Letztes Update: 28. September 2023

The other day, I was a speaker at an event hosted by digital asset manager Selma , and following my talk, I was asked what I look for when buying ETFs. In this blog post, I’ll explain my 7 criteria for ETF selection in a little more detail. Finally, the ETF Explorer of the Swiss stock exchange SIX currently shows 1,668 results. This can make it difficult to choose an ETF in Switzerland.

ETF Selection Switzerland

I always select ETFs based on my asset allocation, i.e. how I divide my existing assets into different asset classes. I then come to the index and only in the last step to the ETF.

Here are some practical questions that can help you make your decision::

- What do I invest the money in?

- How long can I do without it?

- What does my risk profile look like?

- What proportion do I invest in ETFs?

- How do I structure my ETF portfolio?

Looking for support with these questions? Then book an independent online financial coaching with me now. The non-binding initial consultation is of course free of charge.

Often the selection is made from the other side. You see an “exciting” ETF, buy it and realize after a while that this seemingly so promising megatrend ETF somehow doesn’t really fit into your portfolio. At least that’s how I felt when I started investing. But you can do better now, right from the start.

So let’s get to the most important criteria I look for when choosing an ETF.

1) Swissquote ETF Leader

Since I want to save the selected ETFs regularly and I have my main account with the Swiss online broker Swissquote, the ETF must be offered by a Swissquote ETF Leader. At the moment these are:

- DWS Xtrackers (102 ETFs)

- J.P.Morgan (36 ETFs)

- 21 Shares (69 ETPs)

- Amundi ETF (68 ETFs)

- CoinShares (17 ETPs)

- Credit Suisse (9 ETFs)

- iShares (306 ETFs)

- Lyxor ETF (190 ETFs)

- UBS (225 ETFs)

- Vanguard (35 ETFs)

- Franklin Templeton (19 ETFs)

- Legal&General (32 ETFs)

- VanEck (40 ETFs)

- WisdomTree (86 ETFs)

- Zurich Cantonal Bank (34 ETFs)

ETFs listed by Swissquote as ETF Leaders can be traded for CHF/EUR/USD 9.00 per online trade on the SIX Swiss Exchange. Third-party fees, such as stamp, exchange and real-time fees are charged additionally.

Since the purchase costs eat away at the return, this is one of the most important arguments for me.

2) Trading place – purchase costs

Because the CHF 9.00 per trade for ETF Leaders at Swissquote only applies on the SIX Swiss Exchange, the other trading venues already fall away for me. Especially with Swiss brokers, trading on foreign exchanges is often more expensive than it is with domestic exchanges anyway. So I would look for the cheapest trading place with your broker.

3) Income appropriation: distributing or accumulating

Since I am still building wealth, I want the ETF to automatically reinvest the dividends. This is also called reinvestment. Thus, there are no further purchase costs for me and the effort is the least for me.

In Switzerland, by the way, it does not matter for tax purposes whether the ETF distributes or reinvests the dividends.

4) Trade currency

I receive my salary in Swiss francs and most of my living expenses are also paid in Swiss francs. And there are fees associated with any currency exchange, I have written about this on this blog on several occasions. For example, Swissquote charges 0.95% for currency exchange. These are unnecessary costs that eat away at the return on investment and which we can save. That’s why I make sure that the ETF is traded in Swiss francs when I buy it. In order for the ETF to buy shares in other currencies, it must of course exchange the CHF. He does this within the ETF and gets better conditions than small private investors.

In the ETF Explorer of SIX you can filter by the trading currency.

After filtering, you will see a number of ETFs with “hedged” in the title. These ETFs are traded in CHF on the one hand and additionally the currency risk is hedged. Whether currency-hedged ETFs are advisable is another issue.

5) Spread – trading volume

What exactly the spread is, I have already explained in the article about stock exchanges of ETFs. In a nutshell: If you buy an ETF and sell it the next moment, you make a loss (regardless of your broker’s purchase costs and exchange fees). ETFs that are traded frequently usually have a lower spread than ETFs that are traded infrequently or that have just been launched.

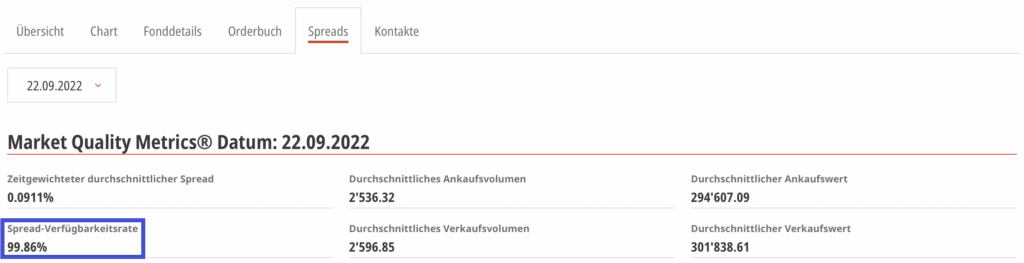

You can also find the spread in the ETF Explorer of SIX. In it, call up the desired ETF and click on Spreads. There you will find the time weighted average spread.

Here I have picked out some spreads for you to compare:

| ETF | Symbol | Spread |

| Xtrackers DAX | XDAX | 0.09% |

| Vanguard All-World | VWRL | 0.13% |

| iShares SLI | SMIEX | 0.13% |

| iShares World Min Volatility | MVOL | 0.45% |

| GLOBAL X Disruptive Materials | DMAT | 0.93% |

Now this is not a recommendation to buy this DAX ETF, but if you have several ETFs to choose from that cover a similar investment universe, the spread can help you decide.

6) TER – current costs

In addition to the trading costs incurred when buying and selling, it is important to keep an eye on the ongoing costs. For an initial overview, the total expense ratio(TER) is suitable. Why only for the first overview? Because not all costs are included in the TER. Thus, transaction costs at the fund level are not included. For example, if an ETF needs to rebalance because a stock falls out of the index, the ETF’s broker will incur trading costs.

7) Tracking difference

Even if an ETF has a high TER, it can still outperform an ETF on the same index with a low TER. This is where the tracking difference comes into play. It denotes the difference between the return of the index and the return of the ETF. The smaller it is, the better.

What causes the deviations from the index return? If an index has a high number of shares, the ETF usually does not buy all shares but only a part of them for cost reasons. This is also called sampling. So he makes a selection and this self-assembled basket of stocks naturally does not perform exactly the same as the index. Other reasons for a deviation besides costs are, for example, the swap fee or income from securities lending.

For example, the SPDR MSCI ACWI UCITS ETF has a rather high TER of 0.40%, but its average annual tracking difference since 2012 has been only 0.19% per year (according to trackingdifferences.com). So the ETF was cheaper than the TER suggests.

In contrast, the iShares MSCI ACWI UCITS ETF has a TER of 0.20% and its average annual tracking difference since 2012 has been 0.24% per year. So this ETF was slightly expensive, even slightly more expensive than the “expensive” ETF from SPDR.

Conclusion ETF Selection Switzerland

The size and age of the ETF are also often cited as decision criteria. The bigger and older an ETF is, the lower the risk that it will be closed and you will have to look for a new one again. In my opinion, however, the two criteria must be viewed in a more differentiated manner. If, for example, Vanguard launches an accumulating variant in addition to the existing distributing ETF, the fund volume is of course still very small at the beginning and the ETF is less than five years old. But the risks of this being closed are smaller than, say, a newly launched pet ETF.

The location of an ETF can also serve as a decision criterion (keyword taxes), but this is more exciting in theory. In any case, based on location, I have never decided against or in favor of an ETF (except for ETFs with only Swiss stocks).

In an ideal world, you would end up with only one ETF left and you would know exactly which one to buy. But that’s rarely the case, so you have no choice but to prioritize your criteria when choosing an ETF. For me, for example, the trading currency is important and that’s where a lot of ETFs already fall away.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.