Letztes Update: 28. September 2023

This post was created in collaboration and with the support of Freya Savings. The content reflects my own opinion.

The Freya 3a app has been discontinued as of the end of 2021. Existing customers had to transfer their assets to another pension fund.

In an interview with the founders, you learned what sets Freya Savings apart from other pillar 3a providers and what is important to them in terms of sustainability. In the second article, we looked at the challenges of sustainable investing in the asset classes of gold and real estate. And this Freya Savings review is specifically about the Freya offer and app. Find out which sense profiles you can choose, what useful calculators the app offers, and how much Freya Savings costs.

Sustainability and sense profiles at Freya Savings

All financial products used at Freya Savings are designed with sustainability in mind and are selected based on environmental, social and ethical considerations, including the underlying investments that form the foundation of your Pillar 3a.

This excludes industries that operate in the following areas:

- Weapons and military

- Steam coal

- Alcohol and tobacco

- Nuclear energy

- Gambling and casinos

- Pornography

As an addition to the basic investment, you select two of a total of five focal points. The following focal points are available for selection:

- Energy & sustainable infrastructure

- Fair companies

- Climate change & natural resources

- New growth

- Health & Medicine

Freya Savings regularly checks whether the high standards are actually maintained and replaces the products if necessary. Read more in the interview with the founders.

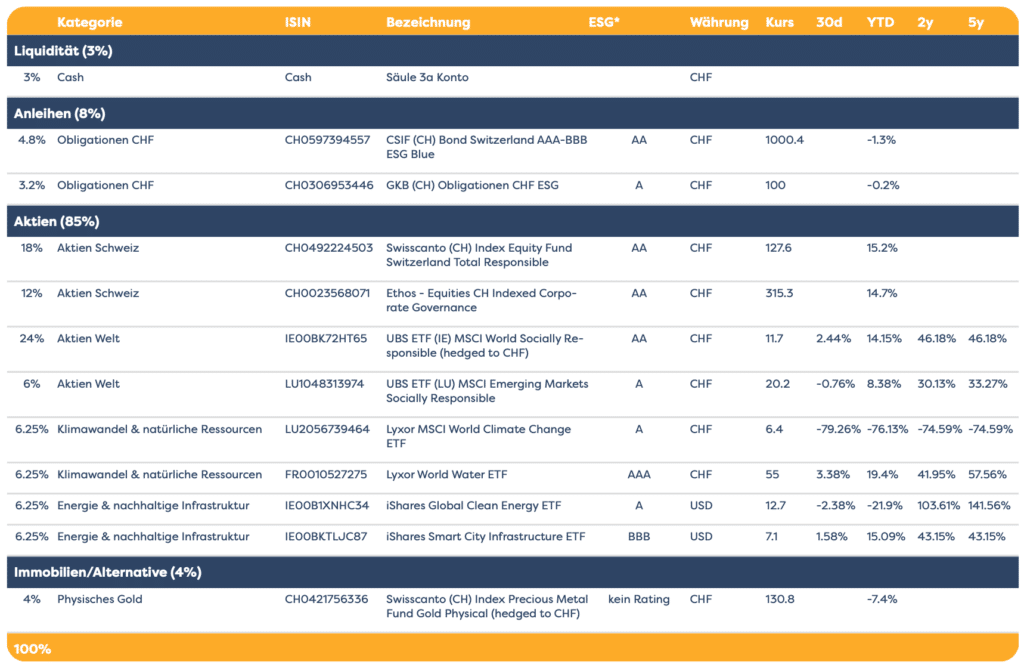

Portfolios at Freya Savings

If you have selected two focal points, approx. 30% of the equity share will be invested in these two focal points via ETFs. The amount of shares will be suggested to you by Freya, based on your investment horizon and your risk capacity, which you can of course adjust individually.

With Freya Savings, share ratios of 25%, 45%, 65% and 85% are possible. For the remainder, bonds, gold and, in the case of portfolios with an equity weighting of less than 85%, real estate are also added. In all portfolios, approximately 3% cash serves as a base amount and is not invested.

The cash and securities are held in a 3a account/deposit account at Graubündner Kantonalbank (GKB). GKB acts as a partner bank and manages everything related to your Pillar 3a account and custody account with Freya Savings.

In the app and on the website, you can see transparently which products are used, how they have performed in the past, and which ESG rating the products have.

Most of the products used are ETFs that passively follow an index. In addition, a few funds are used.

In the future, it will be possible to select all five focal points.

Onboarding at Freya Savings

The individual steps “Register”, “Profile” and “Identification” are listed at the top of the app, so you always know exactly which part of the onboarding you are currently in and what else awaits you.

In the “Profile” step, you select your focus areas, which you can of course change again later in the app, and specify whether you plan to withdraw your Pillar 3a early, for example to buy a house, and how risk-averse you are.

For identification you need your passport, ID, driver’s license or residence permit. You take a photo of that and then you record a short selfie video. So a video chat is not necessary.

The whole onboarding process takes about five minutes and worked flawlessly for me.

From an account balance of CHF 100 is invested in your portfolio. This happens once a month between the 5th and 10th of the month.

The Freya Savings App

From opening an account to managing and monitoring your Pillar 3a, the Freya Savings app serves. So you need a smartphone. You can download the app from the Apple App Store and Google Play.

Convenient: You can have a QR code displayed and sent to you in the app for a one-time transfer. You can create the same for a monthly transfer. You enter your annual savings goal and the app automatically converts the amount into the remaining months.

Freya 3a tax calculator

When determining the annual savings target, the annual tax savings are automatically displayed. You simply enter your gross annual income, your marital status, the number of your children and your denomination (the app already knows your place of residence from the registration) and you already know how much you can save annually in taxes by paying into the pillar 3a. So far, no other provider has made it this easy.

And there’s more: If you cash out your Pillar 3a upon retirement, a capital payment tax will be due on it. The Freya Savings app will also show you the amount of this capital withdrawal tax based on your information and simulated performance in the tax calculator. It even calculates how high the taxes are if you have several Pillar 3a accounts. Again, I’ve never seen this integrated so seamlessly before.

You can also calculate your annual tax advantage on the website. There you will also find the very comprehensive and understandable FAQ. If your question is still not answered, you can reach the Freya Savings team via WhatsApp or email.

Fees at Freya Savings

The base fee is 0.55% and in addition there are product costs of 0.30% on average. The somewhat higher product costs compared to other pillar 3a providers result from the use of the theme ETFs to implement the sense profiles and the use of the most sustainable funds in each investment category.

Freya Savings writes: “Without this strong focus on future issues and sustainability, approximately 50% of product costs, i.e. 0.15 percentage points, could be saved. However, Freya is firmly convinced that companies that focus on saving raw material resources and protecting the environment in their orientation and in all their decisions will perform far better than their competitors in the medium to long term, while at the same time making our environment livable for our descendants.”

With the total of 0.85%, Freya Savings is thus in the upper range of digital pillar 3a providers. However, compared to Pillar 3a offerings from traditional banks, which often do not place the same importance on sustainability as Freya Savings, the fees are still attractive.

In addition, Freya invests 2% of your annual base fee in FREYA Community Projects AG. The purpose of this company is to support projects that have an environmental, social or societal impact.

Stamp duties as well as exchange fees, if any, will be charged additionally as with all other providers. These amount to approximately 0.115% of the transaction amount. If a fund is traded in a foreign currency, a spread of 0.3% is incurred for the currency exchange. This is also attractive in comparison with other providers.

Conclusion Freya Savings Experience Report

Do you want to invest your Pillar 3a funds sensibly and sustainably? You want to set specific priorities with meaning profiles that reflect your value attitudes? Then Freya Savings is the right place for you. The app is simple and clearly designed and offers practical additional functions, such as the calculation of your annual tax benefit and the calculation of the taxes incurred when withdrawing from pillar 3a.

Transparency and disclaimer

This post was created in collaboration and with the support of Freya Savings. The content reflects my own opinion. More about transparency and paid contributions can be found here.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.