Letztes Update: 28. September 2023

Since recently I also offer online financial coaching offer. You can find out what this means and how fee-based consulting differs from commission-based consulting in the article Finanzcoaching Schweiz.

By the way, the consultation can also take place in person on site if desired. Just drop me a line and we can discuss how I can help you.

Financial coaching vs. financial planning

These two terms are often used interchangeably, and a clear distinction does not exist.

Financial Coaching

Financial coaching from Finanzdepot provides financial knowledge and empowers you to make financial decisions on your own. It offers you security and orientation in your decisions, so that you can move confidently in the financial markets and do not get nervous at every twitch of the stock market.

How does financial coaching help you?

- You become clearer about your goals.

- You get a comprehensive overview of your finances.

- You define a strategy that suits you.

- You implement the previously defined steps.

You determine the degree of support individually.

Financial planning

Let’s take a brief look at what I mean by financial planning: You discuss your goals and wishes with a professional. After analyzing your current situation, the financial planner or financial advisor will create a financial plan. Finally, of course, he supports and accompanies you during the implementation. Most clients don’t turn to a financial planner until they experience a significant life event, such as a divorce or impending retirement.

So the two terms are not very different from each other even in my definition. However, in my opinion, financial coaching is a holistic process that teaches you financial skills that you can later apply on your own, whereas financial planning, in simplified (and somewhat trite) terms, ends up with a document with a lot of numbers.

Are you looking for a financial coach or do you want recommendations of specific financial products? Thanks to my training as a certified investment advisor IAF and the registration in a advisor register according to FIDLEG (Financial Services Act), I am allowed to provide financial coaching as well as legally compliant wealth and investment advice tailored to your needs. With financial coaching from Finanzdepot, you will get faster to implement and thus reach your goals sooner.

Commission-based consulting vs. fee-based consulting

Let’s move on to the next pair of words. The differences between commission-based and fee-based consulting are much clearer.

Commission consulting

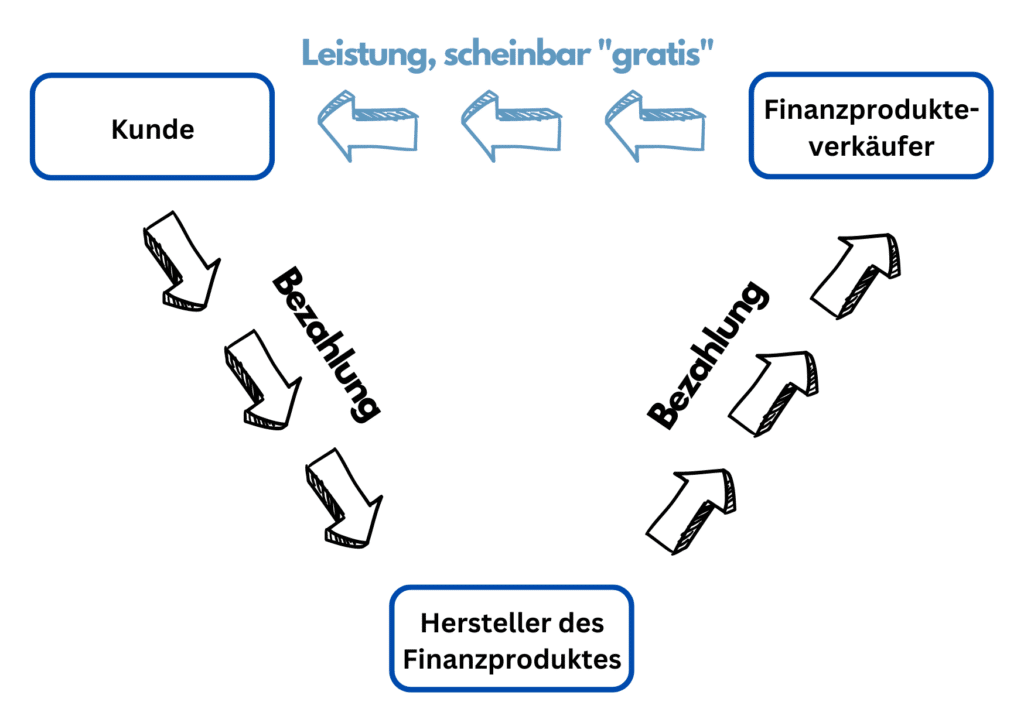

Unfortunately, over 95% of financial advice in Switzerland is still provided on a commission basis. In most cases you will read the term financial advice and not commission advice. That’s why we’ll start by looking at how commission-based consulting works: You contact your bank, insurance company or a structural distributor (such as Swiss Liefe Select). Or more annoying: You will simply be contacted by them. You usually don’t pay anything for financial advice, it’s marketed as free. Most of the time, you don’t find out that the consultant in the background receives a commission when a deal is closed. And certainly not the amount of this commission. So, with these practices, it would be more appropriate to call them vendors than consultants.

And we probably all know this situation: At the end of the conversation, you feel pressured to sign up for a product that you don’t actually need or you don’t really understand. Thoughts come to you like:

- “I’m not sure, but he’s so nice and he’s an expert, after all, and I’m sure he understands better than I do. He will mean well with me.”

- “If I don’t close the product, I’ve wasted its time.”

- “How will he take my no? I don’t like to push people over the head.”

The range of products presented in commission-based consulting is usually not particularly diverse. Either the company’s own financial products are offered or those offers that provide the highest commission for the advisor (or salesperson). Of course, it is not only money-hungry people who work in commission-based consulting, but the conflicts of interest that arise in the process cannot be dismissed out of hand.

It is quite possible that you pay much more for a “free consultation” than for a fee-based consultation, where the actual costs are shown transparently.

Fee-based consulting

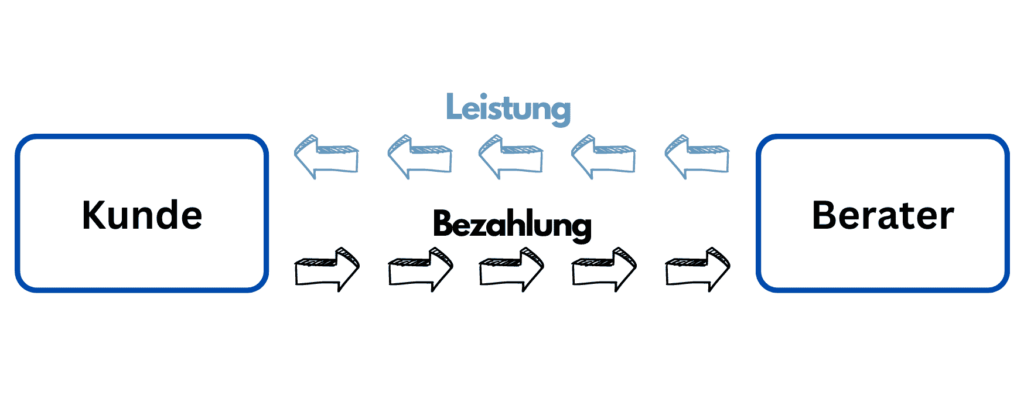

A fee-based advisor is on the client’s side and charges by the hour, similar to lawyers. Since he has no own financial products in the offer and is bound to no offerers, he can advise openly and product-neutrally. No remuneration flows in the background via commissions. If the advisor receives any commissions, he discloses them and reimburses the clients.

To be honest, even fee-based consulting is not entirely free of conflicts of interest. Unnecessarily complicated advice can result in more hours being charged than are actually necessary. For certain services, it may therefore make sense to agree on a flat rate or cost ceiling with the fee-based advisor.

I advise exclusively on a fee basis and transparently pass on any third-party compensation to you.

Financial Depot Online Financial Coaching Switzerland

On my way to becoming an investor, I made quite a few mistakes and learned a lot as a result. You don’t have to make the same mistakes. Take the shortcut and book your appointment now for a free, no-obligation initial consultation. During the approximately 15-minute conversation, we will find out together how I can help you and what your expectations are for financial coaching.

On FinFinder.ch you can find qualified financial advisors whose qualifications and diplomas have been verified.

The Finanzdepot financial coaching – transparent, independent and trustworthy

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.