Letztes Update: 5. October 2023

Many newcomers to the Swiss stock market are afraid of losing money while investing. On the other hand, online gambling is becoming more popular and the number of people with a gambling problem is increasing. Addiction Switzerland and GREA have recently published a study on the online gambling behavior of the Swiss population and launched the gambling-check.ch prevention campaign. But how much money do Swiss people actually gamble for? Answers are provided by the large and small gaming statistics 2021 of the Intercantonal Gaming Supervision Gespa:

At the end of 2021, the permanent resident population of Switzerland comprised 8,736,500 persons. Thus, per inhabitant, stakes are placed for an average of CHF 380 in intercantonal, automated or online lotteries and sports betting, and winnings are distributed for CHF 255. This results in a theoretical average net expenditure per capita of CHF 125.

Money game supervision Gespa

Or to put it another way: the average Swiss spends CHF 380 a year on gambling and wins CHF 255, resulting in a loss of CHF 125. To stay in stock market jargon, you make a loss of around 33%. Stock market years with a 33% loss are rather rare, as my article on the 2022 stock market year shows. But there I am already reaching ahead.

The experiment

I spent my last vacations on Martinique and Guadeloupe and there the so-called FDJ outlets were always well frequented. FDJ is the French state lottery company (which, funnily enough, is even listed on the stock exchange). It is therefore roughly comparable to Swisslos in Switzerland.

One morning in the bakery, which was also an FDJ outlet, I got the idea to play the lottery every month for a year and at the same time invest the same amount in the stock market every month and report on it regularly.

So I downloaded the Swiss Lotto app from Swisslos and transferred CHF 360 (which is easier to divide by twelve than CHF 380). I also transferred CHF 360 to my account at Kaspar& and set up a savings plan there.

When I talk about investing, I don ‘t mean betting on the financial markets – i.e. short-term trading of supposedly particularly lucrative meme stocks – but long-term investing in a broadly diversified portfolio. To be honest, however, the observation period of one year is far too short. Only money that you will not need for ten or better 15 years can be invested in the stock market, if necessary. However, since I know my risk profile and it is a manageable amount in relation to my total assets, I was able to take a chance on the experiment.

Of course, I could have invested the monthly amount in the stock of a single gambling provider like FDJ or in a Sports Betting & iGaming ETF, but as you know, I’m not a fan of individual stocks because of the company-specific risk. As a reminder, company-specific (unsystematic) risk can be reduced through diversification until only systematic risk remains. Classically, this is done by a broadly diversified fund or an ETF. I also don’t like theme ETFs because they are usually launched after the hype around the theme is already over and the stocks they contain are overvalued. The returns of thematic ETFs are then usually very meager in the first years after launch.

Play Lotto Switzerland

My grandmother played the lottery regularly and as a child I was allowed to fill in a box from time to time. Unfortunately, I don’t remember if I ever won anything. But it certainly couldn’t have been a million, otherwise I could definitely still remember it. Anyway, I’ve never played since and I first had to google how lotto even works and how much a tip costs. So here is a brief explanation:

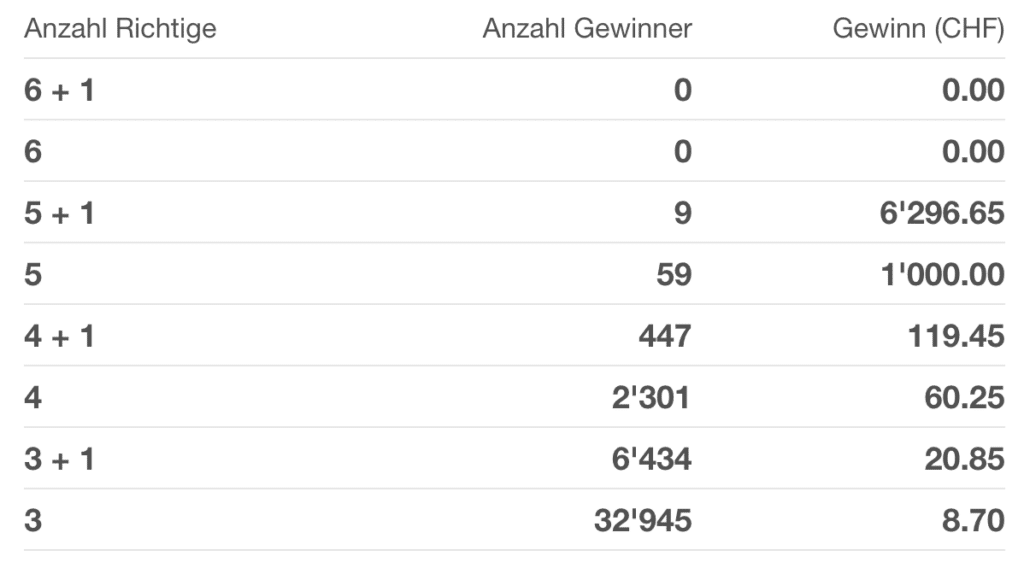

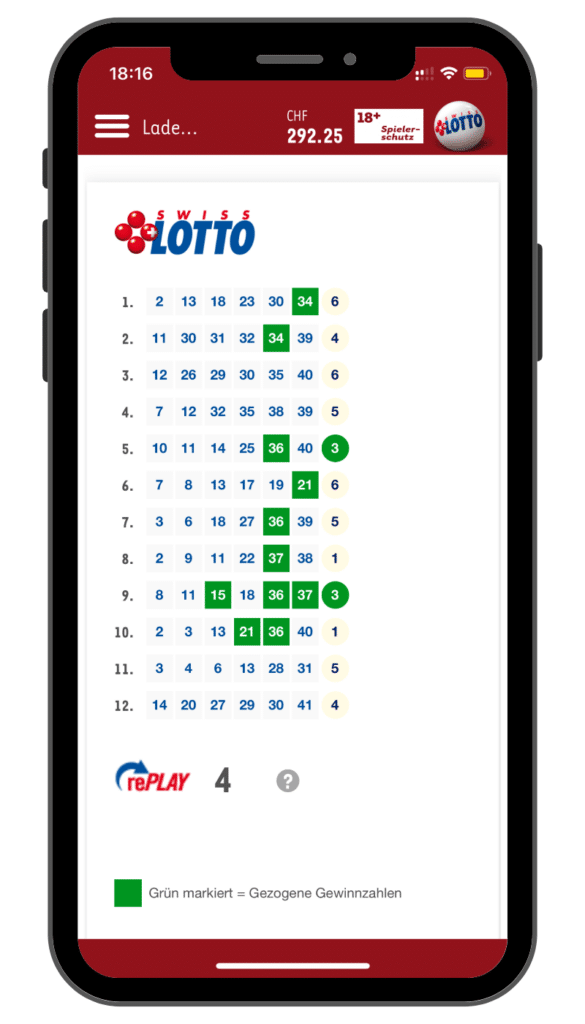

A betting field consists of 42 numbers, of which you can tick six. Also, you have to choose one of six lucky numbers. A completed betting box costs CHF 2.50. With three correct numbers, you win an average of CHF 10. In concrete terms, it looked like this on April 1:

What my grandmother used to fill out at the kiosk can now of course also be played online or conveniently from the road or at home using the Swisslos Lotto app.

What’s handy about the app is that you can have the typing fields filled with random numbers, which is what I did. My desire to choose six numbers out of 48 twelve times each month is limited. Passionate lottery players will surely pull their hair out here, but I’m pretty unreceptive to games of chance.

Let’s take a quick look at where the money Swisslos takes in goes: Swisslos distributes more than a billion francs in profits every year, which is about 65% of its revenue. Around 25% of the profits go to the cantonal lottery and sports funds, thus benefiting the general public. The rest is operating expenses or goes to the sales partners as commission.

Investing with little money in Switzerland

That would clear up the lottery side of things. Now all I needed was a provider where I could invest small amounts of money cheaply on a monthly basis in the stock market. During my grandmother’s lifetime, this was definitely not possible. Any bank would have laughed at her back then if she had wanted to invest CHF 30 a month. But digitization now makes that possible, and I chose Kaspar& for this experiment. I have already presented the provider in more detail in my experience report about Kaspar&. With Kaspar& you can pay, round up and invest, whereby we are particularly interested in the last point in this experiment, i.e. the easily accessible and professional asset management. You can set up savings and investment plans with Kaspar& for as little as CHF 1! The provider is therefore the perfect solution for those who can or want to invest only small amounts.

Setting up a Kaspar& savings plan

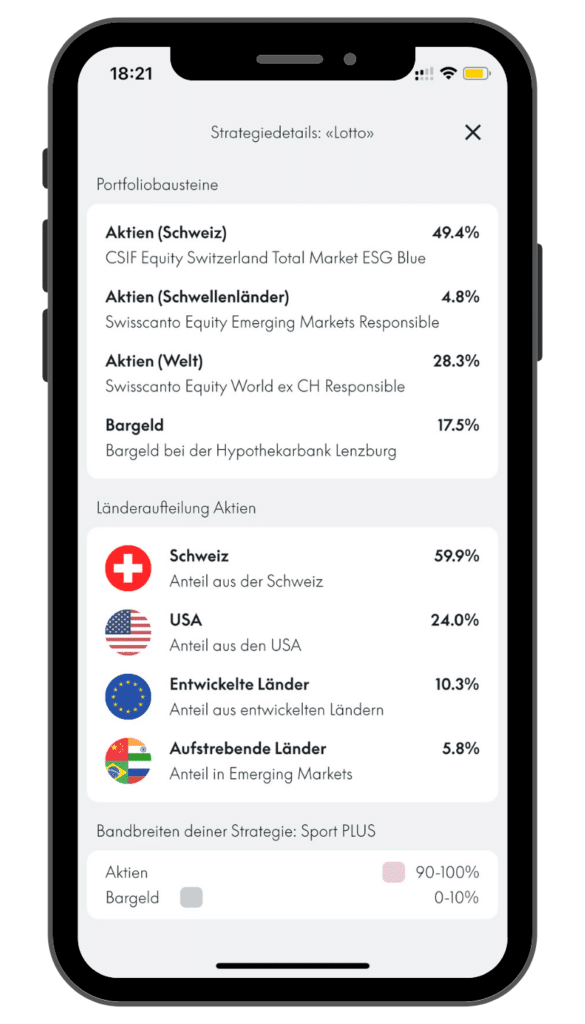

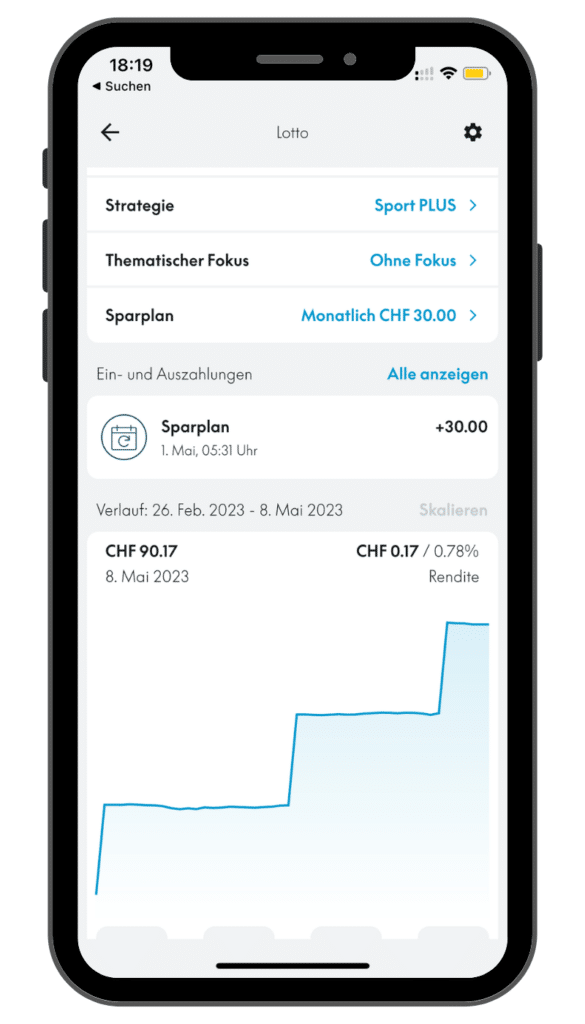

Setting up a savings plan is quite simple. Under “Invest” you select “Open target” and then an investment strategy. I have chosen “Flexible Investing”. Now you can give your target a name, in our case it is of course “Lotto”. Next, you choose a topic focus. Since I am not a fan of thematic investments, I chose “Without Focus”. Now you choose the investment horizon, how fast you want to reach the goal and how dependent you are on the invested assets. Kaspar& will then suggest a strategy, but you can override it. At the end you will get a clear summary and you can confirm the opening. By the way, you can also set up multiple savings plans with different goals.

This is what the strategy details of my lottery portfolio look like:

Conveniently, you will also find all the factsheets of the products used.

Is the stock market a casino?

The stock market may seem like a casino to people who are not involved with it. The media are also partly to blame for this image. A headline of horrendous losses, such as at Credit Suisse, or of dreamlike profits is simply more attractive than the boring and continuous investing that nobody talks about.

Differences:

- Returns: Broadly diversified portfolios historically have higher returns than lottery games.

- Risk: Portfolios with market broad ETFs are generally less risky than lottery games. This can be deduced from historical data. Whereas winning the lottery depends entirely on chance, the success of ETFs is based on the performance of companies, specific sectors or countries.

- Long-term horizon: ETFs and index funds are usually held for the long term, while lottery players think only in the short term and are looking for quick profits.

Commonalities:

- Chances of winning/losing: Both ETFs and lotteries have the chance of winning. On the other hand, the risk of loss exists with both. However, when investing in ETFs, this risk can be minimized by a long holding period.

- Uncertainty: There is a certain degree of uncertainty and unpredictability with both “forms of investment”.

- Randomness: Both lottery play and ETFs can be affected by unpredictable factors. For ETFs, these are, for example, political events or natural disasters.

Apps comparison

App Store

- Kaspar&: 4.4 from 5

- Swiss Lotto: 1.9 from 5

The ratings in the App Store are about the same as my experience. The Swiss Lotto app is slow, very confusing, in short a mess. Using the Kaspar& app is much more fun. This is clearly structured, beautifully designed and you can quickly find what you are looking for.

Lotto evaluation

| Amount invested in CHF | Lottery win | Resulting loss/gain | |

|---|---|---|---|

| 01.03.2023 | 30 | 0 | -30 |

| 01.04.2023 | 30 | 0 | -30 |

| 02.05.2023 | 30 | 22.25 | -7.75 |

| 02.06.2023 | 30 | 0 | -30 |

| 01.07.2023 | 30 | 32.15 | +2.15 |

| 02.08.2023 | 30 | 11.70 | -18.30 |

| 03.09.2023 | 30 | 25.35 | – 4.65 |

| 04.09.2023 | 30 | 22.70 | – 7.30 |

| TOTAL | 240 | 114.15 | -125.85 |

Investment evaluation

| Amount invested in CHF | Portfolio value | Yield | Loss/gain | |

|---|---|---|---|---|

| 01.03.2023 | 30 | 30 | 0 | 0 |

| 01.04.2023 | 30 | 59.85 | -0.51% | -0.15 |

| 07.05.2023 | 30 | 90.17 | 0.78% | +0.17 |

| 06.06.2023 | 30 | 121.85 | 2.97% | +2.09 |

| 02.07.2023 | 30 | 150.98 | 2.01% | +0.98 |

| 05.08.2023 | 30 | 180.49 | 2.92% | +0.49 |

| 03.09.2023 | 30 | 211.21 | 2.66% | +1.21 |

| 05.09.2023 | 30 | 235.62 | 0.16% | -4.38 |

| TOTAL | 240 | 235.62 | 0.16% | -4.38 |

Conclusion Gambling vs. the Stock Market

If you look at historical stock market figures and do probability calculations, it’s pretty clear who wins the gambling vs. stock market battle. But it is just the statistics and they are only of limited help when they say that the stock markets rise by about 7% annually, but the one-year portfolio is 8% in the red. It is also difficult to estimate in advance how someone will react if the portfolio is in the red. The only thing that helps is to try it out with your own money. The fact that you no longer need a fortune of several thousand francs for this is of course great. That’s why I conducted this (admittedly completely unscientific and very subjective) experiment here. And if I hit the jackpot, I’ll keep writing here – I promise.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.