Letztes Update: 28. September 2023

An ETF (Exchange Traded Fund) is an exchange-traded index fund that tracks the performance of an index, such as the SMI. Put simply, ETFs combine the advantages of stocks and funds in one financial product.

ETFs allow you to invest in entire markets with one security at a low cost. They form the perfect building blocks for private financial investment.

Advantages:

- Cost-effective

- transparent

- broadly diversified

- flexible

- liquid

The issuer of an index fund ensures that it tracks the performance of an index as closely as possible. The shares contained therein and their weighting are precisely specified by the index. Indices are market barometers that make it possible to track the performance of entire markets.

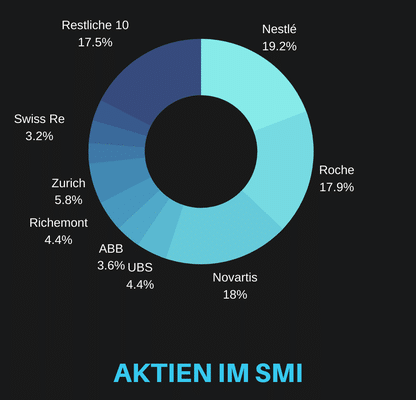

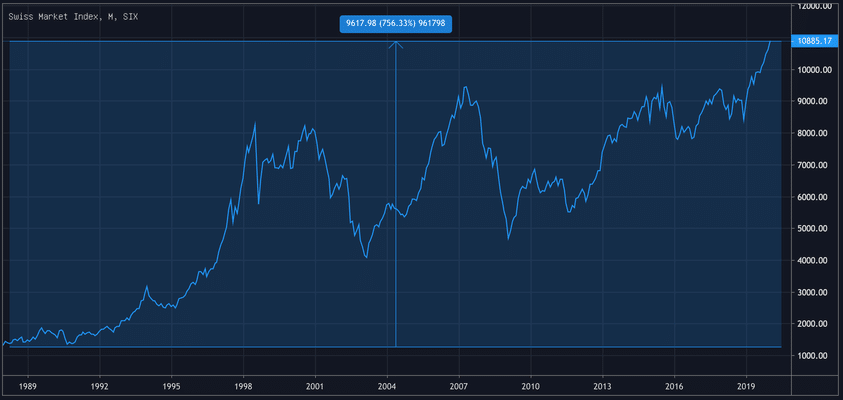

An index fund has the great advantage that you as an investor always know what you are invested in. This is because the composition of the underlying index, such as the SMI, is always known. The Swiss Market Index (SMI) contains the 20 most liquid and largest stocks in Switzerland. On the chart below you can see the weighting of some of the stocks included and the price trend since 1988. More detailed information on the composition and the current index level can be found on the SIX Swiss Exchange website.

You buy ETFs – like stocks – in pieces. Let’s assume that one piece of our SMI ETF has the value of CHF 100. So, for example, you have invested 19.2 CHF in Nestlé shares.

And if we assume that Nestlé rises by 2% on one day and the other 19 stocks remain constant in value, i.e. neither fall nor rise, then your ETF is worth CHF 100.38 at the end of the day. Has therefore increased by 0.38%. The example is very theoretical and will never be the case in practice, but it should show you how a fund works.

The three largest positions account for over 50% in this index. The overall index performance is therefore very much dependent on these three heavyweights, with two stocks still from the healthcare sector. That’s why I don’t advise you to put all your money into just one SMI ETF – it’s simply not diversified enough.

Costs

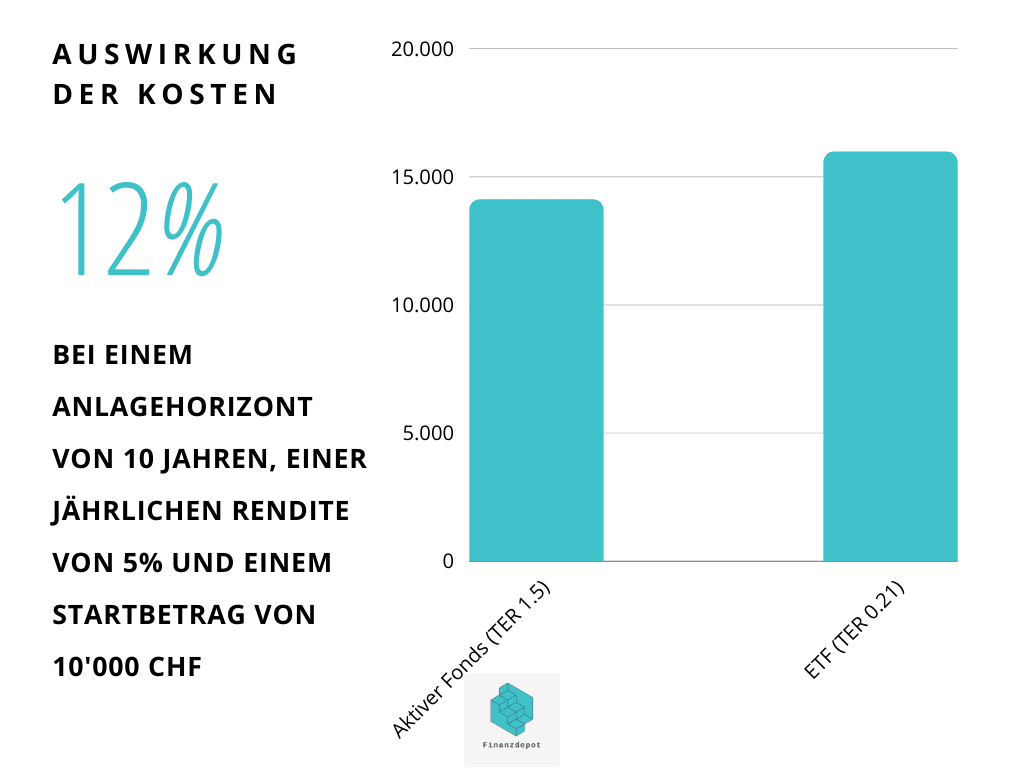

Next, let’s get into a little more detail about costs: an actively managed fund costs about 1.5% per year. An SMI ETF can be bought for 0.21% per year. On the picture you can see the influence of the costs – often called TER (Total Expense Ratio) in brochures and on the internet – on a holding period of 10 years. With the more expensive fund you have 1860 CHF less after 10 years.

If you compare two funds or ETFs on a performance chart, the costs are already included.

How are the costs charged now? You will not receive an invoice at the end of the year. Rather, the costs are deducted on a daily basis. If we stick to the example above and all 20 shares neither fall nor rise on one day and your ETF with an initial value of 100 CHF has a TER of 0.21%, then of course you will still be charged the costs. Your ETF would then still be worth 99.999425 CHF at the end of the day. In simple terms, the 0.21% is divided by 365 and then deducted daily. This happens automatically, you don’t even notice it.

Dividends

If the shares contained in an ETF pay dividends, these are of course passed on to the end customer, i.e. you. Our SMI ETF currently has a dividend yield of 2.62%. So if you have one of these in your custody account, you will be transferred 2.62 CHF once a year, minus the withholding tax of course.

You will come across accumulating and distributing ETFs. What is the difference?

- Distributing: The income or dividends are distributed. The fund collects them and pays them out, usually annually.

- Accumulation: Income is reinvested directly in the fund assets.

From a tax point of view, both types are treated equally in Switzerland. The withholding tax is deducted directly from the income – i.e. it does not even end up in your account – and can then be claimed in your tax return.

If you are at the beginning of investing, then accumulating ETFs are more suitable for you. This way you don’t have to pay any fees for reinvesting the dividends and you immediately benefit from the compound interest effect. This all happens in the background and you don’t have to do anything at all.

But if you depend on the dividends, or you see it as validation of your savings efforts when money lands in your account every once in a while, you can opt for dividend-paying ETFs.

ETF Search

You can find the right ETF on the website www.justetf.com. With the practical search function you can filter out your ETF from over 1390 products. You can use the selection and comparison function to take a closer look at the shortlist. Don’t be afraid of the large number of products, especially at the beginning of investing only a few ETFs really make sense. You’ll find out which ones in an upcoming post.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.