Letztes Update: 28. September 2023

Fintech neon doesn’t have its own TWINT app, but there are still two ways you can use TWINT with neon. Here you can find out exactly how it works and which ones I prefer.

TWINT

TWINT was founded in 2014 and has since been developing “the digital cash of Switzerland”. More than 100 employees now work at TWINT, which is owned by the Swiss banks BCV, Credit Suisse, PostFinance, Raiffeisen, UBS, Zürcher Kantonalbank, SIX and Worldline.

According to a media release on July 14, TWINT now has 3.5 million active users and around 4,500 new registrations are recorded every day.

In the future, TWINT will also be usable abroad. To this end, the company has joined forces with thirteen other mobile payment solutions under the name European Mobile Payment Systems Association (EMPSA).

My experience with TWINT

To be honest, I’m not a big fan of TWINT. Paying at the checkout is way too slow for me. With the Apple Watch, I’m a lot faster and it’s a lot more convenient, too.

Well, I have to admit that I can’t get around TWINT since many in my circle use it and diligently send money back and forth. Some use it to pay the parking meter or when shopping online, but somehow no one uses it to pay in stores.

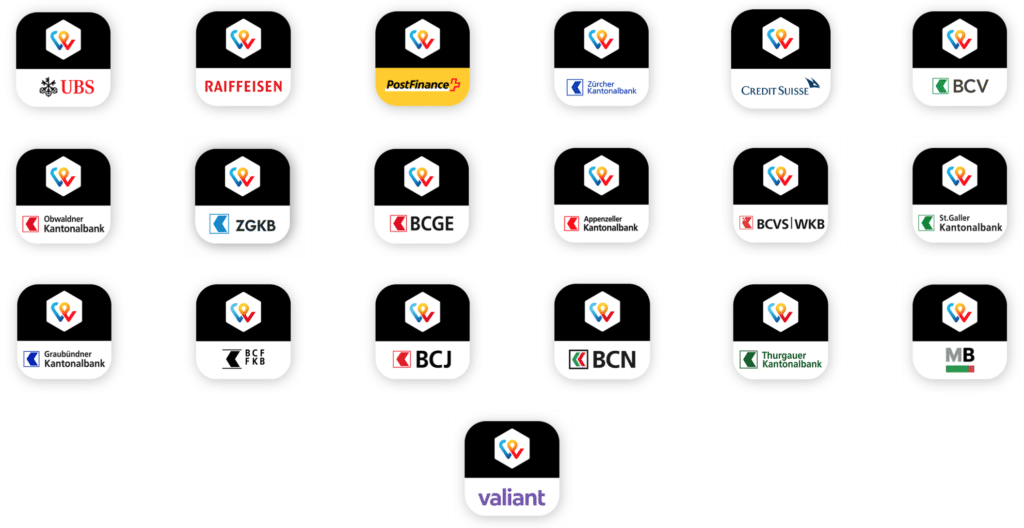

Some banks allow direct connection to your bank account. However, this requires a bank-specific app. So there are a wild number of apps:

neon doesn’t offer its own TWINT app, so I’ve been using TWINT Prepaid until now. But I found the recharging so ridiculously slow that I have already expressed my amazement about it on Twitter:

TWINT prepaid

With some banks, you can top up credit under CHF 200 via direct debit without waiting. This also includes neon and Hypothekarbank Lenzburg, neon’s partner bank. To do this, you need to connect your account once. Amounts over CHF 200 always have a waiting time of up to four working days.

Another option is to top up TWINT with a payment slip. Fill out the form in the app and you will receive a payment slip by mail. It takes up to three working days for the money to appear in TWINT.

The last and most analog variant is the purchase of a credit code. You can buy it in post offices and at Coop. You scan the QR you receive and the amount is then immediately available.

TWINT-Prepaid can be used from a minimum age of 12 years. Whereby lower monthly and annual limits are applied here.

UBS TWINT

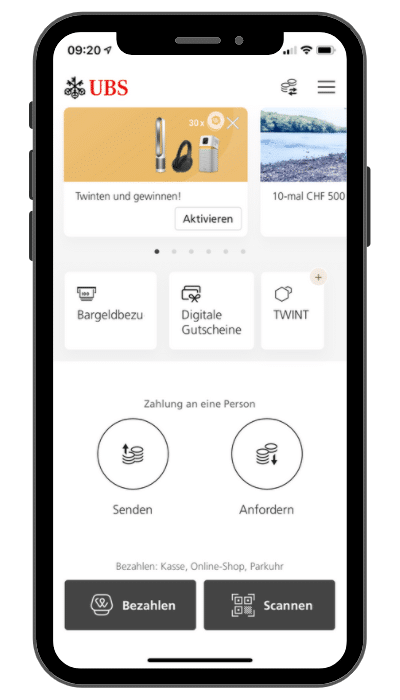

For some time now, the UBS-TWINT app has offered the option of storing a (non-bank) credit card, which allows you to use your neon account via a direct connection. An account with UBS is not necessary for this.

In the Apple Store, the UBS TWINT app has a record-breaking 97,213 reviews and a rating of 4.9 out of 5.

The app looks more like a UBS app and not a TWINT app.

By the way, you can now use TWINT to withdraw money from Sonect partner stores. As a neon customer, however, you are better off using the Sonect app directly. Because then the purchase is free of charge. With TWINT, you pay a fee of CHF 1.00 when withdrawing amounts under CHF 100 and a fee of CHF 1.50 for amounts above that.

Registration

After downloading the UBS-TWINT app, type in your first and last name, accept the terms of use and enter the activation code that will be sent to your cell phone number.

Next, enter the IBAN of your credit account. You can find them in the neon app or on your neon mastercard. If you receive money via TWINT, it will be transferred to your neon account.

Now enter the card details of your neon mastercard. This time, the card number, expiration date and security code are required. Of course, you will find all details on your neon mastercard.

When using a non-UBS credit card – which is the case with the neon Mastercard – an official ID must also be photographed and uploaded. UBS uses 3-D Secure to verify that you are the rightful owner of the card.

Finally, to log in to the TWINT app, you set a 6-digit numerical code. You will need this passcode every time you log in to the app. You can also select the more convenient login via Face ID or Touch ID.

Limits

Send limit

CHF 500 last 30 days

CHF 5’000 last 365 days

Receiving limit

CHF 1’000 last 30 days

CHF 5’000 last 365 days

If you deposit a UBS account or a UBS credit or prepaid card, the limits are sometimes higher.

In the app you can see how much of the limits you have already used.

Things to know about TWINT

You can read how to close your TWINT prepaid account right here on the TWINT website. Just so you know, it’s quite cumbersome, like a lot of things with TWINT prepaid.

By the way, you can use multiple TWINT apps on the same smartphone. However, these are not connected to each other. If someone sends you money, you will receive it on the default app, which is the last TWINT app installed. If necessary, you can set another app as the default app.

If you have a Digital bank without branches (like neon) as an everyday account and you want to Cash to this bank account depositThen it’s easy with the credit code method: With Grosis Zustupf you go to the post office or Coop, buy a credit code and as soon as the money is on your TWINT app, you pay it out to your credit account of your digital bank.

The limits apply here as well. Thus, the method is not suitable for large amounts.

TWINT is free of charge for private customers. As with debit and credit cards, however, merchants must assign a certain percentage of the purchase amount to TWINT. If you use a TWINT QR code sticker, you will be charged 1.3%. Other conditions can be applied for integration into online stores and cash register systems.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.