Letztes Update: 28. September 2023

How do others actually handle private pension provision? That’s what I wanted to know from people around me. In this amount, I’ll show you how they approach the topic and what questions they ask themselves. The whole thing is peppered with interesting facts about the third pillar. The portraits are of acquaintances of mine, but I have changed the names.

Are you looking for a provider for your pillar 3a? Here you can find affordable digital providers.

Simon (24)

Simon is 24 years old and started his first job after his apprenticeship. In his spare time, he likes to travel the world and would prefer not to work at all. He doesn ‘t think much about his future, and certainly not about the time after retirement, which is still much too far away.

However, he has already heard on various occasions that the AHV and pension funds are getting more and more into difficulties. The idea of the OASI and the mandatory occupational pension plan was that together they would cover about 60 percent of the income earned before retirement. However, demographic trends and the reform backlog make it unlikely that the two pillars will be able to cover this in the future. So what alternatives are there, or how can Simon take action and assume personal responsibility? Either he puts some of his salary into his savings account or he invests it. On the side, he can always keep a separate savings account for his travels or he can put it into the third pillar. There, his money is tied up– with a few exceptions – until he retires. In addition, they can save on taxes because they can deduct the amount paid in from their income. In this way, the state promotes individual saving for retirement. Speaking of taxes: You do not pay any wealth tax on the assets in the third pillar. A capital payment tax is only due upon withdrawal.

It is best to do this regularly and always at the beginning of the month. Monthly, because the individual contributions hurt less than if he transferred CHF 6,826 all at once. And at the beginning of the month, because then there is still enough money. The easiest and most reliable way to do this is by standing order. At the beginning, he does not have to use the entire maximum amount of CHF 6,826. So Simon can also pay in less, only more is not possible.

The only requirements to be able to pay into the third pillar: He must be gainfully employed in Switzerland and earn an income subject to AHV contributions. Which has been the case with him since the beginning of teaching.

Precisely because it will still be a while before Simon retires, compound interest has plenty of time to develop its enormous potential. How does compound interest work? You have money in your 3a account, let’s say 10,000 francs. In the graphic, this is the gray bar. At the end of the year you will be credited the interest, at 0.15% this is 15 francs, shown with the turquoise bar. Admittedly, the bar is a bit large, but it’s all about the principle. In the second year, the gray bar is already higher because the 0.15% interest is now applied to the 10,015 francs. And thus, at the end of the year, the red bar is also higher than the turquoise one. Because this time there is CHF 15.02 in interest. This is how it goes on and on.

In more complicated terms, interest accrues exponentially in the future. At the latest since the Corona pandemic, exponential growth should be a concept for many.

In the next portrait of Martina, you’ll see how much a higher interest rate affects your wealth.

Martina (29)

Martina is 29 years old and has had a third column for five years. Each year, it pays in the maximum amount in December. She has a 3a account at the same bank where she has her salary account. In the meantime she gets an interest rate of only 0.15% on her pension assets. Financial matters do not interest her at all, she finds it tedious and complicated. She only has the account because her father recommended it to her. She is not familiar with securities and has great respect for the fluctuations. She is not at all comfortable with the idea that she has less than she originally paid in. However, she has heard that it is also possible to hold shares in the third pillar and now wants to take the plunge and try it out with small amounts.

Digital asset managers now offer products that are easy to understand. So they determine Martina’s risk tolerance with a few questions and then, based on her time to retirement and her other financial circumstances, give her a recommendation for how much to hold in equities. The higher this is, the more the assets can fluctuate. With 100% shares, it can also go down by 30%. But there is also a greater chance that it will go up more steeply.

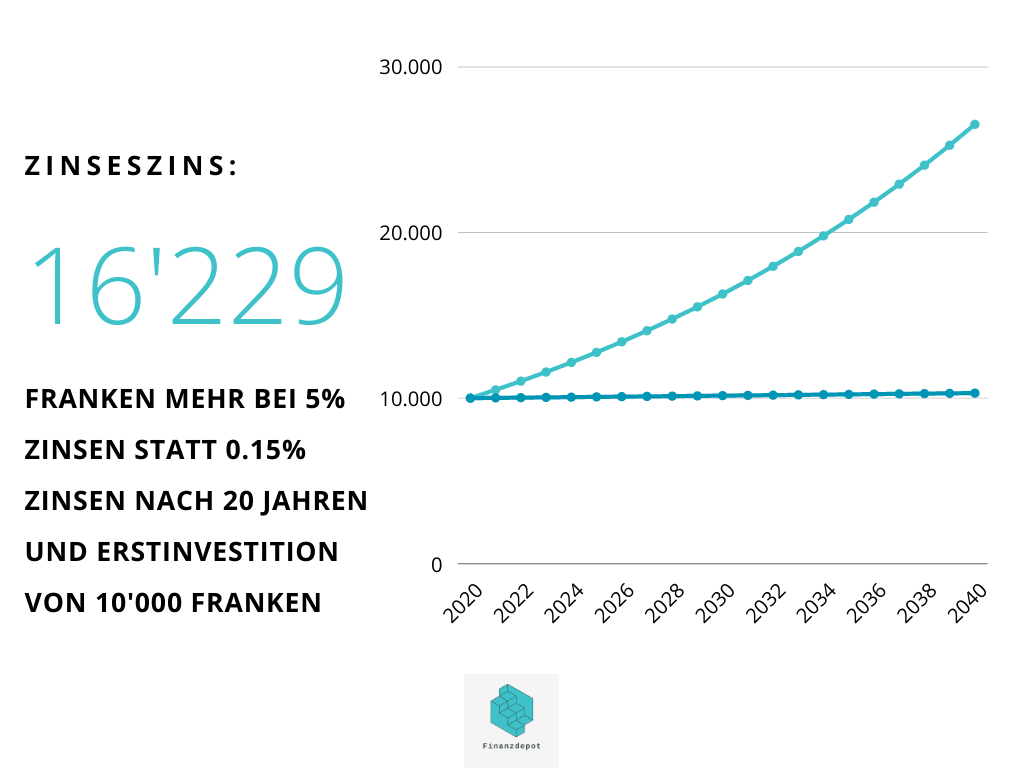

You can see this in the graphic below. There we compare an account solution with 0.15% interest and a securities solution with 5% interest, with a one-time deposit of CHF 10’000. The difference is considerable: after 20 years, you have a whole CHF 16,229 more in your account or custody account. Compound interest plays a significant role in this. You can read about how it works in the portrait of Simon. Of course, 5% is not guaranteed with the securities solution. One year it may be more, one year it may be less. But over several years, this is a realistic average.

Martina leaves the assets she has already saved in her existing account, but opens a pillar 3a securities account with a low-cost, digital provider and now transfers one twelfth of the maximum amount (CHF 6,826, in 2021 it will be CHF 6,883) to this account every month. This allows it to slowly get used to the fluctuations. Since it won’t need the money for more than 30 years, it can easily ride out negative market phases. If Martina plans to buy a house or start her own business in the near future, she should take a deeper look at her overall asset situation. And yes, you read correctly, you can have multiple accounts and of course with multiple providers. Read why this can be useful in Kathrin’s portrait.

By the way, transfers from one provider to another and from an account solution to a securities solution are possible. Many low-cost and digital providers even offer this for free. What is not possible, however, are partial transfers, so it must always be the entire account bez. securities account can be transferred. This way, it can still transfer the balance of its account solution to a provider with a low-cost securities solution at a later date.

Martina is planning a wedding for next year. Even after marriage, both spouses can pay the maximum contribution into their respective account or custody account, the only condition being that both must be gainfully employed. The tax deductions can then of course be made by both.

Laura (34)

Ok, I made up the example with Laura, I didn’t have anyone at hand in my circle of acquaintances who has recently started his or her own business. If you know of any other situations where a third column makes sense or you want to tell about your situation, feel free to use the comments section below.

But now to Laura: She is 34 years old and has recently started her own business. Laura has decided not to join a pension fund, but to save for her retirement using pillar 3a. As an employed person without a pension fund, she can pay in up to 20 percent of her earned income and a maximum of 34,128 francs in 2020.

In order to protect their cohabiting partner and the joint child, both have taken out term life insurance in the event of death. Insurtech startup SafeSide or insurtech Smile offer low-cost, digital solutions. In contrast, financial products that combine saving and insurance are inflexible and the costs are often not transparent. The fact that unit-linked life insurance policies are so widespread is due to the fact that advisors (i.e., rather salespeople) earn a lot from them.

Jonas (38)

Jonas is 38 years old and originally from Germany. He has heard that you can save taxes with pillar 3a. He is not familiar with securities, but he finds the interest rates on 3a account solutions puny. After all, retirement is still a few years away, and he opted for a securities solution with the highest equity component. For many providers, this is almost 100%.

Jonas works part-time because he wants to have plenty of time for his various hobbies in addition to work, and he doesn’t need much to live on either.

However, part-time work reduces later AHV benefits. If Jonas wants to receive the AHV maximum of CHF 2,370 after retirement, he needs an average annual income of CHF 85,320, which he will never achieve with part-time work.

And the second pillar, which has not been adapted to reality, also gives it a leg up: it was introduced in the 1980s and is still based on the outdated image of full-time employment as the standard. The BVG compulsory insurance applies to all employees who are already insured under the 1st pillar and earn at least CHF 21,330. But now there is still a coordination deduction of CHF 24,885 (in 2020). This is deducted from his salary and only the remaining amount is insured.

For example: Jonas earns CHF 35,000. The coordination deduction of CHF 24,885 is deducted from this. His insured salary amounts to CHF 10,115. If he has a progressive employer who adjusts the coordination deduction to his 60% workload, the calculation looks like this: 35,000 – 14,931 (60% of 24,885) = 20,069. This naturally leads to higher pension fund contributions and thus higher insured benefits from the 2nd pillar.

If Jonas were to work part-time for several employers, he can take out voluntary insurance, provided his total income exceeds CHF 21,330. He should make sure that his coordination deduction only occurs once and not with each employer, otherwise he will hardly be able to save anything in the second pillar. If the pension funds of his employers do not allow this, the alternative is the Stiftung Auffangeinrichtung BVG.

This is also the case with me, as an actor I have several employers and they change all the time. Here there are special pension funds such as the Charles Apothéloz Foundation Professional Pension for Cultural Professionals (CAST) or the Pension Foundation Film and Audiovision (vfa).

For Jonas (and me) in particular, it is therefore important that he starts early with private pension provision and uses the maximum amount of the third pillar as much as possible so that he does not have to rely on supplementary benefits in old age. And the great thing about the third pillar is that everyone who has paid in the maximum amount can deduct the amount from their taxes. No matter how much they earn and whether they work part-time.

When he definitively leaves Switzerland, he can withdraw his Pillar 3a assets early. A withholding tax is then due in Switzerland on the capital withdrawal. Depending on the double taxation agreement, the withholding tax may be credited or reclaimed in the new country. The amount of withholding tax depends on the domicile of the pension foundation and differs – how could it be otherwise in Switzerland – from canton to canton. However, he can also leave his Pillar 3a assets in Switzerland for the time being; a withdrawal is not mandatory when emigrating or, in this case, rather returning.

A small tip: He should only have the Pillar 3a funds paid out after deregistration in Switzerland and definitive registration abroad. This is how the withholding tax is due. If he were to have the capital paid out before leaving Switzerland, a capital payment tax would be due. The tax rates for this are usually higher than for withholding tax.

Kathrin (61)

Kathrin is 61 years old and retirement is not too far away. Years ago, a financial advisor recommended that she pay into a pillar 3a. She has opted for an account solution. One account yields 0.1% interest, the other account 0.2%.

When she reaches AHV age – in her case 64 – she must definitely draw the money. If she decides to work longer, she can also delay drawing for five more years. However, she can already withdraw the pillar 3a credit five years before reaching the AHV age. However, the entire pillar 3a account or custody account must always be closed. Partial withdrawals are not possible. However, if you have multiple accounts like Kathrin, you can draw them in different years and thus break the tax progression.

She has decided to draw the 2nd pillar as a pension and not to have it paid out as a lump sum. She will draw on the first account in the year she turns 63, and the second at age 64. Even in the year of retirement, she can still pay in the maximum amount up to the retirement date and thus benefit from the tax deduction in that year as well. If she were to withdraw part or all of the second pillar as a lump sum, Kathrin should make sure that she does not have any withdrawals from the third pillar this year. Second and third pillar are namely counted together in the calculation of the capital gains tax and she would come into a higher tax progression. But with a total of five years in which the withdrawals are possible, she has plenty of time to close out all accounts. So creating more than five accounts doesn’t make that much sense.

But where to put the money? Incidentally, some providers of 3a securities solutions also allow the transfer of securities funds into free assets upon retirement. This way you don’t run the risk of having to sell the funds at an inopportune time. The best way to find out is to contact your provider.

However, Kathrin has no securities in her third pillar. She is looking for an account solution. Quite a few providers offer senior citizen savings accounts that have special terms. Whereby Kathrin should always observe the withdrawal limits. And, of course, there is nothing to be said against investing a portion in securities; after all, life expectancy in Switzerland for women is around 80 years. With Kathrin, however, this will only be a rather small amount.

Would you like to find out more about retirement planning? Then I recommend you the book “What you should know about retirement planning” from the NZZ Libro publishing house. It presents the Swiss pension system in more detail. You will learn what is important when it comes to taxes, how you can make private provisions, what a share is, what there is to consider when inheriting and much more. It is not a book that you read just before you go to sleep, but a reference book for your retirement planning, with many examples of calculations and valuable tips.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.