Letztes Update: 28. September 2023

You have your first child, buy your own house and take out a mortgage for it, or live in a relationship with someone who is financially dependent on you. But what happens to the survivors when you pass away? Can they continue the standard of living they are accustomed to and stay in the house? You’ve probably wondered how you can insure against this financial risk.

Especially for unmarried couples it is worth knowing the legal situation. Because your partner and you are largely treated as individuals and just not as a married couple. For example, if one cohabiting partner dies, the other is not entitled to a widow’s or widower’s pension from the first pillar (AHV). Benefits from the second pillar (BVG) vary for cohabiting couples depending on the pension fund.

Mixed life insurance

For many, the first thing that comes to mind when thinking about coverage is blended life insurance, also known as savings or endowment life insurance. This financial product combines coverage for surviving dependents in the event of death and savings for retirement.

However, the range of mixed life insurance products in Switzerland is extremely opaque. On the one hand, you can hardly compare premiums on your own, since traditional insurance companies don’t have online calculators. So you’d have to deal with multiple consultants (salespeople) before you could finally compare prices.

On the other hand, the products are often non-transparent and unnecessarily complicated in structure. Insurance companies adorn their financial products with euphonious names reminiscent of superfood granola bars or, in the lower-risk version, salami variations at a discount store. Have you ever tried to track down the cost of a fund used in a unit-linked life insurance policy? Or the surrender value in the event of early termination? It’s a jungle, and you won’t get through it by being comfortable. For insurance and insurance intermediaries, this is a paradise. From far away I hear the snake Kaa from the Jungle Book: “Listen to me, believe me, close your eyes, trust me …!”

Life insurance policies are often taken out over a long period of up to thirty years. It is therefore almost certain that hedging needs will change over the course of a lifetime. Therefore, it makes sense to insure the risks as individual parts. This makes the costs more transparent and thus comparable.

So if you prefer to take life insurance into your own hands, you’re better off with pure life insurance, also called whole life insurance or term life insurance.

Pure life insurance

With a pure life insurance policy, you define the amount of the sum insured and the insurance period when you take out the policy. If you die during the term of the policy, your survivors, whom you have named as beneficiaries, will receive the contractually stipulated sum insured. With pure life insurance, unlike blended life insurance, you don’t save for retirement. This means that you will not receive a capital payout after the end of the term.

For retirement savings, you can use a digital and low-cost pillar 3a provider. This way you also benefit from the tax savings. You can find an overview of cost-effective and transparent pillar 3a providers in this article. Insurance companies often read that one advantage of blended life insurance is the “supportive savings process.” But honestly, if you need support for your savings process, if I were you, I wouldn’t buy this disciplinary measure expensively with insurance, but rather set up a monthly standing order on your Pillar 3a account right now.

Pure life insurance is usually much less expensive than blended life insurance and has been offered for a long time. However, you also had to go through an insurance broker to get quotes, and comparing them was correspondingly difficult and time-consuming.

SafeSide

This is where Michael Klien comes in. As a young father, he asked himself how he could protect his family and seven years ago he did not find a suitable product on the Swiss market. The available financial products were too non-transparent for him and the application process was not possible digitally. That’s why he founded SafeSide together with Georg Liechtenstein.

Its SafeSide pure life insurance has been on the market since the fall of 2020. Basler Leben AG, which is part of the Baloise Group, acts as SafeSide’s insurance partner. The beginnings of Basler Versicherung date back to 1863. SafeSide and Basler Leben AG attach great importance to security and data protection. Thus, insurance data is stored exclusively in Switzerland.

Demand calculator and application

SafeSide has reduced the application process for pure life insurance to the essentials. Within a few minutes you can determine your needs independently and at the end of the process the premium will be shown to you immediately. No coffee-drinking middleman trying to sell you all kinds of extra stuff and pushing you to close, all without a doctor’s visit and around the clock.

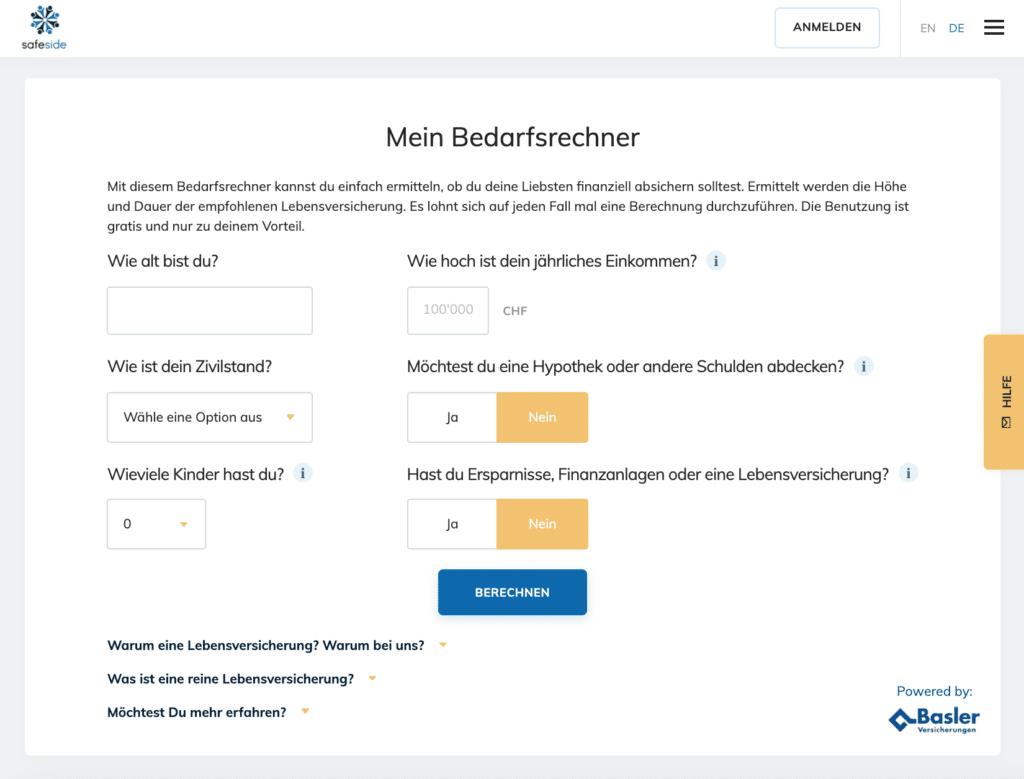

But let’s take a closer look at the understandable application process: The needs calculator helps you to calculate the sum insured and the term of the pure life insurance. You can enter all the necessary information on a single screen.

Finally, the demand calculator makes three recommendations. Under the generated recommendations, you will see a transparent breakdown of how the recommended sum insured was calculated. If you select one of the three recommendations, the values will be transferred to the application process and you can directly start entering the date of birth and personal information. And these are solely four questions:

- Your gender,

- Whether you have used smoking products in the past 12 months,

- Whether you plan a hospital stay in the next 12 months,

- Whether you are currently fully employed.

After that, you will already see three bonuses. This way, you can also see right away how the amount of the sum insured affects the monthly premiums. Finally, you specify the beneficiaries.

Now you have to register by entering your name, address and choosing a password for the user account.

User account and coupon code

You will receive the confirmation code for your user account either by SMS or e-mail. Logging into your account, you will see a summary of your application and you can enter a coupon code.

As a reader of the blog Finanzdepot you will benefit from a voucher worth CHF 50 at SafeSide. Enter the voucher code FINANZDEPOT in your user account and as soon as you have paid the first premium, you will be refunded CHF 50.

Last but not least, you can complete the application process by clicking on “Submit application”.

Individual wishes and future

If you have requests that are not covered by the simple and short application process, you can contact SafeSide by mail or phone. As an example: You prefer a leveled (constant over the runtime) premium, SafeSide can make you an individualized offer. By default, SafeSide offers a rolling premium. This is adjusted every year and therefore offers maximum flexibility, because you can cancel or reduce the sum insured every year.

If you have very high assets or neither a mortgage nor a person who is financially dependent on you, then you probably don’t need to take out a pure life insurance policy. To be fair, the SafeSide needs calculator also came to this conclusion in my case.

In the near future, SafeSide plans to add more insurance companies to its platform. The additional selection options will then make it even easier for customers to find the optimal insurance solution.

In a further step, the expansion of business activities to Europe is also planned.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.