Letztes Update: 28. September 2023

Dividend season has started and on Instagram you can’t help but be flooded with dividend statements. Why I don’t think much of a pure dividend strategy, dividend ETFs and funds, you can read here.

This article is aimed at Swiss investors who are starting to invest or have already taken their first steps and are unsure which strategy to choose or to deepen. For American retirees or Swiss supporters of the FIRE movement, the dividend, and thus the dividend strategy, is likely to take on a different meaning.

The dividend

According to the Duden dictionary, the word dividend comes from the Latin dividendum, which means “that which is to be divided“. Duden goes on to say that a dividend is the “annual share of net profit attributable to one share.

Explained more practically: A company makes a profit and distributes part of this profit to its shareholders in the following year. The Board of Directors proposes the amount of the dividend and the shareholders vote on it at the Annual General Meeting.

Incidentally, there is no right to dividends, which means: A stock corporation does not have to pay out dividends. It can leave the profit generated in the company for further growth and invest it in research and development, for example.

The dividend yield

Many people look at the dividend yield when selecting a stock or an ETF. But how is this figure made up? It’s very simple: You divide the dividend paid out by the share price. For example, at Swiss Re (5.9 : 83.2) x 100 = 7.1%. Wow, the savings account can never compete with that. But beware, because the lower the share price, the higher the dividend yield. If a company is not doing well, the share price usually falls. So a high dividend yield can be a red flag. And the dividend is not guaranteed. A stock corporation may reduce the dividend or suspend it altogether. Just as happened in 2020 because of the Corona pandemic. According to the Janus Henderson Global Divid end Index, global dividend volumes fell by just over 10% in 2020.

The stock yield is composed of the price yield and the dividend yield.

Share yield = price yield + dividend yield

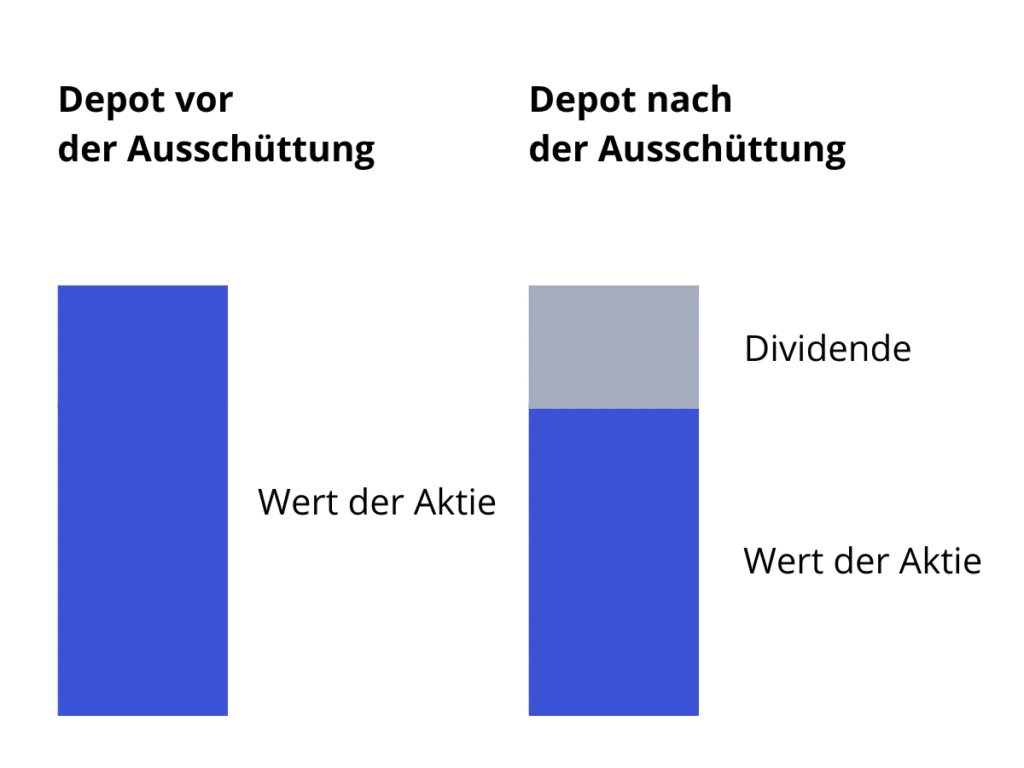

For example: You own a share of company XY worth CHF 100. The company pays a dividend of CHF 2. The opening price on the following day is adjusted for the dividend discount. The share therefore has a value of CHF 98. There is now CHF 2 on your clearing account. And CHF 98 plus CHF 2 equals CHF 100. So you have neither lost nor gained anything.

By the way, science has also looked at dividends. Behavioral economists have found that investors perceive a total return of, say, 7% to be more valuable if it consists of 3% price gains and 4% dividends than a total return consisting of only 7% price gains.

Samuel M. Hartzmark and David H. Solomon call looking at price returns and dividend yields separately the “free dividends fallacy.”

The dear taxes

You have to pay taxes on dividends. You can reclaim the 35% withholding tax levied in Switzerland on dividends from Swiss corporations, but dividends count as income, like your salary, and you pay income taxes on them.

On the other hand, capital gains are tax-free in Switzerland – unless you are classified as a professional securities trader. I will go into this topic in more detail in this article.

Arguments of the dividend strategy disciples

But I can afford something with it!

This is of course up to you. You can use it to go on vacation, pay your cleaner, or buy a pizza. But if you don’t reinvest the dividend, you’re missing out on a big chunk of the return, you’re slowing down compound interest. In a graphic it looks like this:

The blue price trend is the SMI. The Swiss Market Index contains the 20 largest shares. It is a price index. The dividends are not reinvested. The orange course is the SMIC. This index contains exactly the same shares as the SMI, but the dividends are reinvested immediately after distribution. Such an index is called a performance index or a total return index.

The SMI is bobbing along, while the SMIC is almost five times higher after five years. So if you’re going to take a hit with the dividend, you have to be aware that you’re giving up a lot of the return.

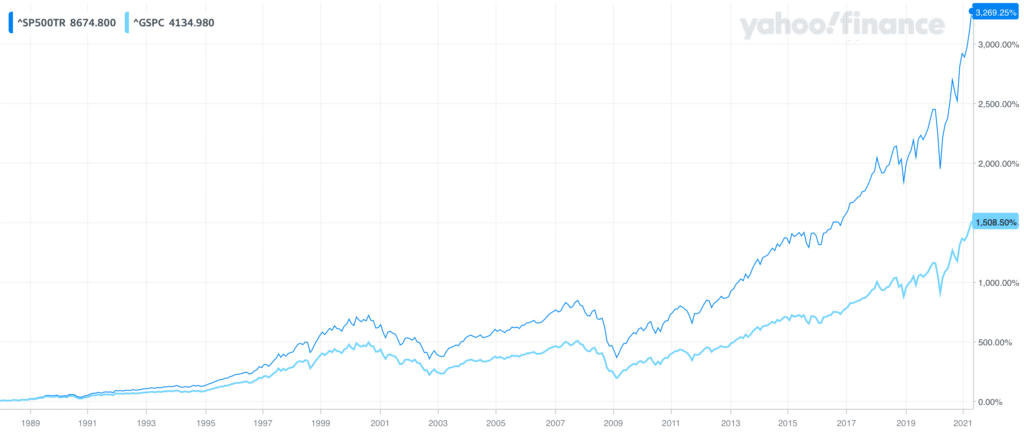

This looks similar with the S&P 500 from the USA. This index contains the shares of 500 of the largest listed U.S. companies. The dividends were not reinvested in the light blue price trend, but they were in the dark blue one.

The easiest way to benefit from the compound interest effect is to add an accumulating ETF to your custody account. Because it automatically reinvests the dividends. That way you don’t have to worry about it yourself. You save on purchase fees and you won’t be tempted to spend the money elsewhere.

Because we were talking about taxes earlier: Accumulating and distributing ETFs are treated equally in Switzerland. Even if the dividend never landed in your clearing account, it is taxable as income.

But I can determine where I want to invest the dividend!

You can do that too. You can use it to buy bitcoin, gold or any other stock. But if you feel you know better what to do with the money than the company you’re getting the dividend from, then I would consider whether you’ve invested in the right company.

But dividends motivate me!

That’s right, it’s great: you do nothing and suddenly money ends up in your account. Although doing nothing is nonsense, of course. Just as there is no such thing as passive income in my opinion. Because you had to choose the one stock among several thousand, find a broker, buy the stock and hold it …

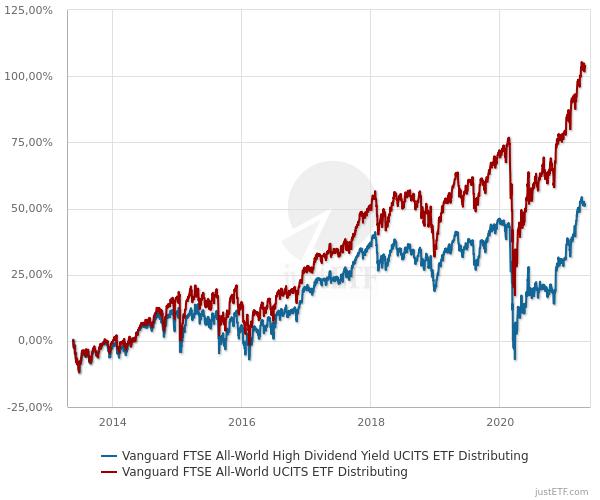

Which ETF from the chart below would you be more likely to buy?

Even if you invest in a world portfolio, you will receive dividends. In addition to better overall performance, the All-World ETF is cheaper, more diversified and has a much better risk-return ratio.

| Vanguard FTSE All-World UCITS ETF | Vanguard FTSE All-World High Dividend Yield UCITS ETF | |

| TER | 0.22% | 0.29% |

| Anzahl Aktien | 3’559 | 1’579 |

| Dividendenrendite | 1.7% | 3.3% |

| Grösster Sektor | Technologie (22%) | Finanzwesen (26%) |

| Rendite über 5 Jahre | 78% | 40% |

| Rendite/Risiko 5 Jahre | 0.75 | 0.45 |

The ETF selected here still comes off reasonably well. Others include only 100 companies and have a much worse risk-return ratio.

So why choose a specific dividend ETF and prefer a dividend strategy to a global portfolio?

So dividends are nonsense?

No, not at all. They are part of the stock return, but no more.

Conclusion

If this post were an Instagram quote, it would look like this:

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.