Letztes Update: 28. September 2023

This post was created in collaboration and with the support of Freya Savings. The content reflects my own opinion.

After the founders of Freya Savings introduced us to their Pillar 3a in the interview, this post is now less about the function of gold and real estate in a diversified portfolio and much more about the issues that arise when these asset classes are used in a sustainable portfolio. Here you will find out what challenges fund managers face, what solutions are available and finally, what specific products Freya Savings uses and what sets them apart.

Gold

The challenges

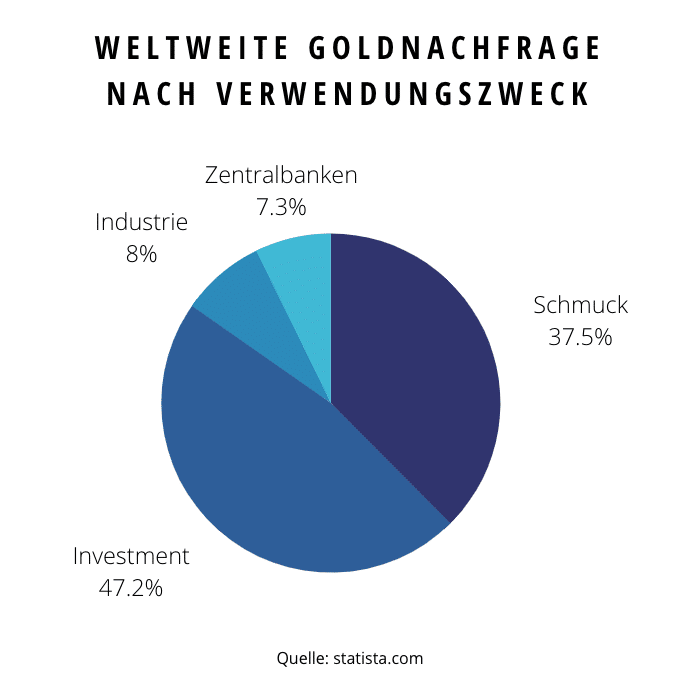

Gold is not only used as a store of value and for the production of jewelry, but also in industry, for example, as a base material for semiconductor products. Thus, there are between 30 and 35 mg of gold in your cell phone.

Gold does occur naturally as nuggets, but that’s more the case with Lucky Luke. Much more often it occurs in reality as gold dust. Cyanide and mercury, among other things, are used to dissolve this out of the rock and bind it. These chemicals can leach into soils, rivers and groundwater, where they can be detected for decades to come. Mercury, for example, can enter the human food chain through fish and cause damage to the central nervous system. Workers often lack protective equipment, leaving them directly exposed to toxic fumes.

According to the human rights organization Human Rights Watch, children are also used in gold mining, especially in smaller mines. These can climb into narrow improvised tunnels and not infrequently there are mining accidents.

Rainforests are being cleared and indigenous peoples displaced to extract gold. The higher the gold price, the more lucrative it becomes to open up new mining areas. In addition, gold mining consumes vast amounts of water, which causes the water table to drop. This deprives the local population of its livelihood.

Some gold mines are located in politically unstable areas. There is a danger that proceeds from the gold business will be used to finance civil wars and weapons.

The solutions

Recycled gold

Gold can be recycled from scrap gold and electronic waste. The energy required for recycling is still considerable, but the environmental balance is much better than with newly mined gold. Recycled gold now accounts for about 30% of the world’s gold supply, and the trend is rising. You can also buy gold bars made from recycled gold as a private investor.

Responsible Gold Guidance of the London Bullion Market Association

The London Bullion Market Association (LBMA) is an international trading organization that coordinates over-the-counter gold trading. Members include central banks, mining companies, producers, refiners and processors. LBMA certified gold must meet a certain size and purity. Since 2012, refiners trading their gold on the London Bullion Market have had to implement the Responsible Gold Guidance (RGG). Certified refiners must ensure that processed gold comes from sources that are not linked to money laundering, terrorism financing, or human rights abuses. The RGG is continuously revised and environmental aspects are increasingly taken into account.

Fairtrade Gold of the Max Havelaar Foundation

Child and forced labor are prohibited under the Max Havelaar Foundation’s Fairtrade label. Among other things, the label prescribes protective clothing for workers and measures are taken to prevent accidents. The mines join together to form mining organizations, can dispense with middlemen and thus achieve higher selling prices. In addition, Fairtrade certified mines receive a Fairtrade premium. This is used to improve production and working conditions, as well as for community projects such as education and health facilities. There are strict guidelines for the use of chemicals. The certification company FLOCERT regularly inspects the mines to ensure that the Fairtrade standards are being met. The gold is also traceable back to the mine. Using the serial number of the gold bar, the origin can be queried on the website www.maxhavelaar.ch.

You can buy fair trade gold bars at the Graubündner or the Zürcher Kantonalbank, for example. The surcharge is around 4%.

Traceable gold

Using the DNA marking technology of the ETH spin-off Haelixa, gold can be traced and its origin proven. At the mine, the gold is sprayed with a DNA marker. The refinery in Switzerland can then use a PCR test to determine whether the gold actually comes from the specified mine. The bars are then produced on a separate production line and given a serial number. This DNA labeling technique was developed specifically for the ZKB. Currently, the smallest unit available is a 250 g bar, which corresponds to a current value of CHF 13,587. The offering is therefore still aimed more at institutional investors or wealthy private investors.

Gold at Freya Savings

Freya Savings uses the “Swisscanto (CH) Index Precious Metal Fund Gold Physical hedged” (ISIN CH0421756336) with a weighting of 4% in each portfolio. As with all funds, the selection criteria included:

- stringent and comprehensible sustainability process,

- Tradability

- physical replication

- attractive cost structure

According to Swisscanto, the fund used fully complies with the LBMA’s Responsible Gold Guidance. In the next few years, the entire fund is also to be converted to “traceable gold”. At the moment, however, there is not enough “traceable gold” for the big gold funds.

Real Estate

The challenges

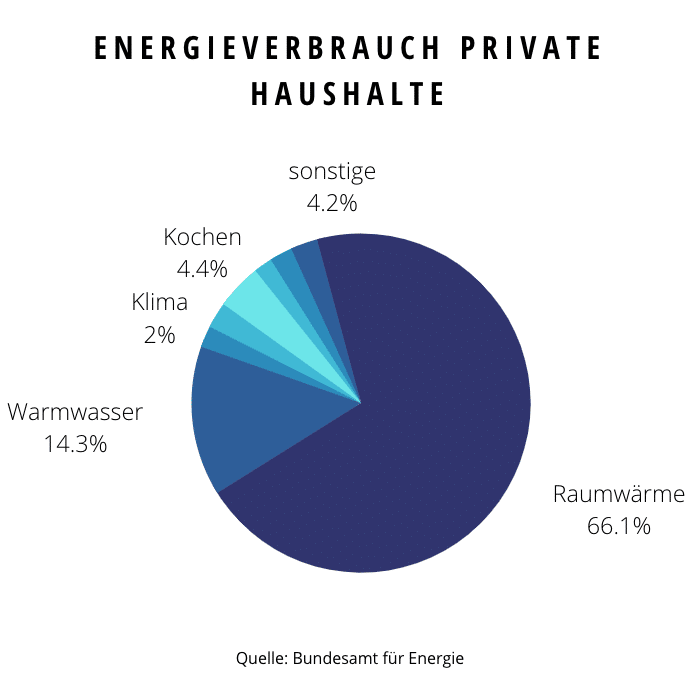

Energy efficiency and CO₂ emissions certainly have the greatest leverage in real estate. After all, buildings account for around one-third of total final energy consumption and 40 percent of all current CO₂ emissions.

But the materials used, such as concrete and steel, are also very energy-intensive in production. When buildings are deconstructed, topics such as recycling and circular economy become topical.

The perfectly insulated house with the most modern heating system can hardly be classified as sustainable if it is built on a greenfield site, for which high-trunk fruit trees have to be felled, access roads have to be built and the nearest store can only be reached by a forty-five-minute drive.

Not only ecological, but also social and economic criteria are decisive for real estate: Are the materials used harmful to health? Is an apartment free of obstacles? How marketable is a property and what about life cycle costs?

As you can see, the sustainability criteria for real estate are very broad and multi-layered. Thus, a uniform, generally accepted definition of sustainable real estate has not yet been established. Every supplier understands sustainability differently.

However, there is a consensus in the industry that sustainably oriented real estate investments are better equipped to meet the challenges of the future and thus offer investors a better risk-return ratio.

The solutions

SGNI – Swiss Society for Sustainable Real Estate Management

Is an association with the goal of promoting the sustainability of real estate and the built environment in Switzerland along the entire life cycle from planning to construction and operation to use, as well as making itvisible and measurable. SGNI’s Swiss DGNB certification system is based on criteria developed by the German Sustainable Building Council (DGNB). The DGNB system is based on the three central sustainability areas of ecology, economy and socio-cultural.

Building energy certificates of the cantons GEAK

The GEAK is a nationwide standard and enables the comparison of properties with regard to the energy required by a property. It works similarly to an energy label for electronic equipment and divides buildings into categories from A to G. On the one hand, the efficiency of the building envelope (thermal insulation, etc.), and on the other hand, the overall energy efficiency (heating, hot water preparation, lighting, etc.) are included in the evaluation.

Global Real Estate Sustainability Benchmark, GRESB Rating

Is a rating system for measuring the sustainability performance of real estate companies and real estate funds. Seven different aspects lead to a GRESB score. This can be used to check and compare the ESG (environmental, social, governance) performance of real estate vehicles.

greenproperty – the Credit Suisse seal of approval

Credit Suisse Asset Management’s Swiss seal of approval for sustainable real estate takes a holistic ESG (environmental, social, governance) approach that considers both environmental and social issues as well as aspects of corporate governance. For the seal of approval, a property is assessed on the basis of around 50 ecological, economic and social indicators – summarized in five dimensions.

Real Estate at Freya Savings

Portfolios with less than 85% equities contain 6% Swiss real estate at Freya Savings. The fund “Swisscanto (CH) Real Estate Fund Responsible Switzerland indirect (I) GT CHF” (ISIN CH0325172887) is used. This is an actively managed fund of funds, which in turn invests in individual other funds.

If a fund has not defined a sustainability strategy, it is excluded from the investment universe. The annual progress in terms of energy efficiency of the individual funds is measured and compared. Those funds that can demonstrate the highest increase in efficiency are subsequently given a higher weighting in the fund of funds.

The largest position in Swisscanto’s fund of funds is the “UBS (CH) Property Fund – Swiss Mixed “Sima”” fund with 17.9%. This was awarded a “Green Star” in the GRESB rating and has a comprehensive sustainability report.

The second largest position is the fund “Credit Suisse Real Estate Fund Siat” with a share of 7%. The Global Real Estate Sustainability Benchmark (GRESB) confirms a leading ESG integration in national and international comparison. Thus, with five GRESB stars, the fund is one of the leading ones on the market. 19% of the properties included bear the Credit Suisse greenproperty seal of approval.

Conclusion

Unfortunately, Swisscanto’s factsheet does not address sustainability approaches at all. And also on Swisscanto’s website, hardly anything can be found about sustainable gold and sustainable real estate. Surprising, since Swisscanto succinctly emphasizes its sustainability approach on its website. There is certainly room for improvement.

After all, a report in condensed form is to be published for the real estate fund before the end of the year, showing the increase in efficiency over the last few years.

Freya’s selection criteria are comprehensible to me and the path taken by Swisscanto is promising. The two funds are currently at light green on the sustainability color scale, but the path to a darker green is discernible.

In the third and final post – the Freya Savings experience report – we take a closer look at the sense profiles, the app, and the fees.

Transparency and disclaimer

This post was created in collaboration and with the support of Freya Savings. The content reflects my own opinion. More about transparency and paid contributions can be found here.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.