Letztes Update: 28. September 2023

At the beginning of February, SIX launched ESG indices for the first time in its history. In addition to twenty bond indices, the two equity indices “SPI ESG” and “SPI ESG Weighted” have also been launched. These cover the sustainability criteria Environment, Social and Governance. The sustainability rating data comes from the Swiss sustainability rating agency Inrate.

SPI

The SPI serves as the basis for the two new indices. But what is the SPI anyway? The Swiss Performance Index is also published by SIX. It includes almost all Swiss stock corporations listed on the SIX stock exchange.

Much better known than the SPI is the SMI. Most of the time, the news only talks about him. The SMI (Swiss Market Index) contains the 20 most liquid and largest Swiss stocks.

The SPI, on the other hand, currently counts 214 shares and is thus much broader based. I have presented other Swiss indices to you here.

The SPI is a performance index (total return index), which means that dividend payments are included in the index calculation. Dividends paid out are therefore handled as if they were immediately reinvested in the same share.

The index has been around since 1987, with calculation every three minutes.

The companies in the SPI are weighted according to their market capitalization. Market capitalization is the total value of all shares in a company.

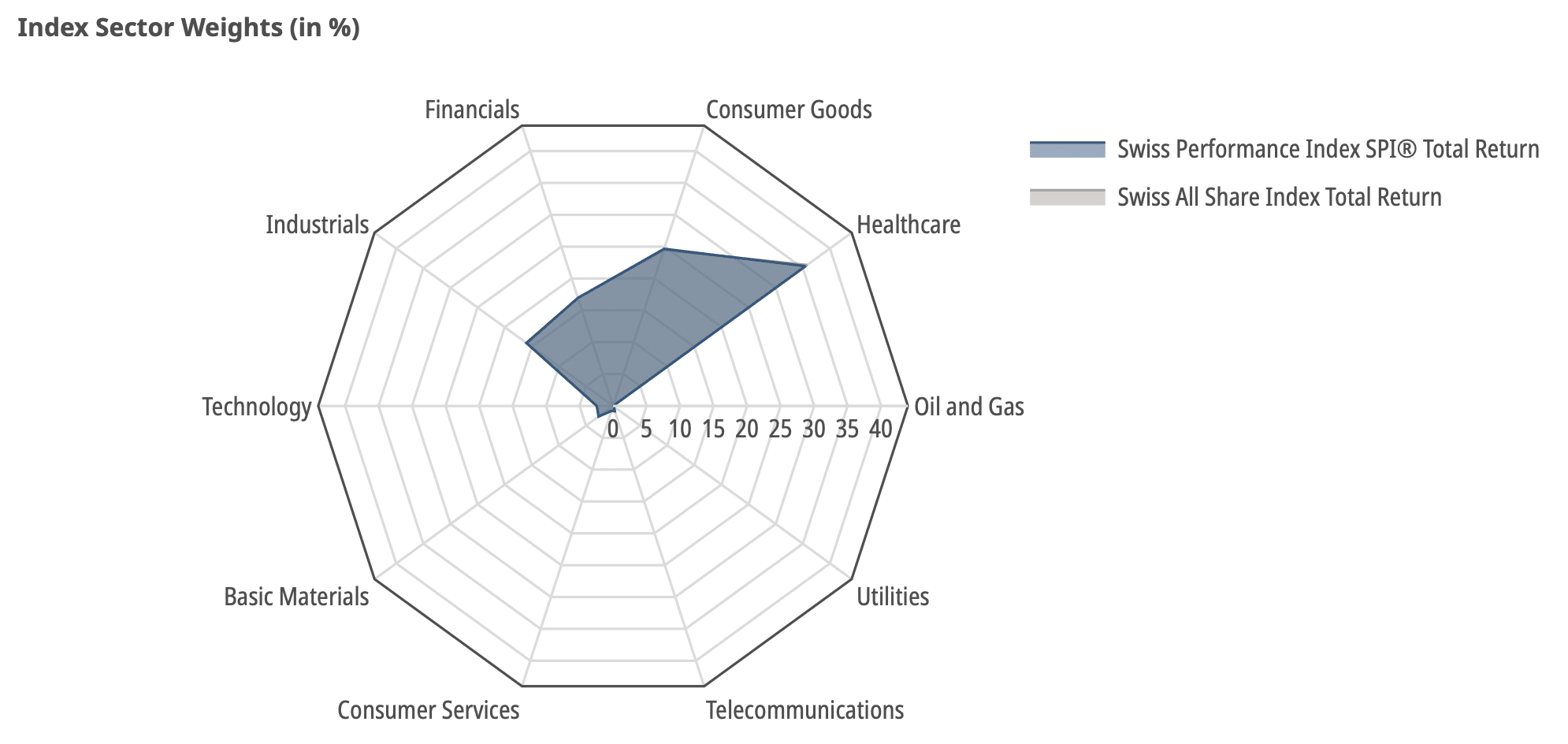

The sector weighting is interesting:

As with the SMI, the sectors dominated are healthcare (Roche Holding, Novartis), consumer goods (Nestlé), financial services (Zurich Insurance Group, UBS Group) and industrials (ABB). Then comes nothing for a very long time and at some point a few already almost insignificant sectors such as technology and basic materials.

There are various ETFs on the SPI. The cheapest with a TER of 0.10% is offered by iShares with assets under management of CHF 1.88 billion. So it’s a real fat ship.

SPI ESG

As already written, the SPI forms the basis for the SPI ESG. Various filters are now applied to the SPI stock universe:

- All companies with an ESG impact rating lower than C+ are dropped. In total, that’s 72 companies that are excluded as a result. Exactly how such a rating works would fill a separate article. If this interests you, post it below in the comments.

- Also excluded are companies that generate more than 5% of their sales in a critical sector. Critical sectors include: Adult entertainment, alcohol, defense, gambling, genetic engineering, nuclear energy, coal, oil sands and tobacco. This eliminates three more companies.

- If a company is recommended for exclusion by the Swiss Association for Responsible Investment (SVVK), it also does not end up in the SPI ESG. Currently, there is no Swiss company on this list. Companies that manufacture anti-personnel mines or cluster munitions, for example, would be excluded.

- And then there are companies for which no data are available. These are not included in the SPI ESG. At the moment, these are four companies that fall out of the index as a result.

Finally, there remain 139 stocks included in the SPI ESG.

Here, too, the companies are weighted according to their market capitalization.

SPI ESG Weighted

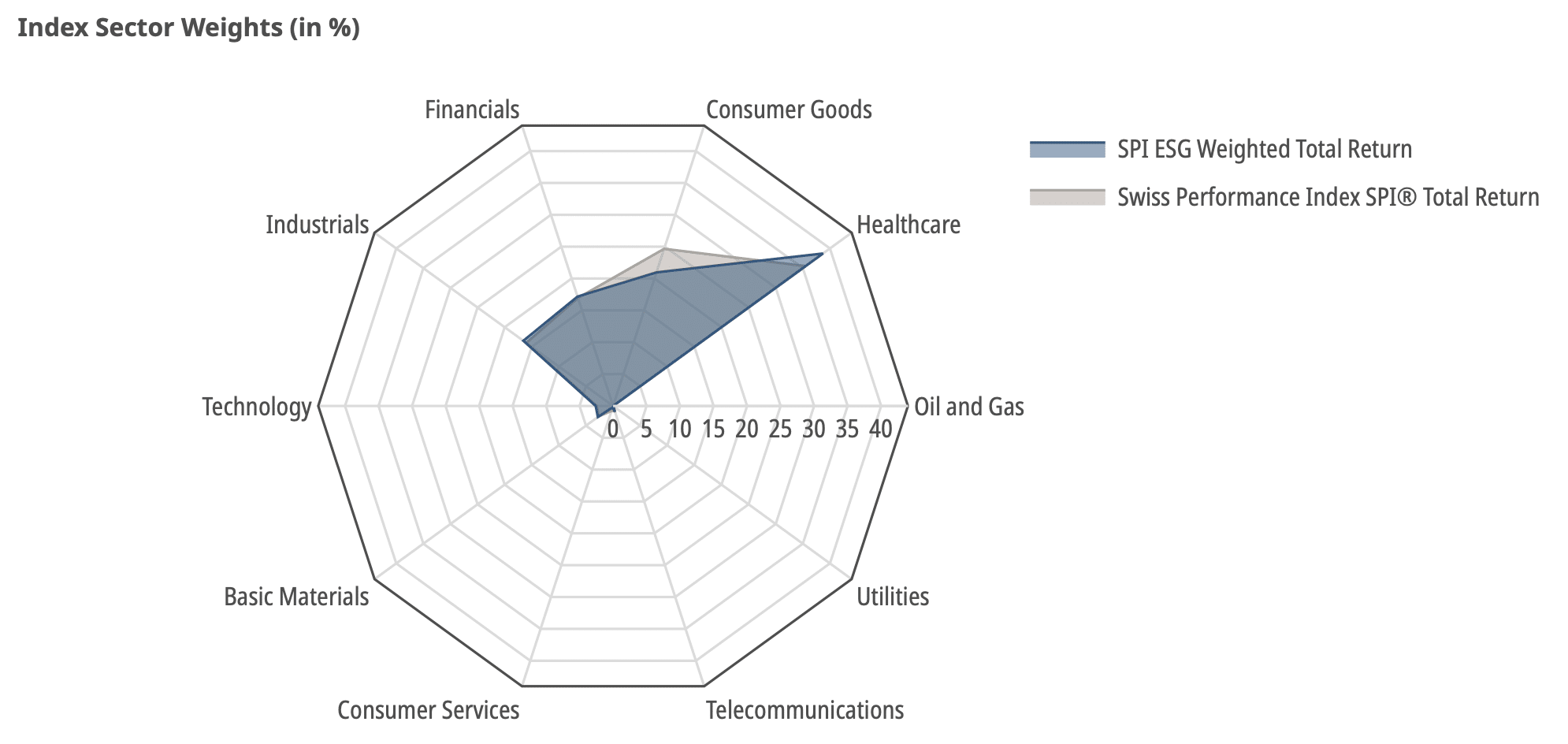

And now we come to the index that I find most interesting: The SPI ESG Weighted applies exactly the same filters as the SPI ESG. So there are 139 shares in it as well. In addition, companies are underweighted or overweighted here according to their ESG rating. For example, the weight of companies with a rating of C+ is halved. If a company has the best rating, its weight is doubled. Of course, this changes the sector weighting, although not fundamentally, as you can see here:

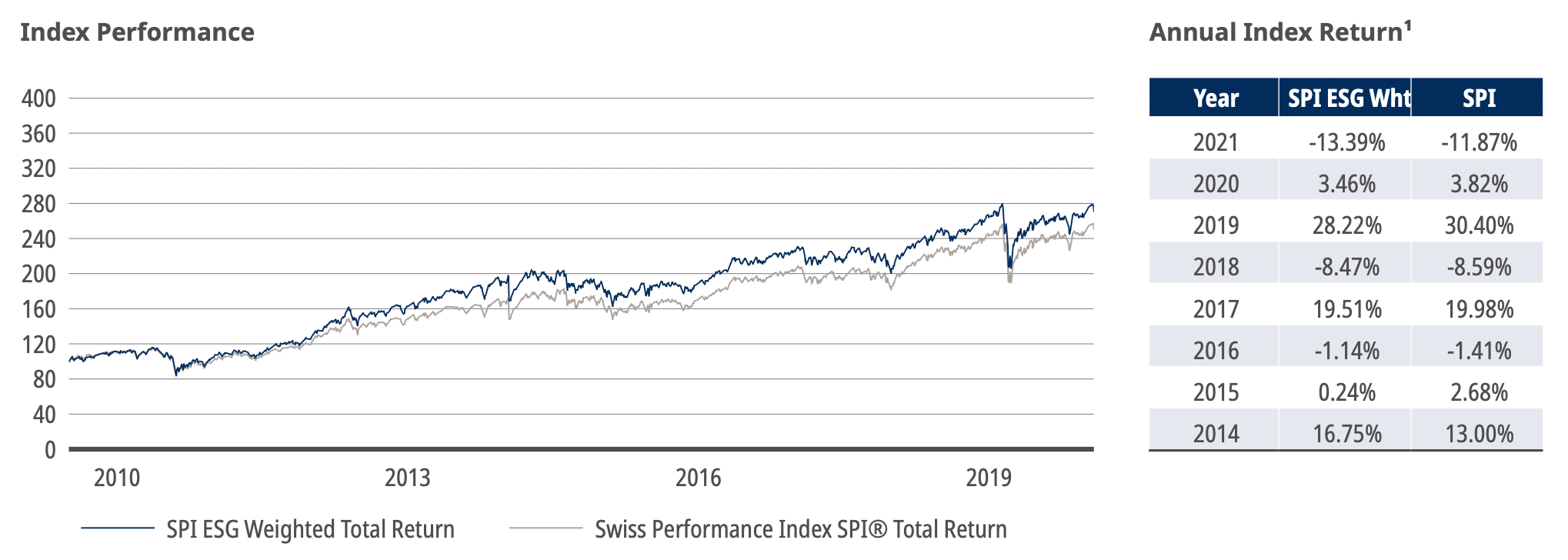

SIX has calculated the historical price development of the SPI ESG Weighted and compared it with the SPI. It will look like this:

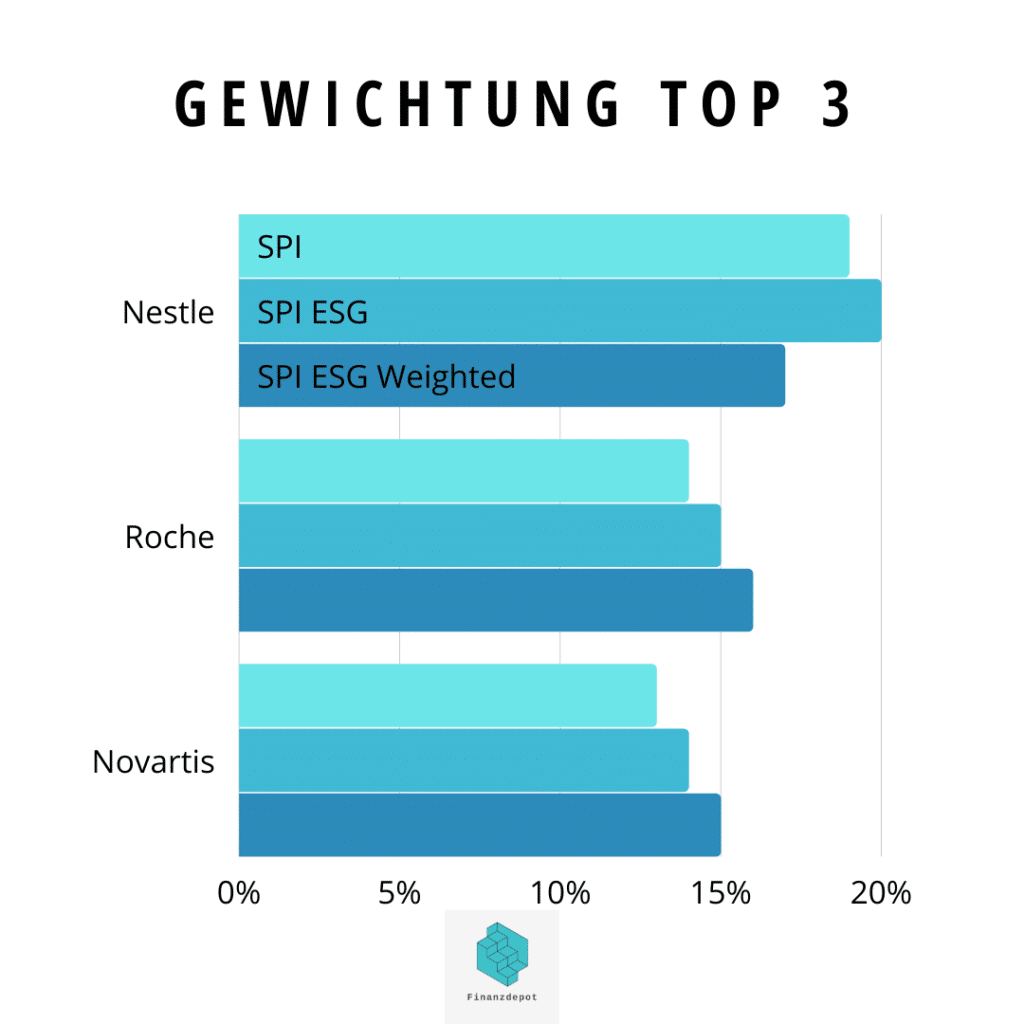

Comparison of the 10 largest positions

Here I have compiled the largest ten positions and their weighting in the respective index:

| SPI | SPI ESG | SPI ESG Weighted | SPI ESG Weighted | ||

| Nestle | 19% | Nestle | 20% | Nestle | 17% |

| Roche | 14% | Roche | 15% | Roche | 16% |

| Novartis | 13% | Novartis | 14% | Novartis | 15% |

| Zurich Insurance | 4% | Zurich Insurance | 4% | Zurich Insurance | 4% |

| ABB | 3% | ABB | 3% | ABB | 4% |

| UBS Group | 3% | UBS Group | 3% | Richemont | 3% |

| Richemont | 3% | Richemont | 3% | UBS Group | 3% |

| Lonza | 3% | Lonza | 3% | Alcon | 2% |

| Sika | 2% | Sika | 2% | Sika | 2% |

| Alcon | 2% | Alcon | 2% | Givaudan | 2% |

| Total | 66% | 69% | 68% |

The differences are relatively small and even the SPI ESG Weighted Index only leads to minor deviations. It is therefore not surprising that the returns are in a similar range to the parent index. Thus, volatility and diversification are not fundamentally different either.

ETF on the new indices

As you know, you cannot invest directly in an index, but need a financial product such as an ETF or index fund to do so. That’s why I asked the two best-known ETF providers in Switzerland whether they plan to launch ETFs on the new indices.

In mid-March, Credit Suisse Asset Management, Pictet and UBS also launched the first institutional index funds on the SPI ESG indices.

UBS

UBS already launched an accumulating ETF on the “SPI® ESG Weighted Total Return Index” on February 23. The ISIN is CH0590186661 and the TER of the ETF is 0.15%. Thus, the TER is exactly the same as for the “normal” SPI ETF of UBS. This ETF is already tradable at Swissquote.

I was a bit surprised about the speed and therefore asked UBS a few questions:

How long does it take for an ETF to be launched, listed and investable for private investors?

The time it takes to set up an ETF, i.e. to launch it and list it on a stock exchange, depends on several factors (including the complexity of the underlying index, the stock exchange). In principle, this process can be expected to be completed in around 6-8 weeks (for the recently launched UBS ETF SPI ESG it was 7 weeks until listing).

The “UBS ETF (CH) MSCI Switzerland IMI Socially Responsible (CHF) A-dis” (CH0368190739), launched in September 2017, was previously the only explicitly sustainable Swiss ETF on the SIX. The issue of sustainability is also becoming more and more of a focus for private investors. Could this also be seen in the “MSCI Switzerland IMI Socially Responsible”?

Yes, the trend toward sustainable, indexed investments such as ETFs has accelerated over the past year. This has also been demonstrated by the “UBS ETF MSCI Switzerland IMI SRI”, where the total fund volume has now risen to CHF 318 million (as of 19.02.2021).

In addition, a wide range of other sustainable ETFs traded on other exchanges is available to our customers. For example, with CHF 23.5 billion (as of Feb. 19, 2021), UBS is the second-largest provider of sustainable ETFs in Europe.

UBS ETF MSCI Switzerland IMI SRI

Let’s take a quick look at the ETF mentioned in the interview, UBS’s “MSCI Switzerland IMI Extended SRI Low Carbon Select 5% Issuer Capped NTR CHF ETF”. The index on which this ETF is based is constructed by MSCI and the ESG rating is also from MSCI.

Again, the first companies to be excluded are those involved in nuclear power, tobacco, alcohol, gambling, military weapons, civilian firearms, genetically modified organisms and adult entertainment. MSCI applies the best-in-class selection process to the remaining companies. This gives smaller companies greater weight. Furthermore, the highest weight of a company in this index is limited to 5%.

The three largest positions are currently: Logitech, Alcon and Kuehne + Nagel International. So this index is quite different from the SPI.

Selma, for example, uses this UBS ETF in the Switzerland portion of its sustainable strategy.

iShares

Next, I checked in with Ed Gordon, head of iShares & Wealth at BlackRock:

At the beginning of February, SIX presented the “SPI ESG” and “SPI ESG Weighted” indices. Does iShares plan to offer ETFs on these indices?

This depends in each case on customer demand for such products. We are constantly analyzing this and will launch ETFs or index funds on these indices as needed.

Currently, according to your website, you offer nine Swiss ETFs. If you filter these by “sustainability”, not a single one appears. What is the reason that you do not offer a sustainable Swiss ETF so far?

We have the largest range of sustainable ETFs and index funds in the world. However, in order to launch sustainable ETFs and index funds, you need a corresponding underlying index that meets our sustainability criteria. The first sustainable indices on Swiss securities have now been launched by SIX and more will follow. Accordingly, we expect that in the near future our Swiss-domiciled ETFs and index funds will also include sustainable versions.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.