Letztes Update: 28. September 2023

The term tracker certificate has appeared more frequently in Switzerland recently. Last year, for example, Migros Bank launched a tracker certificate on the Migros Bank elleXX Gender Equality Basket, which was discussed controversially in the media. But what exactly is a tracker certificate and how does it differ from an ETF? This is exactly what we take a closer look at in the article Tracker Certificate vs. ETF using two examples. The text is admittedly a bit technical because of all the laws and legal distinctions, but at the end you’ll find the similarities and differences clearly listed.

This article is not an investment recommendation and does not constitute a buy or sell recommendation for either the mentioned tracker certificates or the ETF. The financial products mentioned serve only as examples.

Structured products

Tracker certificates are preferably issued on fashion themes. Beautiful stories can be told around it. Let’s take the “LUKB Tracker Certificate on Global Infrastructure Basket” (ISIN: CH1121309509) as an example. There it sounds like this:

"Well-functioning infrastructure is critical to sustainable, long-term economic growth. Investors can now benefit from the fact that governments around the world intend to close the investment gap of recent years."

You can read what I think about themed investing in an older blog post.

Tracker certificates belong to the structured products and within them to the participation category. This sounds a bit complicated, but a tracker certificate is fortunately the easiest category to understand: If the underlying asset rises by 5%, then the tracker certificate also rises by 5%. Pictorially it looks like this:

Small parenthesis: As with any financial product, fees are also incurred with a structured product. The structured product therefore does not perform 1:1 like the underlying. But that is not the case with ETFs. An ETF always deviates slightly from its index.

Underlying

But what is an underlying value again? Let’s stay with our example, the “LUKB Tracker Certificate on Global Infrastructure Basket”. Here, the underlying is the “Global Infrastructure Basket”. In even simpler terms, the tracker certificate tracks the performance of a basket of stocks. In total, the basket in our example contains 22 stocks and these are equally weighted. Each share is therefore represented with almost 4.55%.

However, an underlying asset can also be a single stock, a cryptocurrency, a commodity such as gold, bonds, indices, etc.

Issuer

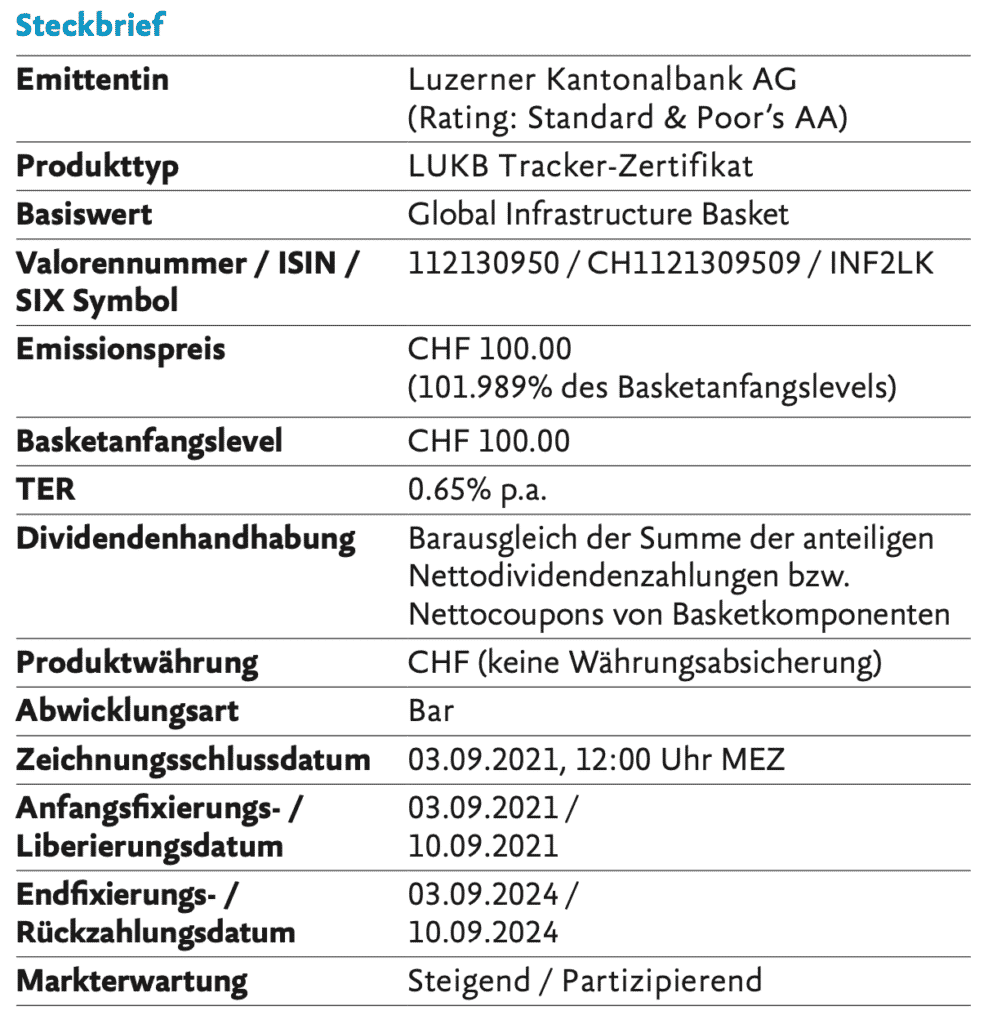

An issuer is an issuer of securities. In our example product, the issuer is Luzerner Kantonalbank (LUKB). On the fact sheets of structured products, the issuer is usually immediately followed by the corresponding rating. In our example, it looks like this:

The rating is commissioned by the company to be rated. LUKB has therefore commissioned Standard & Poor’s (S&P), and thus also paid them, to assess its solvency (creditworthiness). This commissioned relationship is, of course, not entirely free of conflicts of interest.

Cantonal banks that still have a state guarantee, such as LUKB, usually have a high rating. LUKB’s AA rating was confirmed by Standard & Poor’s on May 24, 2022. AA is the second highest rating at S&P and means that there is a very good ability to meet financial obligations. The highest AAA rating, for example, is held by countries such as Germany and Switzerland, or by Zürcher Kantonalbank, one of the few banks in the world to do so.

Why am I harping on ratings and creditworthiness? Because this is where a big difference with funds or ETFs comes into play.

ETFs and the Collective Investment Schemes Act (CISA)

As an example, we take the “iShares Global Infrastructure UCITS ETF” (ISIN: IE00B1FZS467). This has a similar focus to the Structured Product above. However, we do not want to compare the performance of the two products here, but the legal structure.

ETFs are considered to be collective investments. This means that investors do not purchase individual shares, but invest together with others in a basket of securities. Up to this point, it sounds like our Structured Product. But unlike the latter, an ETF is subject to the Collective Investment Schemes Act (KAG) and requires approval. Thus, our ETF can be found in the list of approved foreign collective investment schemes for offering to non-qualified investors under FINMA ID F00145033. The purpose of the CISA is to protect investors and to ensure the transparency and functionality of the market for collective investment schemes.

And now comes another important distinguishing feature: According to Art. 40 of the Financial Institutions Act (FINIG), the assets and rights belonging to the investment fund (which includes our ETF) are segregated in favor of the investors in the event of bankruptcy of the fund management company. So, for example, if iShares goes bankrupt, the shares from our ETF are not on iShares’ balance sheet and do not go into the bankruptcy estate. The shares of our ETF are held by a custodian bank, specifically State Street Custodial Services (Ireland) Limited. The latter would then look for a new fund company to continue the ETF.

Due to all the laws, regulations and permits, the Establishment of a fund ref. ETF more expensive and lengthy than issuing a tracker certificate. And thus your money is also better protected.

Structured Products and the Issuer Risk

Let’s switch back to our Structured Product: on most factsheets, you’ll find a section like this or similar:

"These products are derivative financial instruments and do not qualify as units of a collective investment scheme within the meaning of the Swiss Federal Act on Collective Investment Schemes ("CISA") and are not registered thereunder. Therefore, they are not subject to approval or supervision by the Swiss Financial Market Supervisory Authority FINMA ("FINMA"). Accordingly, investors do not enjoy the specific investor protection of the CISA. Investors bear the issuer risk."

If the issuer goes bankrupt, a structured product is merely a debt security (borrowed capital on the issuer’s balance sheet). Structured products are therefore not segregated as with an ETF and are also not subject to deposit protection. In the event of bankruptcy, your tracker certificate may become worthless because the issuer can no longer meet its obligations.

Especially in the case of a cantonal bank with a state guarantee, bankruptcy is fortunately rather rare, but you should still be aware of the issuer risk and study the factsheets of tracker certificates carefully.

Similarities between structured products and ETFs

- Represent a basket/index (basket of shares),

- may contain foreign currency risks.

Differences between structured products and ETFs

| Tracker certificate | ETF | |

|---|---|---|

| Runtime | Often limited | unlimited |

| Issuer risk | yes | no |

| subject to the Federal Act on Collective Investment Schemes CISA | no | yes |

| subject to approval and supervision by the Swiss Financial Market Supervisory Authority FINMA | no => can be set up relatively quickly and easily | yes |

| tradable on stock exchange | often | always |

| Spread | rather higher (0.74%) | rather lower (0.31%) |

| Number of shares included | rather few (22) | rather many (235) |

| TER | rather higher (0.65%) | rather lower (0.65%)* |

| Dealing with dividends | Compensation payments or the dividends go to the issuer (note the factsheet) | distributed or reinvested |

The figures in brackets refer to the example products considered.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.