Letztes Update: 21. January 2025

I recently read the book “Das ETF-Portfolio” by Markus Neumann and wanted to replicate the strategy described in it. Because the cost of buying multiple ETFs through a Swiss broker is relatively high, I looked around for an alternative and found True Wealth‘s robo-advisor. I have already had a free trial account there since 2018 and have now decided to open a real account. So it’s time to introduce True Wealth, tell you about my experiences and point out the differences to Selma Finance.

The book is suitable for more advanced investors. If you’re looking for something easier to get started with, you’re better off with“Der Finanzwesir 2.0 – Was Sie über Vermögensaufbau wirklich wissen müssen “*.

The True Wealth robo-advisor

The online wealth management platform True Wealth was founded back in 2013 by Oliver Herren and Felix Niederer. Incidentally, Oliver Herren was co-founder of digitec Galaxus, and Felix Niederer is a physicist and portfolio manager. A first version of the platform went live at the end of 2014. Sustainable investment strategies have also been available since 2018, and in 2020 the app was launched for iOS and Android. In the first quarter of 2025, True Wealth, as an independent asset manager and member of the Swiss Association of Asset Managers (VSV), managed over CHF 1.7 billion in client assets and counts over 30,000 clients.

The minimum amount from which True Wealth offers a customized ETF portfolio with broad diversification is CHF 8,500. The annual asset management fee is 0.50%, which makes True Wealth one of the cheapest providers. From CHF 500,000, the asset management fee decreases continuously. You can find more details directly at True Wealth.

Subsequent deposits, similar to a savings plan, are possible at any time and are included in the asset management fee. True Wealth advises that deposits under CHF 200 may be held as cash until the amount is sufficient to purchase another ETF share. There are no additional fees for withdrawals either.

The Federal Stamp Tax as well as the costs incurred for the exchange of currencies will be charged additionally. Foreign currency exchange costs are only 0.10%, which is very low compared to other providers and banks. And a special feature of True Wealth: you will automatically receive four accounts when you open the account, in CHF, EUR, GBP and USD. So if you own foreign currencies, you can transfer them to True Wealth and pay no foreign currency exchange fees. For deposits in CHF and EUR, you’ll find a handy QR code in your user account, so there’s no need for tedious typing of the IBAN in your banking app.

Account opening

Within 15 minutes you can open your account completely digitally. You fill in the account details online and you can sign the contract digitally. To do this, you scan an identification document of yours and create a short video in which you follow a dot with your eyes. A video call is not necessary.

During the opening process you will be asked which bank to open an account with. The Basellandschaftliche Kantonalbank BLKB and Saxo Bank (Schweiz) AG are available for selection. BLKB has a state guarantee from the Canton of Baselland. Saxo Bank has a Swiss banking license, so your deposits are protected up to CHF 100,000.

At the end of the account opening process, you will immediately see the IBAN of your four accounts. You can make the transfer from a bank account, which must be in your name. At least that is the case at BLKB. At Saxo Bank, account opening takes two to five business days.

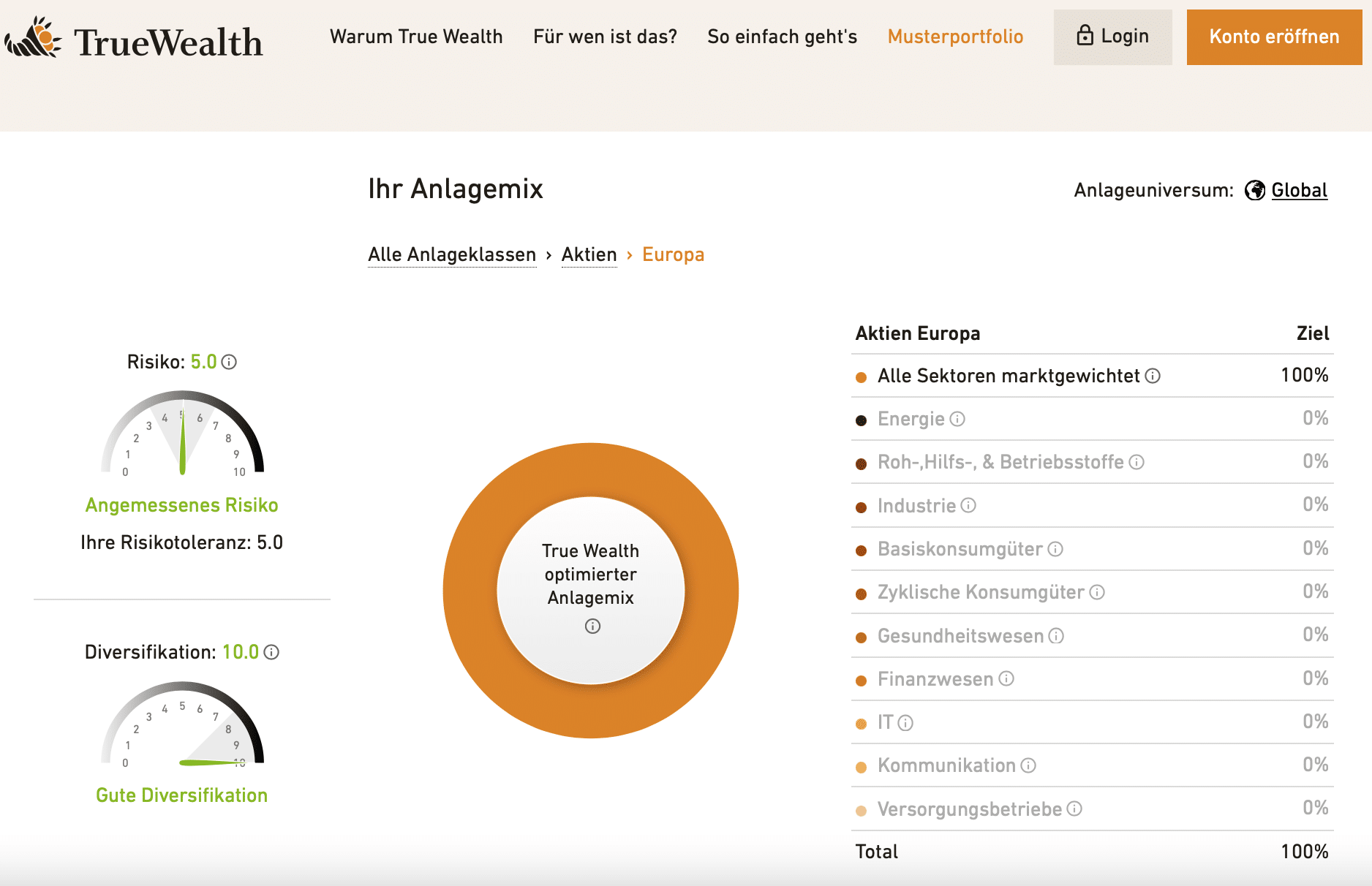

Asset mix

As soon as your money arrives in the account – in my case it arrived the same day – your risk profile is created. To do this, you answer a few questions about your circumstances and asset situation. After about five minutes, True Wealth presents you with a globally diversified portfolio optimized for you. If you agree, you can confirm it and True Wealth will buy the corresponding ETFs in the next few days. The securities transactions are pooled for efficiency reasons and executed every trading day at BLKB and every second trading day at Saxo Bank.

True Wealth has been using currency-hedged investment instruments in some cases since 2024. Currency hedging can reduce the risk of fluctuations in the value of the portfolio. The lower the portfolio risk (i.e. the fewer shares you have in it), the higher True Wealth hedges the currency risk.

If the target weighting of an asset class deviates over time, True Wealth performs a rebalancing. The costs for this are of course included in the asset management fee.

And now comes another advantage of True Wealth: if you want to deviate from the proposed portfolio, it’s easy. You can not only adjust the weighting independently, but also completely exclude individual asset classes or even overweight sectors.

However, True Wealth still makes the selection of which ETF to use. For example, ETF XY from provider Z is used for Europe. True Wealth selects the best ETFs from over three thousand. Among other things, product costs, liquidity and tracking error play a role.

True Wealth is therefore suitable both for beginners who do not want to bother much with the allocation of asset classes and for experienced investors who prefer to structure their portfolio themselves.

Even though it is very easy to change the strategy, you should not do it too often, because due to the bid-ask spread you will always lose some money when you switch.

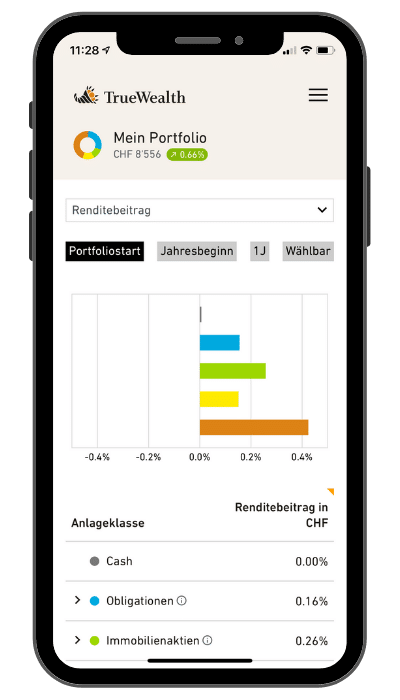

Platform and reporting

I have not seen such detailed and at the same time easy-to-understand reporting features in any robo-advisor. For example, your return is shown to you as time-weighted and money-weighted. You can read about the differences in this post.

A sample portfolio is available on the True Wealth website, where you can test the platform down to the last detail. This way you can play around with the weighting of the individual asset classes and you will immediately see how high the weighted total expense ratio TER is. Or you can view the simulated return of your portfolio and select a benchmark for comparison.

The ETF lookthrough from True Wealth, which you can find under “Portfolio Properties” and “Companies”, lists all companies or issuers you are invested in. For me, the list currently includes 5,067 entries. The largest position has a weight of 3.1%.

And as mentioned at the beginning, you can create a test account for free and run it with a fictitious amount of money to familiarize yourself with True Wealth’s features.

To protect your account, you can set up 2-factor authentication. And account withdrawals are only possible to an account that is in your name.

True Wealth payment plan

Since summer 2024, you can create a withdrawal plan with periodic payouts at True Wealth. Under “Payments”, “Payouts” and “Regular payout” you can set up a personal withdrawal plan to a bank account in your name. The following frequencies are available:

- monthly

- quarterly

- semi-annually

- yearly

If a payout falls below the minimum investment amount, the payout plan is automatically stopped.

True Wealth Pillar 3a

True Wealth now also offers its own pillar 3a. The same risk profile applies as for free assets; a different equity quota is not possible with pillar 3a. The True Wealth Pillar 3a automatically opens five accounts over time, so that payouts can be staggered over several years.

True Wealth waives all management fees for pillar 3a. This means that only the product costs are incurred, which amount to approx. 0.13%. This makes True Wealth currently the cheapest pillar 3a provider in Switzerland.

Comparison

| True Wealth | Selma Finance | |

| Mindestanlagesumme | CHF 8’500 | CHF 2’000 |

| Verwaltungsgebühr | 0.50% (bis CHF 500'000) | 0.68% (bis 50’000), 0.55% (50’000 bis 150’000), 0.47% (ab 150’000) |

| TER der ETFs | ca. 0.13%** | ca. 0.22%** |

| Fremdwährungs-Wechselkosten | 0.10% (Einzahlung in Fremdwährungen möglich) | 0.25% |

| Depotführende Bank | Basellandschaftliche Kantonalbank (BLKB) oder Saxo Bank (Schweiz) AG | Saxo Bank (Schweiz) AG |

| Securities Lending der ETFs bei Depotbank | bei beiden Banken ausgeschlossen | ausgeschlossen |

| Individualisierungsgrad | hoch | tief |

| Gewichtung der Anlageklassen selbst vornehmen | ja | nein |

| Nachhaltige ETFs | optional möglich | optional möglich |

| App | iPhone und Android | iPhone und Android |

| Säule 3a | ja | ja (in Zusammenarbeit mit dem VermögensZentrum) |

| Kinderkonto | mit eigenem Konto auf den Namen des Kindes | noch nicht |

| Angebot | Bezahle ein Jahr lang nur 0.25% Verwaltungsgebühr Link* | Lege die ersten CHF 5’000 ein Jahr lang ohne Verwaltungsgebühr an: Code finanzdepot oder Link* |

**The effective percentage depends on the specific products used and their weighting. Sustainable strategies are slightly more expensive with both providers. This is due to the ETFs used, which have a slightly higher TER.

And another difference: While True Wealth is on the passive side, Selma Finance keeps an eye on the valuation of the stock markets and sells investments if they appear “too expensive” or buys “cheap” investments in return.

Isn’t a robo-advisor far too expensive?

I am always asked whether a robo-advisor is not money thrown out of the window. It would be much cheaper to put together and manage an ETF portfolio yourself. Yes, you can, but here’s what you should consider when making your decision:

- Do I want to spend a lot of time investing and pick out ETFs myself? Can I independently determine the equity ratio that suits me? Do I know what risk I am willing to take?

- How many ETFs do I need to create a diversified portfolio that meets my risk tolerance? What are the purchase costs then? Do I invest monthly or all at once, how does that relate to costs?

- A robo-advisor protects against impulsive trading. Before you sell everything in a crash, it can’t hurt to have a contact person on your side.

- A robo-advisor protects against fads and wild back-and-forth. You’re prevented from buying a cannabis ETF today, a battery ETF tomorrow, and an emerging market e-commerce ETF the day after.

I am intentionally not making a comparison that contrasts the cost of a robo-advisor with the cost of self-managing through a broker. Because if I’m going to talk you into a robo-advisor, I can make up the numbers so that it’s cheaper, and the same goes for self-managing through a broker.

So once again, there is no universal right and wrong. You have to figure out for yourself what is right for you, your financial situation and your financial goals. With my financial blog Finanzdepot I want to show you different ways to achieve these goals. You must then choose and walk the path yourself.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.