Letztes Update: 28. September 2023

In one of the last posts, I showed you how to tax your ETFs. This post is now about how you declare your securities held through robo-advisors on your tax return. With most digital asset managers, a tax statement is included in the all-inclusive fee. This makes filling out the form a breeze. Using Inyova and Selma, I’ll show you how easy it is. By the way, with both of them you don’t have to pay anything extra for the tax statement.

Once again, as a reminder, dividends are taxed as income in Switzerland. The value of your shares on December 31 counts as assets. Capital gains are tax-free unless you are classified as a professional securities trader.

Tax extract Inyova

Inyova buys individual stocks for you (and ETFs for the bond portion). You can read more about the provider in this article.

With Inyova, filling out your tax return is easy because you get an electronic tax statement. By now you should be able to scan this in all cantons. If you live in a canton that does not yet know the electronic tax statement, a little more manual work is required. You can see how this works below with the example of Selma.

Inyova puts an eTax statement in your online dashboard. The eTax Statement contains a traditional tax statement and barcodes are attached to the end of the multi-page PDF containing all the detailed data. For me, the PDF is 18 pages in total, but don’t worry, you don’t have to plow through it all. In the electronic tax return of the advanced cantons, you can simply upload this PDF at “Import eTax Statement” and then it will take a while. This is because all cash balances, securities positions, sales, dividends, etc. are now read in automatically. On the (extremely sober) website of the Systemverbund elektronisches Wertschriftenverzeichnis (EMV), this is so nicely described as a “media break-free process”.

After the operation you will be asked if you want to transfer the corresponding values to the DA-1 form. THAT-WHAT?

Form DA-1

This form serves, on the one hand, as an application for a lump-sum tax credit for dividends and interest and, on the other hand, as an application for a refund of the additional withholding tax USA. In other words, you can use this form to reclaim a portion of the foreign withholding taxes.

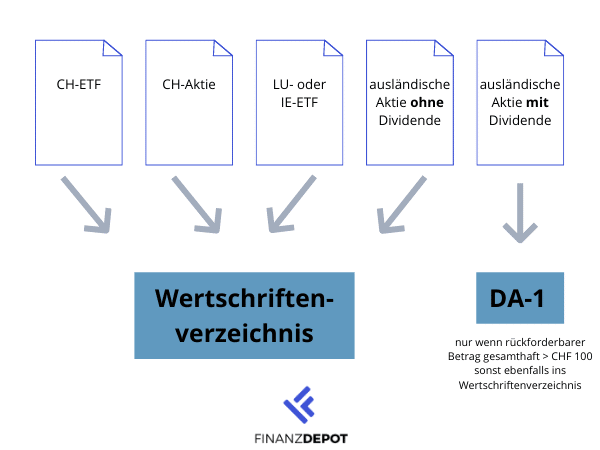

Why didn’t this come up in the previous post? Because it was about ETFs domiciled in Ireland and if an ETF distributes dividends from Ireland, then there are no withholding taxes. That is why there is nothing to recover. For Swiss ETFs, withholding tax is withheld and the ETF is declared in the securities register.

The DA-1 form is used only for reclaiming or crediting foreign withholding taxes. Thus, only securities for which withholding taxes were effectively deducted are listed in the DA-1. All others are listed in the securities register. As an example: Apple ends up in DA-1 (pays dividends), Amazon ends up in the securities list (does not pay dividends).

If the requested foreign withholding tax of all securities does not exceed the amount of CHF 100, no credit will be granted. In this case, you can save yourself the trouble and the securities are to be listed in the securities register.

There is no minimum amount for the recovery of the additional USA tax withholding. So, you can list all U.S. stocks that paid a dividend on Form DA-1.

But back to Inyova:

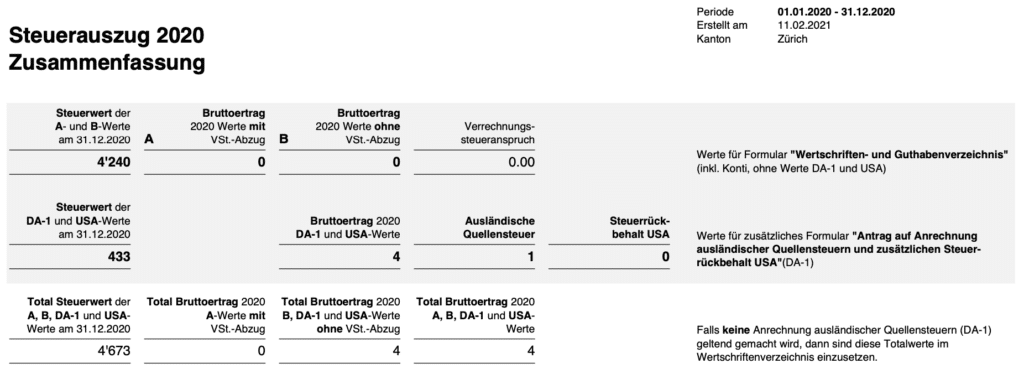

In my example, I could only claim CHF 1. So everything goes into the securities register. In my example, you can ignore the values in the gray area and only enter the values in the white area. Or rather, the e-tax statement does this automatically, depending on what you have selected and in which canton you live.

eTax statement Robo-Advisors

findependent, Kaspar&, True Wealth and wiLLbe now also send the convenient electronic tax statements. With them, filling out the tax return is as easy as with Inyova.

Tax statement Selma

Selma buys ETFs for you. You can read more about the provider in this article.

With Selma you also get a multi-page PDF, but it is not quite as extensive as with Inyova. For me, it was two pages. Here you have to enter three numbers yourself, because there is no eTax statement at Selma.

In the PDF it looks like this:

Below is a more detailed list of the individual ETFs, but you do not need to be interested in this for your tax return.

You select on your tax return that you have a tax statement, list the bank, which is Selma Finance, as well as your account/deposit number. The total tax value in my case is CHF 3’776. The income with withholding tax amounts to CHF 3 (income A) and the value without deduction of withholding tax (income B) is CHF 1. At the end you upload your PDF, which you received from Selma – done.

All examples again refer to Zurich. In your canton, the designations and process may be slightly different.

Tax statement with your broker

If you want to have it as simple as that and do not want to enter all values including purchase and sale dates manually, you can obtain a tax statement (sometimes it is also called tax statement, tax report or tax statement) from the Swiss brokers. For this you usually pay around CHF 100. For me completely incomprehensible. The data is all available digitally anyway.

Advertising

Open your custody account or your pillar 3a with the digital investment assistant Selma via this link* or the code finanzdepot and receive a starting bonus of CHF 34

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.