Letztes Update: 28. September 2023

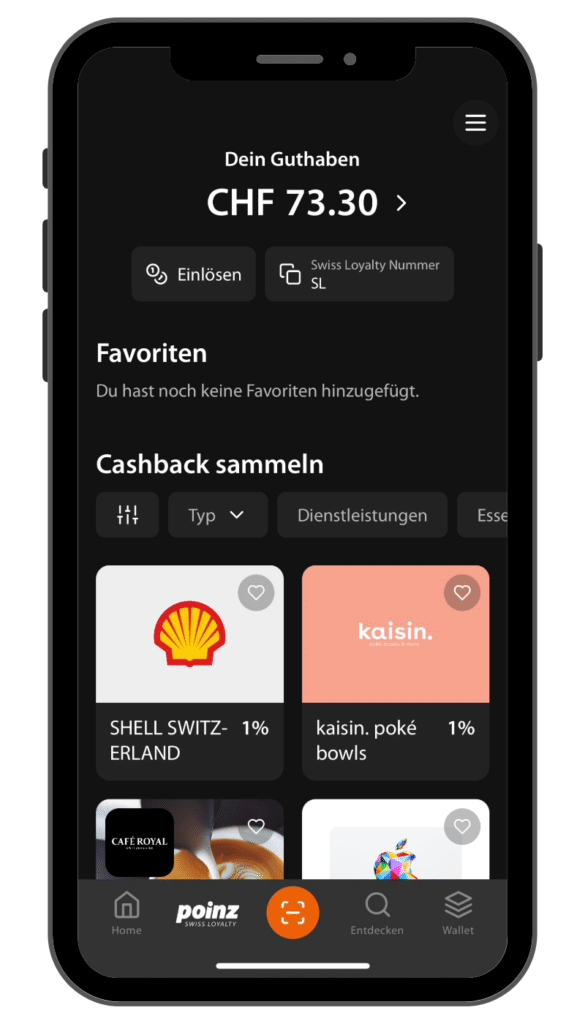

Collecting cashback is possible with various providers, but no provider has created as extensive a cashback ecosystem as poinz, with digital stamp cards, deals, digital loyalty cards, automatic cashback, digital vouchers and its own “Swiss Loyalty Cards” credit cards. Here you can read everything you need to know about collecting cashback and my experience with poinz.

poinz

The start-up poinz* was founded in 2012 and brought the paper stamp card into the digital age in 2013 with the poinz app. The Zurich-based company now employs around 30 people and networks around 1,600 stores with over 1,000,000 poinz customers. In addition to the digital stamp card, poinz has built an entire cashback ecosystem since launch, and now we’ll take a closer look.

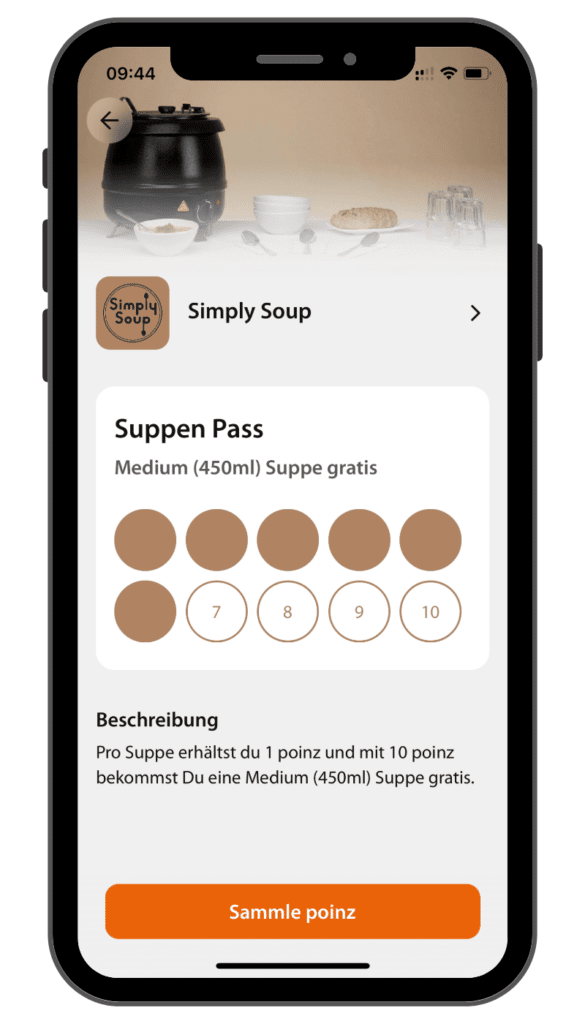

Digital stamp cards

Of course, you can still collect so-called poinz with your digital stamp card. Here’s how it works: When paying, you tell the waitress in a participating store that you want to collect poinz. It will generate you a code that you can scan with your poinz app. And you’ll have one more point on your digital stamp card.

If you have filled up your stamp card, usually ten stamps are required, but this varies from store to store, you can get a free product. By the way, you don’t have to search for the stamp card of the respective store in your poinz app. A tap on the scan icon of the poinz app is all it takes. The poinz are automatically credited to the correct stamp card. Full stamp cards can then be found under “Wallet”.

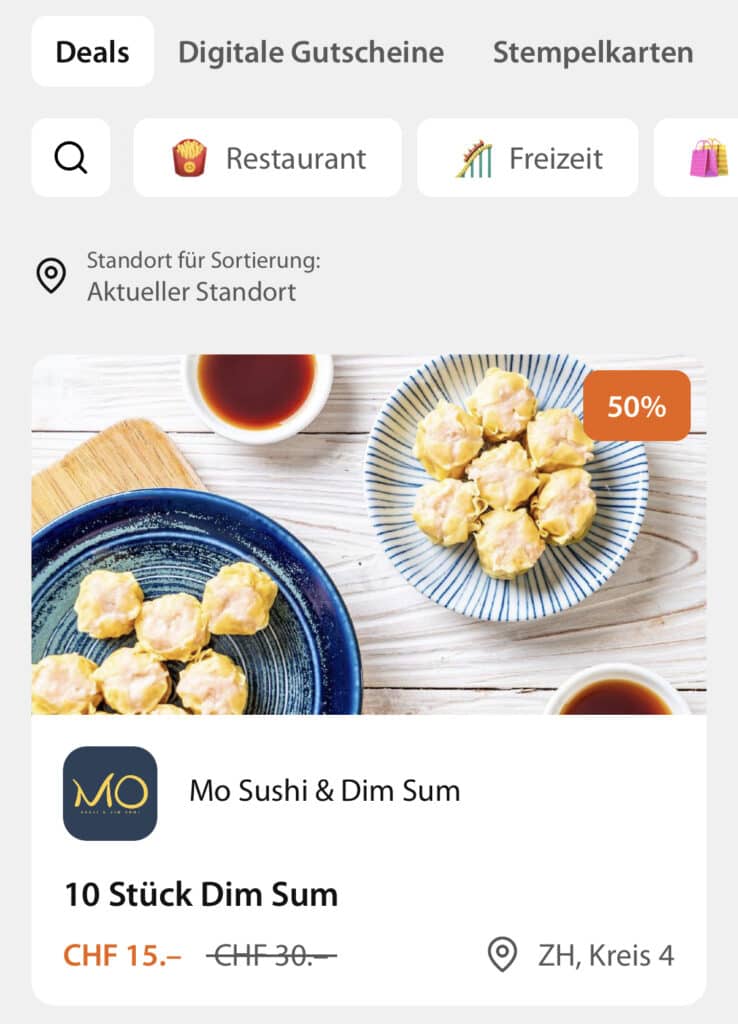

Deals

The participating stores always offer attractive deals, which you can find under “Discover” in the poinz app. For example, an Italian restaurant is currently offering a takeaway pizza of choice for two people for CHF 21 instead of CHF 43. So you buy the deal for CHF 21 in the app and scan the QR code when you pick it up at the restaurant to redeem the deal.

Note that purchased deals have an expiration date and thus may expire. Also, some deals are only redeemable at certain times. So always read the conditions carefully before buying.

Digital customer card

Here you can add, for example, the SwissPass, the Migros Cumulus card or the Coop Supercard, so that you no longer have to physically carry the customer cards around. Adding is easy: either scan the barcode on the card or enter it manually.

You can find the digital loyalty cards under “Home”, which is the quickest way to have them at hand at the checkout, or under “Wallet”. It would be great if the loyalty cards were also available on the Apple Watch and you could add them as a widget on the iPhone.

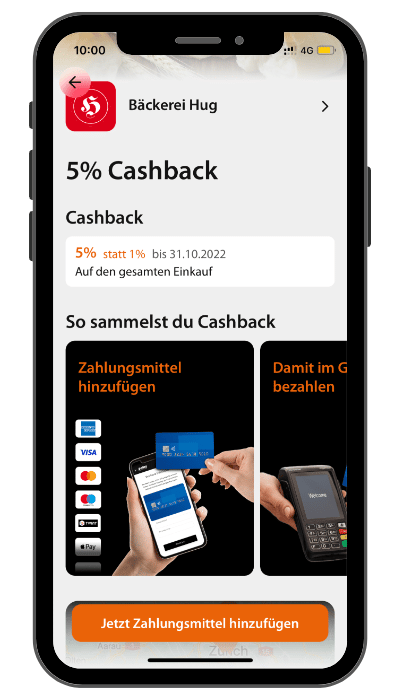

Automatic cashback

Let’s move on to the first innovation, and it’s quite something, because now you don’t have to open your app and actively scan a code every time you make a payment. Instead, you store your means of payment once in the app. In total, you can deposit up to five means of payment. In addition to credit and debit cards, you can also deposit mobile payment solutions such as Apple Pay or TWINT.

Credit and debit cards are deposited by entering the card number and name of the holder. By the way, poinz has no insight into the deposited data. These are stored anonymously at the processing partner Worldline.

Mobile payment solutions are a bit more cumbersome to deposit because you have to make a transaction with the cashback partner, ask for the receipt, and then enter certain information on the receipt into the app. This is too analog for me for an actually digital solution.

If you now make a purchase at a cashback partner such as Orell Füssli with your deposited card, the 2% cashback is automatically credited to the poinz app. Immediately after the payment, you will receive a push message showing you the cashback amount received. Here, too, there are always special promotions, for example, you get a whole 10% cash back at kaisin until mid-January.

Digital vouchers

Either you can have the collected Swiss Loyalty credit paid out to your bank account from an amount of CHF 100 or you can buy digital vouchers in the poinz ecosystem with the credit and receive cashback on them in turn. Currently the following digital vouchers are available:

- Zalando

- Rituals

- PlayStation Store

- Xbox gift card

- Apple

- Google Play

- H&M

- Spotify Premium

- Roblox

Yes depending on the partner the amount of the vouchers and the amount of the cashback are different. At Apple, for example, you can freely choose between a value of CHF 30 to CHF 250 and you will receive a cashback of 3.5%. This cashback will be credited to your Swiss Loyalty balance after payment.

Cashback online stores

You can also collect cashback in online stores. Currently, more than 80 online stores are connected. Simply search for the corresponding online store in the poinz app and select “Open online store now”. A window with the store will then open in your smartphone’s browser, where you can make your purchase normally.

At ABOUT YOU, for example, there is a cashback of 4.5% for existing customers or 8.5% at Linsenklick.

About 24 hours after the purchase, the Swiss Loyalty credit will appear in your poinz app and as soon as the partner has confirmed your purchase, you will receive the definitive credit. This can take several months.

Swiss Loyalty Cards – Free credit cards

In April 2022, poinz launched the free credit cards Swiss Loyalty Cards in collaboration with Swisscard AECS. This makes collecting cashback even easier. After applying, which you can do directly in the poinz app, you will receive an American Express credit card and a VISA credit card. With the former, you collect 1% cashback on every payment worldwide (in the first three months after card issuance even 3%, up to a maximum value of CHF 100), with the latter 0.25% cashback.

Here you don’t have to scan a code, don’t have to select a store, don’t have to deposit a card, just pay your daily purchases with one of the Swiss Loyalty Cards and the cashback will appear in the poinz app under provisional credit. Upon receipt of the monthly credit card statement, the provisional balance will be converted into redeemable balance. This is in contrast to the Swisscard Cashback Cards, where the collected Cashback amount is credited to your card account only once a year. So my poinz experience has been very positive.

The individual transactions can be viewed at any time in the Swisscard app. You can cancel the paper bill, which is automatically activated and costs CHF 1.95 per bill, in the Swisscard app under “Service”, “Bill delivery”. You will then either receive it by mail or even easier by eBill.

Mobile payments are possible with Apple Pay, Google Pay, Samsung Pay and SwatchPAY!

moneyland.ch compared 168 Swiss credit and prepaid cards in June 2022 and voted Swiss Loyalty Cards the best credit card in Switzerland in four categories.

When you apply for a Swiss Loyalty Card, you will also receive a starting credit of CHF 30. And as a reader of Finanzdepot another CHF 30 on top!

poinz recommendation code

Apply for poinz credit cards* and you will receive your additional bonus of CHF 30 as soon as the credit cards are issued.

Conclusion poinz experience

You can even combine the different cashbacks. For example, if you pay in the online store of ABOUT YOU with your American Express credit card from Swiss Loyalty Cards, you will receive a cashback of 4.5% plus 1%. And if you redeem your accumulated Swiss Loyalty credit for a Zalando gift voucher, you’ll get just another 5.5% cashback.

The poinz cashback ecosystem is extremely extensive and everyone can find a way to save, even if it’s “just” with the free credit cards. But that’s also the downside. It’s not so easy to keep track of all the cashback opportunities. In fact, in addition to the described savings and collection options, there are always contests, digital scratch cards and events.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.