Letztes Update: 28. September 2023

The other day, reader D. M. sent me the following question via the contact form regarding the stock market and the stock exchange. Trading venue of ETFs provided:

"I was wondering if it matters whether you buy an ETF from, say, the Swiss exchange or a German exchange. The only thing I found out that you should look at volume and bid/ask difference. For some ETF's, the volume at the Swiss exchange is relatively low, e.g. SLMA, SUSM, ESGL, ... Meaning, you should rather buy them from other exchanges?"

The answer should be of interest not only to D. M. and that is why this article was written.

Although specific ETFs are mentioned in this article, this is not investment advice or recommendation for the products mentioned. Likewise, this does not constitute a recommendation to buy or sell securities. In this post we will only look at buying ETFs with Swissquote. In the case of equities, the home stock exchange is often the most attractive. However, this must be assessed on a case-by-case basis.

The spread

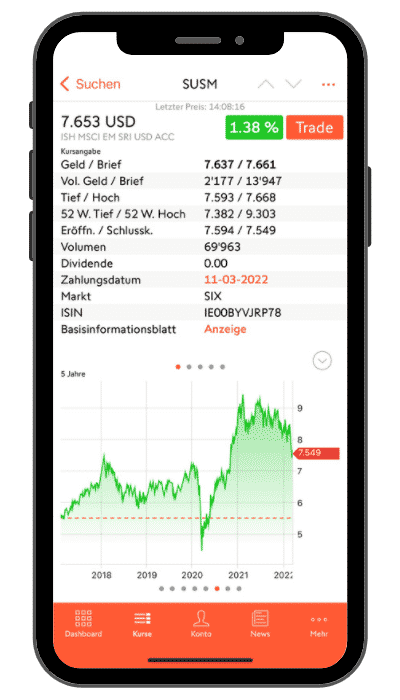

The bid/ask difference referred to by reader D. M. is also called spread or the difference between the buying and selling price. Let’s see an example of this in the Swissquote app:

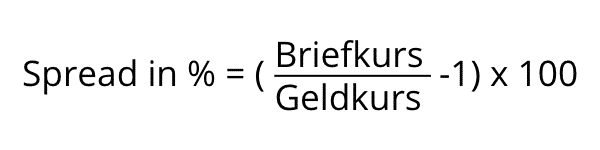

The mentioned ETF with the symbol SUSM has a bid price of USD 7,637 and an ask price of 7,661. From this you can calculate the spread as follows:

In our example (7.661 : 7.637 – 1) x 100 = 0.31%. If you were to buy the ETF and sell it immediately, you would make a loss of 0.31%. This is also called implicit trading costs, since they are not shown anywhere. The explicit trading costs, which you will find in the price list of your broker, would of course be added to this.

For those who want it easier, the current absolute and percentage spread can also be found on the website of the Swiss Exchange SIX. Enter this in the ETF Explorer enter the ISIN or the symbol and under “Overview”, “Key figures” you will find the two values. If you click on “Spreads”, you will also find the time-weighted average spread.

The spread comparison

For the three ETFs mentioned by D. M., I have compiled the spreads on the Swiss exchange SIX and the most important exchange trading place in Germany Xetra. I did both a sample on a Friday at 14:20 and entered the time-weighted average spread into the table.

As written by D. M., the three ETFs are not traded very frequently on the SIX. Therefore, I have additionally listed a liquid ETF on the SMI for comparison.

- SLMA: iShares MSCI EMU ESG Screened UCITS ETF EUR (Acc)

- SUSM: iShares MSCI EM SRI UCITS ETF USD (Acc)

- ESGL: Lyxor MSCI Europe ESG Leaders (DR) UCITS ETF

- SMICHA: UBS ETF (CH) – SMI (CHF) A-dis

| ETF | Trading currency on SIX | Sample SIX | Time-weighted average spread SIX | Sample Xetra | Xetra Liquidity Measure (XLM) |

|---|---|---|---|---|---|

| SLMA | EUR | 0.15% | 0.19% | 0.08% | 10.34 |

| SUSM | USD | 0.31% | 0.33% | 0.13% | 12.29 |

| ESGL | CHF | 0.11% | 0.17% | 0.13% | 24.57 |

| SMICHA | CHF | 0.12% | 0.10% |

The spreads of the three ETFs are not that bad compared to the frequently and in large volume traded ETF on the SMI.

We do not go into further detail on the Xetra liquidity measure XLM. Just this: the lower the value, the lower the implicit costs. If you want to know more about the XLM, you can find details here.

Spread – Market Maker

How does such a low spread come about with low trading volume in the first place? You rarely buy an ETF from another investor, but often from a market maker. This ensures the necessary liquidity, even if no other investor wants to sell ETF shares at the moment. As with stocks, it can be said that the more frequently an ETF is traded, the lower the spread. You can read more about this in the article about market makers.

The ETF purchase

Let’s look at the purchase costs in detail. Lyxor and iShares are among the ETF Leaders at Swissquote and therefore you pay only CHF/EUR/USD 9.00 per online trade on the SIX Swiss Exchange (excluding third-party fees such as stamp, exchange and real-time fees).

Let’s assume that on this Friday afternoon I want to buy ETF shares via Swissquote for CHF 2,000. Let’s take the ETF with the symbol SUSM, because it has the biggest spread difference at the moment. On SIX the ETF is traded in USD, on Xetra in EUR. In this example we assume that I can trade fractional shares of the ETF (which in reality is not possible at Swissquote) and we simplify the currency conversion a bit. It will look like this:

| SIX | XETRA | |

|---|---|---|

| explicit trading costs* | USD 9.00 | EUR 30.00 |

| Spread | 0.31% | 0.13% |

| implicit trading costs (1/2 of the spread) | CHF 3.10 | CHF 1.30 |

| Currency exchange costs (0.95%) | CHF 19.00 | CHF 19.00 |

| TOTAL Purchase costs (converted to CHF) | CHF 30.49 (8.39 + 3.1 + 19) | CHF 50.03 (30.73 + 1.3 + 19) |

*External fees, such as stamp duties, stock exchange fees and real-time fees are not included.

Although the spread on the Swiss stock exchange is slightly higher, buying on the Swiss stock exchange is still worthwhile for reader D. M., he would save almost CHF 20.

The currency exchange

One thing that stands out in the table is that the cost of exchanging currencies dips quite a bit. If you find an ETF that is traded on the SIX Swiss Exchange in Swiss francs, the purchase costs are the lowest. The slightly higher spread is then as good as negligible.

Lyxor ETF in particular (which recently became part of Amundi ETF and is thus the largest European ETF provider) has many ETFs in its range that are traded in Swiss francs. On Lyxor’s website you can easily filter the ETFs by currency. Lyxor ETF, in particular, has recently expanded the number of ESG ETFs.

UBS and Vanguard also offer a number of ETFs in the Swiss franc trading currency.

For more details, see the article on currencies and ETFs.

Conclusion: Which stock exchange for ETF purchase?

In a long-term investment strategy – and that’s probably why you’re reading this blog – implied trading costs (spreads) are less critical. However, if you trade back and forth frequently, these may well come into play. Low trading fees and low or no currency exchange costs are much more important.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.