Letztes Update: 15. April 2025

Looking for a free online bank in Switzerland? Then you’re in the right place with this article about my neon Bank Switzerland experiences in 2025. Because I have been using neon as my everyday bank and payroll account since January 2020.

Inhaltsverzeichnis

- neon Bank – the bank that is actually not a bank at all

- neon Bank – Open account

- neon Bank – Comparison of range of accounts

- neon Bank – Numbers

- neon Bank – exchange rate for foreign currencies

- neon bank – bank statement

- neon finsights

- neon Bank – Interest

- neon duo – first mobile joint account

- neon Bank – Invest

- neon Bank – Promo Code

- neon bench – alternative

- neon Bank Switzerland – advantages and disadvantages

- FAQ neon bank

neon Bank – the bank that is actually not a bank at all

Read correctly, neon is not a bank at all. In Switzerland, a bank can only call itself a bank if it has a FINMA banking license, and neon does not have one. The account is held at Hypothekarbank Lenzburg, neon’s partner, and thus offers deposit protection of up to CHF 100,000 per customer.

So what is neon? Simplified:

- One account

- One app

- One card

Briefly about neon’s past: the account app neon was launched in spring 2019. Even then, the account could be opened paperless and included a Mastercard. Domestic payments and standing orders were also possible. In spring 2020, foreign transaction fees on card payments were abolished, which also led to reduced fees among competitors. By the end of 2024, neon has over 225,000 customers, making it one of the largest Swiss neo-banks.

neon Bank – Open account

The account is opened directly in the app and takes only about ten minutes. After that, it takes two to three days until your account is ready and you receive your own Swiss IBAN. Other smartphone banks are a bit faster in this respect.

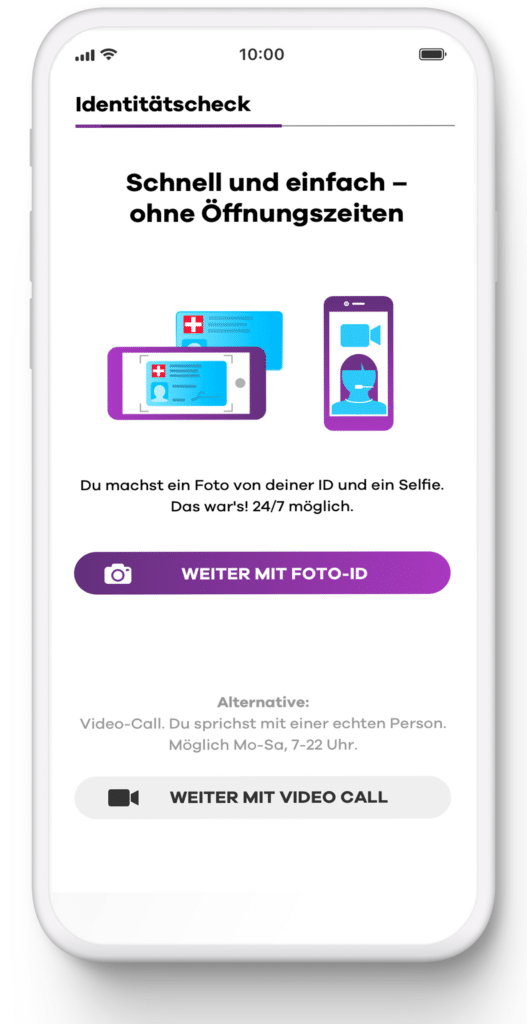

You can identify yourself either by photo-ident or by video-call. For Photo-Ident, which is available around the clock, you need a Swiss ID. You take a photo of your ID and a photo of yourself for this. When the account is ready, you complete the opening with a transfer from a Swiss account, current in your name, to your new neon account. At the video call, which is available from Monday to Saturday from 7 a.m. to 10 p.m., you can also identify yourself with other IDs, i.e. foreign ones. An additional transfer of evidence is then not necessary.

The prerequisite for a neon account is residence and tax residency exclusively in Switzerland. If you move abroad or transfer your tax domicile out of Switzerland, the neon account must be closed.

The minimum age for opening a neon account is 15 years. For legal reasons, however, you must be at least 18 years old to invest with neon.

neon Bank – Comparison of range of accounts

With neon free, neon green and neon metal you have a total of three different accounts at your disposal:

| neon free | neon green | neon metal | |

|---|---|---|---|

| Fee per month | free | CHF 5 | CHF 15 |

| Fee first ticket | CHF 20 (free with code finanzdepot) | free | free |

| CO2 neutral | yes | yes | – |

| Material card | Plastic | recycled PVC or wood | Metal |

| Warranty extension | no | yes | yes |

| Withdrawal CH | 2 times per month free of charge, then CHF 2 | 2 times per month free of charge, then CHF 2 | 5 times per month free of charge, then CHF 2 |

| Withdrawal abroad | 1.5% | 1.5% | free |

| Interest | 0% | ||

| Surcharge exchange rate | no surcharge (Mastercard exchange rate) | ||

| Special | free account | for every CHF 100 spent with the neon card, one tree is planted | Insurance packages |

You can find details about each account in the neon green and neon metal blog posts.

neon Bank – Numbers

neon mastercard

About one to two weeks after opening your neon account, you will receive your neon Mastercard at home. You can change the four-digit PIN code at any ATM in Switzerland. Unfortunately, this is not possible in the app.

Previously, neon sent out prepaid cards that functioned like debit cards. Now, neon actually uses debit cards. These have slightly higher acceptance, but otherwise there is no difference.

When you pay with your neon Mastercard, you’ll receive a push notification to your smartphone. You can link the neon Mastercard with the following mobile payment services:

- Apple Pay

- Google Pay

- Samsung Pay

- Garmin Pay

- SwatchPAY!

All card details such as card number, expiration date, etc. are also available in the neon app. So you don’t have to keep looking for your wallet with the physical neon Mastercard when shopping online, just a glance at the app is enough.

Of course, in the app you can block the card, view the card PIN, or order a new card. You will also see the remaining free cash withdrawals for this month. A second card is currently not yet available from neon Bank.

At Lidl you can withdraw cash for free (up to CHF 300). Prerequisite is a purchase worth at least CHF 10.

neon bank – deposit money

Under “Profile” you will find your personal IBAN, to which you – and after verification also any other person or company – can transfer money. If you need more details like the SWIFT code, you can find them under “Profile” and “Bank details”.

Advertising

neon Bank – Bank Transfers

The easiest and most convenient way to make payments is QR-bill. You can either scan them or upload them as a PDF with QR code. All fields will then be filled in automatically. If you didn’t receive a QR invoice, just enter the IBAN and the beneficiary. You confirm payments with the transfer PIN.

Transfers from neon account to neon account are executed immediately (instant payment). Transfers to a total of 40 currency areas are also possible. You can read more about this below.

neon bank – eBill

Under “Profile” and “eBill” you can set up eBill. This way you receive invoices from many billers directly into your neon app. For this to work, you need to add the respective biller beforehand. You do this in the eBill portal, which opens in an external browser window.

neon Bank – Twint

neon does not have its own Twint app. However, you can deposit your neon-Mastercard in the UBS-TWINT app and thus use TWINT conveniently. The amount paid with TWINT is automatically debited to your neon account via the neon Mastercard. You can find out how to deposit your neon Mastercard with TWINT in the article How to use TWINT with neon.

neon Bank – exchange rate for foreign currencies

neon exchange rate – Mastercard

When you pay with your neon Mastercard, you will be charged the Mastercard reference rate. Neon does not add any further surcharge to the exchange rate. The exchange rate of the previous day applies.

neon exchange rate – international transfer

Transfers to a total of 40 currency areas are possible. neon works together with Wise and charges a convenience fee of 0.4% on the average exchange rate. In addition, there is a dynamic fee from Wise. This fee is displayed in the neon app before the transfer.

Incoming payments in foreign currency on your neon account are automatically converted into Swiss francs. Separate foreign currency accounts are not offered by neon.

neon exchange rate – cash withdrawal

If you withdraw cash from an ATM abroad, the fee is 1.5% of the amount withdrawn (except for neon metal). Again, there are no further surcharges.

neon bank – bank statement

In the neon app, you can find your account statements under “Profile”. You can download the monthly account statements as PDF or CSV files. In addition to the details of each payment, at the top you will see the balance of your main account and your Spaces, as well as the respective deposits and withdrawals.

At the end of the year you will also find your tax certificate there. If you use neon Spaces, this is two-sided. Report both the balance of your main account and the balance of your Spaces on your tax return. And, of course, the interest on both accounts.

neon finsights

finsights is a new neon feature that gives you personalized insights into your spending habits. With the help of AI, you can ask questions about your finances and receive answers to specific expenses, such as for vacations or public transport, directly in the neon app. This makes it easier to decide whether an annual subscription is worthwhile, for example, or whether you are achieving your savings goals. Your data remains protected at all times. finsights is ideal for neon users who want to better understand and manage their finances.

neon Bank – Interest

Currently, you do not receive interest on the balance in your Spaces. The balance in your main account also does not earn interest. For details on neon subaccounts, see my post neon Spaces.

For your Spaces balances, the withdrawal limit of a cumulative CHF 50,000 per month applies.

neon duo – first mobile joint account

neon has been the first neobank to offer a joint account since April 2024. To open a joint account with neon, you must both have an existing neon account (free, green or metal) and live in the same household. The opening process is then 100% app-based and you are already fully-fledged and equal account partners with a single IBAN.

Both receive a neon duo card, which costs CHF 10 each. neon duo costs CHF 3 per person per month. So a couple pays CHF 6 per month. In the neon app, you can switch from your personal account to the joint account with a single swipe; no additional login is required.

neon Bank – Invest

The account app was launched with neon invest in summer 2023. At the launch, 55 Swiss and 97 international shares and 70 ETFs were tradable. There are no custody account fees. Per transaction you pay 0.5% of the buy or sell price, for international stocks the trading fee is 1%, with no additional fees for currency exchange – but the spread should be a bit higher. As with any Swiss broker, stamp duty is also due.

From July 2024, neon has introduced a minimum fee of CHF 1. The minimum fee only applies to trades outside the savings plan.

Dividends received in foreign currencies are automatically converted into Swiss francs with an exchange rate premium of 1.5%.

The shares are traded on the BX Swiss Exchange and are held in custody by Hypothekarbank Lenzburg AG.

Limit orders will be possible at a later date.

You can find the available ETFs in the neon Invest ETF list.

If you are a neon invest user, you will find the tax statement (main account, Spaces and invest) in eTax format free of charge in the neon app from the end of February.

0% fee ETFs

neon continues its partnership with asset manager Invesco and pays the trading fees for two ETFs. The choices are:

- Developed Markets (ESG)

- Global Stocks (FTSE)

- Emerging Markets ESG Paris Climate Aligned

- Global High Yield Corporate Bond (ESG)

The following ETFs are available from the provider Xtrackers by DWS:

- Xtrackers S&P 500

- Xtrackers Nasdaq 100

- Xtrackers AI & Big Data

- Xtrackers Clean Energy

- Xtrackers Bitcoin (ETP)

- Xtrackers Ethereum (ETP)

From Leonteq the ETP:

From Swisscanto (ZKB):

- Swiss Stocks (ESG)

- Global Stocks (ESG)

- US Stocks (ESG)

- Eurozone Stocks (ESG)

From WisdomTree:

- Megatrends

- Crypto Top Coins (ETP)

- Enhanced Commodity

The fee of 0.5 percent when buying or selling ETFs is waived or refunded to your neon account on the next business day. Only the federal stamp duty and the product costs of the ETF are still due.

0% specials

From April 8 to September 30, 2025, you can buy and even sell four ETFs from Swisscanto without fees. Or rather, the fees will be refunded within two business days. You only pay the government stamp duty and the product costs (TER) of the ETFs. The “0% Specials” should not be confused with the “0% Savings Plan”, as the “0% Specials” are only tradable free of charge for a limited period and do not need to be set up as a savings plan. The choices are:

- Swiss Stocks (ESG) (CH1408319130)

- Global Stocks (ESG) (IE000ZI3FFP9)

- US Stocks (ESG) (IE00035F1RO6)

- Eurozone Stocks (ESG) (IE000KIQ3DT5)

neon savings plan

From May 2024, you can set up a savings plan with up to three shares or ETFs with neon. Thanks to low trading fees – the same fees apply as for a one-off purchase – and no custody account fees, you end up with more. Selected ETFs(0% fee ETFs) can even be traded without purchase fees in the neon savings plan. neon refunds the trading fees on the next working day after the purchase is executed! The minimum investment corresponds to the purchase price of the share or ETF. If an ETF unit is traded at CHF 5, the minimum investment amount is CHF 5 (plus 5% as a reserve). The savings plan is also subject to federal stamp duty and the product costs of the ETF.

neon Bank – Promo Code

Get the neon Mastercard for free (instead of CHF 20) plus CHF 10 starting credit with the code: finanzdepot

Advertising

neon bench – alternative

In Switzerland, radicant, Yuh or Zak are available as alternatives to neon with a similar range of functions.

neon Bank Switzerland – advantages and disadvantages

Advantages neon

- Free bank account with neon free

- Advantageous exchange rates

- Clear app

- withdraw money for free with Sonect

- Free Swiss ETF savings plan

Disadvantages neon

- The benefits seem like they’re on a coffee run. At least they are relatively unobtrusive in the app (unlike other providers).

- Sometimes logging in does not work for a short time. However, payment with the neon Mastercard still works in each case.

FAQ neon bank

neon itself does not have a banking license. So neon is actually “just” an app that gives you access to an account. Your account is held at Hypothekarbank Lenzburg. It has a banking license and is therefore subject to deposit protection up to CHF 100,000 per private account.

neon has no counters, so a direct deposit is not possible. You can either buy TWINT credit and load it onto your neon account or create a QR payment slip online and take it to a post office counter (Swiss Post charges a fee for this).

The Mastercard from “neon free” costs a one-off fee of CHF 20 if you enter the code finanzdepot when opening your account, you will receive the Mastercard free of charge and an additional CHF 10 starting credit. An annual fee is not charged.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.