Letztes Update: 28. September 2023

Let’s not kid ourselves, private liability and household insurance are 0815 products and boring for most customers. It’s like an undershirt: you can tailor it a little tighter or wider, vary the width of the straps, use different materials, and you can position it by price. But in the end, it remains an undershirt and most of the time it just sits in the closet. In the event, with an undershirt mostly in winter, but then you are glad about it. So how do you manage to make a boring product like household insurance exciting and create a brand around it? This is where smile.home comes in – the Smile personal liability insurance and household insurance.

Smile insurance

The company’s history began in 1994 with the sale of insurance over the telephone. At that time, Smile was still called Coop Versicherung and belonged to Nationale Suisse Versicherung. With the advent of the Internet, sales then became more and more digital and, over time, shifted to online business. In 2014, the Swiss insurance group Helvetia finally took over its competitor Nationale Suisse, and thus smile.direct also changed parent companies.

Smile has now grown up, serves 180,000 customers, expanded to Austria in 2022 and is the largest digital Swiss direct insurer. As befits a digital lifestyle brand, Smile has also recently been present in the Metaverse. Even degrees are possible in a virtual environment.

smile.home household insurance

Before we get to the benefits and experiences of smile.home, let’s first take a closer look at the insurance policies it contains, but without any blah-blah – as you’re sure to be familiar with from smile advertising.

With Smile, you can combine personal liability insurance with household insurance or take it out separately. The premium calculator shows you transparently which insurance costs how much.

Personal liability insurance simply explained

Extremely simplified: You break something for others (personal injury) or others (property damage), then you have to pay for the damage you caused.

Example with Ki-generated image for this: You crash into another person while skiing or your flower pot falls on your neighbor’s Lambo. This can be quite expensive and although personal liability insurance is not mandatory in Switzerland, it is strongly recommended.

You are now wondering which sum insured you should choose? Mostly you can choose between the sums insured CHF 5 million and 10 million. Keep in mind that especially personal injuries can become very expensive very quickly and the higher sum insured costs only a few francs more per year.

You can also include additional coverage with Smile’s personal liability insurance:

- Gross negligence,

- occasional driver of other people’s motor vehicles,

- Tenants of other people’s horses.

You can find out what the individual inclusions mean directly in the smile.home premium calculator by displaying the information. If you want to change the cover even more, click on “More settings” at the bottom.

Household insurance simply explained

Extremely simplified: this insurance is about your property. It pays for the damage if your household goods are broken, destroyed or stolen.

Example with Ki-generated picture to it: A candle warms not only the soul, but also your sofa, which then catches fire.

With Smile household insurance, you can also include the following:

- Theft,

- simple theft away from home,

- Glass breakage,

- Homeowner’s Comprehensive,

- Luggage and rental cars.

You can also find the explanations in the Smile premium calculator.

Homeowner’s insurance is voluntary in most cantons. However, it is compulsory in the cantons of Nidwalden, Vaud, Fribourg and Jura.

In the case of household insurance, there is always the question of the amount of the sum insured. In principle, the sum insured should always correspond to the value of your entire household contents. At smile.home, you can either enter the exact sum insured in the premium calculator or select your facility standard and Smile will suggest a sum insured based on your information.

With smile.home, by the way, there is no reduction of benefits in partial damage despite underinsurance. A simple example: Your agreed sum insured is CHF 50,000, but the actual value of your household is CHF 100,000. If you have a claim of CHF 20,000, many insurance companies will only pay CHF 10,000 due to the underinsurance clause, because your household contents are 50% underinsured. Fortunately, this is not the case with Smile and the damage amount would be a full CHF 20,000.

Financial tip: Regularly check whether the sum insured still corresponds to your household contents so that you do not pay too much or too little for your insurance.

Deductible household insurance

With many insurances you can choose the amount of the deductible. The higher you set it and the more you take on yourself in the event of damage, the lower the insurance premium will be.

Think about how much you can pay yourself in the event of a claim. You should then always have this amount available, i.e. add it to your nest egg.

smile.home experiences

On Google, Smile is rated 4.2 stars out of 5 from a total of 1,071 Google reviews. In particular, the fast and unbureaucratic claims handling is positively emphasized.

The high level of customer satisfaction is also reflected in the Comparis comparison. There smile.home achieved a good school grade of 5.0.

What has been your own experience with Smile? Write them below in the comments.

smile.home advantages

- You can choose to pay the insurance premium monthly or annually, with the annual option being cheaper.

- No gag contracts. Your smile.home insurance runs for one year and if you don’t cancel it one month before it expires, it will continue for one year. In addition, you have a monthly right of cancellation.

- Choice of your preferred communication channel: you decide whether you prefer to contact Smile by chat, email or phone. And most importantly, with Smile you can be sure that no agent or representative will come to your home for coffee.

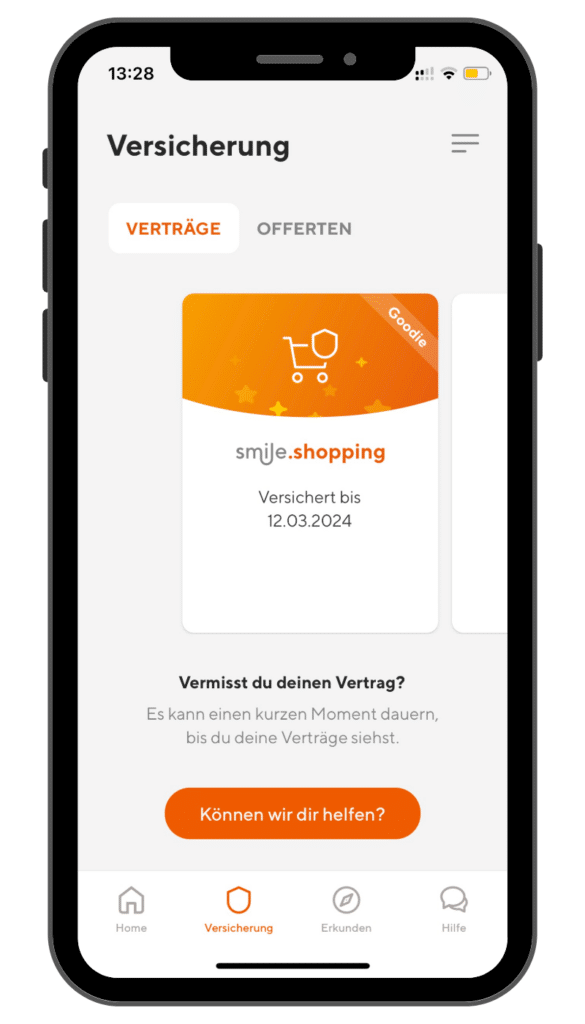

Smile App

You can easily try the app without logging in. You can even test insurance completely free of charge! Smile was the first European insurance company to launch a freemium model. With smile.shopping insurance, you also benefit from free online purchase protection. If, for example, you do not receive the goods or they arrive damaged, smile.shopping will cover the costs up to CHF 300.

You can also easily calculate offers in the app, where you can find them again later, and if you have taken out an insurance policy, you can find everything you need in the Smile app.

In the Apple App Store, the Smile app has been rated 700 times and has an average rating of 4.6 out of 5 stars. But let’s move on to other gamification elements in the Smile app.

Smile Rewards points

If you take out a smile.home, smile.car or smile.bike insurance policy as a new customer via this link*, you will receive 4,000 Smile Rewards points worth CHF 50.

If you choose not to have the documents physically mailed to you and instead have them emailed to you, you will earn an additional 600 Rewards points.

Furthermore, you will be rewarded for your loyalty and trust with Smile Rewards. For example, if you invite friends to Smile and they sign up for a Smile contract through your link, you will receive 3,400 points each, which is worth CHF 40.

With the first digital Drive Coach in Switzerland, which is integrated into the Smile app, you can analyze and optimize your driving behavior. You don’t need any additional installation in your car, the Smile app is enough. You will receive Smile Rewards for good driving behavior. By the way, the data collected on your driving behavior does not affect your premiums.

In order to get the points paid directly to your bank account, you need to have an active contract.

Smile Insurance Report Damage

You can report a claim directly in the Smile app or via the online claim form on the Smile website, as befits online insurance. But of course you can also call Smile or send Smile an email.

Smile sustainability

By the way, Smile has a fan store, there you can not buy undershirts, but T-shirts and other textiles made of organic cotton. Which brings us to the topic of sustainability. Banks and retailers have been outbidding each other in recent years with light to dark green products. Insurance companies were somewhat more reticent about this. Not so Smile, because smile.green engagements are an integral part of the digital business model.

smile.green engagements includes:

- E-documents instead of paper: 600 Rewards points,

- Electric car or hybrid car: three free additional coverages,

- Viva con Agua: Donate rewards points to non-profit organization,

- Repanet partner: Have your car repaired sustainably,

- Drive Coach: Rewards points for environmentally conscious driving.

Smile coupon code CHF 50

As a new customer, take out a smile.home, smile.car or smile.bike insurance policy via this link* and you will receive 4,000 Smile Rewards points worth CHF 50.

FAQ

Smile is a company of Helvetia Swiss Insurance Company Ltd. The risk carrier is also Helvetia Swiss Insurance Company Ltd.

No, you can pay your bill by payment slip or credit card.

Yes, you can include e-bikes with pedal assistance below 25 km/h.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.