Letztes Update: 3. July 2025

After years of zero and negative interest rates, there was a period when interest was once again available on bank accounts. However, in 2024, these rates have started to slide again, and now one must search for them. In this blog post, I compare the current interest rates of various Swiss banks and show you where you can currently achieve the highest return on your savings. The comparison shows that there are still major differences between the individual banks – so a switch can quickly pay off.

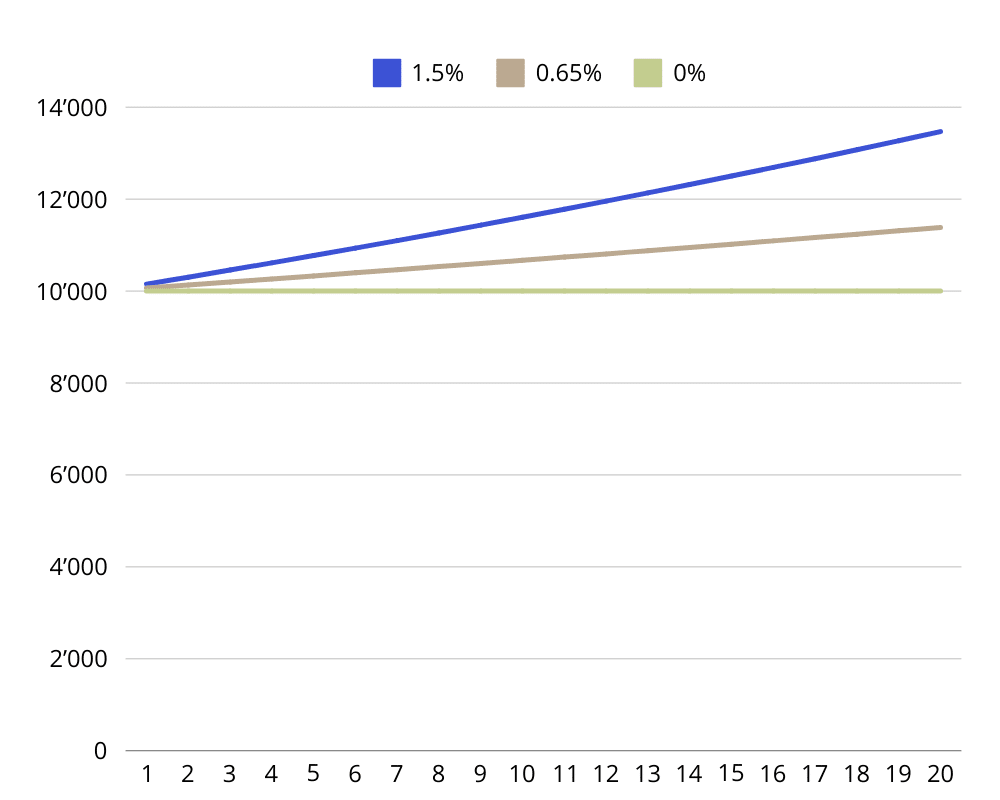

The following chart shows how differently CHF 10,000 develops over 20 years at different interest rates.

Change bank Switzerland: Procedure

With most banks, account closure is free of charge. A few charge a fee for this. If you don’t want to change your entire bank account because you have different employers or sources of income and all standing orders go through your main bank, you can at least change your savings account. As a rule, only you pay into it, and the switch is done quickly: you open a new account at a bank with higher interest rates and transfer your savings to the new bank as soon as you have the IBAN of the new account. This takes about 15 minutes for the opening and another 15 minutes for the transfer and account closure – so the effort is manageable. Find out which Swiss bank currently offers the best interest rates.

Savings account Withdrawal limit

When switching banks, you should not only pay attention to possible costs for closing the account, but also to withdrawal limits. There is often an amount limit up to which you can easily transfer the money to another bank with better interest rates; amounts above this are then subject to a notice period. You must therefore give some notice if you want to withdraw a larger amount. If you do not cancel the amount beforehand, a withdrawal premium, also known as a non-cancellation fee, is often due, which is usually between 1% and 2%. This withdrawal fee is only charged on the amount that exceeds the withdrawal limit.

High interest rates in Switzerland: bait-and-switch offers

Banks often entice customers with particularly high special interest rates. You transfer an amount of money from another bank and receive a higher interest rate for a certain period of time. The withdrawal conditions are usually unattractive or you may even lose the bonus interest if you withdraw the money. After the promotional period, the bonus savings account is usually converted into a normal savings account at the bank, where the interest rate is no longer as attractive. You should therefore not be dazzled by a high interest rate, but also read the small print carefully.

Interest rates Switzerland comparison

Which bank has the best interest rates in Switzerland? You can find out in the interest rate comparison Switzerland. You can sort the second column with the heading “Interest rate” and display the bank with the highest interest rate at the top.

All information without guarantee

Source: Provider websites

Last updated: 01.07.2025

Experience reports, tests and reviews of the individual providers can be found here:

If you can do without your money for longer – from two years with most providers – medium-term notes could be of interest to you. You can find out more about medium-term notes and which banks offer the highest interest rates in the medium-term note interest rate comparison.

Conclusion Interest rates Switzerland comparison

Neo-banks generally offer the most attractive interest rates and withdrawal terms. With neo-banks, you often don’t even have to transfer your money to a special savings account, but can conveniently leave it in your current account. Whether you’re looking for a neo-bank or a traditional bank, if you’re looking for an account with the highest interest rate, always pay attention not only to the interest and account management fees but also to the withdrawal conditions and any non-termination commissions in the small print.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.