Letztes Update: 15. December 2024

At the moment, investors seem to be attracted by issues and sustainability. Until recently, digital and sustainable asset management was only offered by fintechs. In recent months, traditional banks have also entered the wealth management platform market (others refer to them as robo-advisors or investment apps). For example, Bank CIC with cleverinvest or now Liechtensteinische Landesbank (LLB) with wiLLBe. Find out everything you need to know about wiLLBe here, including my experiences with the investment app and the wiLLBe cash account.

Liechtensteinische Landesbank

Behind wiLLBe is the Liechtensteinische Landesbank (LLB), headquartered in Vaduz. The bank was founded in 1861 and its main shareholder is the Principality of Liechtenstein. The limited state guarantee of the Liechtensteinische Landesbank was lifted in 2019.

Moody’s gives the LLB an Aa2 rating, which corresponds to the third highest level: “Aa-rated liabilities are of high quality and carry a very low credit risk”.

The competent supervisory authority is the Financial Market Authority Liechtenstein FMA. Deposits with a Liechtenstein bank are protected up to a maximum coverage amount per depositor of CHF 100,000 by the “Deposit Guarantee and Investor Protection Foundation of the Liechtenstein Bankers Association” (EAS).

So, enough with the legal stuff, let’s finally get to my experience with wiLLBe.

wiLLBe

wiLLBe is a sustainable, purely digital asset management platform. The LLB makes it possible for wiLLBe investors to invest in investment strategies that would otherwise be unavailable to private banking clients.

The wiLLBe account is accessed via app or web app. If you want to have a look around the app first, you will find a demo login under “More options” after the download.

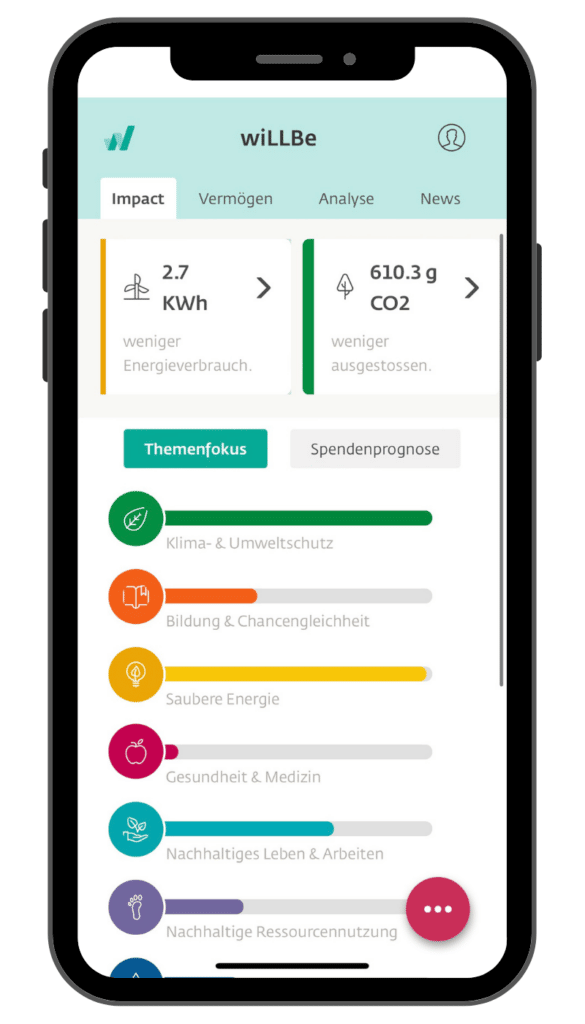

When opening an account, you can set an investment focus on up to seven themes. The theme worlds are based on the 17 UNSustainable Development Goals. The choices are:

- Education & equal opportunities

- Climate & Environmental Protection

- Clean water

- Clean energy

- Sustainable use of resources

- Sustainable living & working

- Health & Medicine

wiLLBe account opening

After downloading the app, you set your password, confirm your email address, and can set your focus from the seven investment topics. The short descriptions you can call up for each topic will help you make your choice.

Now it’s time to plan the investment strategy. You will be asked in which country you are registered and in which currency you want to invest. This is followed by questions about your ability to take risks and a willingness to take risks. Even without investment knowledge, the questions are easy to answer.

From the following five investment strategies:

- Conservative,

- Yield,

- Balanced,

- Growth,

- Shares

the app will suggest one that suits you. The “Equities” strategy invests in equities, of course, and a small portion is held as liquidity. The four other strategies additionally invest in bonds and alternative investments. You can easily override the investment suggestion if you find another investment strategy more suitable.

An ID card or passport is required to open the investment account. After answering nine identification questions, you take photos of your identity document, the hologram is verified, and you take a selfie. A video call is not necessary, so you can make the opening at any time. To complete the approximately 20-minute process, you sign the contract documents directly in the app.

wiLLBe – starting to invest

To make deposits, you must first register your account from which you are sending the money in the app. This is easily done by providing the amount and your IBAN to the house bank. By the way, deposits are only possible from an account in your name and the minimum investment amount is CHF 200. You can transfer smaller amounts at the beginning, but wiLLBe will only start investing when you have a total of CHF 200 in your account.

Subsequent deposits are not tied to any amount and are invested on an ongoing basis. Thus, savings plans are possible even with small sums. By the way, the investment round takes place every Thursday.

wiLLBe – sustainable investments

In addition to the sustainable theme worlds already mentioned above, wiLLBe also applies the following criteria when selecting stocks:

"We explicitly exclude sectors such as gambling, tobacco, military and adult entertainment. It is important to us that the stocks we select also offer prospects for returns, have low volatility and that the companies selected not only stand for a sustainable world, but are also economically sound."

Details on the selection process can be found in the very comprehensive FAQs (“How are companies selected for my sustainable portfolio?”) of wiLLBe.

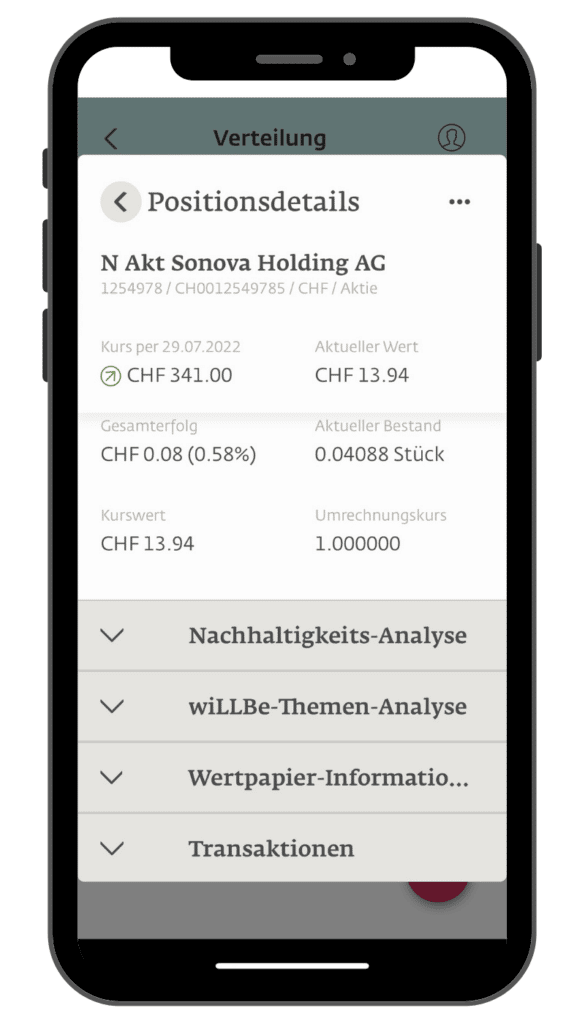

To ensure that even smaller portfolios are optimally diversified, wiLLBe uses fractional shares. These are fractions of a share or an ETF. Note that fractions exceeding whole pieces (i.e., 0.3 for a position of 5.3 pieces) are a receivable from the LLB. In the event of bankruptcy, these fall into the bankruptcy estate. Each whole piece is treated as a special asset and remains untouched in the event of bankruptcy.

You don’t really know what you’re going to put in your portfolio at the beginning. For example, my portfolio included an in-house inflation-linked bond fund with a weighting of 3%, the “RobecoSAM Sustainable Water Equities” fund (17%), a rather exotic CAT bond (catastrophe bonds) fund (5%) and individual stocks such as Vestas Wind Systems A/S (6%), Waste Management (5%), ABB (2%) or Sonova (1%). Detailed information can be called up for the individual items.

Under “Impact” you can see how your portfolio compares to the MSCI World equity index in terms of sustainability. For example, my portfolio has consumed 2.7 kWh less energy since it was created.

wiLL costs

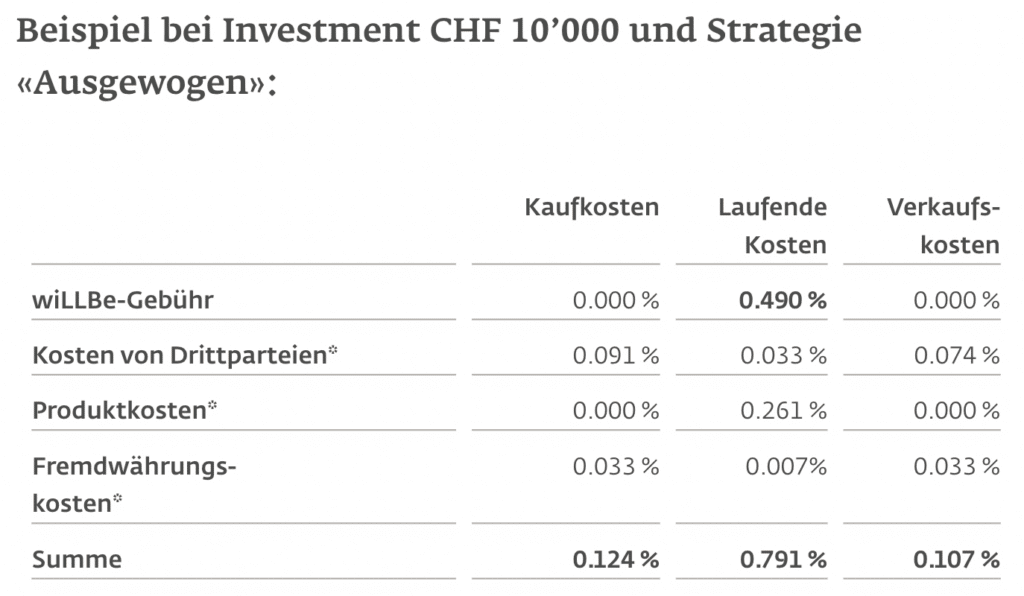

wiLLBe is certainly one of the more active digital asset managers on the market and the annual fee of 0.49% is all the more astonishing.

In addition to the wiLLBe fee, there are of course third-party costs, as with most other providers. At wiLLBe, total costs are broken down in an exemplary manner into purchase costs, ongoing costs and sales costs. It will look like this:

Due to the use of active funds, the ongoing product costs are rather high compared to a pure ETF portfolio.

Also included in the cost is a custody account statement with the tax values of your investments so you can complete your tax return. When it comes to taxing your investments, it does not matter whether the provider is based in Liechtenstein or Switzerland.

wiLL Donate

wiLLBe is currently working with three non-profit organizations to which you will be able to donate money easily from the wiLLBe app in the future. The cooperation partners are:

- Aiducation (access to education, scholarships)

- Mercy Ships (hospital ships in developing countries)

- Compensators (purchase of CO₂ certificates)

Over the course of the year, it should be possible to make automatic donations to non-profit organizations, for example, with an annual percentage of the performance of your investment. At the end of the year you will receive a donation receipt for your tax return.

wiLLBe cash account

Since summer 2023, wiLLBe has been offering a free cash account . In total, there are attractive interest rates in three currencies. We are only looking at the Swiss franc cash account here.

You currently get the following interest on your wiLLBe cash account in Swiss francs:

- 0.35% up to 50,000

- 0.05% up to 150,000

- 0.00% from 150,000

You don’t make any commitment with it, there are no fees and the balance is available daily. This means that the wiLLBe cash account offers one of the most attractive interest rates in Swiss francs. wiLLBe writes that an upward or downward adjustment of interest rates is likely in the event of a change in the key interest rate.

You can open and manage your wiLLBe cash account easily and conveniently in your wiLLBe app. It is also possible to set up a savings plan there. There is a minimum investment amount for the cash account, so you benefit from the first franc.

wiLLBe fixed deposit account

The free wiLLBe fixed-term deposit account combines predictability with security. From a minimum deposit of CHF/EUR/USD 100, wiLLBe offers flexible terms from 1 month to 10 years in the currencies EUR, CHF or USD. Here too, the funds are subject to Liechtenstein deposit protection. All functions, terms and interest rates can be accessed via the wiLLBe app.

In contrast to the call deposit account, the interest rates here are guaranteed for the entire term, but you can only access your funds again once the term has expired.

wiLLBe recommendation code

Enter referral code Y5K2EF in the wiLLBe app when you open and receive three months of wiLLBe Invest free of charge and no fees.

Comparison wiLLBe – Inyova Experiences

The first thing that catches the eye is of course the price. The all-inclusive fee at Inyova is 1.2% (for assets under CHF 50,000). Since Inyova is an all-inclusive fee (the stamp duty is still additional), the 1.2% cannot be directly compared to the 0.49%. If you look at the total running costs, wiLLBe is only about 25% cheaper.

With Inyova, you can see exactly which companies will end up in your portfolio before you invest, and you can go through them one by one and deselect them if necessary. With wiLLBe, you only see what ends up in your depot afterwards and you have no possibility to intervene.

Inyova is much more stylish and reduced and therefore meets my taste much more. With the wiLLBe Invest app, I still feel the bank and the compliance department in the background pretty well, which doesn’t have to be all bad. For example, the analytics features (yes, the app really calls them that) are more sophisticated. For each transaction, you can also access a PDF with the prices of the security, exchange rates, stamp taxes, etc.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.