Letztes Update: 28. September 2023

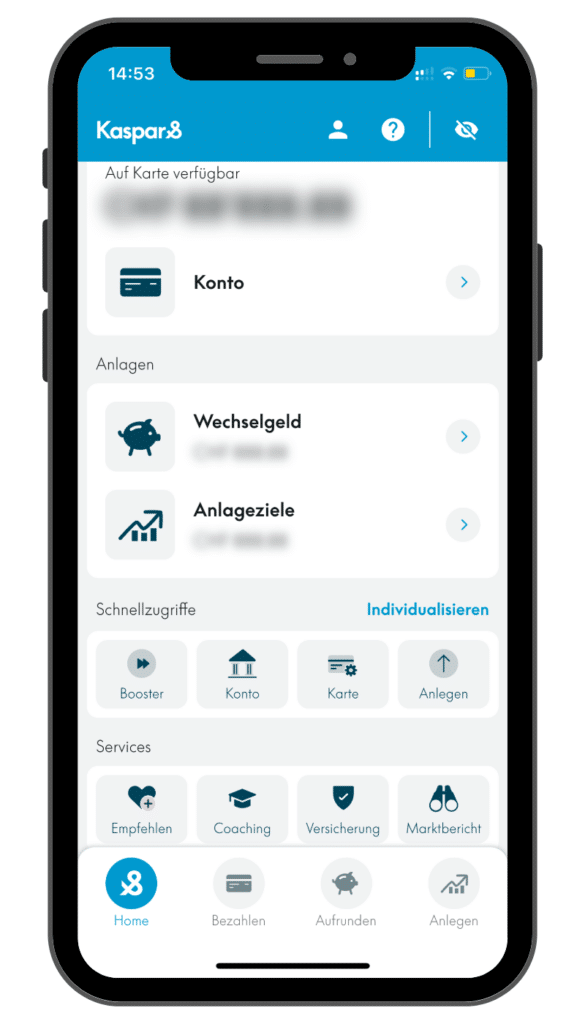

Kaspar& is the combination of a neo-bank with digital asset management. Or to put it more simply: Kaspar& is a digital piggy bank. Unlike a conventional piggy bank, however, with Kaspar& your money doesn’t just lie idle in the pig’s belly, but is invested. How easy it is and what your money is invested in, you can read in this article about my Kaspar& experience.

Kaspar&

FinTech Kaspar& is a spin-off of the University of St. Gallen and ETH Zurich and now comprises a team of ten people. The four founders previously worked at asset managers. Offices are located in St. Gallen and Zurich. Kaspar& is the first FinTech with asset management license regulated and authorized by the Swiss Financial Market Supervisory Authority FINMA. You may know the name Kaspar& from the fourth season of the start-up show “Höhle der Löwen”.

How can I pay with Kaspar&?

When you open, you get a free Swiss account and a free prepaid Mastercard. A nice detail: Your first name is printed on the Mastercard. With your Kaspar& card you can make payments worldwide free of charge. And if you pay in a currency other than Swiss francs, the interbank exchange rate is applied.

Hypothekarbank Lenzburg acts as the banking partner. Cash held with Kaspar& is therefore subject to Swiss deposit protection up to CHF 100,000. Incidentally, the fintechs neon and findependent also use the services of Hypothekarbank Lenzburg in the background.

You will receive your own IBAN number to fund the account. In a later step, recharging will also be possible with a debit or credit card.

Mobile payment is possible with Apple Pay, Google Pay and Samsung Pay.

Kaspar& Card Management

Under “Card management” you can:

- retrieve your four-digit PIN and card details (card number, valid until, CVC)

- block the card

- deactivate contactless payment

- Reset PIN attempts

- Order replacement card

You will also find the daily limits for card payments, online payments and cash withdrawals.

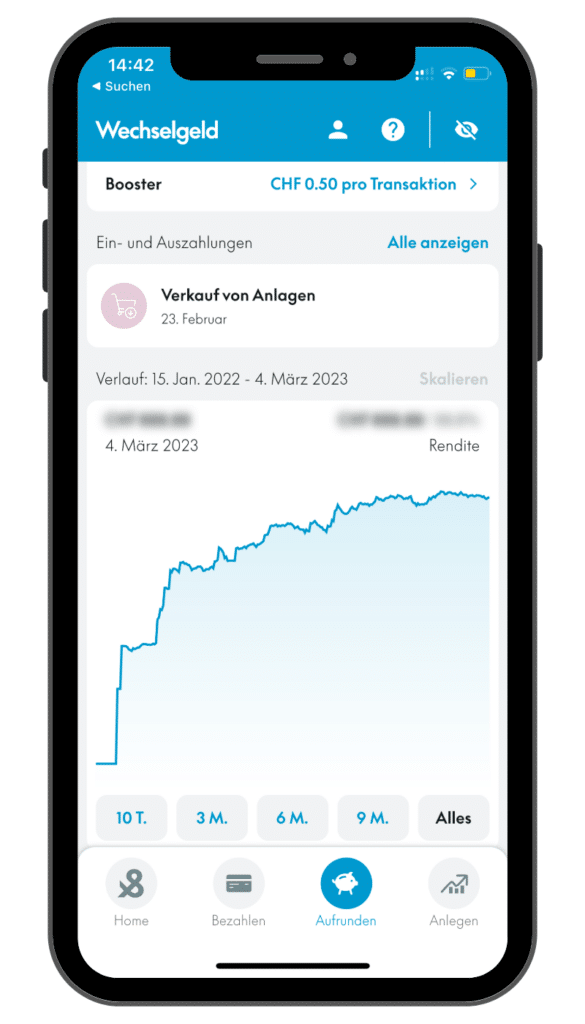

How can I round up with Kaspar&?

Up to this point, Kaspar& is simply a Mastercard. But now comes the special part: Every time you pay with the Kaspar& card, you can round up the amount and have it invested automatically. Kaspar& invests your saved change from as little as CHF 1.00.

You can round up with:

- Factor (1, 2, 3, 4, 5, 10)

- Percent (5%, 10%, 15%, 20%, 25%, 50%)

- Fixed amount (0.10, 0.20, 0.50, 1.00, 2.00, 5.00)

Here is an example: I have selected a factor of 5 when rounding up. For my purchase of CHF 2.20, they rounded up to the nearest franc with CHF 0.80. And CHF 0.80 times the factor 5 results in CHF 4.00. This CHF 4.00 was automatically invested in the next investment run. Purchases and sales take place once a week, on Thursdays.

And here is an example with rounding up factor 1 from Kaspar&:

What is invested in?

The current “Normal” strategy profile is composed as follows:

- Shares (45-75%)

- Bonds (15-45%)

- Cash (0-5%)

Specifically, index funds from Swisscanto, a subsidiary of Zürcher Kantonalbank, are used for the equity and bond components. The equity index fund tracks the SPI, i.e. contains just over 200 Swiss equities. And the bond index fund contains bonds issued in Swiss francs. The current round-up portfolio therefore invests only in Swiss equities and only in bonds denominated in Swiss francs. The factsheets of the index funds can be accessed directly in the app.

In the future, you should be able to individualize your round-up portfolio and adjust it to your risk appetite. In addition, Kaspar& is currently working on a pillar 3a solution. You can then invest your change directly in your Pillar 3a.

How can I invest with Kaspar&?

In addition to the round-up portfolio, you also have the option to set any number of your own investment goals. The special feature: Your money is already invested with a minimum deposit of CHF 1.00. Even with very small contributions and without investor knowledge you can invest with Kaspar& in a broadly diversified portfolio.

First, you define whether you want to invest goal-based or free and give your investment goal a name. Finally, you can select a topic focus. The choices are:

- Demographics

- Biotechnology

- Robotics

- Digitization

- Healthcare

- Electromobility

- Smart Cities

- Cybersecurity

- Multifactor

- Without focus

If you select a topic, a short, understandable text appears and you can view the factsheet directly. You can read here that I am not a big fan of themed investing. At least with Kaspar& you can be sure that you have a broadly diversified core in addition to the theme.

If you have chosen a target-based investment goal, you will now be asked how you want to get there. The choices range from “slow and safe” to “always nice and steady” to “as sporty as possible”. And the last thing Kaspar& wants to know is if you still have reserves or if you need to access the invested money in the short term.

Based on the information you provide, Kaspar& will put together a strategy for you. In the app, you can see the ranges of each asset class and view the strategy details as a PDF. In it you can see what proportion Kaspar& invests in which investment products for you and Kaspar& shows you a historical simulation of your strategy. Of course, you can override the strategy and switch from “Comfort” to “Normal” or even “Sport”, for example.

You can make changes to the strategy and thematic focus at any time. You can make deposits and withdrawals on a daily basis. For the latter you currently have to contact Kaspar&.

What is invested in?

Index funds from Swisscanto or Credit Suisse are again used for the core. Here, in addition to Switzerland, industrialized and emerging countries are also taken into account. In addition to bonds, a gold and a real estate index fund are used for additional diversification. Recently, Kaspar& has been following an ESG approach and has been using Responsible bez. ESG funds. The themes are implemented using ETFs from iShares. You can read about the difference between index funds and ETFs in this article.

For example, with my investment goal, it looks like this:

All activities can be viewed transparently in the app, and you can also display the associated transaction receipts as PDFs.

Kaspar& Savings Plan

From as little as CHF 1.00, you can set up a savings plan per investment goal.

There are three versions to choose from: daily, weekly and monthly. If there are sufficient funds available in the card account on the execution date, the money is automatically transferred to the investment destination. You can easily make changes to the savings plan at the respective investment target in the app.

Kaspar& Fees

Card and account are always free of charge at Kaspar&. The annual fee of 0.85% on your investments includes:

- Custody account management

- Product costs (TER)

- Stock exchange brokerage

- Stamp duties

- Foreign currencies

- Administrative expenses

At first glance, the 0.85% doesn’t seem like much of a bargain. However, if you look in detail at the fees of other investment solutions shown large and bold, they rarely include product fees, stamp taxes and foreign currency exchange costs. If you then compare apples with apples, the 0.85% is no longer high.

And another special feature with Kaspar&: Administration costs are capped at CHF 34.95 per month. The cap is applied to investments of approximately CHF 100,000. On the Kaspar& website you will find a slider that allows you to easily view your annual costs.

By the way, withdrawing cash from an ATM costs CHF 5.00 per withdrawal.

Opening

Onboarding takes place directly in the Kaspar& app and takes about ten minutes. At the beginning you will get an overview of what to expect. After entering your email address and cell phone number, you set a password. In order for Kaspar& to create your risk profile, you answer a few questions. Finally, digital identification takes place. You will need your passport, identity card or alien’s identity card. Finally, you will see the contracts that you can sign electronically.

For security reasons, payouts are always made to your Swiss bank account with your name on it. You also define the withdrawal account in the onboarding process.

After opening your account you will receive your own IBAN from Kaspar&. You complete the activation process by transferring money from an existing Swiss bank account in your name.

Kaspar& coupon code

Enter the voucher code FINANZDEPOT when registering and you will receive CHF 10 starting credit from Kaspar&.

Conclusion Kaspar& Experience and Review

What I like about Kaspar& is the simplicity and the possibility to start investing from as little as CHF 1.00. The app is clear, the questions to create the risk profile are easy to understand and you see transparently what is invested in. With the round up function, you invest quite incidentally, and depending on the setting, there can also be nice amounts together. In addition, Kaspar& is the savings plan with the lowest minimum investment volume of only CHF 1.00 in Switzerland.

In an ideal world, I could keep the credit or debit cards from my existing neo-bank and Kaspar& would round up and invest for me in the background for each payment. But it will probably be a while before such open banking applications are available in Switzerland.

FAQ Kaspar&

Yes, this has been possible since March 2023.

The all-in annual fee of Kaspar& is 0.85%. This includes all the costs of investing as well as the management fee.

You can join us for as little as CHF 1.00!

Kaspar& does not have its own TWINT app. With the UBS TWINT app, however, you can deposit your Kaspar& Mastercard and thus also round up when twinning and invest your change.

Yes, enter the voucher code FINANZDEPOT when registering and you will receive CHF 10 starting credit from Kaspar&.

BLKB supports FinTech start-up Kaspar& and is seeking a minority stake.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.