Letztes Update: 28. September 2023

As I did last summer, this time I again brought back exchange rates and fees on foreign currency transactions from my vacations and compare them here. When paying abroad, the similar neobanks are again the cheapest. And where are the big banks to be found with their digital offerings? Credit Suisse, for example, is currently advertising: “Pay abroad without fees? Sure you can. No foreign fees and full control with CSX” for its all-in-one banking CSX. In this article you will learn that “without fees” does not always have to be cheap.

By the way, I have always paid for trains, hotels, rental cars, and gas in France with a debit card, and it has worked flawlessly everywhere.

Costs when paying abroad

Before comparing, let’s take a closer look at the individual fees that can be incurred – often unnoticed – when paying abroad.

Exchange rate

When exchanging currency – in our example from Swiss francs to euros – the banks calculate their own exchange rate. Added to the “correct” exchange rate, the interbank exchange rate or mean rate of exchange, is what we call a foreign exchange markup.

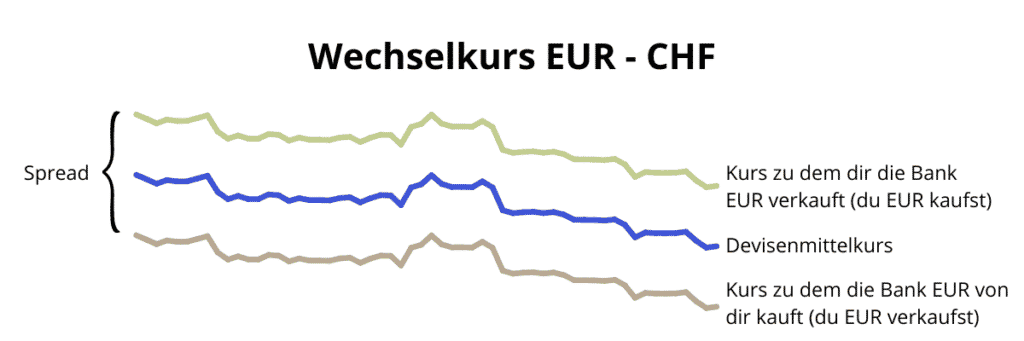

This looks simplified at the exchange rate Euro – Swiss Franc of the last 30 days like this:

In the center (blue) the average exchange rate is shown. Above (in green), you can see the rate the bank charges you when you exchange Swiss francs for euros. So you will get less Euro for your Swiss Francs than if the average exchange rate would be applied. The bank keeps the difference, also called the spread, for itself.

If you go to the bank in Switzerland and get notes in foreign currencies at the counter, then you are usually not charged the exchange rate, but the note rate and this includes an even greater markup. So the green line would be even higher up in our picture and the bank would keep even more for itself.

If you exchange your euros from vacation back into Swiss francs, the bank will charge you the rate of the brown line. Again, it makes a markup on the mean exchange rate. This way you get less Swiss Francs for one Euro.

Wondering where to look to see what the markup is at your bank? Very few providers transparently display this surcharge for card payments in advance. Wise*, for example, is exemplary.

For each currency pair you can find the corresponding fee on Wise’s website.

Percentage foreign currency fee

In the past, almost all banks knew a foreign currency fee for credit cards. With the advent of debit cards and foreign competition, more and more banks are waiving the percentage foreign currency fee. With the cards I use, only the Cashback Cards still know a fee for foreign currency or foreign transactions. By the way, the brand-new Cumulus credit card from Migros Bank also does not charge a fee for transactions in foreign currencies.

These fees are shown in the price overviews and fee schedules. If the fee is incurred, it is calculated in addition to the foreign exchange markup fee. Then you pay quite a lot of fees, as you can see in the comparison below based on the cashback cards.

Fixed foreign currency fee

Some banks know a fixed fee for payments abroad. This fee is mainly incurred when using the debit card or Maestro card. The Raiffeisen banks or Migros Bank, for example, charge a fee of CHF 1.50 for a payment abroad with their debit cards. None of the neobanks and credit cards tested here charge a fixed fee. Especially for small amounts, this fee disproportionately reduces the amount.

You can also find this fee in your bank’s records. If your bank still knows a fixed foreign currency fee, this will also be charged in addition to the foreign exchange markup fee.

But now let’s come to the comparison of the charged exchange rates and foreign currency fees.

Procedure

On Friday morning, June 24 at 9:45, I bought the same item eight times for EUR 4.25. As soon as the final booking was available in the providers’ apps, I calculated the respective markup in percent. Some posted the transaction within seconds. With the Cashback Cards, neon and Zak it took several days until the final amount was displayed.

Comparison

Markup to the average exchange rate in percent including percentage foreign currency fee, if levied.

* I have not taken into account the 1% cashback on the purchase amount.

** At Revolut, a currency exchange usage fee of 0.5% applies to the Standard account type from CHF 1,250 per month.

Unfortunately, Yuh did the conversion from my USD sub-account, which is why Yuh doesn’t show up here. However, due to the fixed exchange fee of 0.95%, Yuh is certainly not one of the cheapest providers.

“Without fees”

Let’s come back to the Credit Suisse advertisement.

In advertising, “no fees” sounds great, but a closer look reveals that “no fees” does not mean free. And what does Credit Suisse’s 24-page overview of conditions say about paying abroad?

Of course, how high the spread is at these forex rates is nowhere to be found. So you can only rely on comparisons, such as this one or the one from the Handelszeitung. Although the same providers are not always the cheapest, trends can be identified.

- Cheap: neon, Revolut, Wise, Yapeal

- Midfield: CSX, Yuh, Zak

- Expensive: cashback cards and other traditional credit card issuers bez. Banks

If we again calculate two weeks of vacation for two people for a total of CHF 4,368, as in the last post about foreign currency rates, then the foreign currency transaction fees would be CHF 4.81 (0.11%) for Revolut and CHF 189.57 (4.34%) for Cashback Cards.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.