Letztes Update: 27. September 2024

In March 2020, Zürcher Kantonalbank became the first major Swiss bank to launch an (almost) radically simple, transparent and affordable app for pillar 3a. But let’s take a closer look at the ZKB frankly pillar 3a app, the frankly fees and my experiences in this review.

ZKB

I don’t think I need to introduce you to Zürcher Kantonalbank. It is one of the safest universal banks in the world. As the name suggests, she comes from Zurich, but she travels throughout Switzerland and internationally. This is how frankly is advertised throughout Switzerland. In 2020, Zürcher Kantonalbank celebrated its 150th anniversary.

In 2014, ZKB bought the asset manager Swisscanto Invest. Swisscanto is one of the largest Swiss fund providers. We meet him again in the frankly plant products.

frankly

All you need to open the account is a smartphone or laptop and an ID card, so there’s no paperwork at all, and you don’t even need to visit a bank. You can open and manage pillar 3a from frankly both via the app and in the web version on your PC or laptop.

You can’t manage to pay in the maximum Pillar 3a amount this year? No problem, with frankly you remain flexible, because there is no minimum deposit or minimum term. From CHF 1.00 you are part of it and from CHF 5.00 frankly buys fund shares for you.

In total, you can open up to five 3a-pillars and thus choose five different strategies.

A unique feature of frankly is that you have both a normal 3a account and a 3a securities account within your pillar 3a. This allows you to decide for yourself when to transfer how much from your account to your securities account and thus invest. For example, you can invest an existing pillar 3a account gradually and thus reduce the risk of joining at an inopportune time. To do this, simply set the investment mode to “independent”. The default is the “automatic” investment mode.

Incidentally, the current interest rate is 0.70% and your money is held in an account with the Zürcher Kantonalbank’s Sparen 3 pension foundation. The all-in fee is no longer charged on the account balance (cash), but only on the funds actually invested in securities. Details about the frankly fees can be found below.

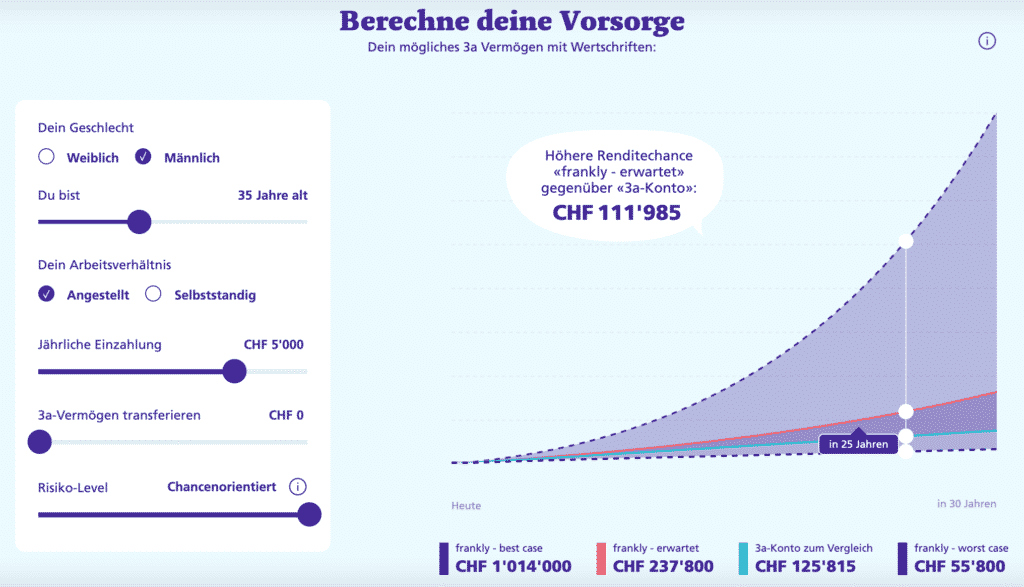

frankly pension calculator and pillar 3a comparison

On frankly’s website, you can calculate your potential 3a assets at retirement with the pension calculator. You specify how old you are, how much you want to deposit and choose a risk level. frankly shows you four different scenarios: The classic pillar 3a account, the expected return, the best case and the worst case.

You can also compare the securities solutions with various pension products from traditional banks.

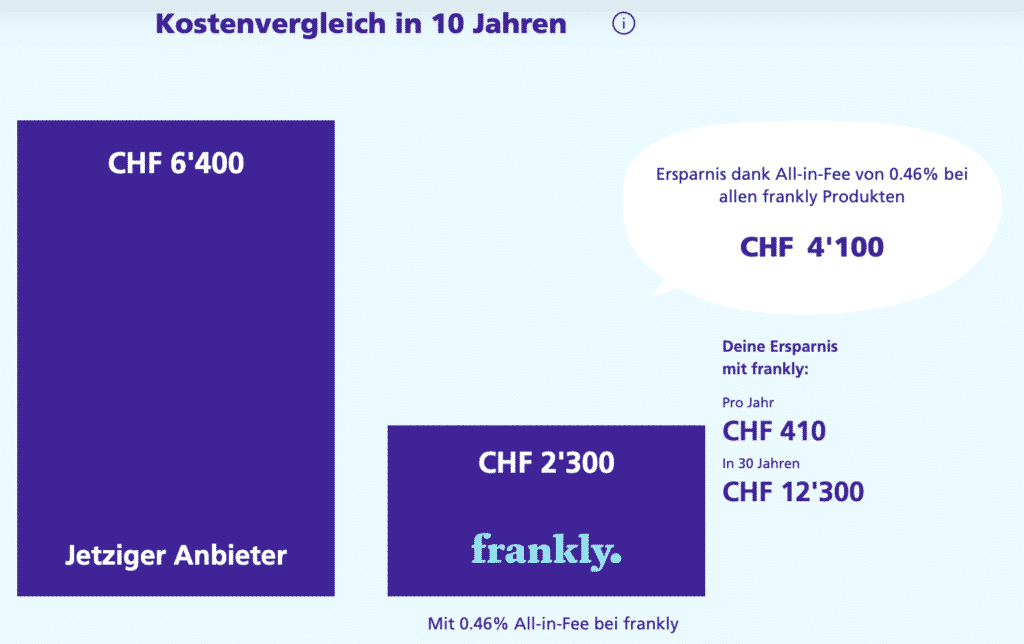

After entering some numbers, don’t worry, you don’t have to register for this, a cost comparison will be displayed and you will see how much you can save with frankly. If you scroll down further, you can also compare the performance, and frankly does not have to hide at all. The best thing to do is to start a comparison with your existing pillar 3a right here.

frankly all-in fee

The current all-in fee on the securities balance is 0.44%. The all-in fee is no longer charged on account balances (cash).

And why “currently”? Because the all-in fee decreases the more the customers have invested with frankly. This is called a community discount and the next level will be reached at CHF 5 billion. From then on, the all-in fee will be just 0.43%. This makes frankly one of the most favorable providers with the “opportunity-oriented” strategy.

The all-in fee is really radically simple. This is because the same all-in fee is always charged, regardless of the selected strategy, the investment product and thus the share proportion. Billing is on a quarterly basis.

If your old bank foundation incurs costs for balancing the account or selling your previous securities, frankly will cover the costs. These will be refunded to you as a discount on the All-In Fee. Contact frankly support for reimbursement with your old bank’s expense report. If, on the other hand, your Pillar 3a comes from an insurance company, the costs will not be covered by frankly.

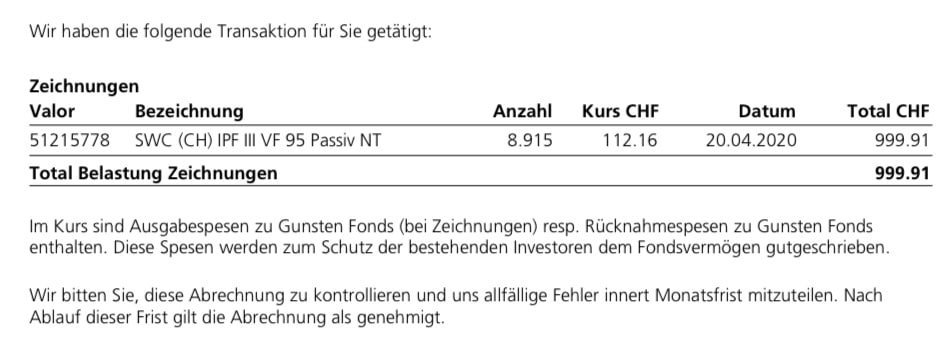

frankly investment products

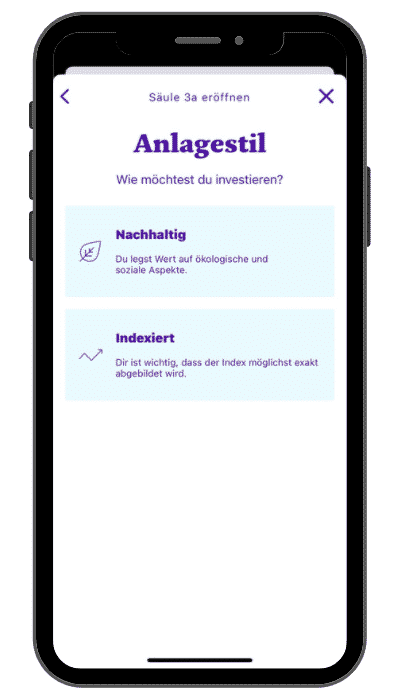

There are six strategies and an almost unlimited number of investment products to choose from. The figures for the investment products indicate the approximate proportion of shares.

| Strategy | Active investment product Strictly sustainable | active investment product Sustainable | indexed investment product |

|---|---|---|---|

| Safety-conscious | – | Light 15 Responsible | – |

| Careful | Gentle 25 Sustainable | Gentle 25 Responsible | Gentle 25 Index |

| Balanced | Moderate 45 Sustainable | Moderate 45 Responsible | Moderate 45 Index |

| Ambitious | Strong 75 Sustainable | Strong 75 Responsible | Strong 75 Index |

| Opportunity-oriented | Extreme 95 Sustainable | Extreme 95 Responsible | Extreme 95 Index |

In addition to the “Responsible” sustainable investment products, frankly has also been offering strictly sustainable investment products under the name“Sustainable” since November 2023. Unfortunately, frankly does not succeed in making the differences easy to understand, which leads to confusion and makes the actually simple frankly unnecessarily complicated – radically simple is different.

Active funds are structured somewhat differently than indexed funds. In addition to real estate, bonds and equities, indexed funds also contain commodities and precious metals, depending on the strategy. In addition, active funds take much stricter sustainability aspects into account. I think the differences in structure should be made clearer on frankly’s website.

Regarding the division into active and indexed products: This is a novelty, also that the all-in fee is exactly the same, but laymen are thus faced with a decision that is not easy to make.

The aim of actively managed investment products is to achieve a better return than the market average. Since their launch in April 2020, the active frankly solutions have also shown a slightly better return than the index-linked solutions. This does not always have to be the case and the period under review is relatively short.

By the way, if you want to change the investment product, this is possible at any time in the app or the web version.

frankly sustainability

The aim of Swisscanto’s Responsible Standard is to reduce CO2e emissions by at least 4% per year with the investment products.

In addition, manufacturers of outlawed weapons are excluded. And Swisscanto does not invest in companies which, in its opinion, do not have a promising business model or/and unacceptable reputational risks.

Swisscanto is in dialogue with the companies in its funds and encourages them to formulate CO2e reduction targets and implement them. In addition, Swisscanto exercises its voting rights, following sustainability-oriented voting guidelines.

The Sustainable Funds – the strictly sustainable funds – also focus on companies and countries that contribute to achieving one or more of the United Nations’ 17 Sustainable Development Goals (SDGs). The aim is also to reduce CO2 intensity by at least 7.5% annually.

For indexed strategies, only blacklisted companies are excluded. Systematic ESG integration does not take place here. Other pillar 3a providers show that ESG criteria can also be applied to passive strategies. By the way, you can find my big pillar 3a comparison with other digital providers here.

frankly advantages

- Investment mode independently customizable

- simple fee model

- no minimum deposit, no minimum term

- large cantonal bank with many years of experience in the background

frankly disadvantages

- Division into active/indexed and sustainable/strictly sustainable products makes selection more difficult

- Indexed products apply less stringent ESG criteria

FAQ frankly

From CHF 1 you are in.

The all-in fee at frankly is currently 0.44%. It is settled quarterly pro rata on total assets.

frankly was developed by the Zürcher Kantonalbank. The Pension Foundation Savings 3 of Zürcher Kantonalbank is also involved and the funds are managed by Swisscanto Invest by Zürcher Kantonalbank.

The interest rate in pillar 3a is currently 0.70% in frankly vested benefits 0.30%.

Yes, since 2023 you can also access your account at frankly via PC or laptop. Of course, you can also open the account in the frankly web version.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.