Letztes Update: 28. September 2023

When you buy securities, i.e. stocks, ETFs and so on, from your broker at an exchange, you can always select the order type. After a brief introduction to the different order types, we’ll take a concrete look at which order type makes the most sense when buying an ETF.

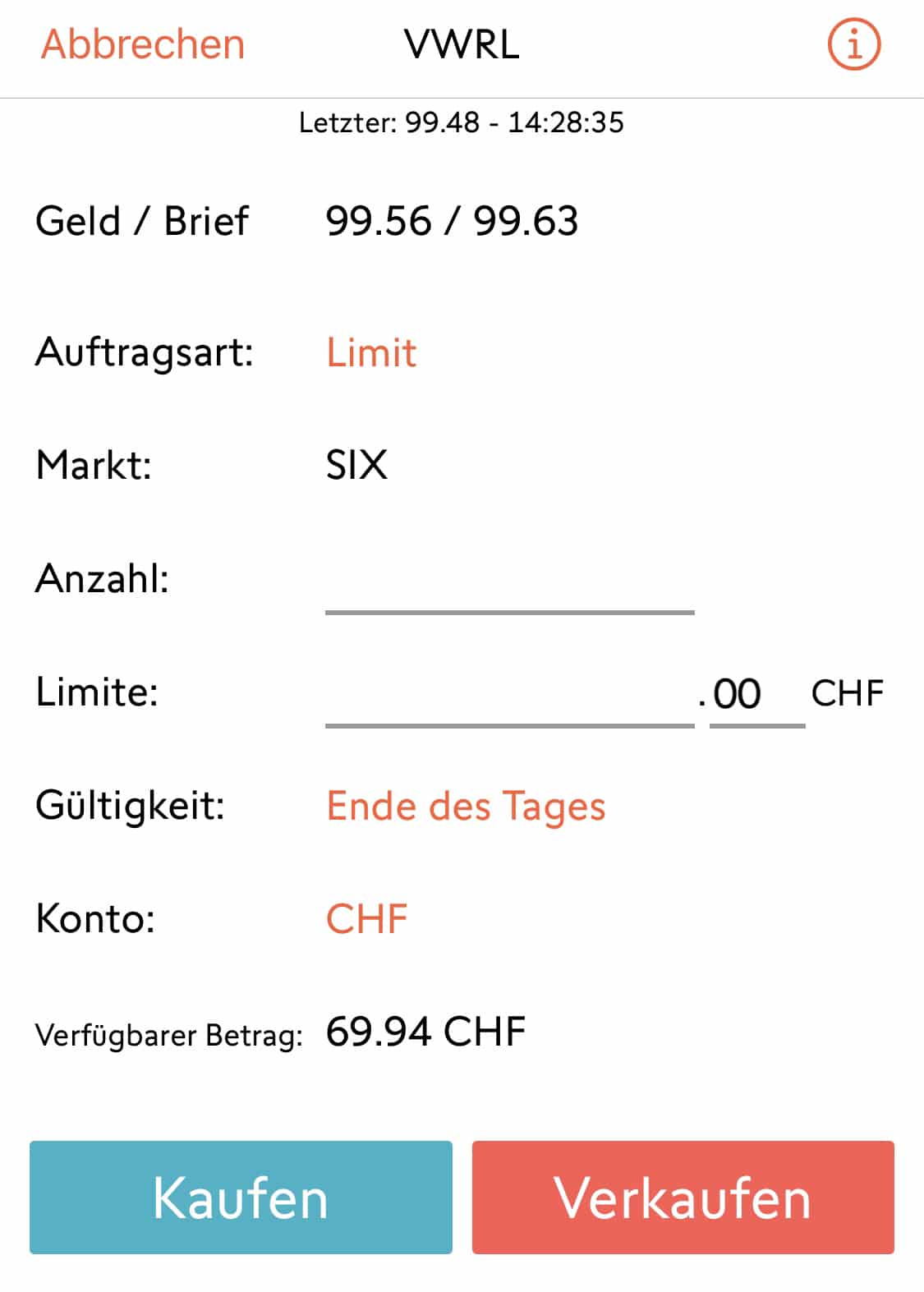

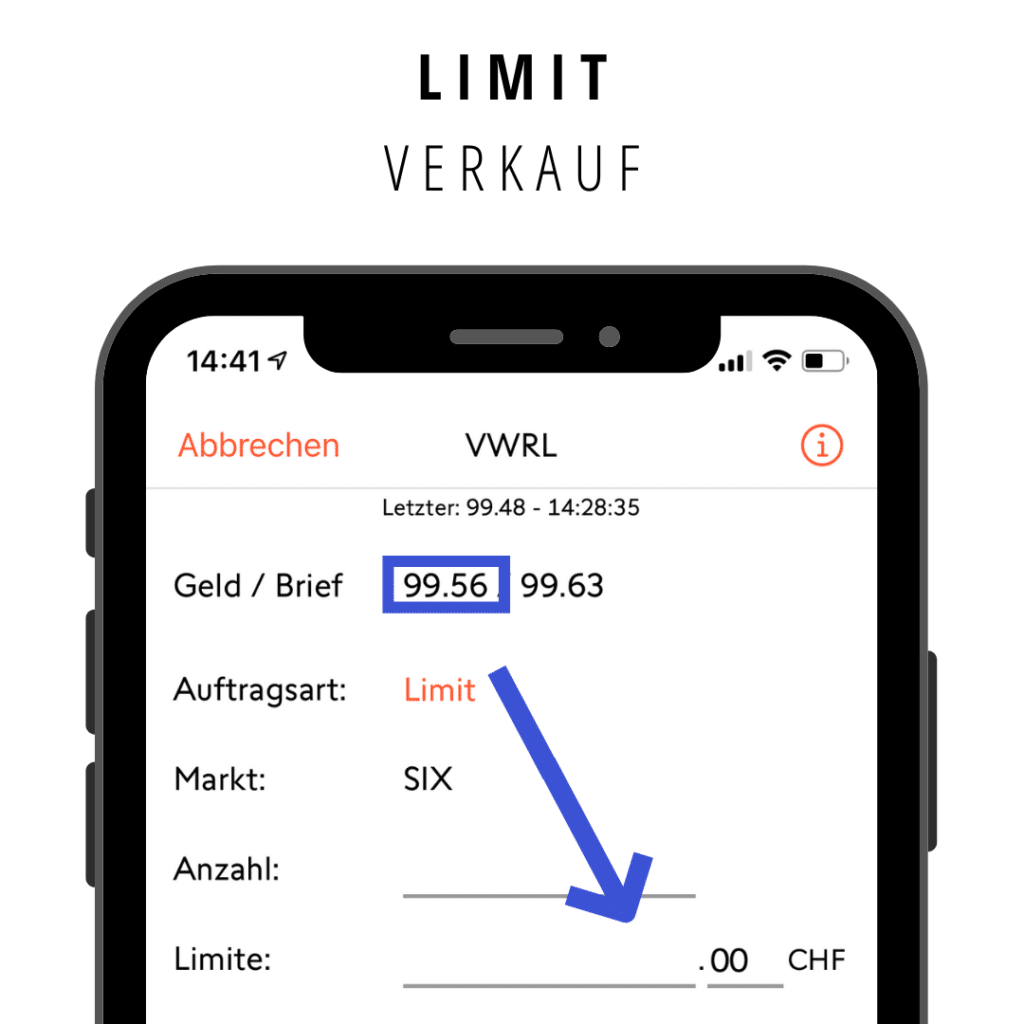

In the Swissquote app, the order screen looks like this:

Asking and bid rate

You will see that not only one price or rate is displayed, but three. What do the three different courses stand for?

The first thing that is displayed is the last price. At this price, the buyer and seller agreed in the last trade. The time is then also usually written next to it.

Ask price (Ask): The price at which sellers are willing to sell securities.

Bid price: The price at which buyers are willing to purchase securities.

The bid price is lower than the ask price. The difference is called spread.

You should always keep in mind whether you are acting as a buyer or as a seller, because this plays a role especially in the order type “Limit”. This will become clearer with the following examples and graphics.

Order types

Limit

Most brokers have this order type preset. A limit protects you from unpleasant surprises. You announce from the beginning how much you are willing to pay as a maximum, or the minimum price you want to receive when selling.

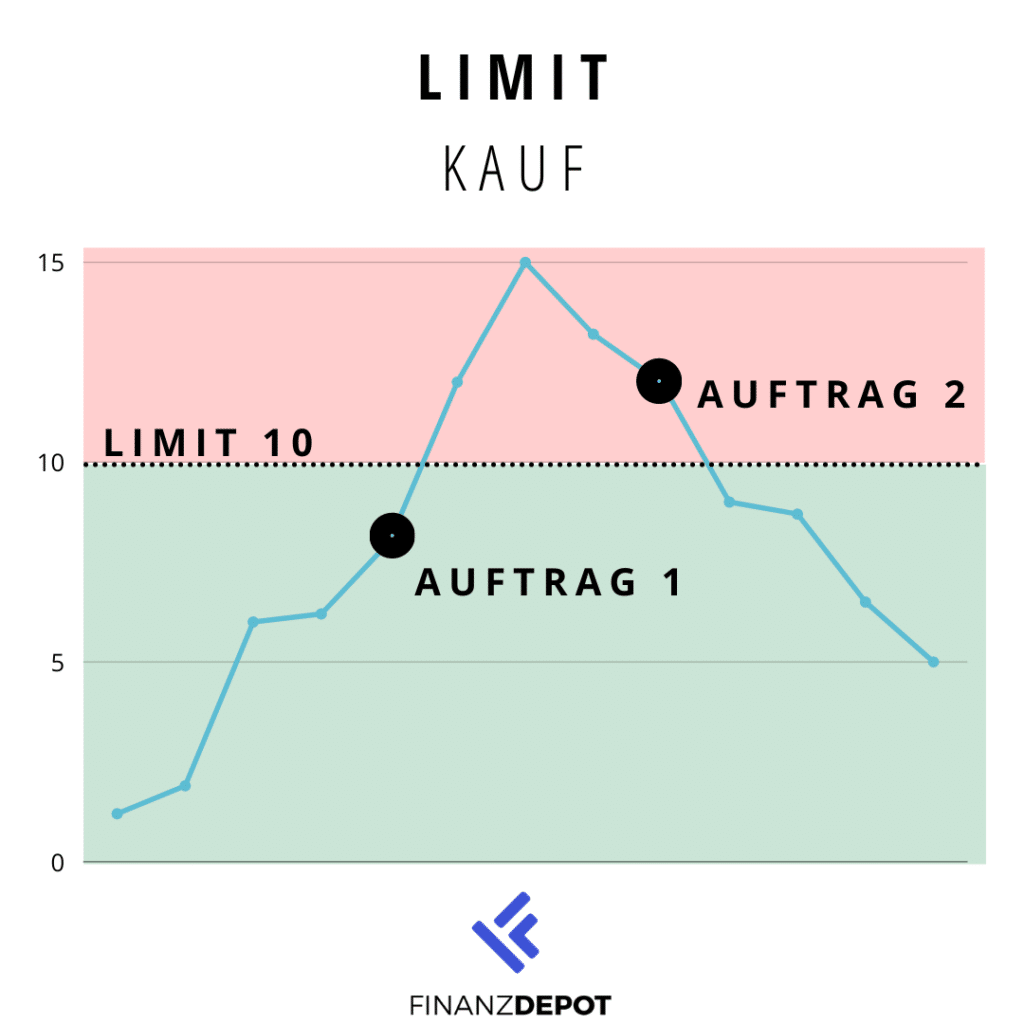

Purchase

You enter the maximum price you are willing to pay for the ETF.

Order 1: The current rate is CHF 8, the limit is set to CHF 10. This purchase would probably be executed immediately, provided a counterparty could be found. The price is below your limit – in the chart in the green area.

Order 2: The current rate is CHF 12, the limit is set to CHF 10. This purchase will not be executed immediately. The price is above your limit – in the red area of the chart. In the course of the day, the price fell below CHF 10 again and as soon as this is the case, the purchase would be executed.

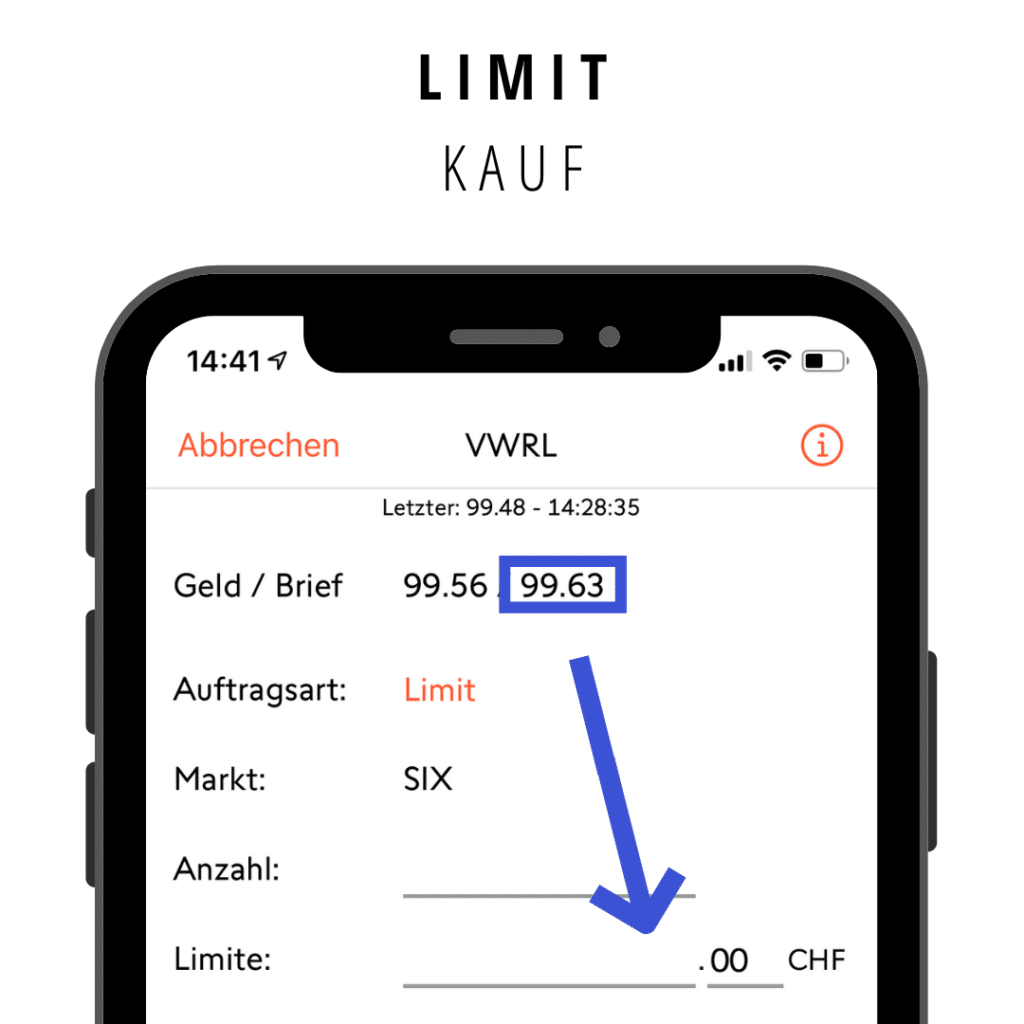

If the buy order is to be executed safely, you enter at least the ask price as the limit. In our example with the VWRL ETF, this would be at least CHF 99.63. In the app it looks like this:

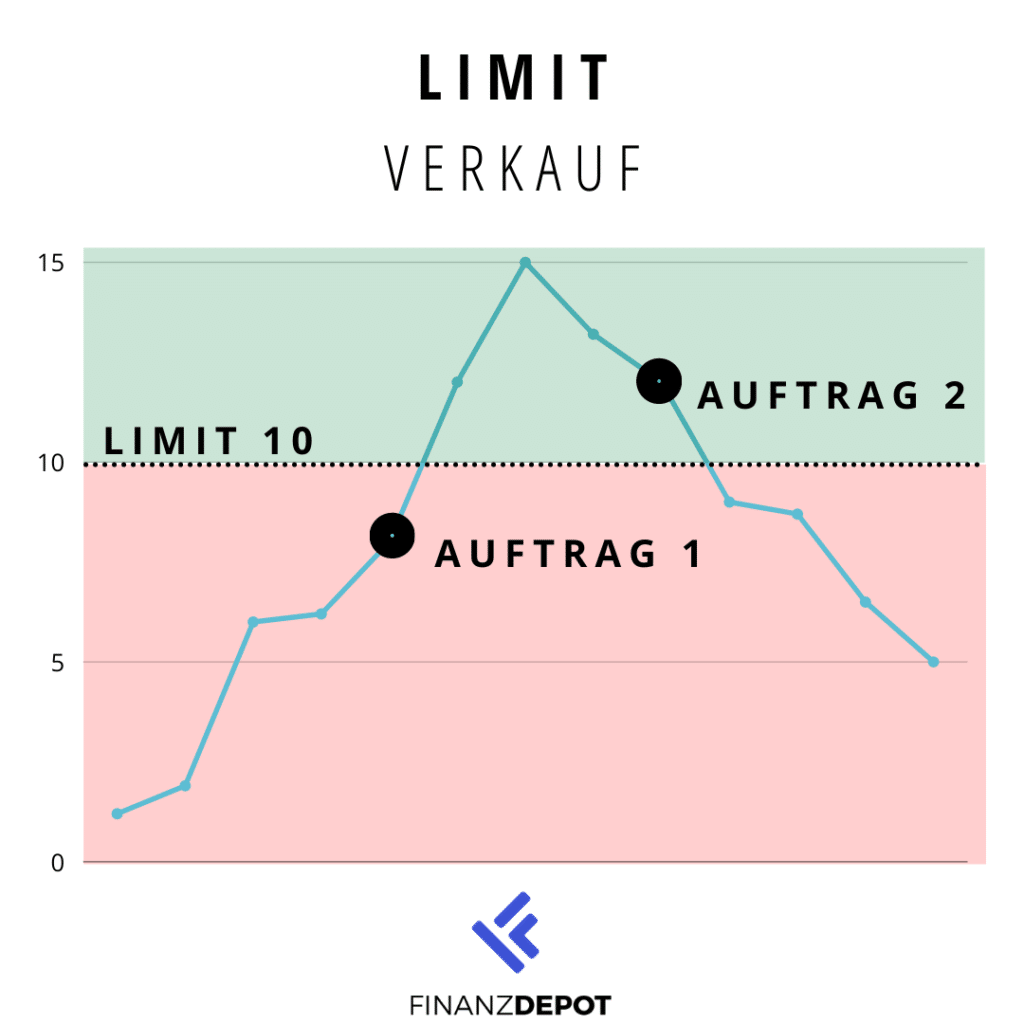

Sale

You enter the minimum price you want to get for the ETF.

If the sell order is to be executed safely, you enter at most the bid price as the limit. In our example with the VWRL ETF, this would be a maximum of CHF 99.56.

If your broker doesn’t offer real-time data by default or you don’t subscribe to it, then the quote is usually delayed by 15 minutes. You should keep this in mind when entering the limit and possibly make it a bit more generous. Swissquote offers real-time data by default for securities traded on SIX. For this you pay CHF 0.85 with every purchase. If it is not real-time data, this is marked with a small clock. It will look like this:

Market

This type of order is unlimited. You are instructing the broker to execute your order immediately. A buy order is also referred to as “cheapest”, and a sell order as “best”. Once a counterparty is found, the order is executed.

The problem with this order is that you don’t know how much you are even paying or getting for your securities until after you buy or sell them. With shares and ETFs, which are traded very frequently, you are relatively safe from nasty surprises. But in the case of small caps, which are traded less frequently and on days when the stock market jumps wildly, you may pay significantly more than usual or receive significantly less than usual for this security.

This order is therefore only to be applied if you want the order to be executed in any case.

Stop

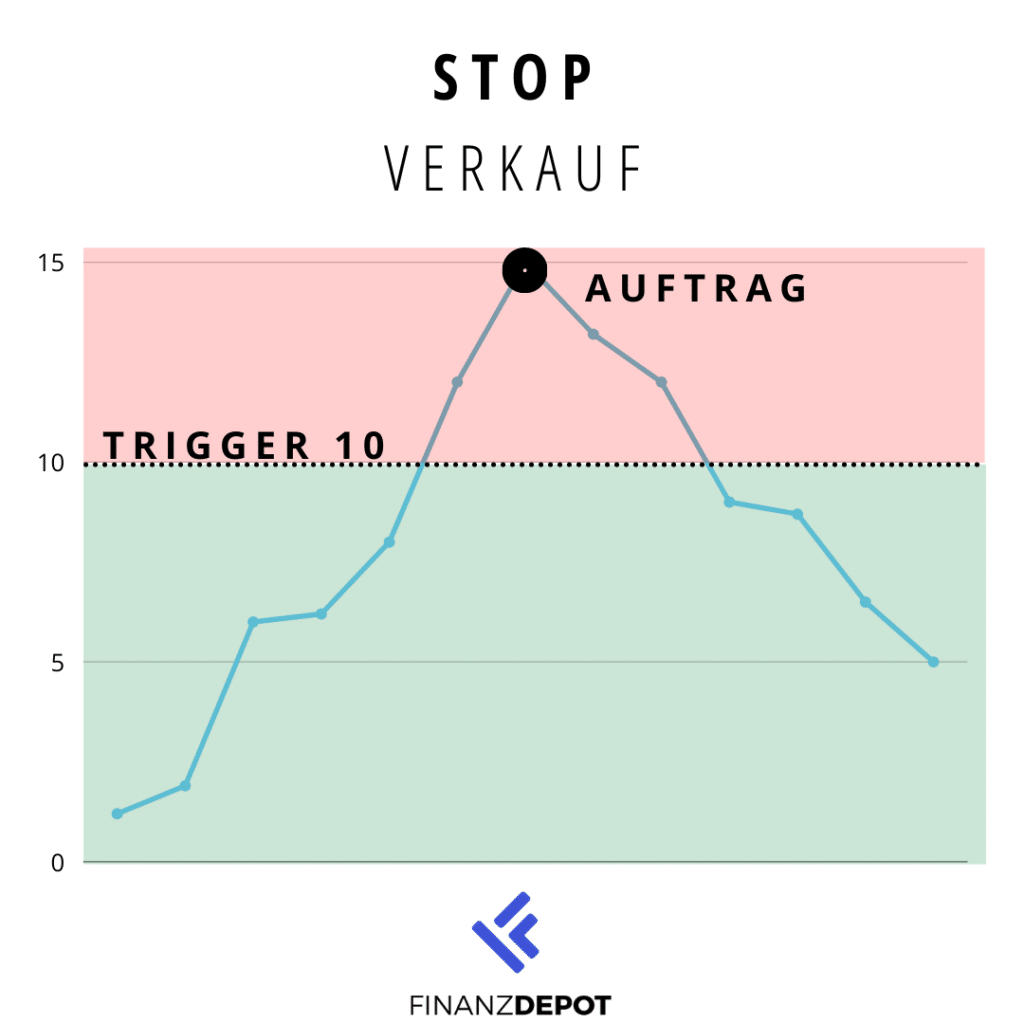

This type of order, also called “stop loss” at DEGIRO and other brokers, is often used as a hedge against price drops. As soon as a certain price value is reached or fallen below, the order is executed “at best”, i.e. like the order type Market. Swissquote calls this price value Trigger.

Let’s assume your stock has risen to CHF 15. You now fear that the price will fall and want to “hedge” it, i.e. sell it when it falls below the trigger of CHF 10. It will look like this:

The danger with this type of order, which is mainly used when selling, is, as with “Market”, that you do not know how much you will receive for your sold securities. You are rid of them, but in our example it is also possible that a counterparty can only be found at CHF 5, in which case you only get CHF 5 for your share.

Sometimes you read that a stop should be set at a certain threshold, for example at the current price value minus 10%. For our share, which is quoted at CHF 15, this would be CHF 13.5. That is a very sweeping statement. First, you would have to constantly tighten this threshold, which takes a lot of time if you have multiple stocks or ETFs. Secondly, the fluctuation range of shares is very different. A Roche share fluctuates much less than, for example, the share of chip manufacturer AMS. The latter can fall by more than 10% in the course of a day and still be quoted at “only” minus 5% at the close of trading. However, the stop order might have already been executed and you would have only made the broker happy. The is pleased with diligent action and the resulting fees.

With a long investment horizon and a broadly diversified portfolio, you can safely ignore this type of order.

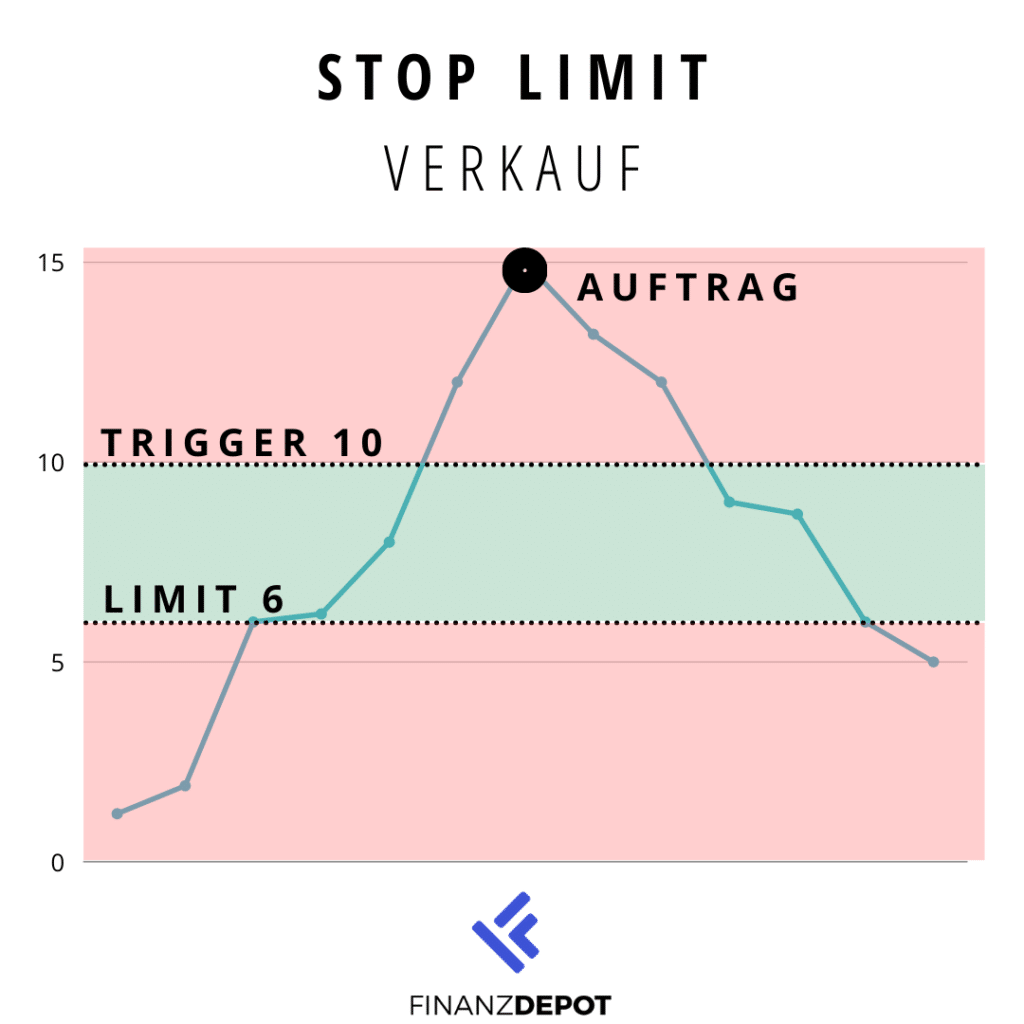

Stop Limit

Here you enter a trigger and a limit. As soon as the price falls below the trigger, a market order is executed, but only up to the limit. In this way, you additionally secure yourself downwards.

In our example, the sale would be executed from the trigger at CHF 10. However, if a counterparty is only willing to buy your shares at CHF 5, then your shares will not be sold and the order will expire. So you may be stuck with your shares.

This order type is also not relevant for long-term asset accumulation with ETFs.

Other order types

With German brokers you also often read about order types, which is a synonym for order types. Interactive Brokers and CapTrader, for example, offer around 50 order types. These then have such adventurous names as “Pegged-to-Market”, “Sweep-to-Fill” or “VWAP – guaranteed (Volume weighted average price)”. You will hardly ever use these either.

Validity of the order

In the order mask you can select how long the order type should be valid. Certain date ranges are available for selection, such as “valid for one day”, “1 week” or “unlimited”. When I buy shares of an ETF, I usually want the order to be executed as soon as possible. That’s why I actually always leave the default setting. For Swissquote, this is “1 week” in the app. If there is no purchase or sale within this one week, the order will be deleted automatically.

Conclusion

As an investor who invests mainly in broadly diversified ETFs and buys in the majority and rarely sells, I only use the mostly preset order type “Limit”. This way, I know the maximum amount I will pay for the purchase and thus have price certainty.

And finally, this article is explicitly about buying ETFs for long-term wealth accumulation. If you pursue a different investment strategy, the remaining order types may make sense.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.