchange rate surcharges (maximum 0.5%) and stamp and stock exchange duties are charged separately.

You benefit from lower findependent fees for larger investment amounts of CHF 50,000 or more. The scale is as follows:

| Investment amount | Investment amount |

|---|---|

| < 2’000 | 0% |

| 2’001 – 50’000 | 0.40% |

| 50’001 – 150’000 | 0.38% |

| 150’001 – 250’000 | 0.35% |

| 250’001 – 500’000 | 0.33% |

| 500’001 – 1’000’000 | 0.31% |

| > 1’000’000 | 0.29% |

Deposits and withdrawals are free of charge, and the digital e-tax statement is already included in the custody account fees.

For whom is findependent suitable?

- Don’t want to let your money just sit around in your bank account and would rather invest in sustainable ETFs for the long term?

- Are you put off by the huge selection of more than 1,500 ETFs?

- You don’t want to look for a broker yourself and then buy the ETFs on the stock exchange every month?

- You value transparency and simplicity?

- Want to invest for your kids, gotti/goddess kids or grandkids?

Then findependent is the right place for you.

Since there are no additional fees for deposits, you can deposit as often and as much as you want. Findependent thus offers a simple and flexible way to implement an ETF savings plan in Switzerland. How an automated savings plan with findependent compares to a manual savings plan at Swissquote, you can read in the savings plan comparison.

Ah, and one more thing: You can only access your account at findependent via app. So you should have a smartphone.

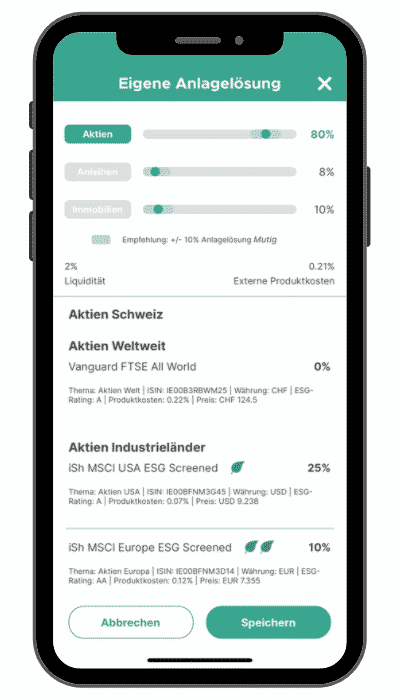

Own ETF investment solution

Since fall 2021, you have been able to put together your own ETF investment solutions at findependent. With an investment volume of CHF 5,000 or more, you can put together your own strategy from around 30 pre-selected ETFs. As with the predefined strategies, the management and custody fees are 0.40 – 0.29% per year.

To make sure you are sufficiently diversified, findependent sets upper limits. For example, you can add ETFs with a thematic focus to a maximum of 10%. This is clearly displayed in the app and you can also easily compile the portfolio directly in the app. As the ETFs at findependent are only traded in whole numbers, there may be slight deviations in the weighting.

I only recommend this option to more experienced investors. Note that a portfolio composition also costs time and whether you beat the standard strategy then is questionable. Besides, when you create your own strategy, you want to know how it compares. That means you have to track them and that takes time again.

findependent – creation for children

The long investment horizon of children and young people predestines them for investing in equities. To invest for your own child, godchild or grandchild, you must first open your own findependent account. You can then add a separate investment goal for each child in the app. The minimum investment amount per target is CHF 500. If the child is of legal age, they can open their own findependent account and you can transfer your target’s assets to them free of charge. To do this, simply select “Transfer” for your destination in the findependent app. By the way, other people cannot contribute to the investment goal, only you can.

The investments at findependent legally belong to you until you later transfer them to the child or have them paid out. So it’s not tied child assets like other providers. If it were tied child assets, the child would automatically receive full power of disposition on his or her 18th birthday.

My findependent experience

When I present a product, I want to try it out myself if at all possible. That’s why I opened an account with findependent and deposited my own money.

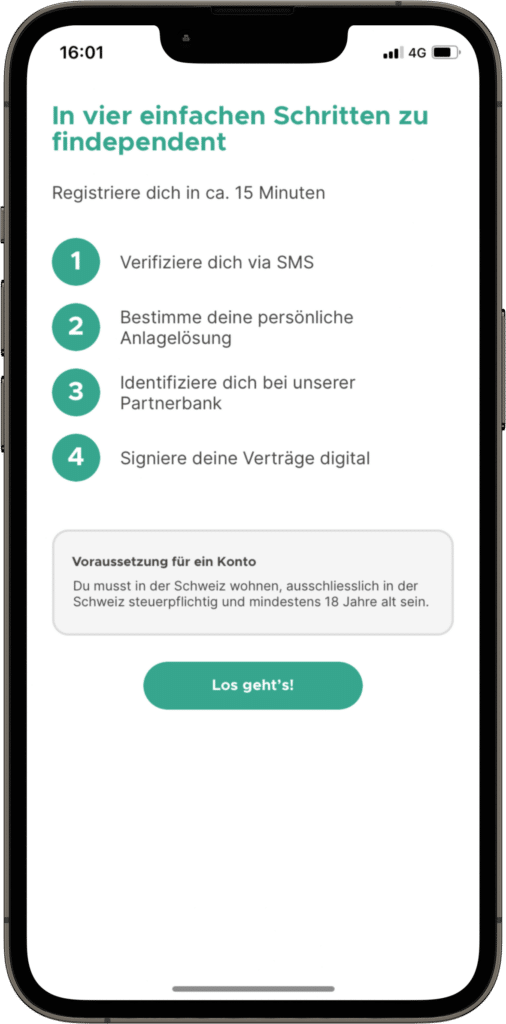

You can open an account directly in the app.

First, you enter your name and e-mail address. If you want to try findependent as well, you can use the code “finanzdepot” when opening it. With this you will receive a cash bonus of CHF 20 as a gift after your first deposit.

After verifying your email address, you will be asked for legal information and answer questions about your investment nature, what you are investing the money for, your risk tolerance and knowledge. Findependent will then suggest one of its five investment solutions. You can of course override the proposal.

You can also download the factsheet for the respective investment solution. On it, the various asset classes and the products used are explained in an understandable way.

Once you have confirmed the investment profile, you will need to have the front and back of your ID or passport photographed, and finally a facial scan will follow. The contract is then signed digitally. In total, onboarding only takes about ten minutes.

After about two days, my account was set up and I was able to transfer money from an existing Swiss account that is in my name.

findependent reporting

You can view the time-weighted return and the total value of your investment solution in a progress chart.

At the beginning of 2022, reporting at findependent was greatly expanded. You can now see the return since inception of each individual ETF. You can also select the ETFs in your portfolio and get detailed information about the ETFs. In addition to the TER, you can, for example, call up the factsheet and view the weighting in your investment solution.

Under “Transactions” you will now find PDF statements for each ETF purchase or sale. In it, for example, the stock exchange and stamp duties are shown in detail.

findependent taxes

In spring, you will receive a free digital e-tax statement for the previous year. You can find this in the end user app under “Profile”, “Documents, Investment profile” and ” Tax statement”.

You will find a summary on the first page of the tax statement issued by Hypothekarbank Lenzburg. However, you don’t have to type out any numbers because it’s an electronic tax statement (e-tax statement). You can simply import the PDF into your tax return.

findependent code

Enter the code finanzdepot when opening. With this, you will receive a cash bonus of CHF 20 from the investment app findependent as a gift after your first deposit.

findependent comparison

findependent vs. selma

With digital wealth manager Selma, your overall wealth is more in focus. Selma also takes into account whether you own a house, for example, or are planning a major purchase in the future. You can also open a pillar 3a account with Selma and your investments will be treated as a single unit.

In the event of market fluctuations, Selma may reallocate investments and underweight American equities, for example. Accordingly, it costs a little more, and the minimum deposit is four times higher.

The findependent investment app simply offers five investment solutions. Findependent sets like for example. Viac on a completely passive investment strategy: As long as the deviation does not exceed 5%, findependent does not intervene either. Besides, at findependent you can also create for children.

findependent vs. true wealth

True Wealth is one of the oldest robo-advisors on the Swiss market. Accordingly, the assets managed there are larger.

At findependent you can start from as little as CHF 500. While at True Wealth the minimum investment is CHF 8,500. Both allow you to create your own investment strategies with ETFs selected by the providers.

With True Wealth, you can access your portfolio via both app and web app, while findependent only offers an app. You can now also invest with True Wealth within the framework of pillar 3a.

findependent vs yuh

With Yuh you can not only invest, but also pay and save. So Yuh is more of a salary or savings account with free Mastercard that you can also use to invest. However, with Yuh you have to build your own portfolio. Since you can only buy individual stocks and ETFs. At findependent you get ready-made investment solutions.

With Yuh, you incur costs with every transaction. Yuh does not know any custody fees. While findependent charges an annual percentage fee.

Conclusion findependent experience

Findependent breaks down ETF investing to its simplest, no frills, no gimmicks approach. This way, even as a beginner, you can take your first steps in the financial markets without spending days looking for ETFs and the cheapest broker or spending sleepless nights with the optimal portfolio composition. Thanks to the low minimum deposit of CHF 500, you can gain experience with small money and test whether this is something for you at all.

I would structure a small portfolio of under CHF 2,000 a little differently. But the advantage of the findependent solution is that as the investment amount increases, the ETFs already purchased are retained and simply supplemented with additional ones. Thus, the costs for you are kept low, and there are no unnecessary spreads and stamp duties.

Like the investment process, findependent’s app is sleek, simple and clear.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.